Maine Extended Date for Performance, also known as MDP, is a legal provision that extends the time frame for performing certain contractual obligations beyond the original agreed-upon date. This extension is specifically applicable in situations where unforeseen circumstances or events beyond the control of the parties involved prevent the completion of the contractual obligations within the originally stipulated time. One key purpose of the Maine Extended Date for Performance provision is to provide protection and flexibility to both parties involved in a contract. It allows for adjustments to be made in response to unexpected disruptions, ensuring fair treatment and preventing undue hardship on either party. This provision is commonly utilized in various types of agreements, including real estate contracts, construction contracts, commercial leases, and other business agreements. The Maine Extended Date for Performance provision can be particularly crucial in projects that are affected by uncontrollable factors such as extreme weather conditions, labor strikes, material shortages, or governmental actions. By allowing for an extension of time rather than triggering a breach of contract claim, this provision encourages parties to work together and find viable solutions to unforeseen challenges. Furthermore, it is essential to note that the Maine Extended Date for Performance provision is not automatically included in all contracts. It needs to be explicitly stated within the agreement to be enforceable. Additionally, the specific terms and conditions of this provision can vary depending on the nature of the contract, industry standards, and the preferences of the involved parties. Different types of Maine Extended Date for Performance provisions exist to cater to specific needs. For instance, a contract may include a fixed-term extension, which grants a predetermined additional timeframe for completion of obligations. Alternatively, a variable extension may be incorporated to allow for a flexible adjustment based on the extent of the unforeseen circumstances. In summary, Maine Extended Date for Performance is a valuable provision that provides the necessary flexibility when unforeseen events hinder the timely completion of contractual obligations. By explicitly defining the terms and conditions within the agreement, parties can mitigate risks, ensure fairness, and work towards mutually beneficial resolutions.

Maine Extended Date for Performance

Description

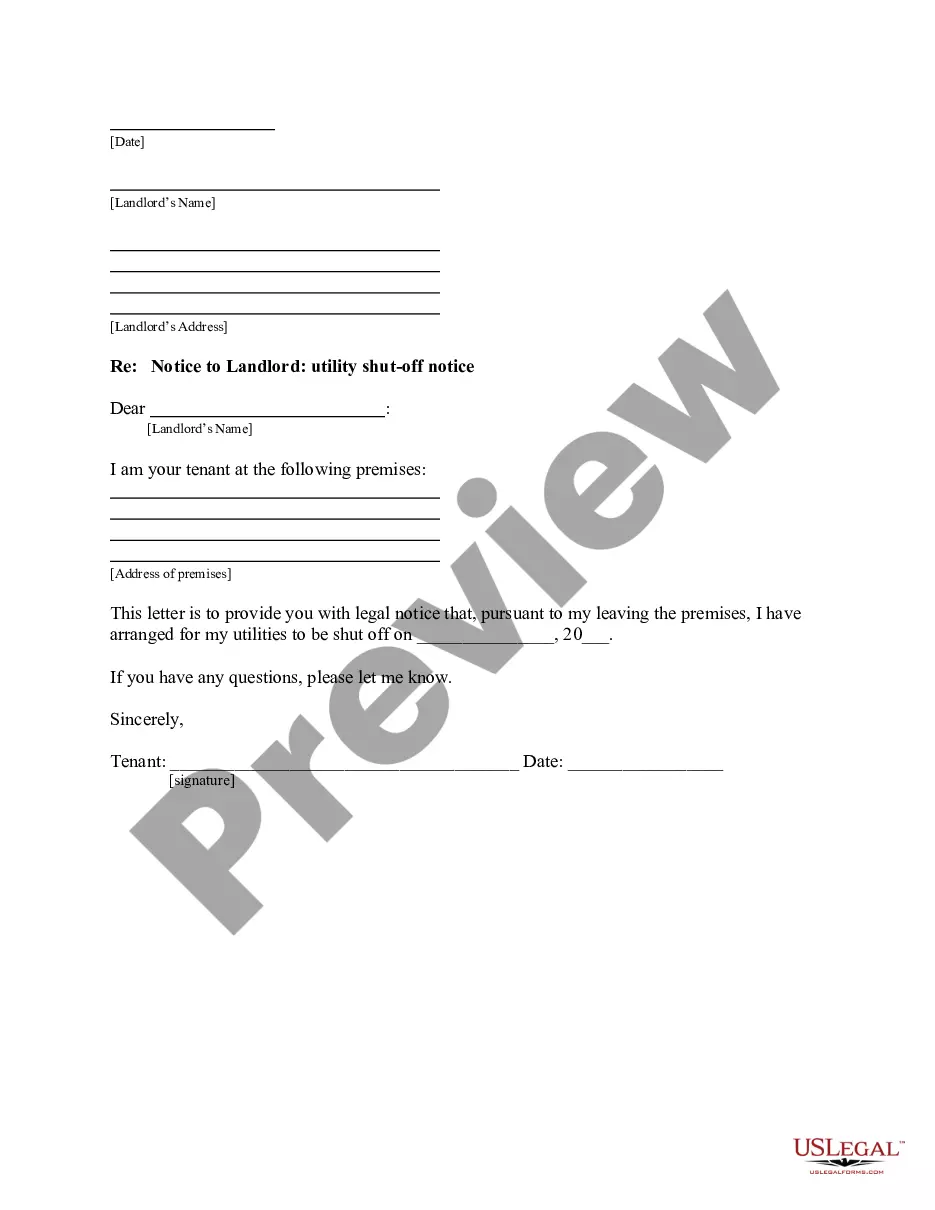

How to fill out Maine Extended Date For Performance?

If you want to full, down load, or print out legitimate file web templates, use US Legal Forms, the greatest variety of legitimate types, which can be found on-line. Use the site`s simple and easy hassle-free lookup to discover the documents you will need. A variety of web templates for organization and individual functions are categorized by groups and suggests, or keywords. Use US Legal Forms to discover the Maine Extended Date for Performance within a number of clicks.

Should you be already a US Legal Forms buyer, log in to the profile and then click the Acquire button to get the Maine Extended Date for Performance. You may also entry types you formerly saved from the My Forms tab of your profile.

If you are using US Legal Forms the very first time, follow the instructions below:

- Step 1. Ensure you have chosen the shape for your right metropolis/land.

- Step 2. Use the Review solution to look through the form`s content material. Don`t overlook to learn the description.

- Step 3. Should you be not satisfied with the form, make use of the Lookup industry towards the top of the display to discover other types from the legitimate form web template.

- Step 4. After you have found the shape you will need, go through the Get now button. Select the prices prepare you choose and add your references to register for an profile.

- Step 5. Procedure the deal. You can utilize your Мisa or Ьastercard or PayPal profile to perform the deal.

- Step 6. Find the structure from the legitimate form and down load it on your own system.

- Step 7. Total, modify and print out or indicator the Maine Extended Date for Performance.

Each legitimate file web template you acquire is your own eternally. You possess acces to each and every form you saved inside your acccount. Go through the My Forms area and decide on a form to print out or down load again.

Be competitive and down load, and print out the Maine Extended Date for Performance with US Legal Forms. There are thousands of expert and state-certain types you may use for the organization or individual requirements.

Form popularity

FAQ

Asking for an extension after the deadline typically requires you to file your tax return late along with an explanation for the delay. While the Maine Extended Date for Performance may offer options, addressing your situation quickly is key to minimizing penalties. Platforms like US Legal Forms are helpful for understanding your rights and responsibilities in these cases.

To file an extension in Maine, you must submit a specific form with the necessary information, including your estimated tax liability. The Maine Extended Date for Performance provides a simple way to extend your filing period. Utilizing resources like US Legal Forms makes it easier to find the correct forms and instructions for a seamless extension.

Filing an extension after the deadline can be challenging, but you can still submit your return as soon as possible. Ensure you understand the potential penalties associated with a late extension request. For a smoother experience, US Legal Forms offers templates and information to help you properly navigate this process.

Filing taxes late without an extension can lead to penalties and interest on any taxes due. The Maine Extended Date for Performance does not apply in such instances, which may complicate your tax situation. To navigate these challenges, consider consulting platforms like US Legal Forms that provide valuable resources for managing late tax filings.

If you miss the deadline to file an extension, you may still be able to submit your tax return, but expect penalties. The state of Maine has specific guidelines related to late filings, which are important to understand. Utilizing services like US Legal Forms can help clarify your options and ensure compliance with state tax laws.

Yes, you can still request an extension on your taxes even after the filing deadline, but it may come with penalties and interest. The Maine Extended Date for Performance allows you to enjoy additional time for filing, but you should act promptly to minimize costs. Consider using resources like US Legal Forms for guidance on managing your tax paperwork effectively.

If you forgot to file your state taxes, don’t panic. You should file your tax return as soon as you remember, as this demonstrates your intention to comply with tax laws. Check if you qualify for the Maine Extended Date for Performance, which might ease some penalties. Additionally, using uslegalforms can provide you with the necessary forms and guidance, making the process smoother and more manageable.

If you miss the tax deadline in Maine, you may face penalties, but you still can take steps to rectify the situation. The Maine Extended Date for Performance might give you some leeway, allowing you to file without facing additional penalties in certain circumstances. You must act quickly, as tax authorities often expect you to submit your tax return and payment promptly. Utilizing resources like uslegalforms can help you navigate this issue effectively.

Maine Schedule NRH, or Non-Resident Homestead, is a form that non-residents use to claim a credit for property taxes. This schedule helps eligible taxpayers benefit from available tax privileges, even if they live outside of Maine. If you need assistance with this process, consider using the services provided by uslegalforms. They can guide you through filing accurately while adhering to the Maine Extended Date for Performance.

If you file your state taxes late in Maine, you may face penalties and interest on the unpaid balance. The Maine Extended Date for Performance can sometimes provide additional time, but it is crucial to understand the deadlines. Keep in mind that filing late may affect your eligibility for refunds or credits. It’s always recommended to file as soon as possible to minimize any potential consequences.