Maine Direct Deposit Form for IRS

Description

How to fill out Direct Deposit Form For IRS?

US Legal Forms - one of the biggest collections of legal templates in the USA - offers a variety of legal document types you can obtain or print.

By using the website, you can find thousands of forms for business and personal purposes, categorized by types, states, or keywords. You can find the latest versions of forms such as the Maine Direct Deposit Form for IRS within minutes.

If you have a subscription, Log In and obtain the Maine Direct Deposit Form for IRS from the US Legal Forms library. The Get button will appear on every form you view. You have access to all the previously saved forms in the My documents section of your account.

Make edits. Fill out, modify, print, and sign the saved Maine Direct Deposit Form for IRS.

Every design you added to your account has no expiration date and is yours permanently. Therefore, if you wish to download or print another copy, simply visit the My documents section and click on the form you desire. Access the Maine Direct Deposit Form for IRS with US Legal Forms, the most extensive collection of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal needs and requirements.

- If you want to use US Legal Forms for the first time, here are simple instructions to help you get started.

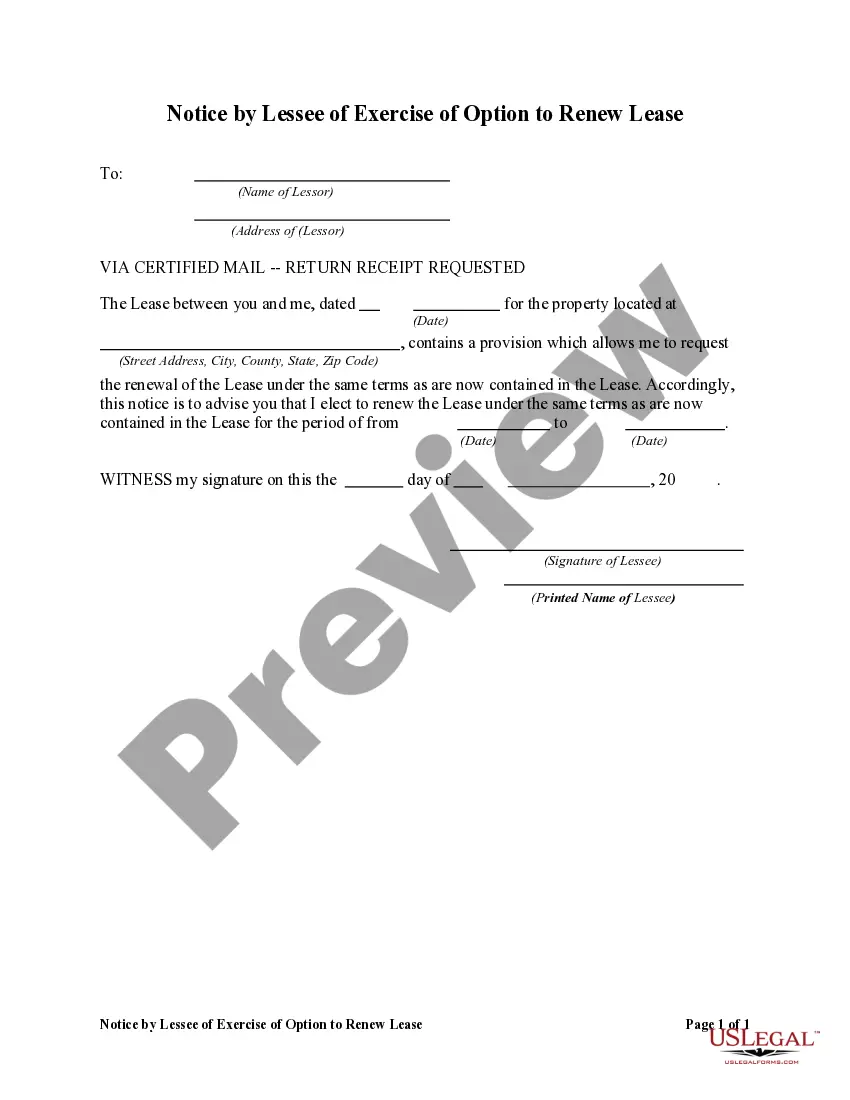

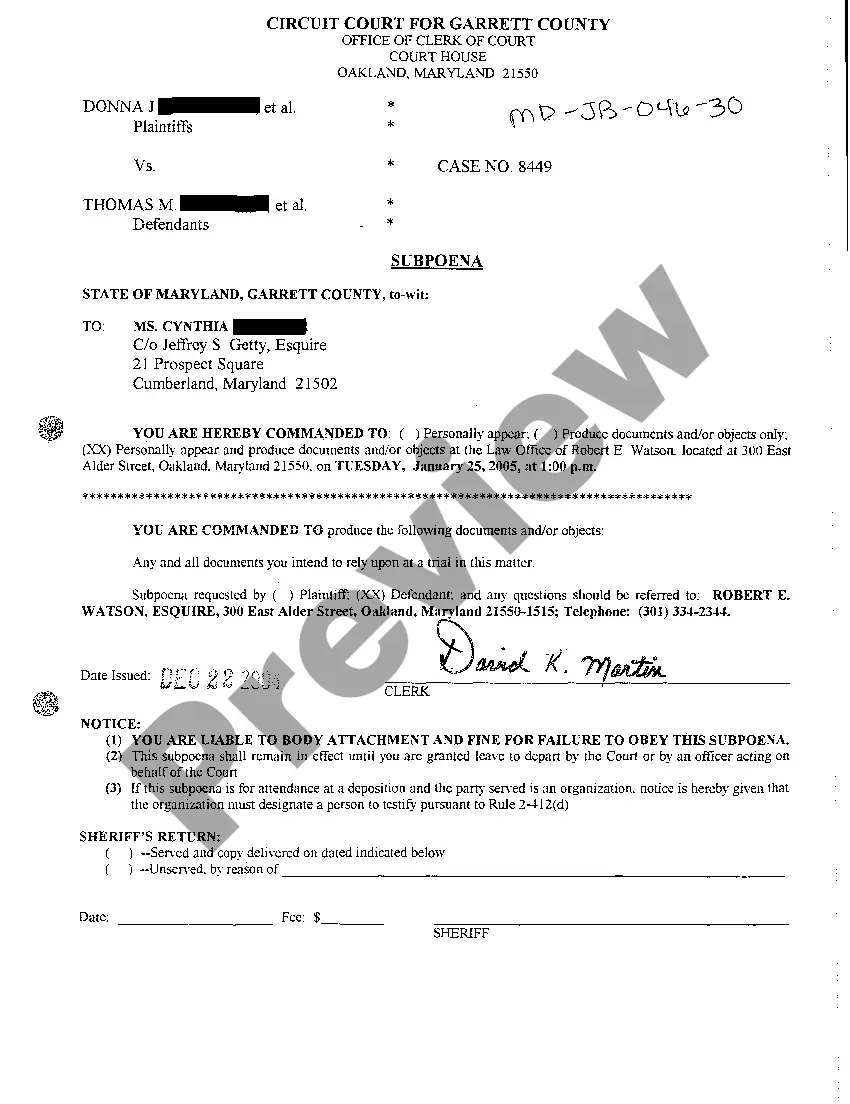

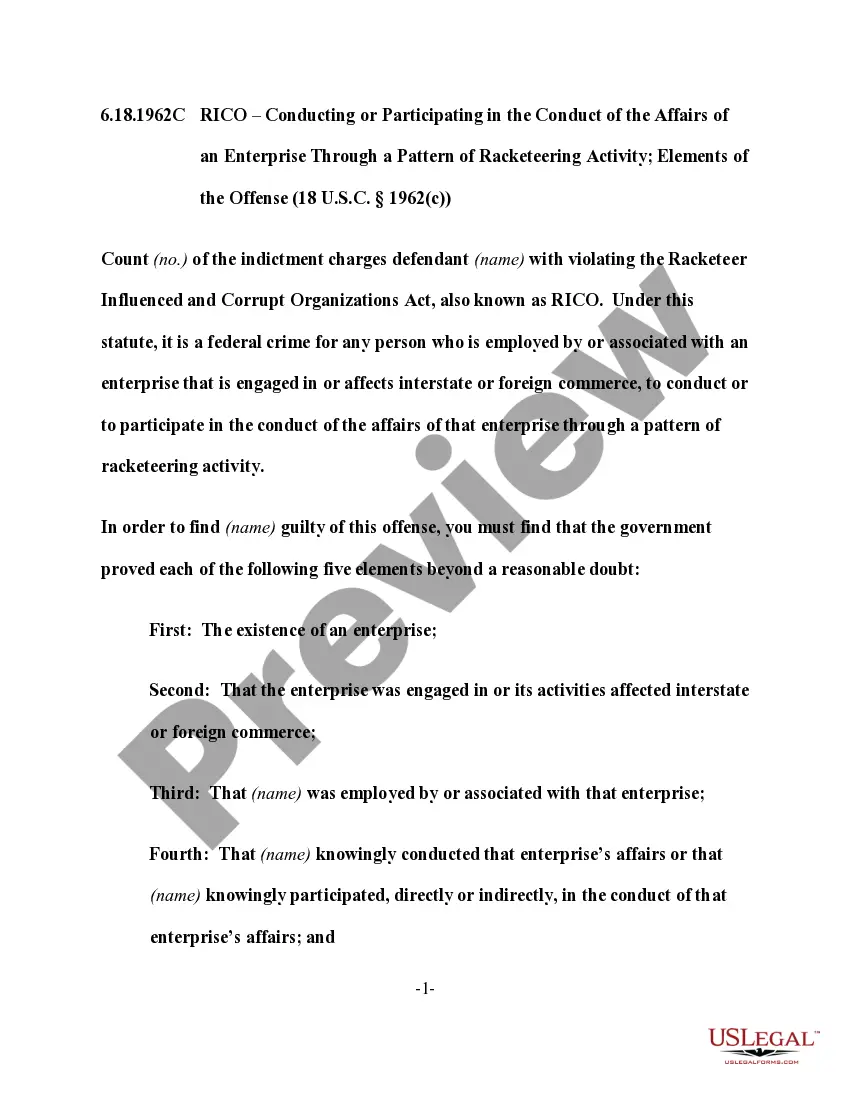

- Make sure you have selected the correct form for your city/state. Select the Preview button to review the form's details. Check the form summary to ensure you have chosen the right form.

- If the form does not meet your requirements, use the Search box at the top of the screen to find the one that does.

- If you are satisfied with the form, confirm your choice by clicking the Get now button. Then, select the payment plan you prefer and provide your details to register for an account.

- Process the payment. Use your Visa or Mastercard or PayPal account to complete the transaction.

- Choose the format and download the form to your device.

Form popularity

FAQ

To properly fill out a direct deposit form, start by providing your personal information, including your name and Social Security number. Next, clearly enter your bank's routing number and your account number on the Maine Direct Deposit Form for IRS. Double-check these numbers for accuracy, as errors can lead to payment delays. If you need guidance, platforms like US Legal Forms offer resources to assist you in completing the form correctly.

Not everyone will receive $3,000 from the IRS; eligibility depends on specific criteria, including income and family size. This amount is part of certain tax credits and relief measures that may apply to qualified individuals. To ensure you receive any benefits you qualify for, it's crucial to file your tax return accurately and use the Maine Direct Deposit Form for IRS for prompt payment. Always check the IRS website for the latest updates on financial relief programs.

Setting up direct deposit with the IRS requires you to fill out the Maine Direct Deposit Form for IRS. You can choose to do this when you file your tax return or by amending your previous return if necessary. By providing your bank details on this form, you ensure that your tax refunds are deposited directly into your bank account, which is faster and more secure. Platforms like US Legal Forms can help you access the necessary documentation easily.

To change your direct deposit information for your tax refund, you need to complete the Maine Direct Deposit Form for IRS. You can find this form on the IRS website or through platforms like US Legal Forms. Once you fill it out with your new bank details, submit it alongside your tax return. Make sure to double-check your account number and routing number to avoid any delays.

Get a direct deposit form from your employer. Fill in account information. Confirm the deposit amount. Attach a voided check or deposit slip, if required. Submit the form.

Setting up direct deposit is easy. Check with your employer's payroll office, you may be able to set up your direct deposit through an online portal.

If you accidentally paid your employee twice, or you paid the wrong employee, you may be able to request a direct deposit to get the money back. You can request a direct deposit reversal 5 business days from the pay date (US) or 4 business days (Canada). But this doesn't guarantee that the funds will be recovered.

To cancel Direct Deposit, notify your Payer (employer, government agency or payroll provider) of the change. It can take up to 2 pay cycles for Direct Deposit to stop once your employer or payroll provider has received and processed your notification.

In some cases, a payment may be canceled in the accounting system that issued it before it is transmitted to the automated clearing house (ACH) network. Once a payment is transmitted to the ACH network, a reversal or reclamation request may be submitted to attempt retrieval of the funds.

A direct deposit can be defined as a payment made directly into a payee's account. The payment can be made electronically from one account to another, instead of the traditional check deposit. Direct deposits are especially common for businesses, as they make use of the transaction to pay their employees.