This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Maine Contract to Sell Commercial Property with Commercial Building - Seller Financing Secured by Mortgage and Security Agreement

Description

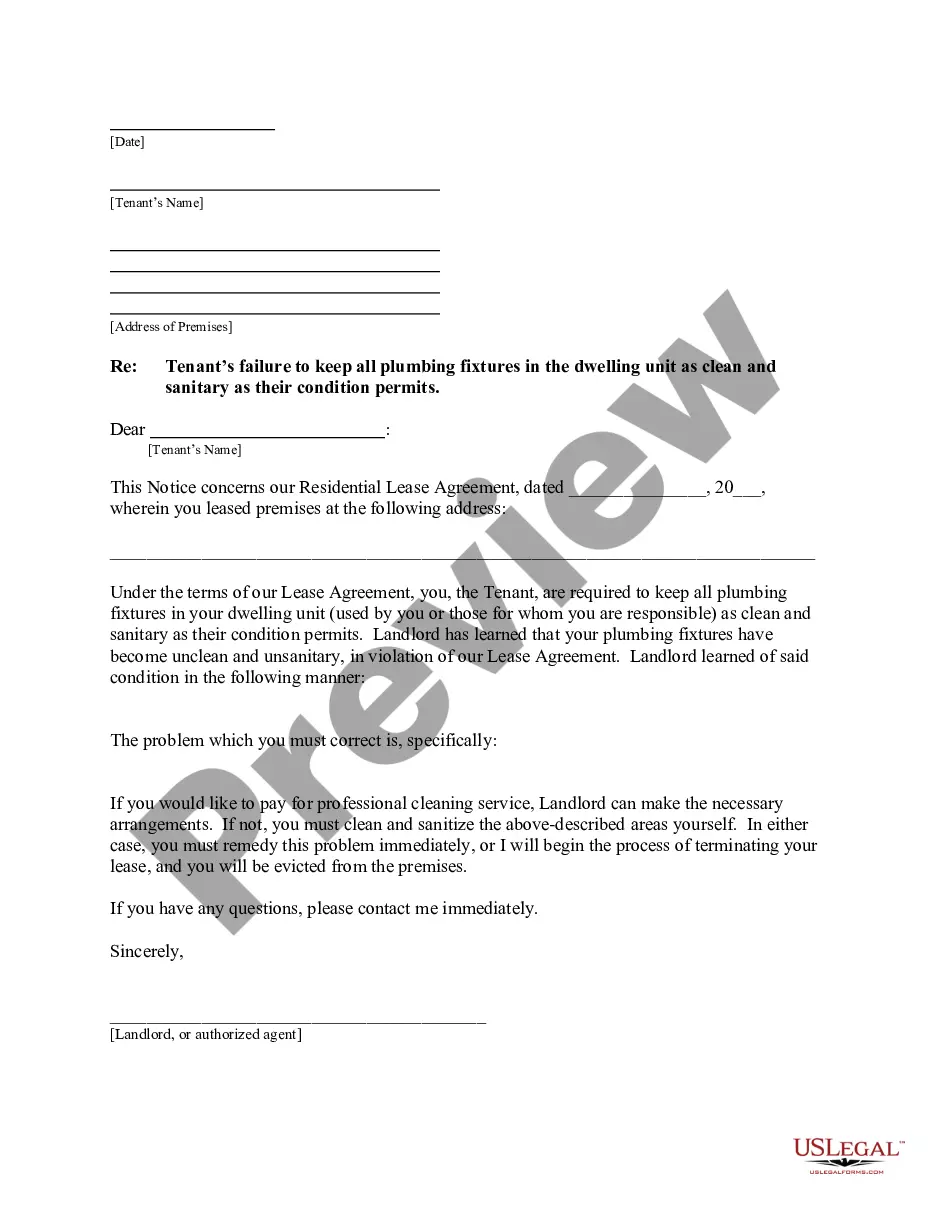

How to fill out Contract To Sell Commercial Property With Commercial Building - Seller Financing Secured By Mortgage And Security Agreement?

Have you been in the situation where you need to have papers for possibly organization or personal purposes nearly every time? There are tons of legal file templates available on the net, but getting kinds you can trust isn`t easy. US Legal Forms delivers a huge number of type templates, such as the Maine Contract to Sell Commercial Property with Commercial Building - Seller Financing Secured by Mortgage and Security Agreement, that are composed in order to meet state and federal requirements.

In case you are presently knowledgeable about US Legal Forms web site and also have an account, basically log in. Following that, it is possible to download the Maine Contract to Sell Commercial Property with Commercial Building - Seller Financing Secured by Mortgage and Security Agreement design.

If you do not come with an bank account and wish to begin to use US Legal Forms, adopt these measures:

- Obtain the type you want and make sure it is for your proper metropolis/area.

- Take advantage of the Review button to examine the form.

- See the description to actually have selected the appropriate type.

- If the type isn`t what you`re trying to find, make use of the Look for area to find the type that suits you and requirements.

- Whenever you find the proper type, simply click Acquire now.

- Select the prices prepare you would like, fill in the desired information and facts to make your account, and pay for your order making use of your PayPal or charge card.

- Choose a handy document structure and download your backup.

Locate every one of the file templates you may have bought in the My Forms food list. You can get a further backup of Maine Contract to Sell Commercial Property with Commercial Building - Seller Financing Secured by Mortgage and Security Agreement any time, if required. Just click on the essential type to download or printing the file design.

Use US Legal Forms, the most extensive variety of legal types, to save lots of time and stay away from mistakes. The assistance delivers skillfully manufactured legal file templates which you can use for a variety of purposes. Produce an account on US Legal Forms and initiate creating your way of life a little easier.

Form popularity

FAQ

A few options to legally avoid paying capital gains tax on investment property include buying your property with a retirement account, converting the property from an investment property to a primary residence, utilizing tax harvesting, and using Section 1031 of the IRS code for deferring taxes.

Seller financing can be used to defer capital gains taxes on the sale of a business or property. Deferring your capital gains tax means that you don't have to pay taxes on the money you make from the sale until a later date. Typically, when a business is sold, the seller will pay taxes on the entire profit.

How Do You Structure a Seller Financing Deal? Don't use current market interest rates to create the interest rate for your seller financing loan. ... The higher the price?the longer the loan term. ... Bring as little cash to the deal as possible. ... Defer payments if possible. ... Exchange down payment for needed repairs.

Disadvantages Of Seller Financing Fewer regulations that protect home buyers. Buyers still vulnerable to foreclosure if seller doesn't make mortgage payments to senior financing. No home inspection/PMI may result in buyer paying too much for the property. Higher interest rates and bigger down payment required.

Disadvantages Of Seller Financing Buyers still vulnerable to foreclosure if seller doesn't make mortgage payments to senior financing. No home inspection/PMI may result in buyer paying too much for the property. Higher interest rates and bigger down payment required.

Seller financing can be used to defer capital gains taxes on the sale of a business or property. Deferring your capital gains tax means that you don't have to pay taxes on the money you make from the sale until a later date.

The key documents in a seller financing transaction include: (1) Purchase Agreement; (2) Promissory Note; and (3) Deed of Trust. Depending on the particulars of the financing arrangement, other documents may also be needed.

Potential Tax Benefits of Installment Sales When a seller receives installment payments from seller financing, it comes with several upsides, including: Tax deferrals: You can spread out paying capital gains tax over years as you receive payments.