Maine Gust Series Seed Term Sheet

Description

developed by Gust, the platform powering over 90% of the organized angel investment groups in the United States.

The goal was to standardize on a single investment structure, eliminate confusion and significantly reduce the costs of negotiating, documenting and closing an early stage seed investment.

For those familiar with early stage angel transactions, this middle-of-the-road approach is founder-friendly and investor-rational, intended to strike a balance between the Series A Model Documents developed by the National

Venture Capital Association that have traditionally been used by most American angel groups (which include a 17 page term sheet and 120 pages of supporting documentation covering many low-probability edge cases), and the one page Series Seed 2.0 Term Sheet developed in 2010 by Ted Wang of Fenwick & West as a contribution to the early stage community (which deferred most investor protections and deal specifics until future financing rounds.)

The Gust Series Seed Term Sheet does meet Section 2.2 of the Founder Friendly Standard. The term sheet providesfor "reverse vesting"so the company can repurchase unvested stock if a Founder leaves before four years.

Annotated with detailed notes to help you understand each aspect of the Term Sheet."

How to fill out Gust Series Seed Term Sheet?

Are you presently in the placement that you need paperwork for possibly company or person reasons virtually every time? There are tons of lawful document layouts available on the net, but getting types you can rely on isn`t easy. US Legal Forms provides a large number of develop layouts, much like the Maine Gust Series Seed Term Sheet, which can be created to fulfill state and federal requirements.

When you are previously familiar with US Legal Forms web site and have a free account, simply log in. After that, you can obtain the Maine Gust Series Seed Term Sheet template.

If you do not have an bank account and want to start using US Legal Forms, abide by these steps:

- Find the develop you need and ensure it is for your correct area/county.

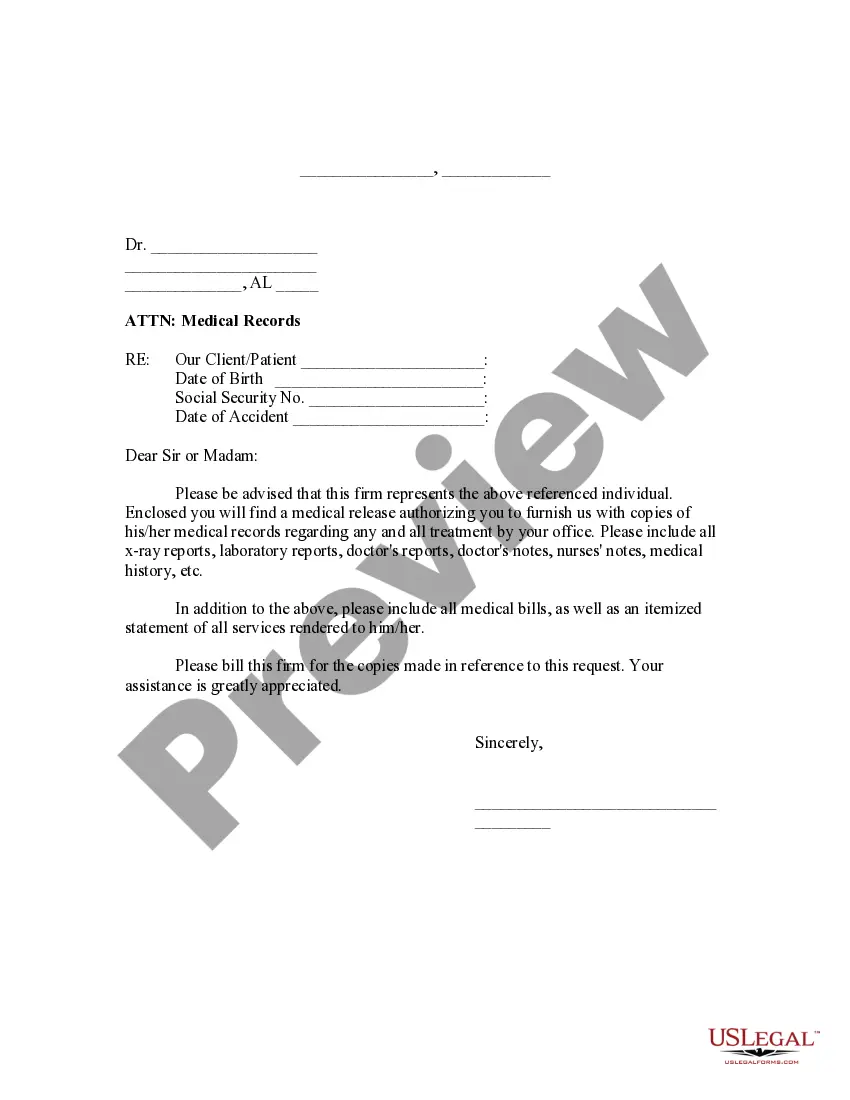

- Utilize the Review switch to review the shape.

- Look at the outline to actually have chosen the right develop.

- In case the develop isn`t what you are searching for, use the Look for field to get the develop that fits your needs and requirements.

- Once you get the correct develop, simply click Buy now.

- Opt for the rates prepare you want, complete the desired information to make your bank account, and pay for the transaction making use of your PayPal or bank card.

- Choose a hassle-free document format and obtain your copy.

Discover every one of the document layouts you might have purchased in the My Forms food list. You may get a more copy of Maine Gust Series Seed Term Sheet whenever, if possible. Just select the needed develop to obtain or printing the document template.

Use US Legal Forms, probably the most substantial collection of lawful forms, to save time as well as stay away from faults. The services provides expertly made lawful document layouts which you can use for a selection of reasons. Produce a free account on US Legal Forms and initiate generating your life easier.

Form popularity

FAQ

How does Series Seed Preferred Stock work? In a Series Seed financing round, startups issue a new class of preferred stock to investors. The terms of this new class are typically set forth in an amended and restated certificate of incorporation, and are sold by means of a stock purchase agreement.

You need a strong pitch because you likely won't have an actual product at this point. This pitch will let investors know precisely what they're investing in and include details about your product, business, target market, and financial predictions for the future of your business.

A typical term sheet has the following details: The proposed amount of funding and the duration of engagement. Rights of founders and other common shareholders. Rights of investors and restrictions. Proposed use of funds (how and where the money will be spent)

But no matter who the investor is, a term sheet will always contain six key components, including: A valuation. An estimate of what a company is worth as an investment opportunity. ... Securities being issued. ... Board rights. ... Investor protections. ... Dealing with shares. ... Miscellaneous provisions.

A term sheet is a preliminary, non-binding document outlining the proposed investment amount and other important details of a deal. When you're raising funds for your startup, a lead investor will use a term sheet to outline the key points of their offer to invest in your company.

What Is a Term Sheet? A term sheet is a nonbinding agreement that shows the basic terms and conditions of an investment. The term sheet serves as a template and basis for more detailed, legally binding documents.