Maryland Actor - Actress Employment Agreement - Self-Employed Independent Contractor

Description

How to fill out Actor - Actress Employment Agreement - Self-Employed Independent Contractor?

Are you currently in a situation where you require documents for either business or personal use almost every day? There are many lawful document templates accessible online, but finding forms you can rely on is challenging. US Legal Forms offers a wide array of form templates, including the Maryland Actor - Actress Employment Agreement - Self-Employed Independent Contractor, which is designed to comply with federal and state regulations.

If you are already familiar with US Legal Forms and have an account, simply Log In. After that, you can download the Maryland Actor - Actress Employment Agreement - Self-Employed Independent Contractor template.

If you do not have an account and wish to start using US Legal Forms, follow these steps.

Access all the document templates you have purchased in the My documents section. You can obtain an additional copy of the Maryland Actor - Actress Employment Agreement - Self-Employed Independent Contractor whenever needed. Just click the required form to download or print the document template.

Utilize US Legal Forms, the most extensive collection of legitimate forms, to save time and avoid mistakes. The service provides professionally crafted legal document templates that can be employed for various purposes. Create an account on US Legal Forms and start simplifying your life.

- Select the form you need and ensure it is for the correct city/area.

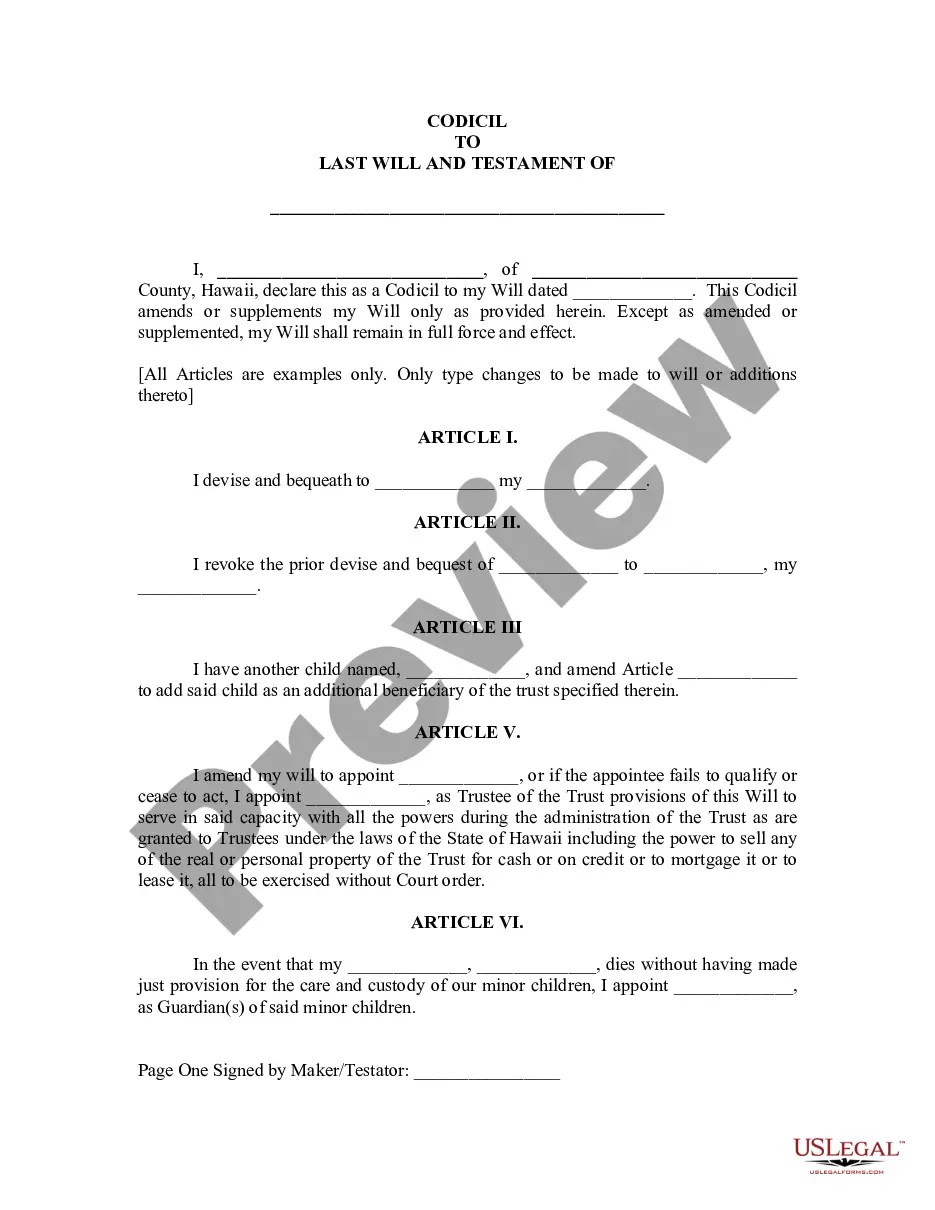

- Use the Preview button to review the document.

- Read through the information to confirm you have selected the correct form.

- If the form is not what you need, utilize the Lookup field to find the form that suits your needs and requirements.

- Once you find the suitable form, click Acquire now.

- Choose your desired pricing plan, fill in the necessary details to create your account, and purchase the order using your PayPal or credit card.

- Select a convenient file format and download your copy.

Form popularity

FAQ

Indeed, an actor is usually deemed an independent contractor in the context of a Maryland Actor - Actress Employment Agreement - Self-Employed Independent Contractor. This designation provides actors with the autonomy to choose their projects, negotiate their terms, and maintain their creative freedom. It is important for actors to grasp the implications of this status for their careers and financial planning. For support in drafting an effective agreement, consider using uslegalforms platform.

Yes, actors often receive 1099 forms for their earnings, verifying their status as independent contractors. This is particularly relevant within the scope of a Maryland Actor - Actress Employment Agreement - Self-Employed Independent Contractor, where actors report their income as self-employed. By doing so, they can take advantage of certain tax deductions related to their business expenses. This understanding helps actors manage their finances effectively.

Yes, actors are typically classified as independent contractors under the terms of a Maryland Actor - Actress Employment Agreement - Self-Employed Independent Contractor. This status allows actors to enjoy flexibility in their schedules while managing their own business affairs. It also means they are responsible for their own taxes and benefit arrangements. Understanding this classification is crucial for navigating the entertainment industry.

Yes, actors can work as independent contractors under a Maryland Actor - Actress Employment Agreement - Self-Employed Independent Contractor. This arrangement allows actors to have greater control over their work, including the projects they choose and how they manage their time. Additionally, such agreements often outline important aspects like payment structure and rights to performances. For actors considering this route, platforms like uslegalforms make it easy to draft and manage these essential agreements.

To show proof of income as a 1099 contractor, you can present your 1099 tax form, which reflects your earnings from clients. Additionally, maintaining organized records of invoices, client payments, and bank deposits is crucial. As a Maryland Actor - Actress Employment Agreement - Self-Employed Independent Contractor, having clear documentation of your income ensures your financial transparency and supports your business viability.

An independent contractor can show proof of employment by providing invoices, contracts, and tax forms that validate their services. These documents outline the work performed and the payments received, establishing a clear relationship with clients. For those navigating the complexities of a Maryland Actor - Actress Employment Agreement - Self-Employed Independent Contractor, using a service like uslegalforms can help create formal contracts that enhance your credibility.

Showing proof that you are self-employed involves sharing certain documents, such as your business registration, tax returns, and profit and loss statements. Additionally, having a well-documented independent contractor agreement can strengthen your claims. As a Maryland Actor - Actress Employment Agreement - Self-Employed Independent Contractor, maintaining accurate records and clear contracts is essential for demonstrating your independent status.

To provide proof of employment as an independent contractor, you can present your signed independent contractor agreement along with payment records. Invoices, bank statements, or tax forms like a 1099 can also serve as evidence. Documenting your work is vital for establishing credibility and demonstrating your role as a Maryland Actor - Actress Employment Agreement - Self-Employed Independent Contractor.

The independent contractor agreement in Maryland establishes the relationship between a client and a self-employed individual, such as an actor or actress. This agreement outlines the services provided, payment terms, and any specific responsibilities or obligations. When creating this document, it's crucial to include key details to protect both parties and ensure clarity, making it an essential tool for Maryland Actor - Actress Employment Agreement - Self-Employed Independent Contractor.