This due diligence worksheet is used to summarize the analysis of insurance policies regarding business transactions.

Maine Insurance Policy Summary Information Worksheet

Description

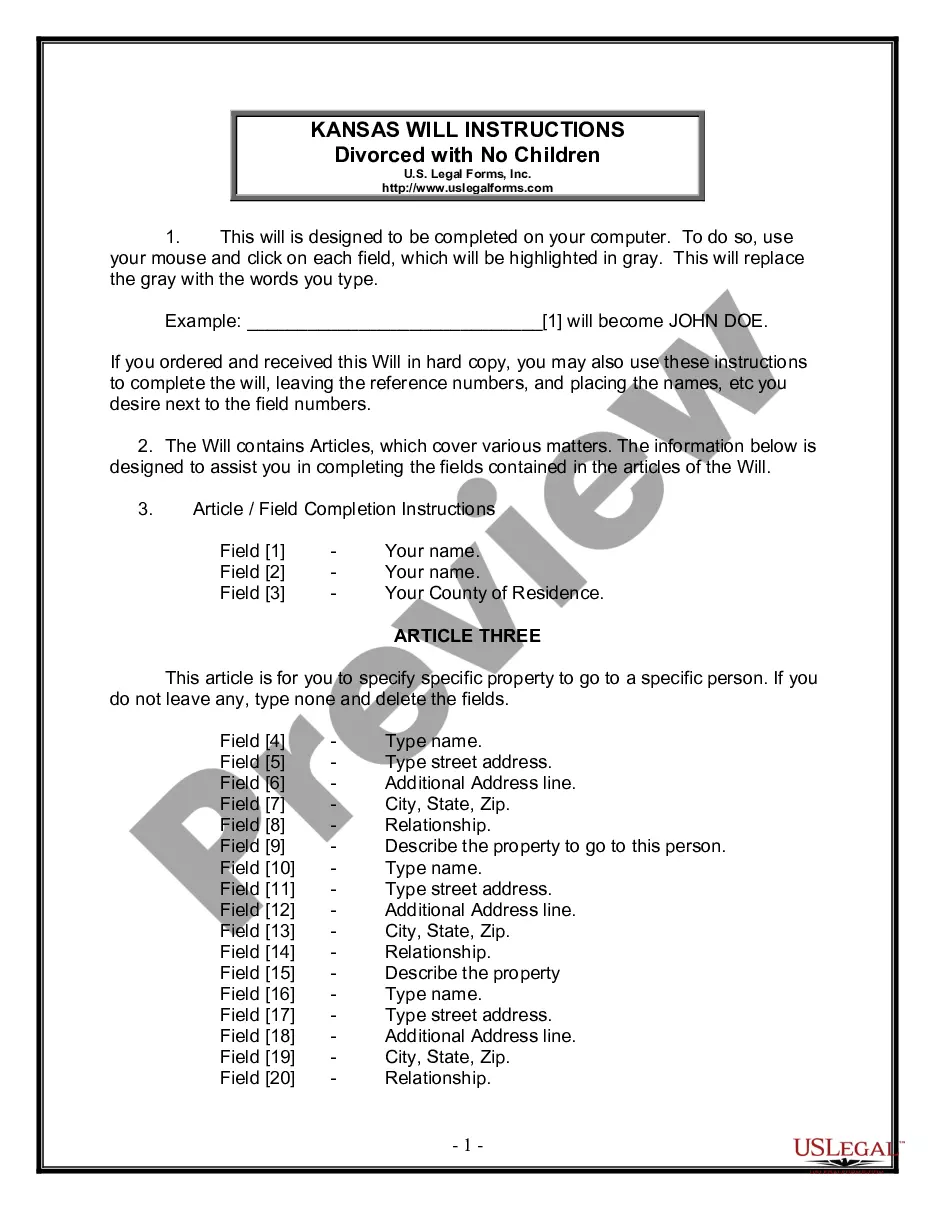

How to fill out Insurance Policy Summary Information Worksheet?

US Legal Forms - one of the most substantial collections of legal documents in the USA - provides a diverse assortment of legal document templates that you can download or print.

By using the website, you can find thousands of forms for business and personal use, organized by categories, states, or keywords. You can access the latest versions of forms like the Maine Insurance Policy Summary Information Worksheet within minutes.

If you already possess a membership, Log In and download the Maine Insurance Policy Summary Information Worksheet from the US Legal Forms library. The Download button will be available on each form you view. You have access to all previously downloaded forms in the My documents tab of your account.

Every template you added to your account has no expiration date and is yours forever. Therefore, to download or print another copy, simply go to the My documents section and click on the form you need.

Access the Maine Insurance Policy Summary Information Worksheet with US Legal Forms, the most extensive collection of legal document templates. Utilize thousands of professional and state-specific templates that satisfy your business or personal requirements.

- Ensure you have selected the appropriate form for your locality/county. Click the Preview button to examine the content of the form. Review the form description to confirm you have selected the correct one.

- If the form does not meet your needs, utilize the Search field at the top of the screen to find the one that does.

- Once you are pleased with the form, confirm your choice by selecting the Purchase now button. Next, choose the pricing plan you prefer and provide your information to create an account.

- Complete the transaction. Use your credit card or PayPal account to finalize the payment.

- Select the format and download the form to your device.

- Make edits. Fill out, modify, and print and sign the downloaded Maine Insurance Policy Summary Information Worksheet.

Form popularity

FAQ

Most insurance companies generate revenue in two ways: Charging premiums in exchange for insurance coverage, then reinvesting those premiums into other interest-generating assets.

Insurance is an agreement that guarantees an individual, company, or other entity against the loss of money. Insurance agreements, sold by insurance companies, are called policies.

The SBC is a snapshot of a health plan's costs, benefits, covered health care services, and other features that are important to consumers. SBCs also explain health plans' unique features like cost sharing rules and include significant limits and exceptions to coverage in easy-to- understand terms.

Check the assumptions the insurance company uses in its policy illustration such as interest rates, mortality rates and expected longevity. Compare results such as premiums, length of time they must be paid and benefits the policy provides. Make sure to look at carrier ratings and financial stability.

Insurance companies will ask for personal information such as your Social Security number and birth date to confirm your identity. They may also want to know what your salary is because they might limit how much insurance you can get based on your annual earnings.

Most insurance companies generate revenue in two ways: Charging premiums in exchange for insurance coverage, then reinvesting those premiums into other interest-generating assets. Like all private businesses, insurance companies try to market effectively and minimize administrative costs.

The policy summary must be delivered prior to or on the date of policy delivery. Either document must be provided to the client upon request.

(2) (a) At the time of delivery of an individual life insurance policy that provides long-term care benefits within the policy or by rider, a policy summary must be provided to the insured.

Existing insurers must provide policyowners with a policy summary for the existing life insurance within 10 days of receiving the written communication and replacement.

Property and casualty insurance companies are collecting data from telematics, agent interactions, customer interactions, smart homes, and even social media to better understand and manage their relationships, claims, and underwriting.