Maine Demand for Payment of Account by Business to Debtor

Description

How to fill out Demand For Payment Of Account By Business To Debtor?

Are you presently in a location where you frequently require documentation for both business or specific purposes? There are numerous legal form templates accessible online, but it can be challenging to find reliable versions.

US Legal Forms offers a vast selection of document templates, including the Maine Demand for Payment of Account by Business to Debtor, which can be tailored to fulfill federal and state regulations.

If you are already aware of the US Legal Forms website and have an account, simply Log In. After that, you can retrieve the Maine Demand for Payment of Account by Business to Debtor template.

Access all of the document templates you have purchased in the My documents section. You can obtain an additional copy of the Maine Demand for Payment of Account by Business to Debtor at any time, if required. Click on the desired form to download or print the document template.

Utilize US Legal Forms, the most extensive selection of legal documents, to save time and avoid mistakes. The service provides professionally crafted legal document templates that can be used for various purposes. Create an account on US Legal Forms and start simplifying your life.

- Locate the form you need and ensure it is for your specific city/region.

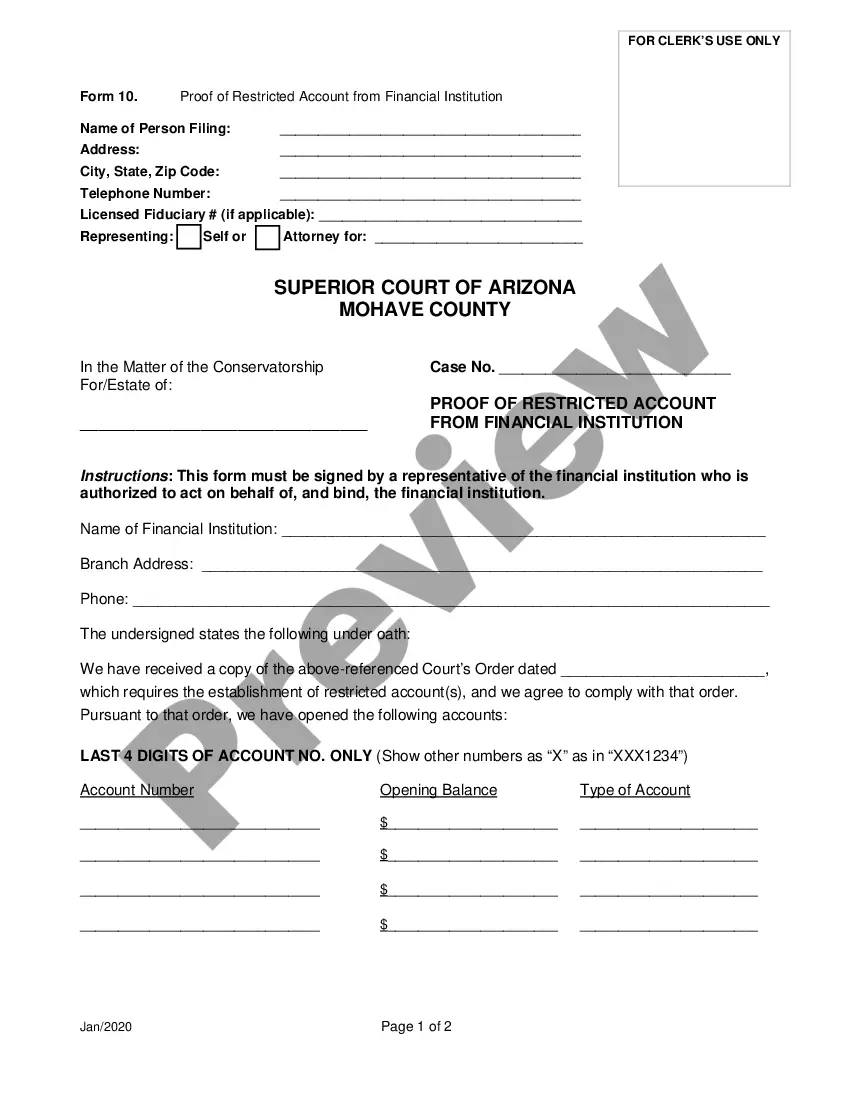

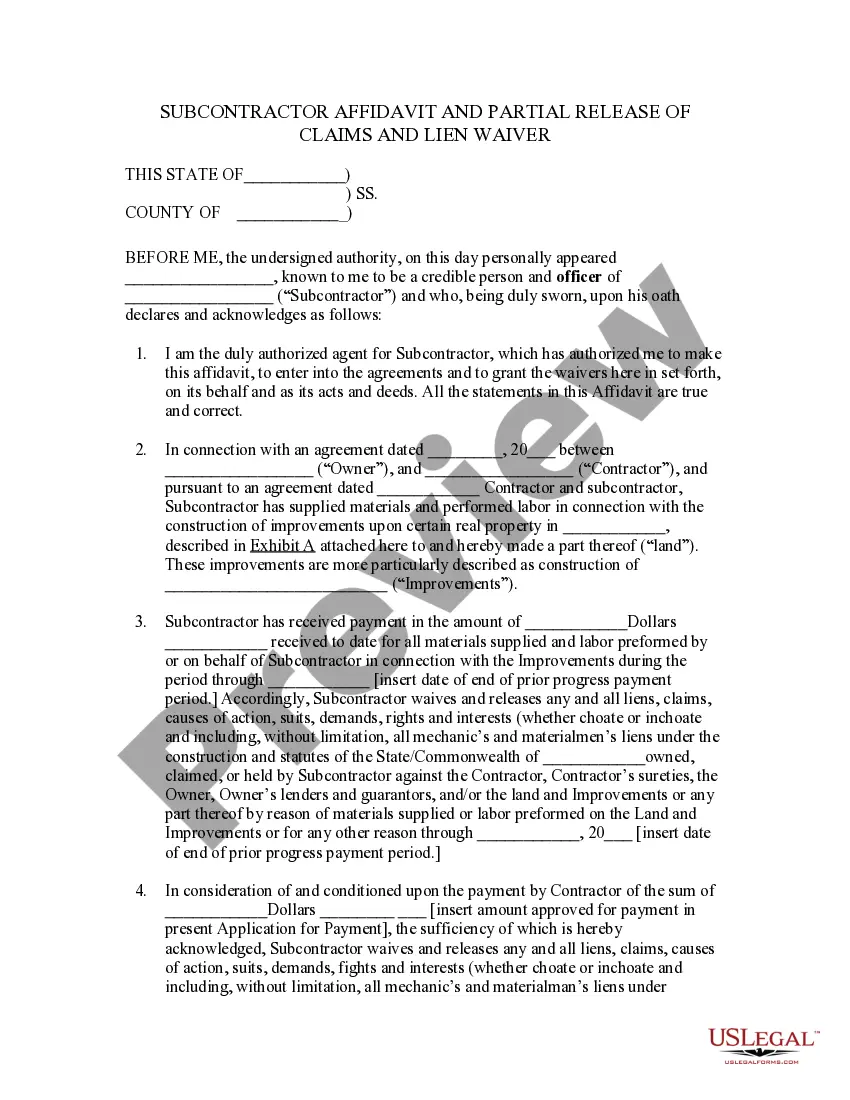

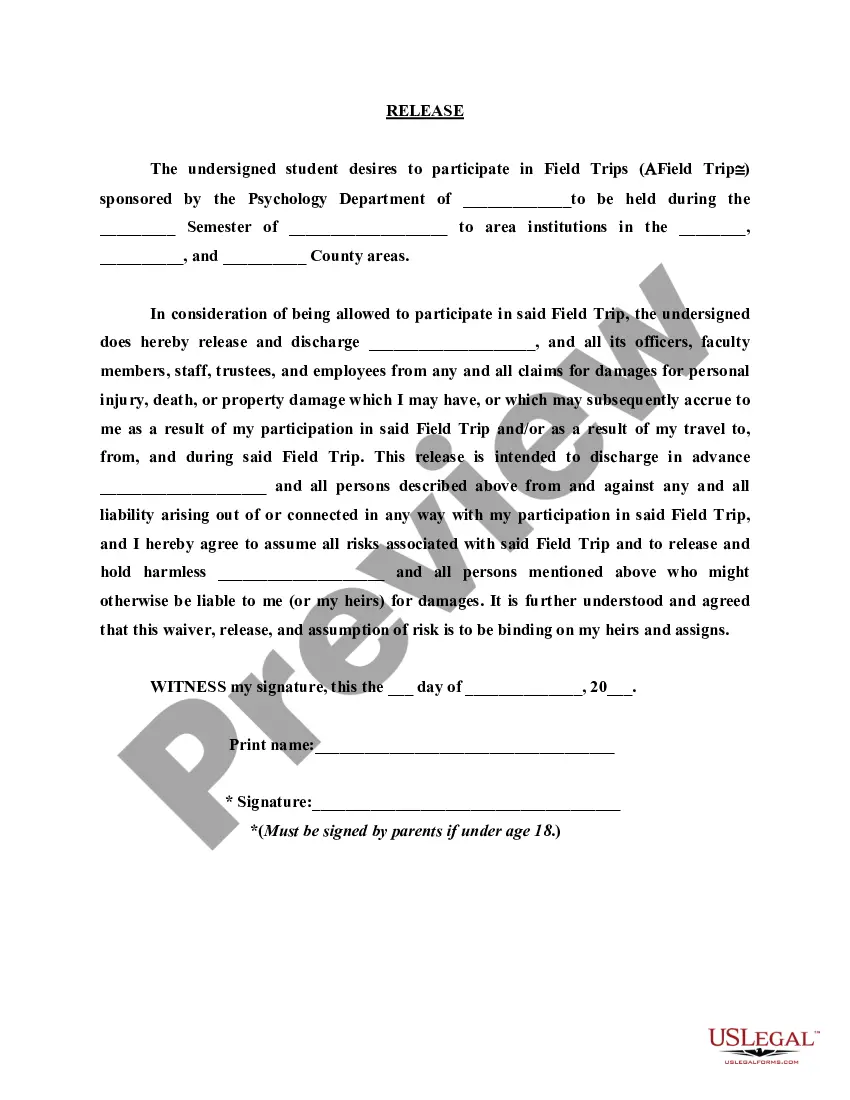

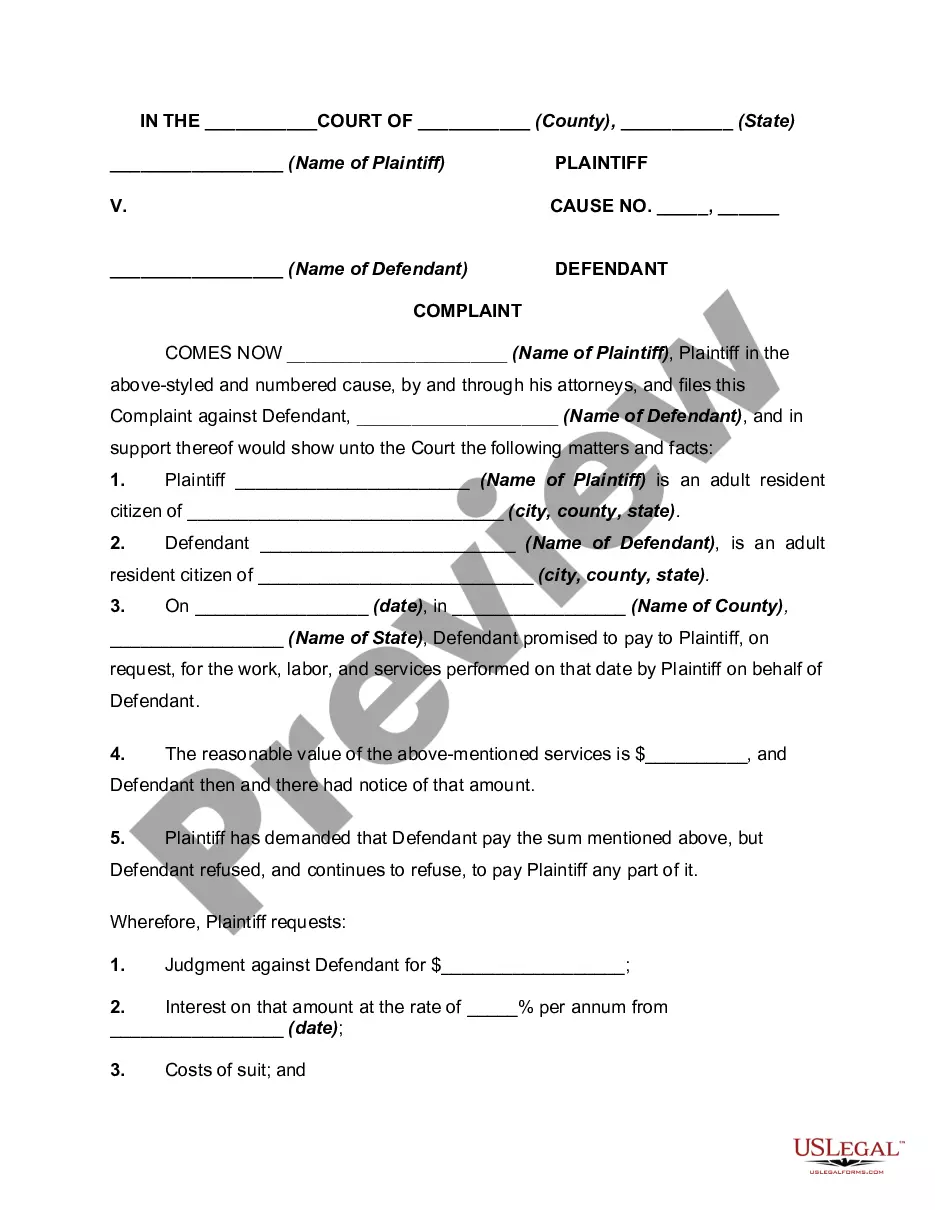

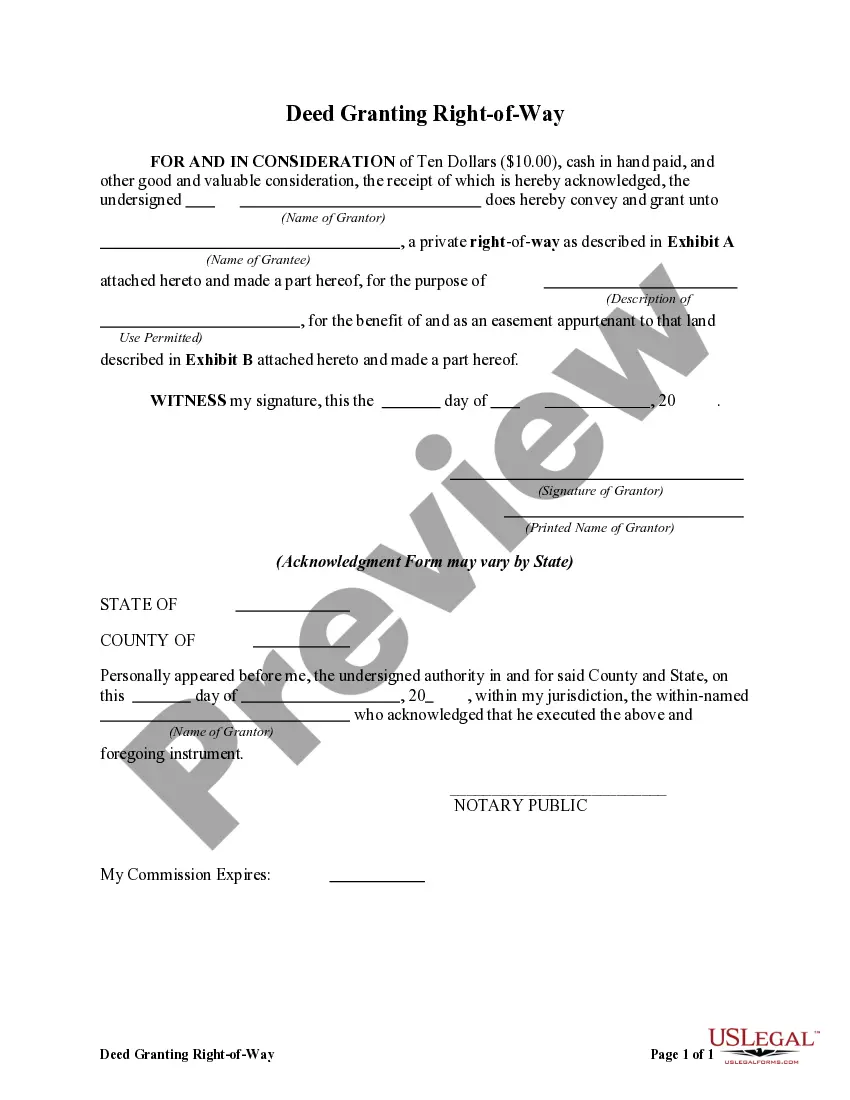

- Utilize the Review button to examine the form.

- Check the description to ensure you have selected the correct form.

- If the form does not match what you’re looking for, use the Search field to find the document that suits your needs and requirements.

- Once you find the right form, click Buy now.

- Choose the pricing plan you prefer, fill out the necessary details to create your account, and complete your purchase using your PayPal or credit card.

- Select a convenient document format and download your copy.

Form popularity

FAQ

A debt collector gains access to your bank account through a legal process called garnishment. If one of your debts goes unpaid, a creditoror a debt collector that it hiresmay obtain a court order to freeze your bank account and pull out money to cover the debt. The court order itself is known as a garnishment.

When Can Others See My Bank Accounts Balance?Government Agencies. Government agencies, like the Internal Revenue Service, can access your personal bank account.Liability Lawsuits.Law Enforcement Agencies and Warrants.Other Considerations.

Your creditors do not have to accept your offer of payment or freeze interest. If they continue to refuse what you are asking for, carry on making the payments you have offered anyway. Keep trying to persuade your creditors by writing to them again.

Creditor's rights can refer to many different aspects of creditor-debtor and creditor-creditor relations including a creditor's rights to place a lien on a debtor's property, garnish a debtor's wages, set aside a fraudulent conveyance, and contact the debtor and relatives.

Your creditors do not have to accept your offer of payment or freeze interest. If they continue to refuse what you are asking for, carry on making the payments you have offered anyway. Keep trying to persuade your creditors by writing to them again.

If the debtor still refuses to pay the unsecured debt, the creditor can file a lawsuit against the debtor. Once a court grants judgment in favor of the creditor, it can usually take money from the debtor's bank account or garnish the debtor's wages.

If the debtor does not show up at the hearing, the court may issue a bench warrant for the debtor's arrest. If the debtor shows up, you will have the chance to ask him or her questions about where he or she works and what bank accounts, property, belongings, stocks, or any other assets the debtor may have.

Of course, that isn't without risk: if a borrower fails to make required payments, the lender can foreclose on the borrower's home. Unsecured loans can curtail extra expenses. If you take out a home or car loan, the lender will require that you carry insurance on the asset.

A bank account levy allows a creditor to legally take funds from your bank account. When a bank gets notification of this legal action, it will freeze your account and send the appropriate funds to your creditor. In turn, your creditor uses the funds to pay down the debt you owe.