Maine Choreographer Services Contract - Self-Employed

Description

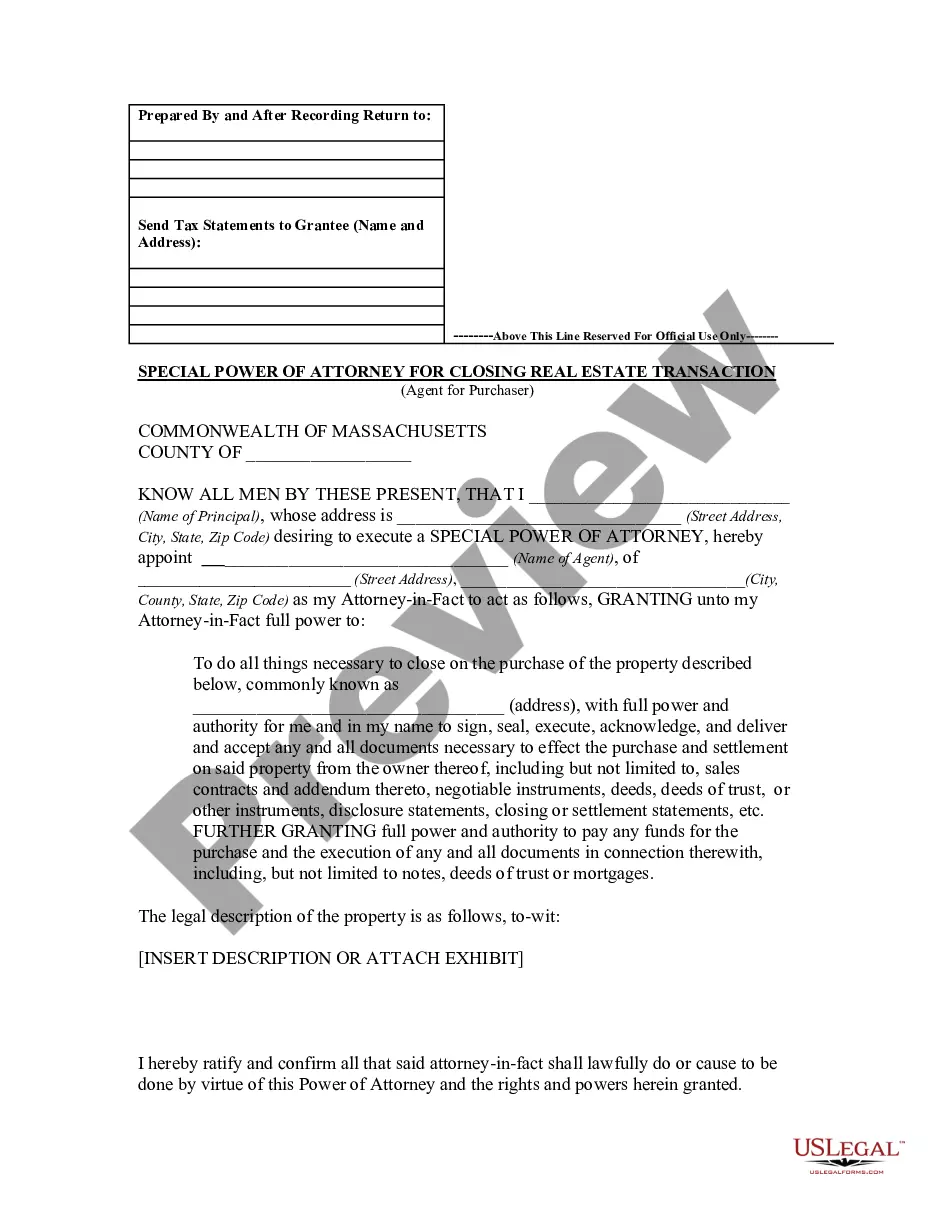

How to fill out Choreographer Services Contract - Self-Employed?

You might spend time online attempting to locate the authentic document format that meets the state and federal requirements you need.

US Legal Forms provides thousands of authentic templates that are reviewed by experts.

You can download or print the Maine Choreographer Services Contract - Self-Employed from the service.

If available, use the Preview button to review the document format as well. To find another version of your form, utilize the Lookup field to search for the format that meets your needs and specifications. Once you have found the format you want, click on Purchase now to proceed. Choose the payment plan you prefer, enter your credentials, and sign up for a free account on US Legal Forms. Complete the transaction. You can use your Visa or Mastercard or PayPal account to buy the authentic form. Select the format of your document and download it to your device. Make modifications to your document if necessary. You may complete, modify, and sign and print the Maine Choreographer Services Contract - Self-Employed. Download and print thousands of document templates using the US Legal Forms site, which offers the largest collection of authentic forms. Utilize professional and state-specific templates to manage your business or personal needs.

- If you possess a US Legal Forms account, you can Log In and click on the Download button.

- Afterward, you can complete, modify, print, or sign the Maine Choreographer Services Contract - Self-Employed.

- Every authentic document format you acquire is yours permanently.

- To obtain another copy of a purchased form, go to the My documents tab and click on the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document format for the state/city of your choice.

- Review the form description to confirm you have chosen the appropriate form.

Form popularity

FAQ

To demonstrate that you are self-employed, you can provide documents such as your Maine Choreographer Services Contract - Self-Employed, tax returns, or invoices. Keeping well-organized records of your contracts, payments, and relevant correspondence will also help substantiate your self-employment status. Additionally, consider acquiring form 1099s from clients, as these serve as essential proof of income. Resources like US Legal Forms can help you create your contracts accurately.

To create a self-employed contract, start by defining the services provided and the payment structure in a clear manner. Your Maine Choreographer Services Contract - Self-Employed should also outline the project timeline and deliverables. Incorporating clauses for revisions and termination can protect both parties. Platforms like US Legal Forms provide customizable templates that make the process easier.

Writing a self-employment contract involves outlining the services you will provide, payment arrangements, and duration. In your Maine Choreographer Services Contract - Self-Employed, it is crucial to specify any expenses you will incur and how they will be handled. Additionally, consider including confidentiality clauses if necessary. US Legal Forms offers templates that guide you in creating a comprehensive self-employment contract.

To write a contract for a 1099 employee as part of your Maine Choreographer Services Contract - Self-Employed, start by detailing the project scope, payment terms, and deadlines. Clearly define the relationship as independent to avoid tax complications. Including terms for cancellation and dispute resolution can also enhance the contract's effectiveness. You can find helpful templates on US Legal Forms that streamline this process.

Yes, you can write your own legally binding contract for your Maine Choreographer Services Contract - Self-Employed. Ensure that the document clearly outlines the terms and conditions, including payment, responsibilities, and duration of services. It is essential to keep language clear to avoid misunderstandings. Additionally, utilizing platforms like US Legal Forms can provide you with templates that simplify this process.

You need to ensure that you have the appropriate business licenses, permits, and insurance required for your specific services. Additionally, organizing your tax information and keeping records of your contracts can help streamline your operations. For those in creative fields like choreography, a Maine Choreographer Services Contract - Self-Employed can also enhance your professionalism and credibility.

To prove your status as an independent contractor, you can show documentation such as contracts, invoices, and business registration documents. Additionally, maintaining a separate business account and keeping detailed financial records can help establish your independence. A well-structured Maine Choreographer Services Contract - Self-Employed is essential in this verification process.

Yes, independent contractors are generally considered self-employed individuals. They work for themselves, set their own hours, and manage their own business expenses. When you engage in a Maine Choreographer Services Contract - Self-Employed, you officially gain the status of a self-employed contractor.

Working as an independent contractor in the USA involves identifying your services, establishing a client base, and managing your finances independently. It's important to create contracts that outline terms and conditions, such as a Maine Choreographer Services Contract - Self-Employed. Make sure to stay informed about tax laws and any industry regulations.

To get authorized, you typically need to register your business, acquire any necessary permits, and ensure you comply with state and local laws. It is crucial to understand tax obligations and other legal requirements. Using services such as US Legal Forms can simplify the process of getting your Maine Choreographer Services Contract - Self-Employed in order.