Maryland Executor's Deed of Distribution

Description

How to fill out Executor's Deed Of Distribution?

If you wish to comprehensive, download, or print authorized record templates, use US Legal Forms, the most important selection of authorized varieties, that can be found on the web. Use the site`s easy and handy look for to obtain the files you want. Numerous templates for business and person reasons are categorized by classes and says, or keywords and phrases. Use US Legal Forms to obtain the Maryland Executor's Deed of Distribution within a number of clicks.

When you are already a US Legal Forms customer, log in to the account and click on the Down load key to obtain the Maryland Executor's Deed of Distribution. You can even entry varieties you previously saved within the My Forms tab of your respective account.

Should you use US Legal Forms initially, refer to the instructions below:

- Step 1. Be sure you have chosen the form for the proper town/nation.

- Step 2. Take advantage of the Preview choice to look over the form`s content material. Don`t forget about to see the outline.

- Step 3. When you are unhappy with all the kind, take advantage of the Look for area at the top of the display screen to discover other models in the authorized kind design.

- Step 4. Upon having identified the form you want, click the Buy now key. Choose the rates plan you prefer and put your references to register for an account.

- Step 5. Process the financial transaction. You can use your credit card or PayPal account to complete the financial transaction.

- Step 6. Pick the formatting in the authorized kind and download it in your gadget.

- Step 7. Full, revise and print or indicator the Maryland Executor's Deed of Distribution.

Each authorized record design you get is the one you have forever. You may have acces to each and every kind you saved in your acccount. Click the My Forms area and choose a kind to print or download once more.

Remain competitive and download, and print the Maryland Executor's Deed of Distribution with US Legal Forms. There are many expert and status-certain varieties you can use for your business or person needs.

Form popularity

FAQ

Certificate of Preparation Individuals not licensed to practice law in this state may not prepare a deed for anyone else. A Certificate of Preparation attests that the document was prepared by an attorney licensed to practice law in the State of Maryland. Real Estate and Maryland Deed Lawyer - Arden Law Firm ardenlawfirm.com ? deeds ardenlawfirm.com ? deeds

In Maryland, real estate can be transferred via a TOD deed, also known as a beneficiary deed. This deed allows a property owner to designate a beneficiary who will automatically inherit the property upon the owner's death, avoiding probate.

Becoming an Executor A common misunderstanding is that nomination in the decedent's last will and testament alone enables the individual to act on behalf of the estate. A nominated personal representative must petition the orphan's court of the proper county to be appointed to serve as the personal representative.

Ideally, you should be able to close the estate within 13 months of the decedent's death. However, depending on the size and complexity of the estate, it may take longer. In any case, it's important to keep meticulous records throughout the process to prove to the court that you've fulfilled all your fiduciary duties.

In Maryland, you can make a living trust to avoid probate for virtually any asset you own?real estate, bank accounts, vehicles, and so on. You need to create a trust document (it's similar to a will), naming someone to take over as trustee after your death (called a successor trustee). Avoiding Probate in Maryland - Nolo Nolo ? legal-encyclopedia ? marylan... Nolo ? legal-encyclopedia ? marylan...

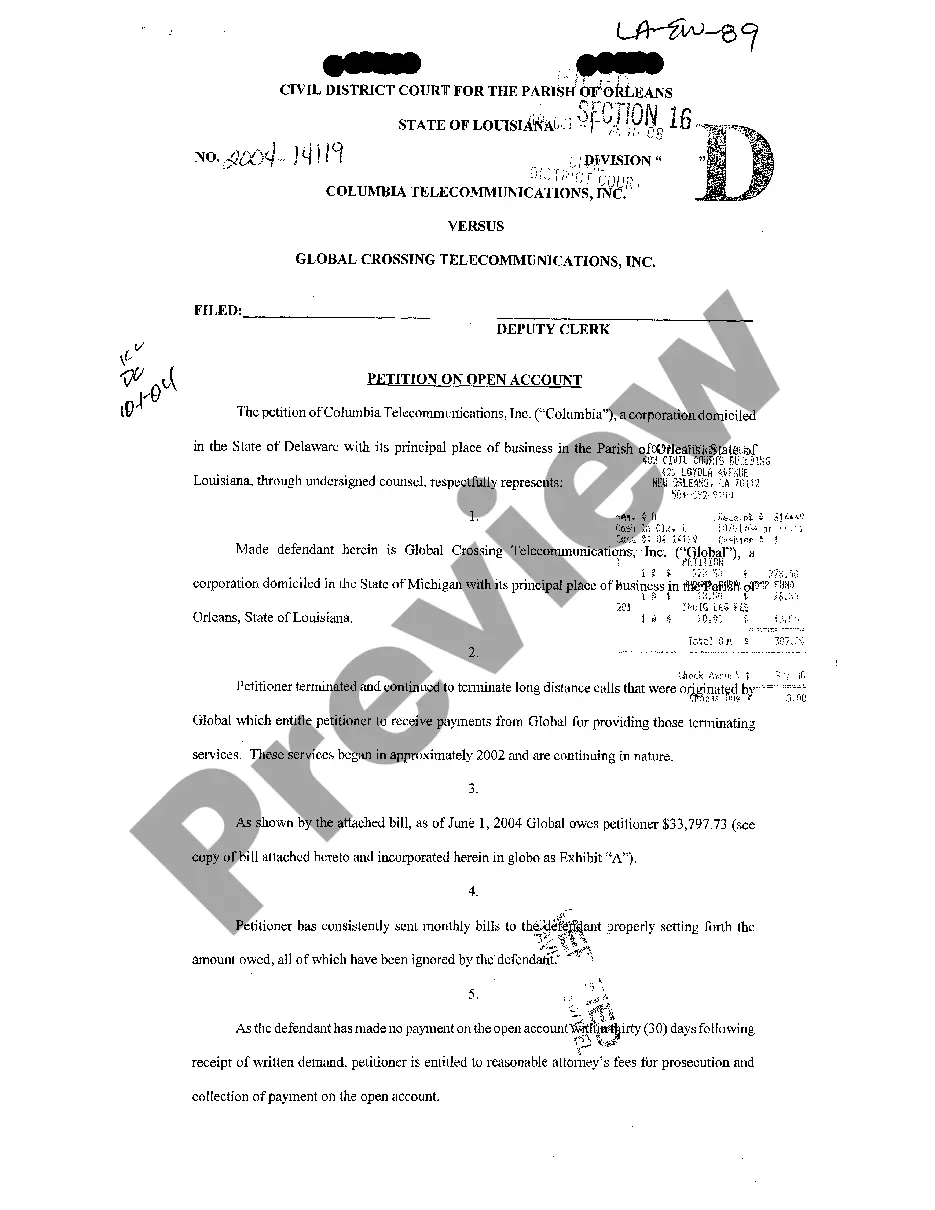

A distribution deed is another way in which to legally transfer real property when the party who is supposed to receive the property cannot be determined from the decedent's will.

A Maryland deed is used to transfer ownership in real estate from one person (usually called the grantor, or seller) to another (usually called the grantee, or buyer). In Maryland a deed must include the name of the grantor and the grantee, the consideration paid for the property. Maryland Deed Forms - eForms eforms.com ? deeds eforms.com ? deeds

Non-Probate Maryland Inheritances Any property in a living trust. Life insurance policies. 401(k)s, IRAs, other retirement accounts. Securities in transfer-on-death accounts. Pay-on-death bank accounts. Joint tenancy real property. Tenancy by the entirety. Maryland Inheritance Laws: What You Should Know - SmartAsset smartasset.com ? financial-advisor ? maryland-inh... smartasset.com ? financial-advisor ? maryland-inh...