Maine Proof of Residency for School Enrollment

Description

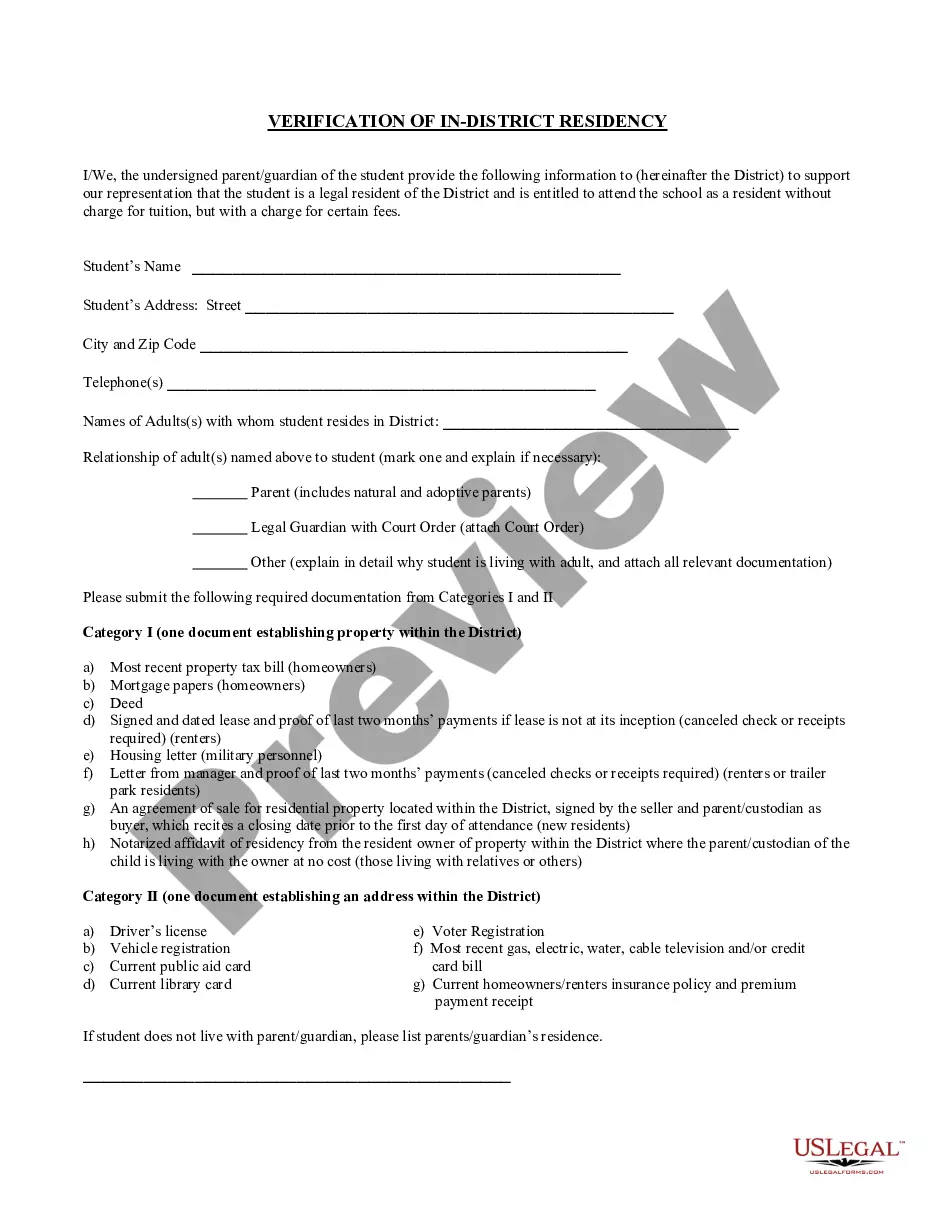

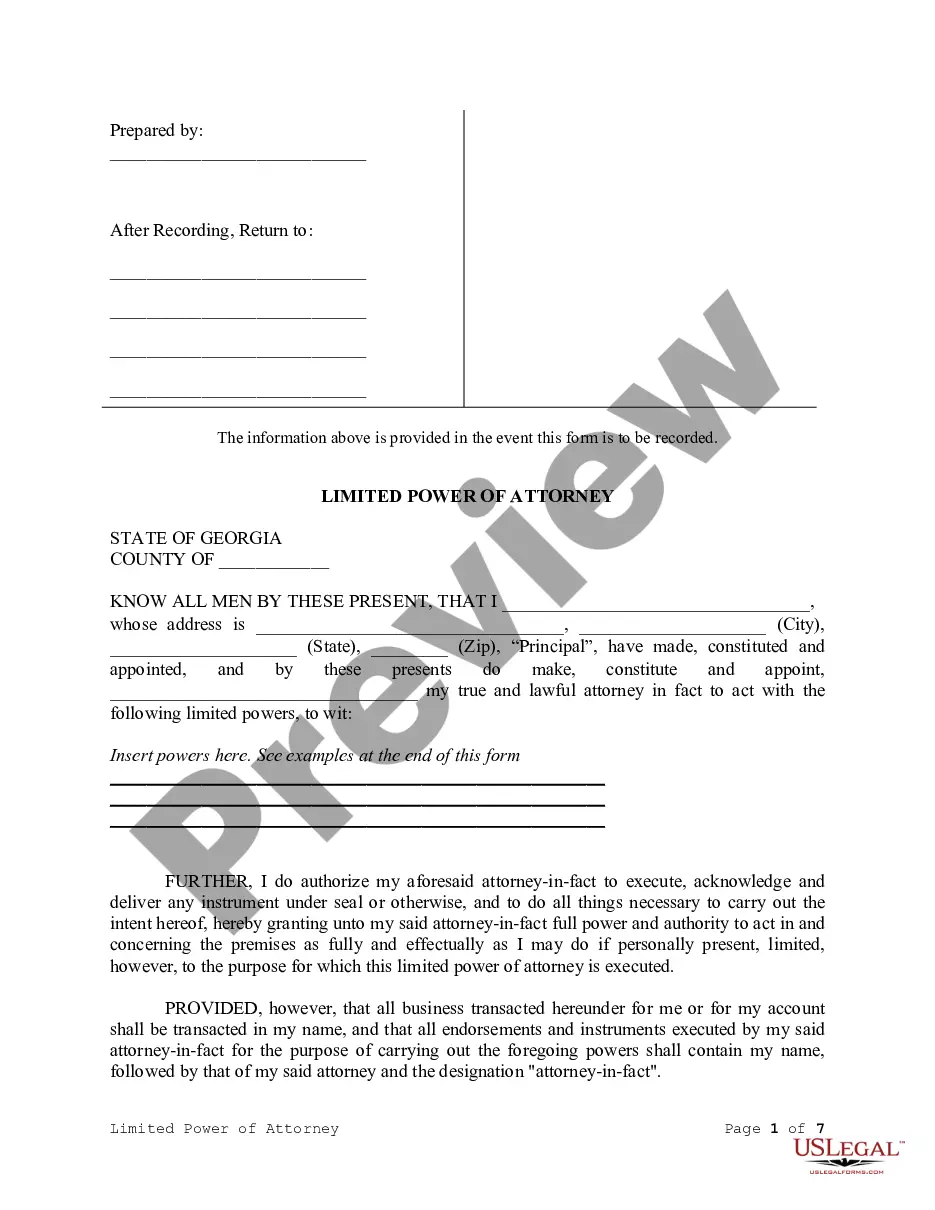

How to fill out Proof Of Residency For School Enrollment?

If you wish to full, obtain, or print out lawful papers themes, use US Legal Forms, the biggest assortment of lawful types, that can be found on-line. Take advantage of the site`s easy and hassle-free research to find the paperwork you will need. Various themes for enterprise and specific uses are categorized by classes and says, or key phrases. Use US Legal Forms to find the Maine Proof of Residency for School Enrollment within a number of click throughs.

When you are currently a US Legal Forms buyer, log in in your accounts and then click the Obtain button to have the Maine Proof of Residency for School Enrollment. You can even entry types you earlier saved within the My Forms tab of the accounts.

If you are using US Legal Forms the very first time, follow the instructions listed below:

- Step 1. Ensure you have selected the form for the proper metropolis/nation.

- Step 2. Take advantage of the Review choice to look through the form`s information. Never forget to learn the outline.

- Step 3. When you are unsatisfied using the type, use the Look for industry near the top of the display screen to discover other versions of your lawful type format.

- Step 4. Once you have found the form you will need, click the Buy now button. Opt for the prices plan you prefer and include your accreditations to register on an accounts.

- Step 5. Process the financial transaction. You may use your credit card or PayPal accounts to accomplish the financial transaction.

- Step 6. Choose the file format of your lawful type and obtain it on your gadget.

- Step 7. Complete, revise and print out or sign the Maine Proof of Residency for School Enrollment.

Every single lawful papers format you get is yours forever. You possess acces to each type you saved in your acccount. Select the My Forms section and pick a type to print out or obtain once again.

Be competitive and obtain, and print out the Maine Proof of Residency for School Enrollment with US Legal Forms. There are millions of expert and condition-distinct types you can utilize for your personal enterprise or specific requirements.

Form popularity

FAQ

Maine residents are eligible for more than 1,800 undergraduate and graduate degree programs through Tuition Break. The programs are offered by public colleges and universities in Connecticut, Massachusetts, New Hampshire, Rhode Island and Vermont ? all at a substantial tuition discount.

Tuition: UMaineUSMIn-State$9,240$8,071Out-of-State$30,030$23,070Regional Student Program$15,720$14,250Canadian$9,240$8,071

Current tax bill or rent receipt. Current vehicle registration. Current voter registration. Divorce decree ? may assign the child(s) primary/permanent residence.

You are a statutory resident if: 1. you spent more than 183 days in Maine during the tax year (with any portion of a day counted as a full day), and 2. you maintained a permanent place of abode in Maine.

You are a statutory resident if: 1. you spent more than 183 days in Maine during the tax year (with any portion of a day counted as a full day), and 2. you maintained a permanent place of abode in Maine.

An individual who has lived in the State of Maine, for other than educational purposes, one year prior to registration or application to a campus is considered an in-state student.

You (or your parent, if you are a dependent student) must have lived in Massachusetts for the 12 months immediately before your enrollment at a state university or at the University of Massachusetts; or for 6 months before your enrollment at a community college.

Utility Bill - electric bill, water/sewer bill, cell phone bill, etc. Maine Resident Hunting and or Fishing License. Contract in their name - mortgage agreement, lease, insurance policy, insurance ID card, SR22. Tax bill.