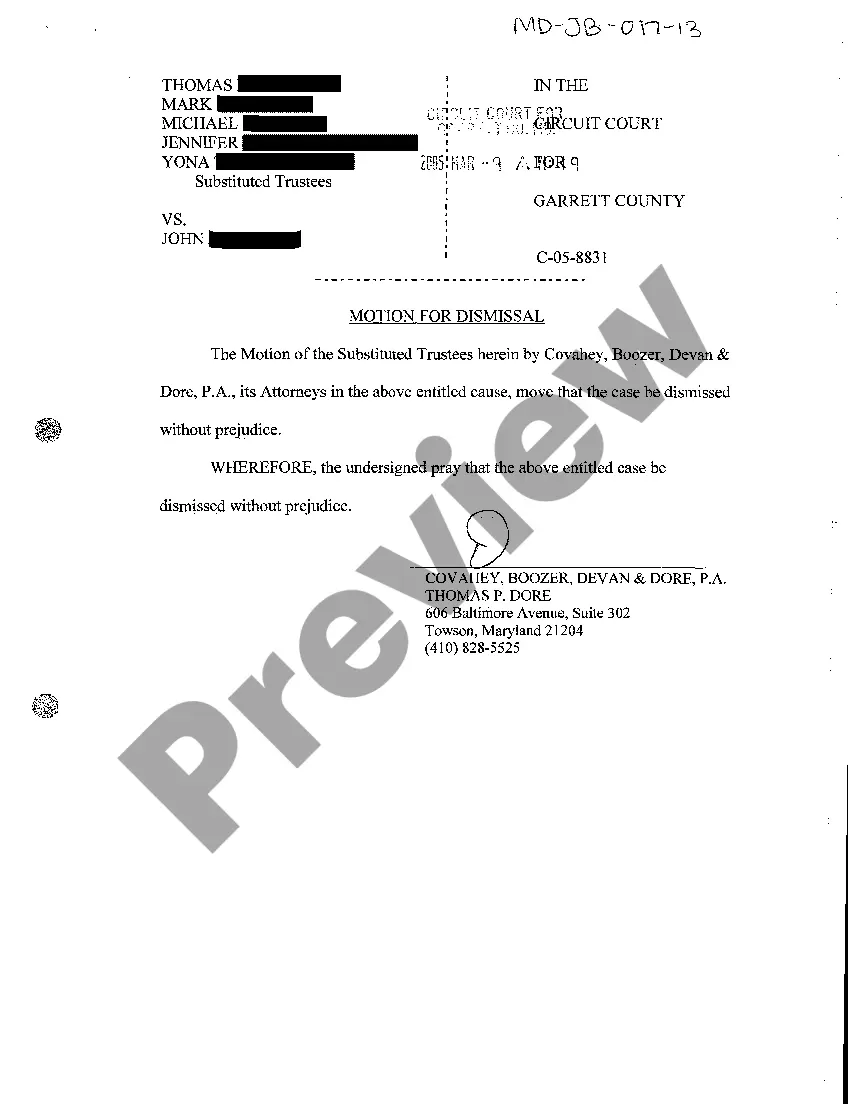

Maine Joint Filing of Rule 13d-1(f)(1) Agreement

Description

How to fill out Joint Filing Of Rule 13d-1(f)(1) Agreement?

Discovering the right legal record format can be quite a have a problem. Obviously, there are a lot of web templates available on the Internet, but how do you find the legal type you need? Use the US Legal Forms internet site. The services gives a huge number of web templates, for example the Maine Joint Filing of Rule 13d-1(f)(1) Agreement, which can be used for enterprise and personal needs. All of the forms are checked by pros and fulfill federal and state requirements.

If you are previously authorized, log in in your profile and click on the Obtain button to obtain the Maine Joint Filing of Rule 13d-1(f)(1) Agreement. Use your profile to appear from the legal forms you may have bought in the past. Proceed to the My Forms tab of your profile and acquire yet another duplicate of the record you need.

If you are a fresh end user of US Legal Forms, listed here are straightforward guidelines for you to comply with:

- Very first, be sure you have chosen the right type to your metropolis/area. You are able to check out the shape using the Review button and read the shape explanation to make sure this is basically the best for you.

- In the event the type does not fulfill your needs, take advantage of the Seach discipline to discover the proper type.

- Once you are positive that the shape is acceptable, go through the Purchase now button to obtain the type.

- Select the prices strategy you want and type in the required info. Make your profile and pay for the order using your PayPal profile or credit card.

- Select the data file formatting and down load the legal record format in your device.

- Full, change and print out and indication the acquired Maine Joint Filing of Rule 13d-1(f)(1) Agreement.

US Legal Forms is the most significant catalogue of legal forms in which you can discover different record web templates. Use the company to down load appropriately-produced files that comply with status requirements.

Form popularity

FAQ

Joint filings are typically used by groups of affiliated stockholders such as venture capital funds and their general partners and managing entities, but can be used by unrelated stockholders as well. An agreement to file jointly can apply to more than one filing.

Rights to acquire beneficial ownership: Under Rule 13d-3(d)(1), a person is deemed a beneficial owner of an equity security if the person (1) has a right to acquire beneficial ownership of the equity security within 60 days or (2) acquires the right to acquire beneficial ownership of the equity security with the ...

Schedule 13D reports the acquisition and other information within 10 days after the purchase.

Schedule 13D is a form that must be filed with the U.S. Securities and Exchange Commission (SEC) when a person or group acquires more than 5% of a voting class of a company's equity shares. Schedule 13D must be filed within 10 days of the filer reaching a 5% stake.

Timing, SEC Enforcement, and Next Steps IssueCurrent Schedule 13DInitial Filing DeadlineWithin 10 days after acquiring beneficial ownership of more than 5% or losing eligibility to file on Schedule 13G. Rules 13d-1(a), (e), (f) and (g).3 more rows ?

New Schedule 13D Requirements: Initial filing deadline of within five business days after acquiring beneficial ownership of more than five percent or losing eligibility to file on Schedule 13G (deadline reduced from 10 calendar days).

Under the prior rule, new 13D filers, including those who previously filed a Schedule 13G, were required to file their initial Schedule 13D within 10 days after acquiring beneficial ownership of greater than 5% of a covered class of equity securities or losing 13G eligibility.

An investor with control intent files Schedule 13D, while Exempt Investors and investors without a control intent, such as Qualified Institutional Investors and Passive Investors, file Schedule 13G.