Maine Complaint Against Drawer of Check that was Dishonored Due to Insufficient Funds (Bad Check)

Description

How to fill out Complaint Against Drawer Of Check That Was Dishonored Due To Insufficient Funds (Bad Check)?

If you wish to total, acquire, or produce legal file layouts, use US Legal Forms, the biggest variety of legal kinds, which can be found on-line. Use the site`s simple and hassle-free search to find the paperwork you need. A variety of layouts for enterprise and personal reasons are categorized by classes and suggests, or keywords. Use US Legal Forms to find the Maine Complaint Against Drawer of Check that was Dishonored Due to Insufficient Funds (Bad Check) in a number of mouse clicks.

When you are already a US Legal Forms client, log in in your bank account and click on the Acquire key to find the Maine Complaint Against Drawer of Check that was Dishonored Due to Insufficient Funds (Bad Check). You can even gain access to kinds you previously delivered electronically within the My Forms tab of the bank account.

If you use US Legal Forms initially, follow the instructions below:

- Step 1. Be sure you have selected the shape for that proper city/land.

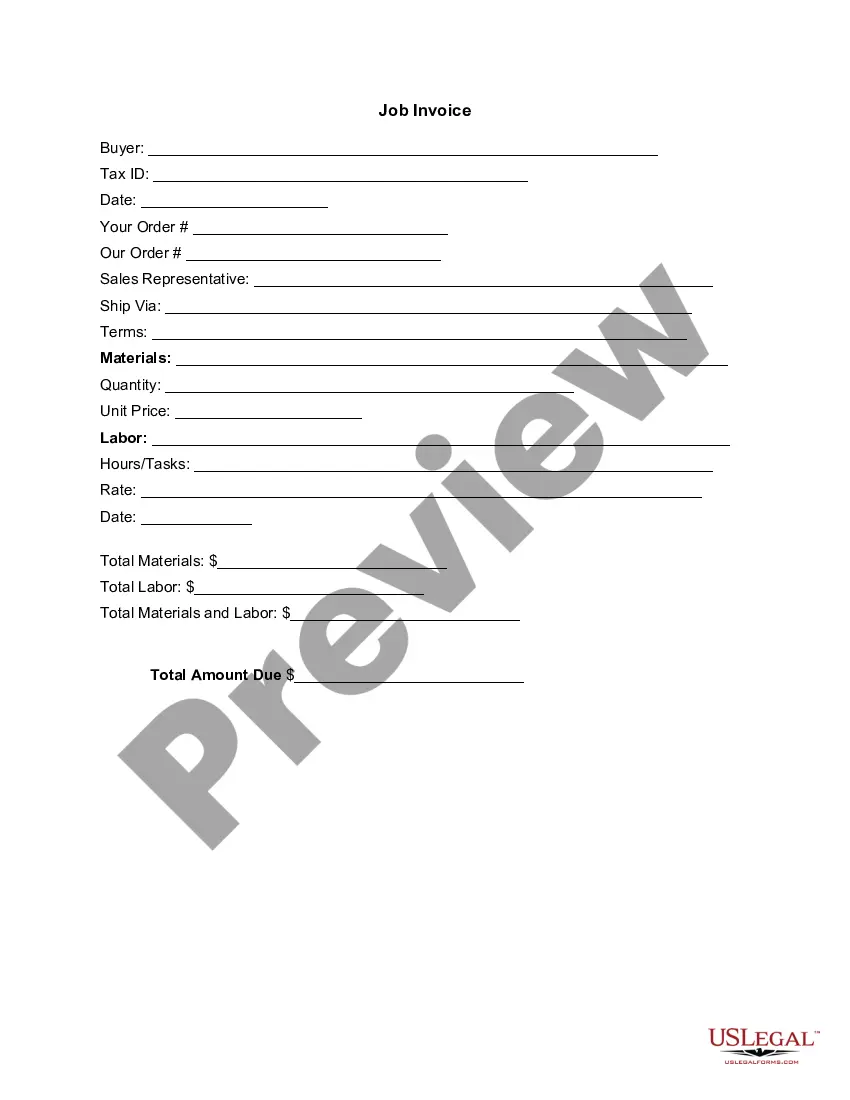

- Step 2. Take advantage of the Preview solution to check out the form`s information. Never forget to read through the description.

- Step 3. When you are not happy with the type, take advantage of the Lookup industry on top of the display to locate other types from the legal type format.

- Step 4. Upon having found the shape you need, go through the Get now key. Opt for the costs prepare you like and put your references to register for the bank account.

- Step 5. Method the purchase. You can utilize your bank card or PayPal bank account to perform the purchase.

- Step 6. Choose the formatting from the legal type and acquire it in your product.

- Step 7. Complete, modify and produce or sign the Maine Complaint Against Drawer of Check that was Dishonored Due to Insufficient Funds (Bad Check).

Every single legal file format you buy is your own for a long time. You may have acces to every single type you delivered electronically within your acccount. Select the My Forms portion and pick a type to produce or acquire yet again.

Compete and acquire, and produce the Maine Complaint Against Drawer of Check that was Dishonored Due to Insufficient Funds (Bad Check) with US Legal Forms. There are thousands of specialist and express-certain kinds you may use to your enterprise or personal requirements.

Form popularity

FAQ

As the recipient of a bounced check, you will need to get in touch with the check issuer and request payment. If you're unable to resolve it with a conversation, you could take further action by sending a demand letter via certified mail.

The charges depend on the check amount. For example, knowingly cashing a bad check for $1,000 to $74,999 will be treated as a misdemeanor, while doing the same for a check for $75,000 or more will be treated as a felony. The misdemeanor could result in a fine between $1,500 and $10,000 and jail time ? up to five years.

If someone comes into the bank and uses a check to make a fraudulent withdrawal from an account that is not theirs, the bank is typically liable for the fraud. Similarly, if a bank cashes a check that was created fraudulently, the bank is also responsible for covering those funds.

Under California Penal Code Section 476a, the crime of writing a bad check while aware of insufficient funds with intent to defraud is punishable as a misdemeanor if the total amount of the checks written does not exceed $950.

Your bank likely will charge you an NSF fee for bouncing a check. The average NSF fee, ing to Bankrate's 2022 checking account and ATM fee study, is $26.58. If the bank pays the check, even though you don't have enough money in your account to cover it, it might charge you an overdraft fee.

A bounced check is slang for a check that cannot be processed because the account holder has non-sufficient funds (NSF) available for use. Banks return, or ?bounce,? these checks, also known as rubber checks, rather than honor them, and banks charge the check writers NSF fees.

When you write a check and there's not enough funds in your account when it's presented, this is considered non-sufficient funds (NSF). When a check is returned due to NSF, it's returned to the payee that deposited the check, at their bank. This allows them to redeposit the check at a later time, if available.

Make sure you look up the phone number on the bank's official website and don't use the phone number printed on the check (that could be a phone number controlled and answered by the scam artist). Next, call the official number and ask them to verify the check.