Maine Reinsurance Agreement between Blue Cross Blue Shield of Missouri and Healthy Alliance Life Insurance Co.

Description

How to fill out Reinsurance Agreement Between Blue Cross Blue Shield Of Missouri And Healthy Alliance Life Insurance Co.?

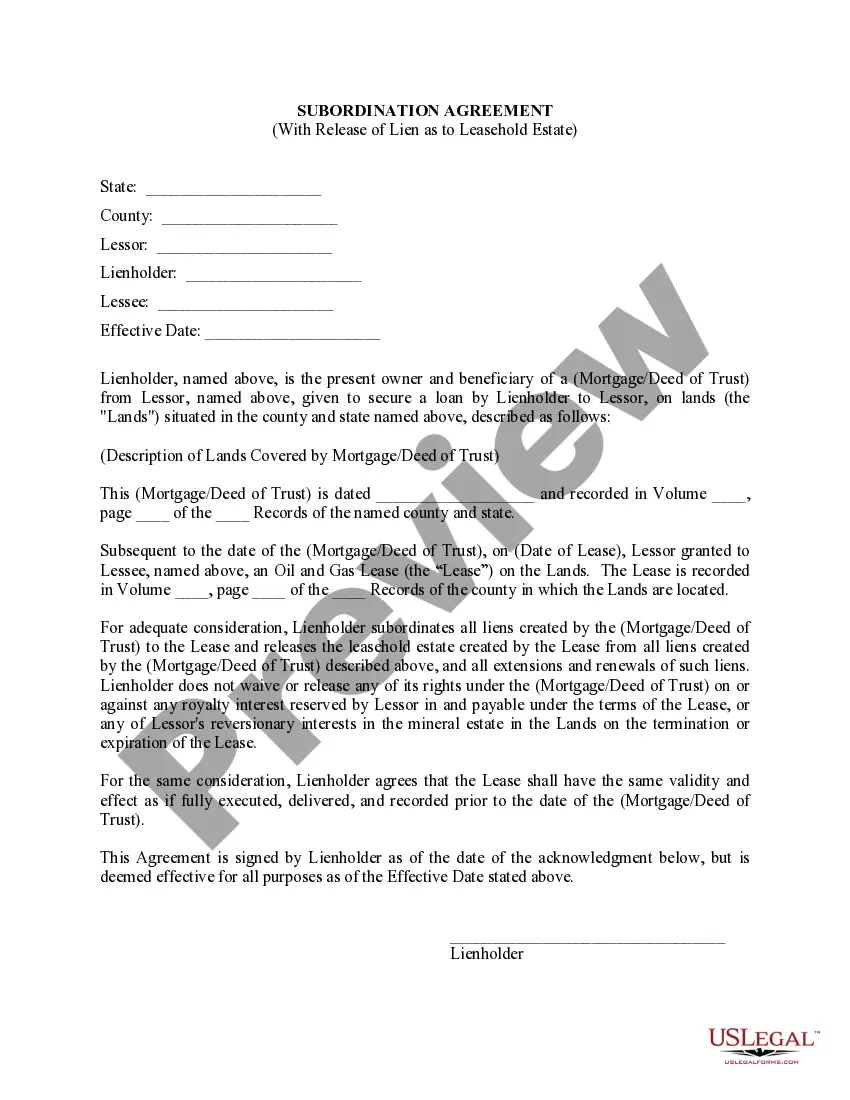

It is possible to commit hrs online attempting to find the legitimate document template that suits the federal and state needs you require. US Legal Forms supplies 1000s of legitimate kinds which are reviewed by experts. You can actually obtain or print the Maine Reinsurance Agreement between Blue Cross Blue Shield of Missouri and Healthy Alliance Life Insurance Co. from our assistance.

If you already have a US Legal Forms accounts, it is possible to log in and then click the Download switch. After that, it is possible to complete, modify, print, or signal the Maine Reinsurance Agreement between Blue Cross Blue Shield of Missouri and Healthy Alliance Life Insurance Co.. Each legitimate document template you get is your own permanently. To obtain another version for any obtained type, proceed to the My Forms tab and then click the corresponding switch.

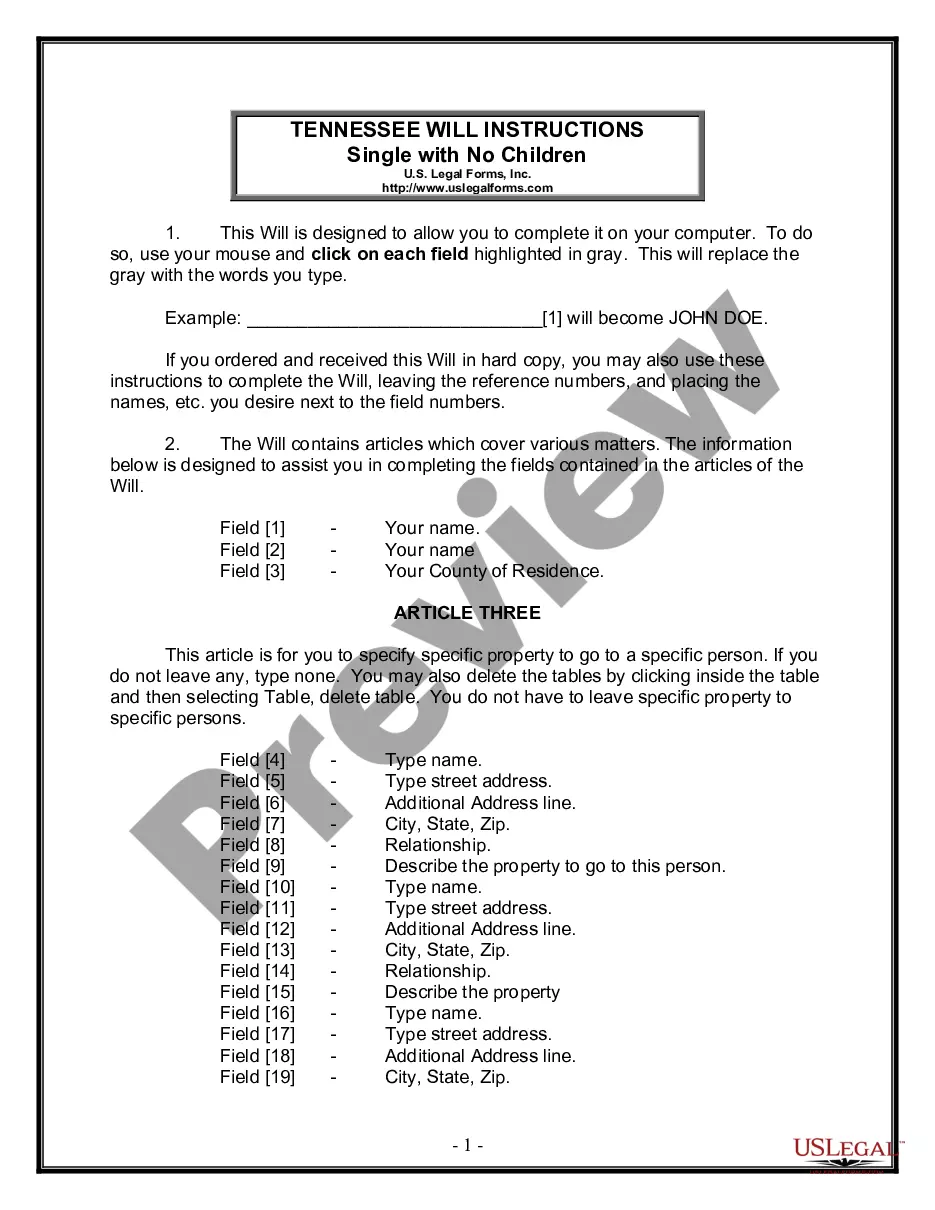

If you use the US Legal Forms web site for the first time, follow the easy directions under:

- First, make sure that you have selected the best document template to the county/area that you pick. Look at the type description to ensure you have picked the appropriate type. If available, make use of the Review switch to appear through the document template also.

- In order to locate another version of the type, make use of the Research area to find the template that meets your requirements and needs.

- Upon having identified the template you want, click on Purchase now to continue.

- Choose the costs prepare you want, type your qualifications, and sign up for a free account on US Legal Forms.

- Total the financial transaction. You can use your charge card or PayPal accounts to pay for the legitimate type.

- Choose the format of the document and obtain it to the product.

- Make modifications to the document if possible. It is possible to complete, modify and signal and print Maine Reinsurance Agreement between Blue Cross Blue Shield of Missouri and Healthy Alliance Life Insurance Co..

Download and print 1000s of document themes making use of the US Legal Forms site, which provides the greatest selection of legitimate kinds. Use specialist and condition-specific themes to take on your business or personal requires.

Form popularity

FAQ

The contestability period is typically two years from the date of application, during which time the insurance company has the right to investigate any information on the application that may be deemed inaccurate or fraudulent. If any inaccuracies or fraud are discovered, it can deny coverage or rescind the policy.

Shopping Assistance Individuals & Family Plans (under age 65): 1-844-290-7588. Medicare Supplement and Medicare Advantage Plans: 7 days a week 8 a.m. to 8 p.m. ... Medicare Part D Plans: 7 days a week 8 a.m. to 8 p.m. ... Employers Plans: Contact your broker or consultant to learn more about Anthem plans.

All life insurance policies have a period of contestability, usually a span of two years, during which the insurer can investigate the application for fraud and misrepresentation and consequently deny a claim for death benefits.

The insurer will provide a clear explanation of why they denied the claim. It's typically not worth contesting a denial unless you have evidence that there's been an error. Your state insurance department or a lawyer can help you contest the denial, but you can also appeal it on your own.

2 years *The validity of the policy may not be contested, unless it's for nonpayment of premium or fraudulent misstatements by the applicant, after the policy has been in force for 2 years.

In Missouri, the period for the life insurance company to do this is 2 years from the policy's effective date.