Maine Physical Therapist Agreement - Self-Employed Independent Contractor

Description

How to fill out Physical Therapist Agreement - Self-Employed Independent Contractor?

US Legal Forms - one of the largest collections of legal documents in the USA - provides a broad selection of legal document templates you can download or create.

By using the website, you will access thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can find the most recent versions of forms such as the Maine Physical Therapist Agreement - Self-Employed Independent Contractor in just minutes.

If you already have a subscription, Log In and download the Maine Physical Therapist Agreement - Self-Employed Independent Contractor from the US Legal Forms catalog. The Download button will appear on every form you view. You can access all previously downloaded forms from the My documents tab in your account.

Every template you added to your account has no expiration date and is yours indefinitely. Therefore, to download or print another copy, simply go to the My documents section and click on the form you wish to access.

Access the Maine Physical Therapist Agreement - Self-Employed Independent Contractor with US Legal Forms, one of the most extensive collections of legal document templates. Utilize a vast array of professional and state-specific templates that cater to your business or personal requirements.

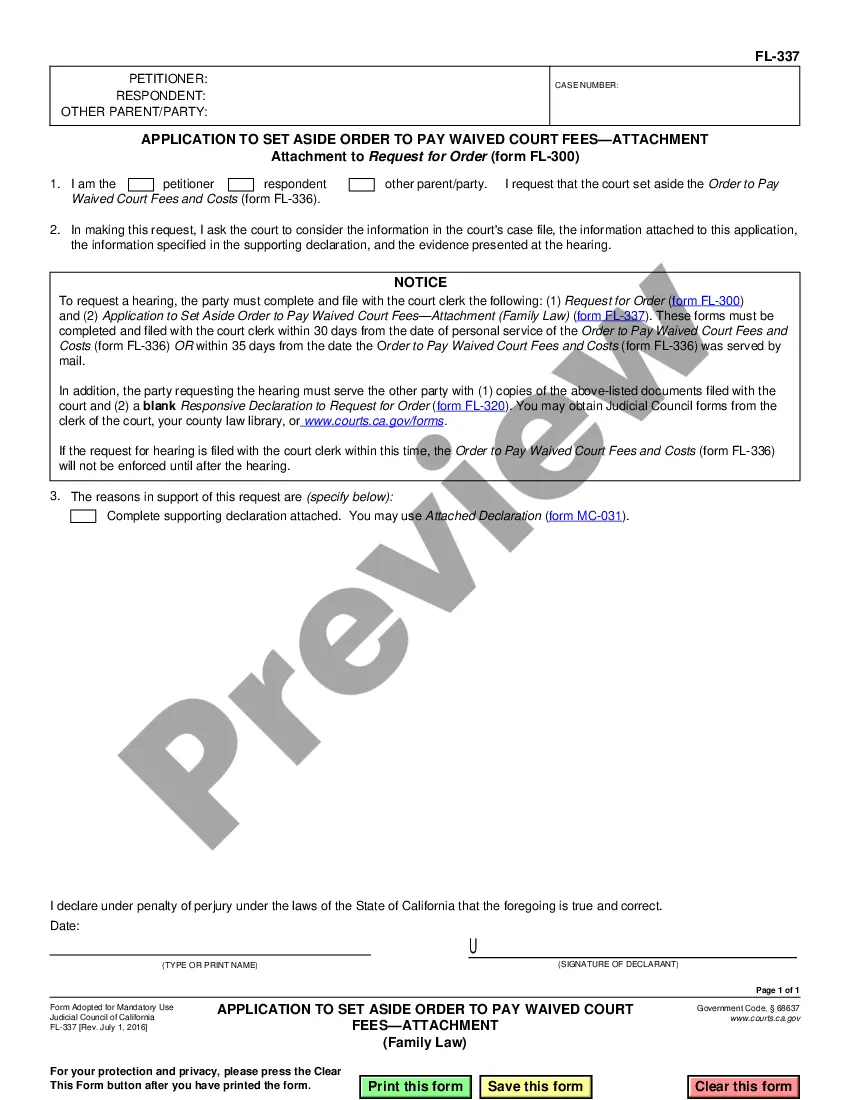

- Make sure you have selected the correct form for your area/region. Click on the Preview button to review the form’s details. Check the form summary to ensure you have chosen the right form.

- If the form does not meet your requirements, utilize the Search field at the top of the screen to find one that does.

- Once you are satisfied with the form, confirm your choice by clicking the Get now button. Then, choose the pricing plan you prefer and provide your information to register for an account.

- Complete the transaction. Use your Visa or Mastercard or PayPal account to finalize the transaction.

- Select the format and download the form to your device.

- Edit. Fill out, modify, print, and sign the downloaded Maine Physical Therapist Agreement - Self-Employed Independent Contractor.

Form popularity

FAQ

To prove independent contractor status under the Maine Physical Therapist Agreement - Self-Employed Independent Contractor, you need to establish certain criteria. Start by demonstrating that you control your work schedule, decide the methods you use, and ensure that you are not an integral part of any business’s operations. In addition, maintaining your own business license and liability insurance further solidifies your position as an independent contractor. Utilizing resources like USLegalForms can help you draft a solid Maine Physical Therapist Agreement to formalize your status.

Yes, you can be an independent contractor as a therapist, and many professionals choose this route for flexibility and autonomy. As an independent contractor, you set your hours and work directly with clients. To formalize your arrangement, it's advisable to use a Maine Physical Therapist Agreement - Self-Employed Independent Contractor, which outlines your services and terms clearly. This agreement will help protect both you and your clients.

Yes, you need a contract as an independent contractor to outline the terms of your working relationship. This document protects your rights and clarifies your responsibilities. A Maine Physical Therapist Agreement - Self-Employed Independent Contractor provides legal assurance, ensuring you and your client have aligned expectations. Without a contract, misunderstandings can arise, leading to potential disputes.

Creating an independent contractor agreement requires a clear understanding of the roles and expectations of both parties. You can start by defining the scope of work, payment terms, and any specific obligations. It's essential to include confidentiality clauses and dispute resolution methods. A well-structured Maine Physical Therapist Agreement - Self-Employed Independent Contractor can help ensure a smooth working relationship.

June 1, 2019. Contract therapy, also known as outsourced therapy, is a service where a hospital or other facility can work with a dedicated therapy provider on a contractual basis. The type and scope of services provided can vary widely, based on the needs of the hospital and the specific contract therapy organization.

What Should Be in a Construction Contract?Identifying/Contact Information.Title and Description of the Project.Projected Timeline and Completion Date.Cost Estimate and Payment Schedule.Stop-Work Clause and Stop-Payment Clause.Act of God Clause.Change Order Agreement.Warranty.More items...

Independent contractors usually offer their services to the general public, not just to one person or company. Government auditors will be impressed if you market your services to the public. Here are some ways to do this: Obtain a business card and letterhead.

The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done. If you are an independent contractor, then you are self-employed.

An independent contractor agreement is a contract between a freelancer and a company or client outlining the specifics of their work together. This legal contract usually includes information regarding the scope of the work, payment, and deadlines.

How do I create an Independent Contractor Agreement?State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.