Maine Accredited Investor Status Certificate Letter-Individual

Description

To become an accredited investor the (SEC) requires certain wealth, income or knowledge requirements. The investor must fall into one of three categories. Firms selling unregistered securities must put investors through their own screening process to determine if investors can be considered an accredited investor.

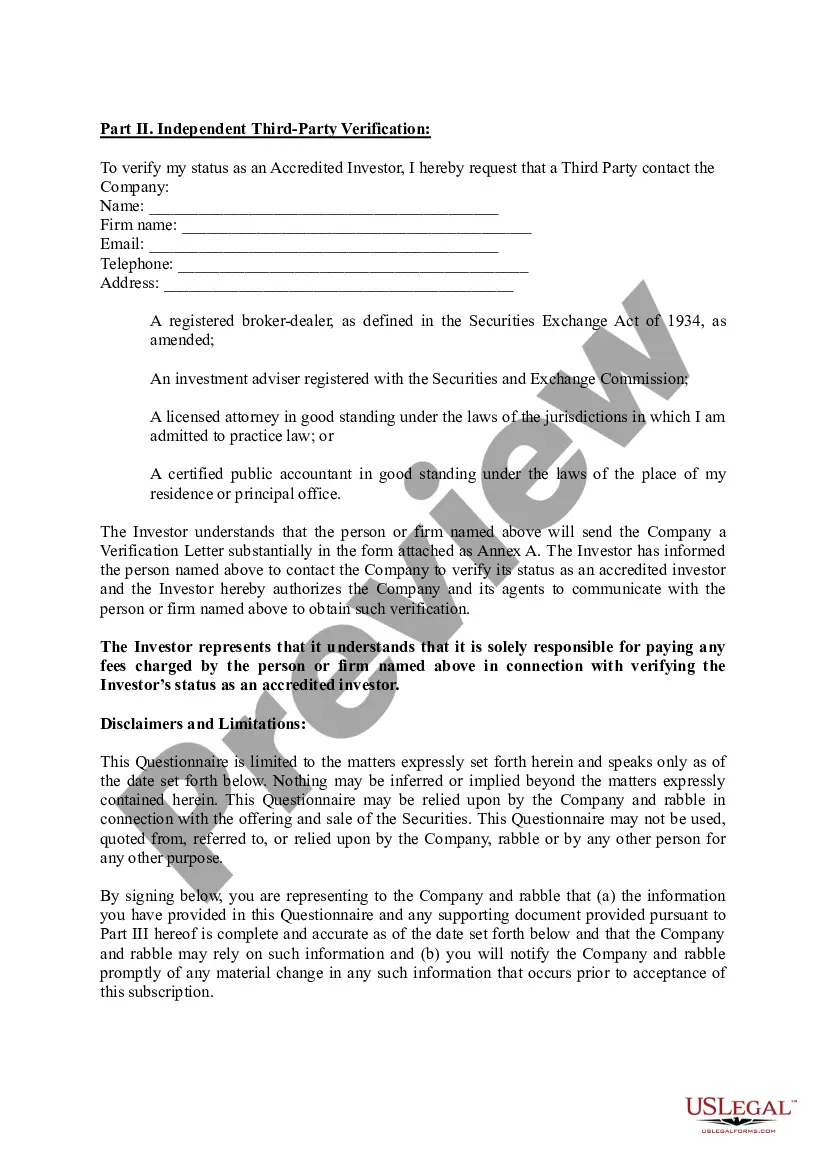

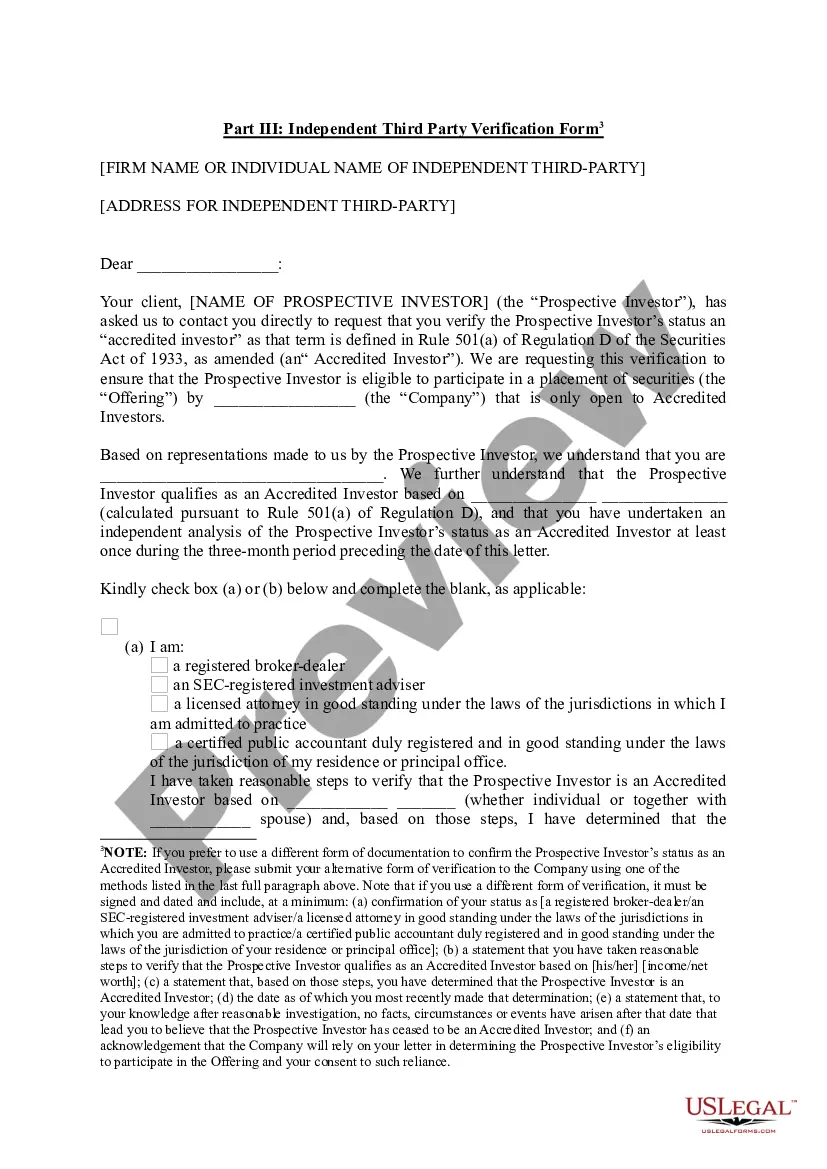

The Verifying Individual or Entity should take reasonable steps to verify and determined that an Investor is an "accredited investor" as such term is defined in Rule 501 of the Securities Act, and hereby provides written confirmation. This letter serves to help the Entity determine status.

How to fill out Accredited Investor Status Certificate Letter-Individual?

Discovering the right legal file design could be a have a problem. Obviously, there are plenty of templates available on the net, but how would you find the legal develop you require? Utilize the US Legal Forms internet site. The service gives 1000s of templates, like the Maine Accredited Investor Status Certificate Letter-Individual, that you can use for enterprise and private requires. Each of the varieties are checked out by specialists and satisfy state and federal needs.

In case you are previously signed up, log in for your accounts and then click the Download key to find the Maine Accredited Investor Status Certificate Letter-Individual. Use your accounts to look throughout the legal varieties you might have ordered formerly. Go to the My Forms tab of your accounts and obtain one more duplicate in the file you require.

In case you are a brand new end user of US Legal Forms, allow me to share straightforward guidelines so that you can follow:

- Initially, ensure you have chosen the appropriate develop to your metropolis/area. You can examine the form utilizing the Review key and look at the form outline to ensure this is the best for you.

- When the develop fails to satisfy your preferences, make use of the Seach discipline to obtain the proper develop.

- When you are positive that the form is acceptable, select the Purchase now key to find the develop.

- Select the pricing prepare you would like and enter in the required information and facts. Create your accounts and buy an order making use of your PayPal accounts or credit card.

- Pick the submit file format and download the legal file design for your system.

- Complete, edit and printing and signal the acquired Maine Accredited Investor Status Certificate Letter-Individual.

US Legal Forms may be the greatest local library of legal varieties that you will find various file templates. Utilize the company to download professionally-produced files that follow express needs.

Form popularity

FAQ

To confirm their status as an accredited investor, an investor can submit official documents for net worth and income verification, including: Tax returns. Pay stubs. Financial statements. IRS forms. Credit report. Brokerage statements. Tax assessments.

How can individuals qualify as accredited? Individuals (i.e., natural persons) may qualify as accredited investors based on wealth and income thresholds, as well as other measures of financial sophistication.

Individuals who want to become accredited investors must fall into one of three categories: have a net worth exceeding $1 million on your own or with a spouse or its equivalent; have earned an income surpassing $200,000 ($300,000 if combined with a spouse or its equivalent) during the last two years and prove an ...

How can I be verified as an Accredited Investor as an Individual? You have a letter dated within the last 90 days from a third party licensed attorney, a CPA, an SEC-registered investment adviser, or a registered broker-dealer certifying that you are accredited.

The simplest way to attain ?accredited investor? status is to ask for a 3rd party verification letter from a registered broker dealer, an attorney or a certified public accountant.

You can provide a letter from your own licensed CPA, licensed attorney, or registered wealth advisor attesting to your status as an accredited investor. The uploaded letter must: Be signed and dated by a qualified third-party; AND.

Since there is no actual accreditation process, there's no need for self-certification. Of course, accredited investors may secure the required financial statements ahead of time so that it is easier to prove their status during the investor verification process.

Can an LLC become an accredited investor? Yes, a Limited Liability Company (LLC) could potentially qualify as an accredited investor if it has total assets of at least $5,000,000 and the LLC was not created for the specific purpose of acquiring the securities.