A disclaimer is a denial or renunciation of something. A disclaimer may be the act of a party by which be refuses to accept an estate which has been conveyed to him. In this instrument, the beneficiary of a trust is disclaiming any rights he has in the trust.

Maine Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee

Description

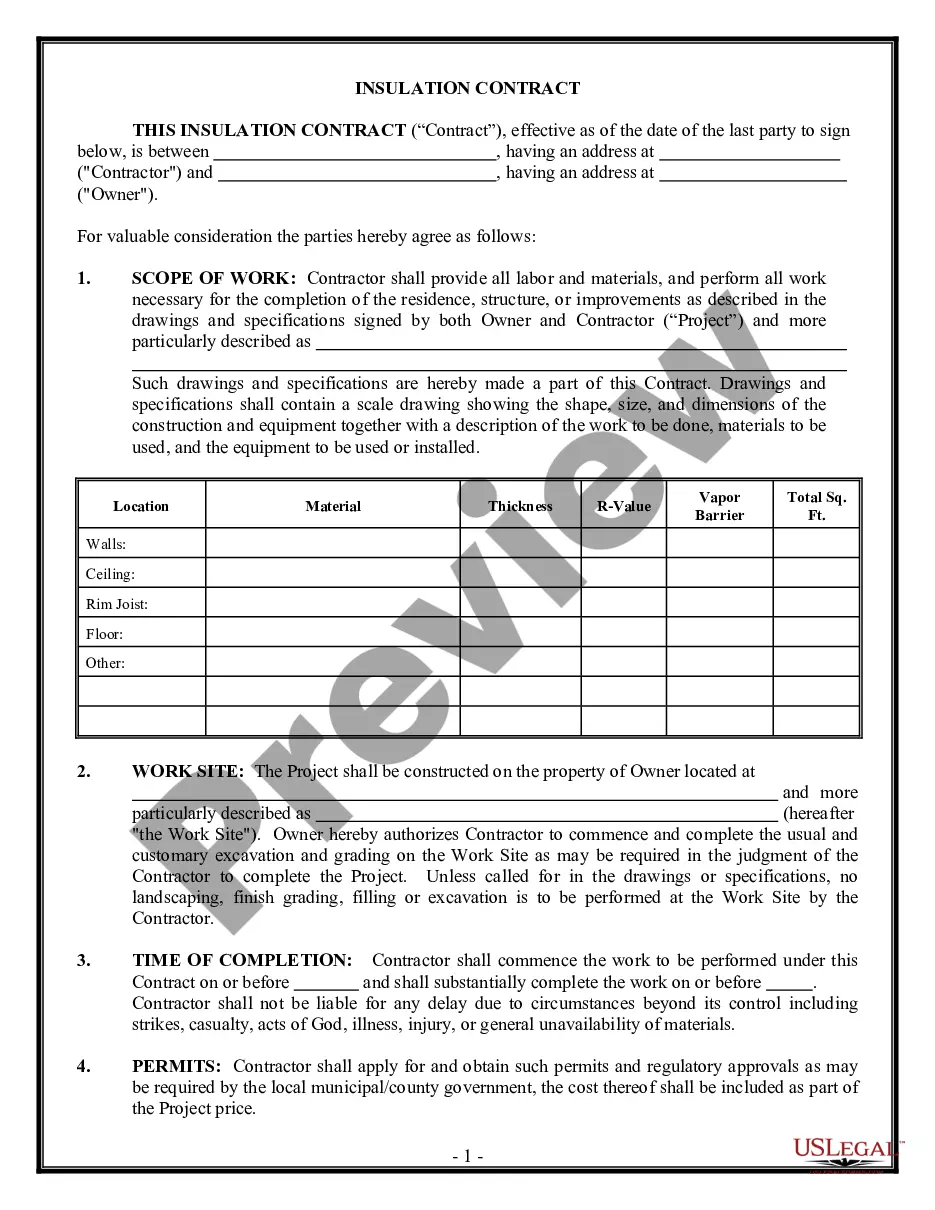

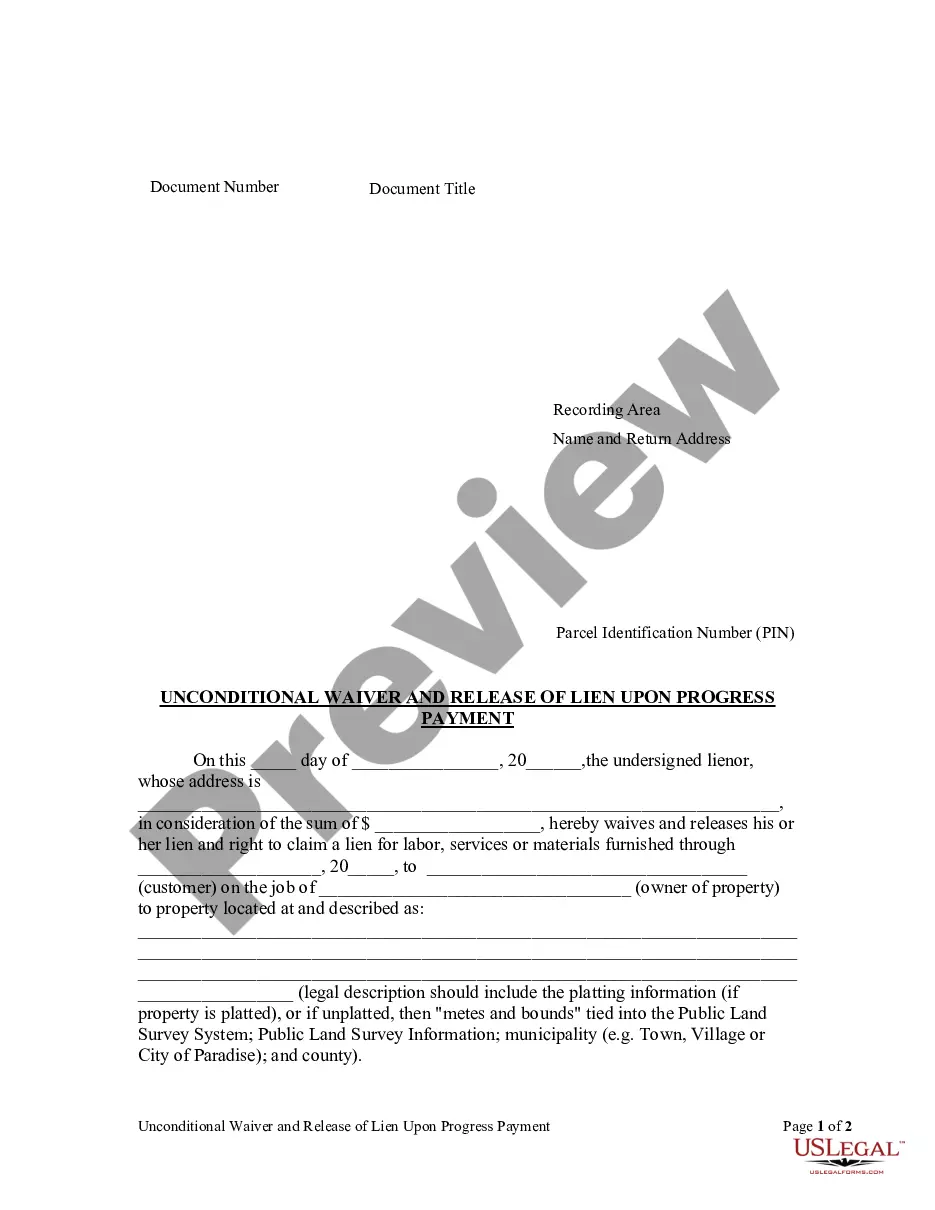

How to fill out Disclaimer By Beneficiary Of All Rights Under Trust And Acceptance Of Disclaimer By Trustee?

If you wish to finalize, download, or print authentic document templates, utilize US Legal Forms, the largest selection of authentic forms available online.

Take advantage of the website's simple and convenient search to locate the documents you require.

Various templates for business and personal purposes are categorized by types and regions, or keywords.

Step 4. Once you find the form you need, click the Buy now button. Choose your payment plan and enter your details to create an account.

Step 5. Process the transaction. You can use your credit card or PayPal account to complete the transaction.

- Utilize US Legal Forms to obtain the Maine Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee with a few clicks.

- If you are a current US Legal Forms customer, Log In to your account and click the Acquire button to retrieve the Maine Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee.

- You can also access forms you previously obtained in the My documents section of your account.

- If it’s your first time using US Legal Forms, follow the instructions provided below.

- Step 1. Make sure you have chosen the form for the correct city/state.

- Step 2. Use the Preview function to review the form’s content. Be sure to read the description.

- Step 3. If you’re not satisfied with the form, use the Search box at the top of the screen to find alternative versions of the legal form template.

Form popularity

FAQ

In Maine, a trust operates as a legal arrangement where one party holds property or assets for the benefit of another. The trustor establishes the trust, and the trustee manages it according to the trustor's instructions. This includes the Maine Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee, which allows beneficiaries to refuse benefits from the trust while providing clarity on distribution. For anyone navigating these concepts, US Legal Forms offers comprehensive documentation and resources to streamline the process.

A beneficiary disclaimer allows an individual to refuse an inheritance or gift, effectively transferring their rights to other beneficiaries. This legal tool can help in estate planning, reducing tax liabilities, or avoiding conflicts. Understanding the mechanics of a beneficiary disclaimer is essential when navigating the nuances of the Maine Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee, ensuring the process aligns with your wishes.

The Slayer statute in Maine prevents individuals from inheriting from someone they have unlawfully killed. It aims to protect the rights of innocent beneficiaries while also promoting justice in the distribution of an estate. This statute plays a vital role in estate planning, particularly when considering disclaimers as outlined in the Maine Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee.

Yes, the administrator of an estate in Maine can receive compensation for their duties. The amount is generally based on the size of the estate and the complexity of the work involved. This compensation helps acknowledge the efforts put into managing the estate, especially when processing disclaimers under the Maine Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee.

The trustee of a disclaimer trust is typically an individual or a financial institution appointed to manage the trust's assets according to its terms. In many cases, the grantor can serve as the trustee, or they can choose a reliable third party, such as a lawyer or bank. This role is crucial in ensuring the proper implementation of the Maine Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee.

The power dynamics between a trustee and a beneficiary can vary widely based on the specific trust terms. While the trustee holds control over the management and distribution of trust assets, beneficiaries possess legal rights to seek accountability. In essence, beneficiaries can influence trustee actions through their rights outlined in the trust agreement. It is important to grasp the Maine Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee for effective navigation of these dynamics.

An example of a disclaimer trust occurs when a beneficiary chooses not to accept an inheritance, allowing it to pass to another party. This may be beneficial in minimizing tax liabilities or aligning with personal financial goals. The beneficiary must formally document their intent to disclaim their rights. Understanding the Maine Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee can clarify the implications of such decisions.

A disclaimer by a beneficiary of a trust is a formal rejection of their right to receive trust assets. This action can be taken for various reasons, including tax benefits or personal circumstances. It is essential for the beneficiary to follow legal procedures to ensure the disclaimer is valid. The Maine Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee provides a framework for this process.

A beneficiary has several rights over a trustee, including the right to receive information regarding the trust. Beneficiaries can request periodic accountings and documentation related to trust management. If a trustee makes decisions that negatively affect the trust, beneficiaries can challenge these actions legally. Familiarity with the Maine Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee enhances the beneficiary's position.

If a trustee violates the trust, they may be held legally accountable for their actions. The beneficiary can seek remedies such as removal of the trustee or financial compensation for losses. In serious cases, the court may intervene to restore proper management of the trust. Knowing your rights under the Maine Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee is essential for safeguarding your interests.