Maine Balance Sheet Deposits

Description

How to fill out Balance Sheet Deposits?

Are you presently in a role that you will require documents for either organization or particular reasons almost every time.

There are numerous official document templates accessible online, but finding versions you can trust is not straightforward.

US Legal Forms offers thousands of form templates, similar to the Maine Balance Sheet Deposits, that are created to comply with federal and state requirements.

Once you find the correct form, click on Purchase now.

Choose the pricing plan you prefer, fill out the necessary information to create your account, and complete the payment using your PayPal or Visa or Mastercard.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Maine Balance Sheet Deposits template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Search for the form you need and ensure it is for the correct city/state.

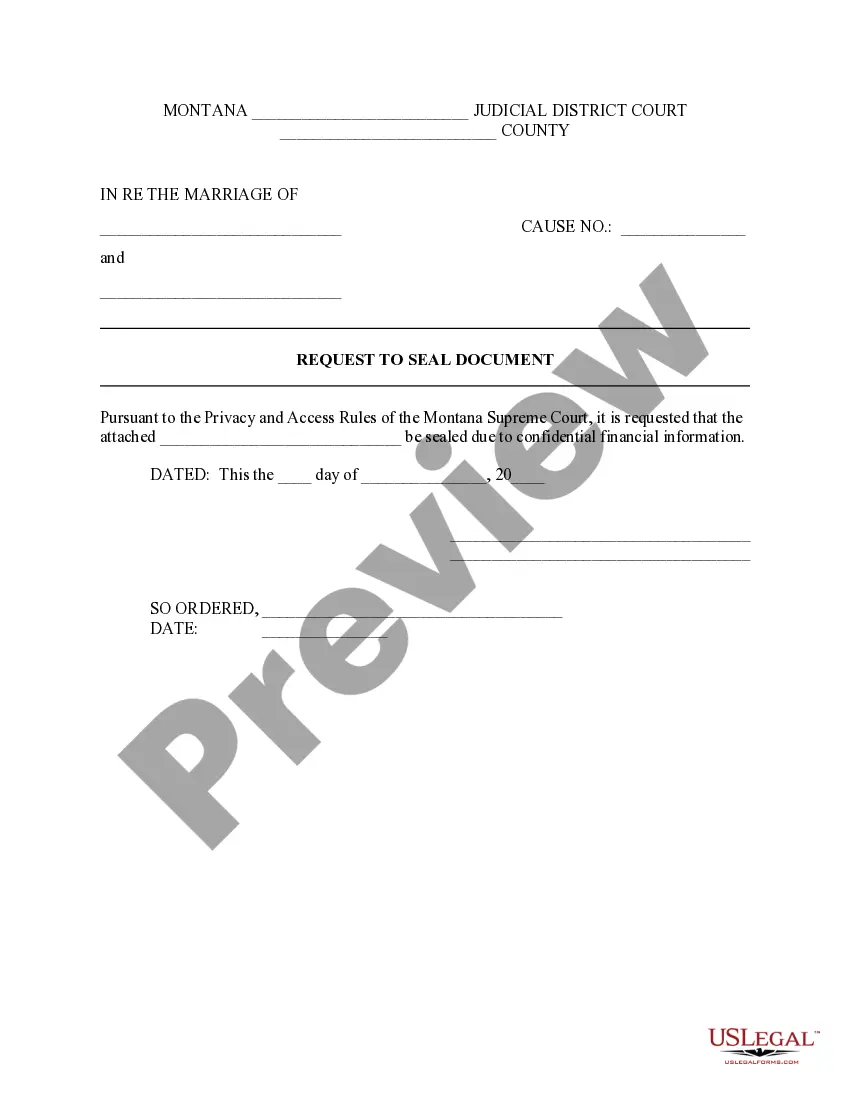

- Utilize the Preview button to review the form.

- Check the description to make sure you have selected the right form.

- If the form is not what you are looking for, use the Search box to find the form that meets your needs and requirements.

Form popularity

FAQ

Cash and cash equivalents under the current assets section of a balance sheet represent the amount of money the company has in the bank, whether in the form of cash, savings bonds, certificates of deposit, or money invested in money market funds. It tells you how much money is available to the business immediately.

The deposit itself is a liability owed by the bank to the depositor. Bank deposits refer to this liability rather than to the actual funds that have been deposited.

A company's balance sheet provides a tremendous amount of insight into its solvency and business dealings. 1 A balance sheet consists of three primary sections: assets, liabilities, and equity.

The volume of business of a bank is included in its balance sheet for both assets (lending) and liabilities (customer deposits or other financial instruments).

In either case, on a bank's T-account, assets will always equal liabilities plus net worth. When bank customers deposit money into a checking account, savings account, or a certificate of deposit, the bank views these deposits as liabilities.

What Goes on a Balance Sheet?Property and equipment.Long-term marketable securities.Intangible assets such as patents, licenses, and goodwill.

However, for a bank, a deposit is a liability on its balance sheet whereas loans are assets because the bank pays depositors interest, but earns interest income from loans.

A bank's balance sheet is different from that of a typical company. You won't find inventory, accounts receivable, or accounts payable. Instead, under assets, you'll see mostly loans and investments, and on the liabilities side, you'll see deposits and borrowings.

Deposits is a current liability account in the general ledger, in which is stored the amount of funds paid by customers in advance of a product or service delivery. These funds are essentially down payments.

Deposits as Assets When a business places a security deposit that is, it gives someone else money to hold against possible future charges the deposit is listed as an asset on its balance sheet.