Maryland Request for Proof of Debt

Description

How to fill out Request For Proof Of Debt?

Selecting the finest legal document template can be quite a challenge. Naturally, there are numerous templates available online, but how do you find the legal form you need.

Take advantage of the US Legal Forms website. The platform offers thousands of templates, including the Maryland Request for Proof of Debt, which you can utilize for both business and personal purposes. All of the documents are reviewed by specialists and adhere to federal and state regulations.

If you are already registered, Log In to your account and click the Download button to obtain the Maryland Request for Proof of Debt. Use your account to review the legal forms you have previously purchased. Visit the My documents section of your account and download another copy of the document you need.

Complete, edit, print, and sign the received Maryland Request for Proof of Debt. US Legal Forms is the largest collection of legal forms where you can find various document templates. Utilize the service to obtain professionally crafted paperwork that complies with state requirements.

- If you are a new user of US Legal Forms, here are simple instructions that you can follow.

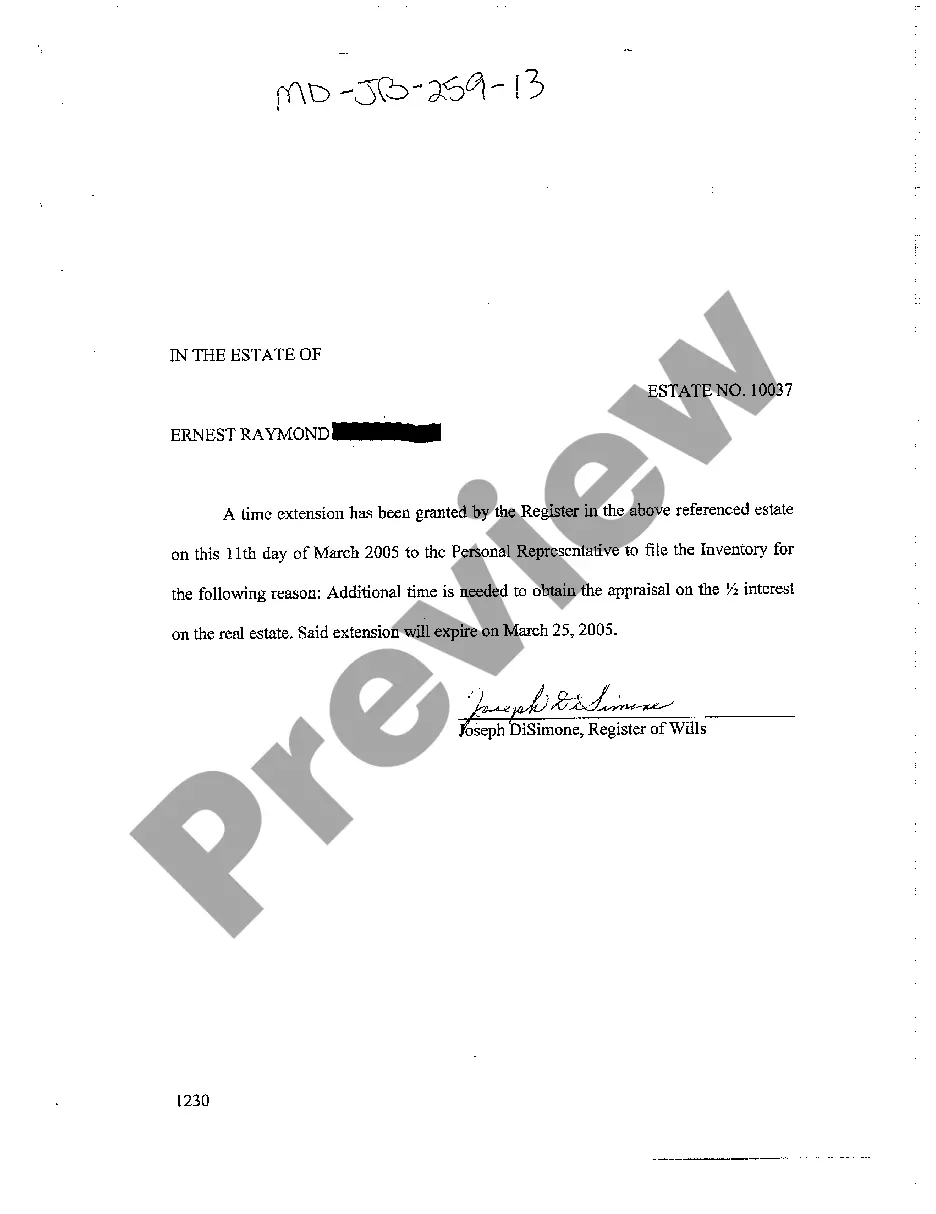

- First, ensure you have selected the correct form for your location/state. You can preview the form using the Preview button and check the form description to confirm it is suitable for you.

- If the form does not meet your requirements, use the Search field to find the appropriate form.

- Once you are confident that the form is right, click the Order now button to acquire the form.

- Choose the pricing plan you prefer and input the necessary information. Create your account and complete your purchase using your PayPal account or credit card.

- Select the document format and download the legal document template to your device.

Form popularity

FAQ

To request proof of debt from a collector, you should send a written request via certified mail to ensure delivery and tracking. In your request, clearly state your desire for verification of the debt and include your contact information. It is advisable to keep a record of your correspondence. For assistance with your Maryland Request for Proof of Debt, US Legal Forms offers user-friendly templates that can simplify the process.

Proof of debt typically includes documentation that verifies the amount owed and the legitimacy of the debt. This can consist of account statements, contracts, or agreements that outline the terms of the debt. Additionally, any correspondence from the creditor confirming the debt can serve as proof. For a comprehensive understanding, refer to US Legal Forms for resources that assist in your Maryland Request for Proof of Debt.

To demand proof of debt, you should write a formal letter to the debt collector, clearly stating your request for verification. Include your account number and relevant details to help them locate your records. It is essential to keep a copy of your demand for your records. US Legal Forms provides templates to assist you in making your Maryland Request for Proof of Debt clear and professional.

Requesting proof of debt involves reaching out to the creditor or collection agency that holds your debt. You can send a written request specifying the details of the debt and asking for documentation. It is important to assert your rights under the Fair Debt Collection Practices Act. Utilizing resources from US Legal Forms can help you craft your Maryland Request for Proof of Debt effectively.

To ask for proof of debt, you can send a formal request to the creditor or debt collector. In your Maryland Request for Proof of Debt, include your name, account number, and a clear statement that you are requesting verification of the debt. This written request ensures you have a record of your inquiry. Additionally, using a platform like USLegalForms can help you create a professional request that meets all necessary legal standards.

Filling out a proof of debt form involves providing accurate details about yourself and the creditor, as well as the debt amount. Carefully follow the instructions on the form, ensuring that you complete all sections without omitting any important information. Utilizing resources from US Legal Forms can guide you effectively through your Maryland Request for Proof of Debt.

To request proof of debt, contact your creditor directly through a letter, email, or phone call. Clearly articulate your request for documentation that verifies the debt and provide your relevant account details to help them assist you. This clear communication is key in facilitating your Maryland Request for Proof of Debt.

Proof of debt should include essential information such as the creditor’s name, contact details, and the amount owed. Additionally, you should attach any relevant agreements or payment history that supports your claim. This documentation is vital for your Maryland Request for Proof of Debt, as it substantiates your case.

Completing proof of debt involves accurately filling out the required forms with details about the debt and your personal information. Be sure to include any supporting documents that validate your claim, such as contracts or account statements. Using a streamlined platform like US Legal Forms can simplify this process, ensuring you meet all requirements for your Maryland Request for Proof of Debt.

When writing a letter requesting proof of debt, begin with a clear subject line and date. Address the creditor directly, stating your intention to request evidence of the debt, and include your account information for reference. Make sure to express your request politely while emphasizing the importance of obtaining this documentation for your Maryland Request for Proof of Debt.