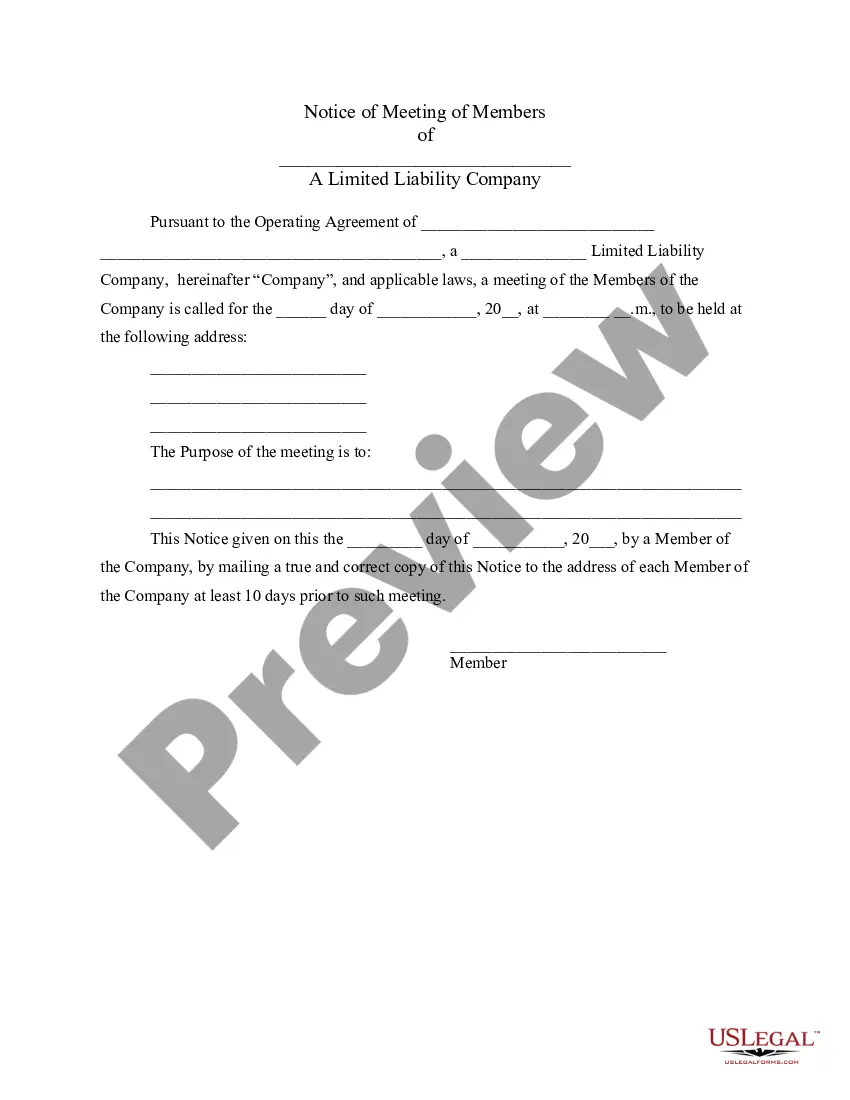

Maine Notice of Meeting of Members of LLC Limited Liability Company purpose to be completed

Description

How to fill out Notice Of Meeting Of Members Of LLC Limited Liability Company Purpose To Be Completed?

Choosing the right legal document format can be quite a battle. Naturally, there are a lot of web templates available online, but how can you discover the legal form you require? Use the US Legal Forms site. The assistance delivers 1000s of web templates, such as the Maine Notice of Meeting of Members of LLC Limited Liability Company purpose to be completed, that can be used for organization and private needs. Each of the forms are inspected by pros and meet state and federal requirements.

If you are previously registered, log in in your profile and then click the Download switch to find the Maine Notice of Meeting of Members of LLC Limited Liability Company purpose to be completed. Utilize your profile to check throughout the legal forms you may have acquired earlier. Check out the My Forms tab of your respective profile and acquire yet another copy of your document you require.

If you are a new user of US Legal Forms, listed below are easy instructions for you to stick to:

- Initially, make sure you have chosen the appropriate form for your personal area/region. It is possible to examine the shape utilizing the Preview switch and study the shape description to guarantee this is the best for you.

- In case the form fails to meet your requirements, take advantage of the Seach discipline to discover the right form.

- Once you are certain the shape is proper, click on the Purchase now switch to find the form.

- Choose the prices plan you desire and type in the needed information and facts. Design your profile and purchase the order using your PayPal profile or credit card.

- Select the file structure and down load the legal document format in your product.

- Full, revise and produce and sign the obtained Maine Notice of Meeting of Members of LLC Limited Liability Company purpose to be completed.

US Legal Forms is the greatest local library of legal forms where you can see various document web templates. Use the company to down load professionally-manufactured files that stick to condition requirements.

Form popularity

FAQ

Every LLC is responsible for paying taxes because running an LLC tax responsibilities are mandatory. Whether you operate as a single-owner or multi-owner, you will be liable to report and pay your tax when required. Many believe that founding an LLC is much better in terms of taxes.

In general, forming a business entity serves four purposes: (1) protecting business owners; (2) saving taxes; (3) providing certainty and structure to business operations; (4) presenting a professional image to customers and the general public.

The purpose of an LLC, or a limited liability company, is to shield the business owner from personal liability for the company's debts. Most states allow residents, individuals who live outside the state or country, other LLCs, corporations, pension plans, and trusts to serve as LLC owners.

Corporations are run by a board of directors who are elected by the shareholders. Within an LLC, however, either members (in a member-managed LLC) or managers or managing members (in a manager-managed LLC) are responsible for the management of the company, rather than a board of directors.

Limited liability - The company has its own legal entity so the liability of members or shareholders is limited and generally they will not be personally liable for the debts of the company.

Most states do not require you to be specific about the purpose of your LLC. Instead, a statement such as "The purpose of the Limited Liability Company is to engage in any lawful activity for which a Limited Liability Company may be organized in this state" is usually sufficient.

Under all LLC statutes, the general rule is that the members of the LLC are not personally liable for obligations of the LLC, subject to such exceptions as personal guarantees or piercing of the organizational veil.

The owners of an LLC are called its members. An LLC member can assume a position resembling a partner, passive investor, or a sole proprietor.

LLCs can be managed by their members--that is, all the owners share responsibility for the day-to-day running of the business. LLCs also have the option of designating one or more managers to run the business. The managers can be designated members, nonmembers, or a combination of both.

A Statement of Organizer is a document that states the initial members or managers of an LLC. The authorized person/organizer at IncNow prepares this document. While the Operating Agreement should be sufficient proof of ownership, some banks require further assurance.