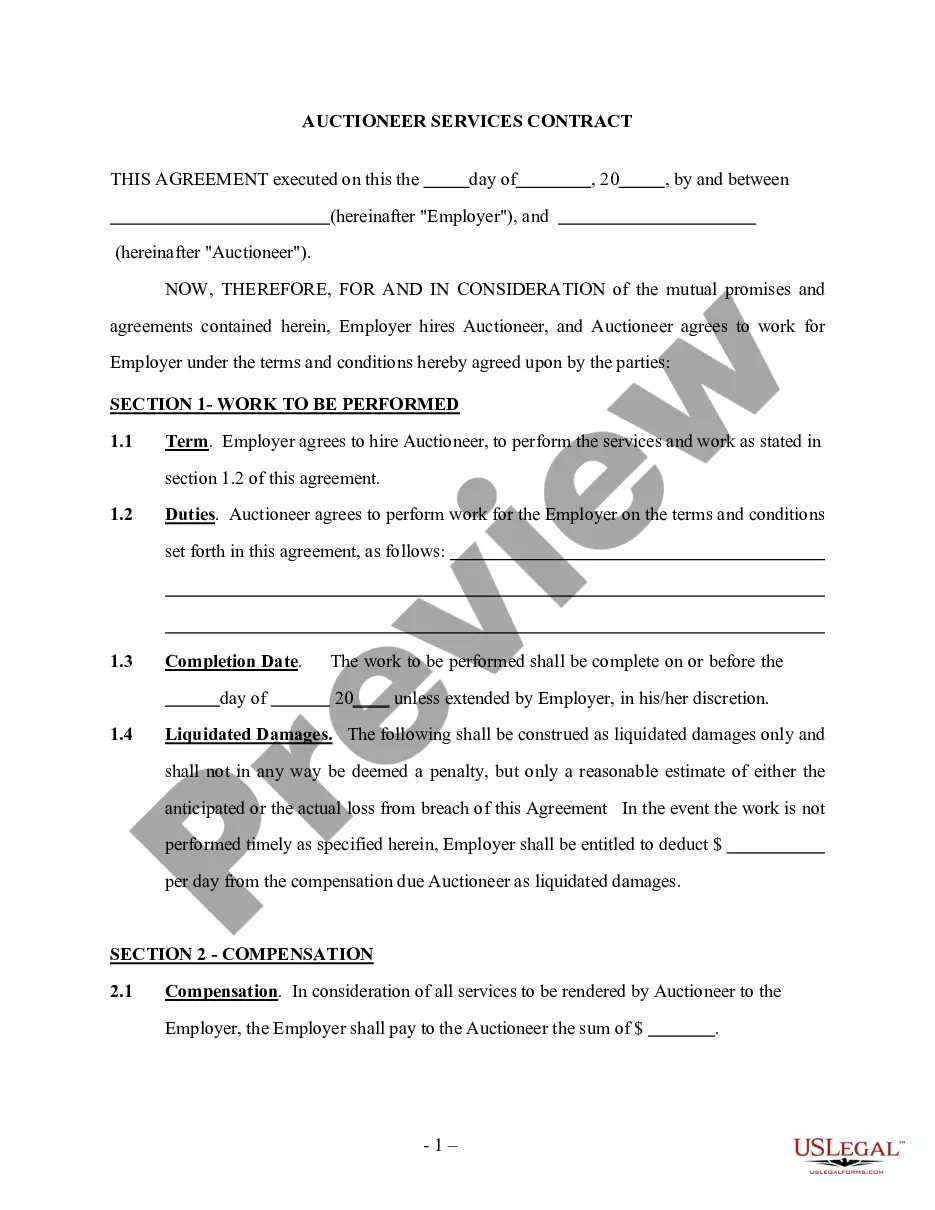

Maryland Auctioneer Services Contract - Self-Employed Independent Contractor

Description

How to fill out Auctioneer Services Contract - Self-Employed Independent Contractor?

US Legal Forms - one of the largest collections of legal documents in the USA - offers a vast selection of legal form templates that you can download or print.

By using the website, you can access thousands of forms for business and personal use, sorted by categories, states, or keywords. You can quickly obtain the latest form such as the Maryland Auctioneer Services Contract - Self-Employed Independent Contractor.

If you have an account, Log In to download the Maryland Auctioneer Services Contract - Self-Employed Independent Contractor from the US Legal Forms collection. The Download button is visible on each form you view. You have access to all previously downloaded forms in the My documents section of your account.

Complete the transaction. Use a Visa or Mastercard or PayPal account to finalize the transaction.

Select the format and download the form to your device.Edit. Fill out, modify, print, and sign the downloaded Maryland Auctioneer Services Contract - Self-Employed Independent Contractor. Each template saved in your account has no expiration date and belongs to you indefinitely. So, to download or print another copy, just visit the My documents section and click on the form you wish to access. Obtain the Maryland Auctioneer Services Contract - Self-Employed Independent Contractor through US Legal Forms, one of the most comprehensive repositories of legal document templates. Access a multitude of professional and state-specific templates that fulfill your business or personal needs and requirements.

- Confirm you have selected the appropriate form for your location/state.

- Click on the Preview button to review the contents of the form.

- Examine the form details to ensure you have the right one.

- If the form does not meet your needs, utilize the Search field at the top of the screen to find a suitable one.

- Once you are satisfied with the form, confirm your selection by clicking the Purchase now button.

- Then, select your payment plan and enter your details to register for an account.

Form popularity

FAQ

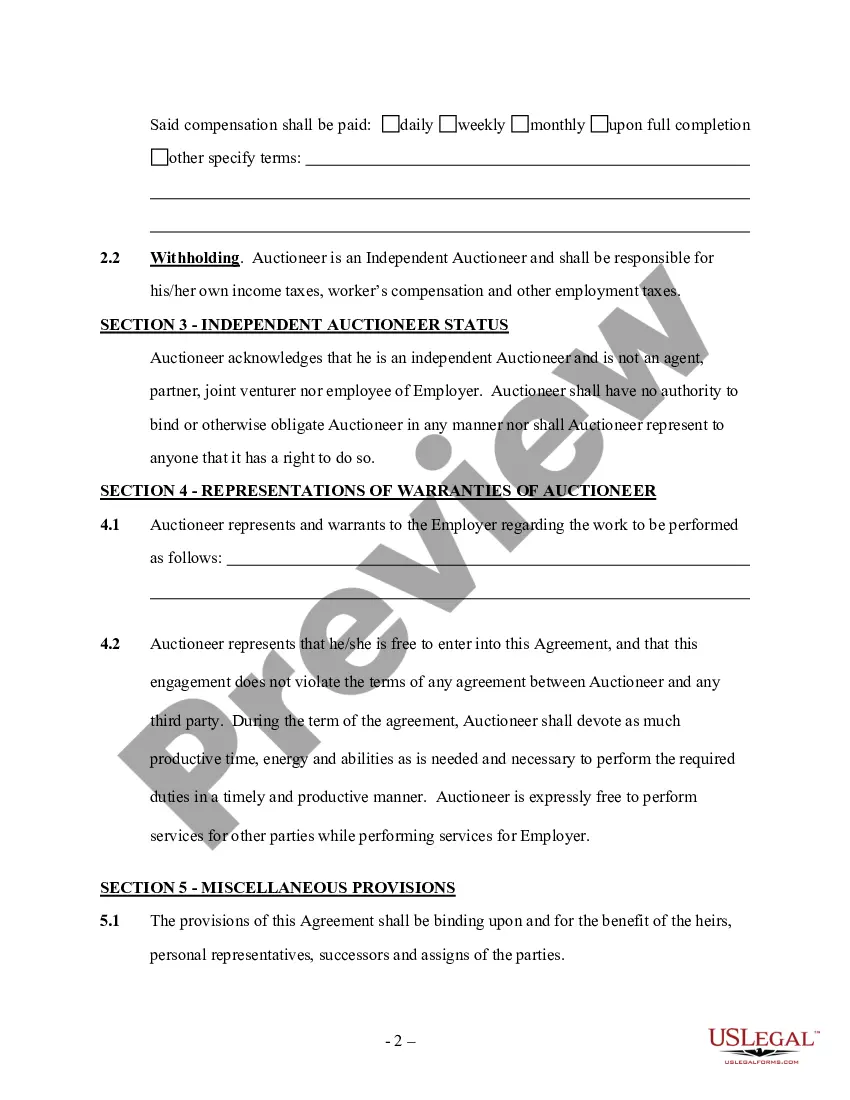

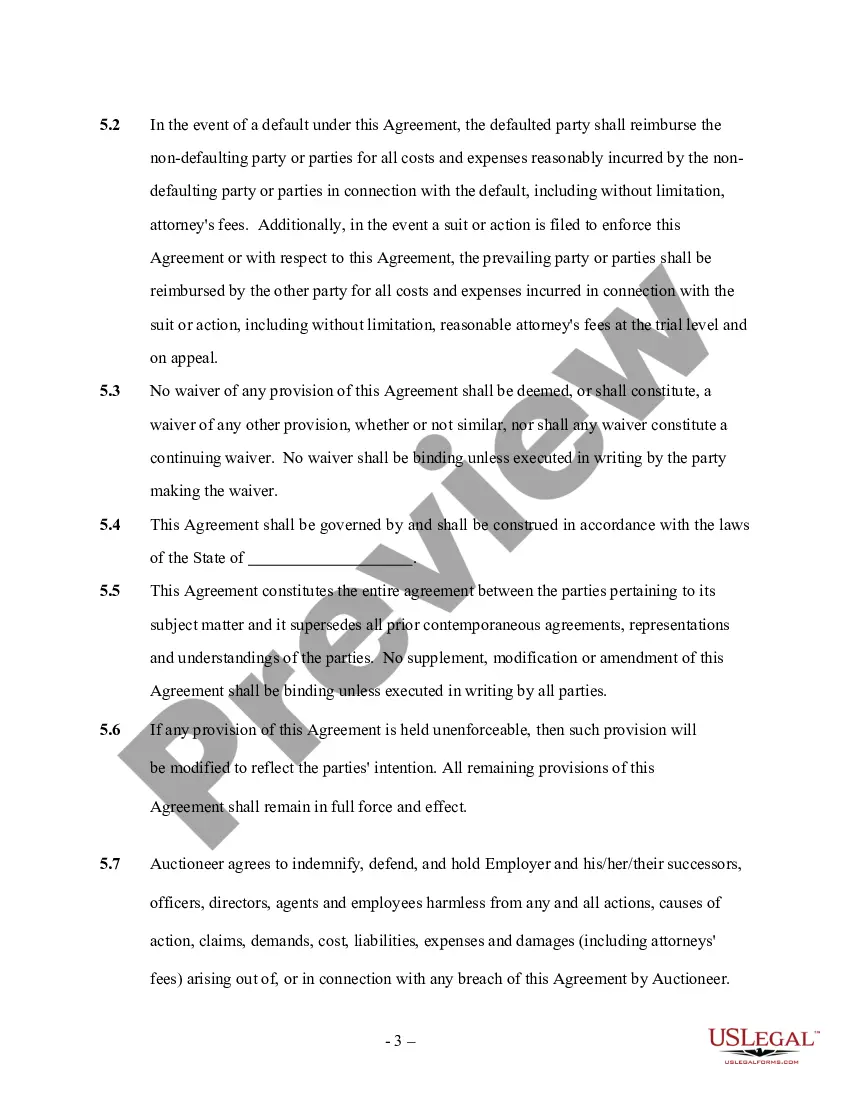

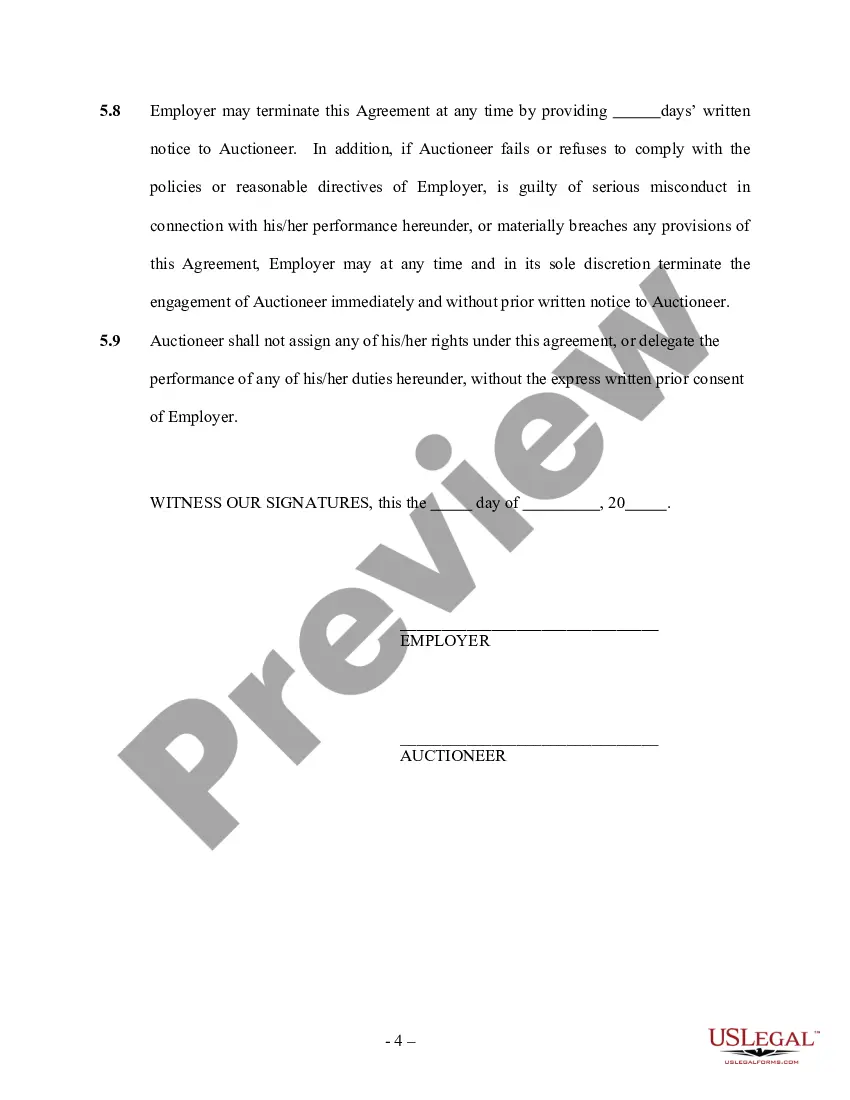

Writing an independent contractor agreement for Maryland Auctioneer Services Contract - Self-Employed Independent Contractor involves several key steps. Start with a clear title and an introductory paragraph that outlines the purpose of the contract. Then, specify all terms, including payment structure, project timelines, and termination clauses. Don’t forget to review the agreement for accuracy and ensure it aligns with your specific needs.

When completing an independent contractor form for Maryland Auctioneer Services Contract - Self-Employed Independent Contractor, begin by entering your personal information, such as name and address. Follow this by detailing the nature of the services you will provide and any necessary legal disclaimers. It’s important to finalize the form with signatures from both parties to validate the contract.

To fill out an independent contractor agreement for Maryland Auctioneer Services Contract - Self-Employed Independent Contractor, start by providing clear details about the parties involved, including names and contact information. Next, outline the services to be provided, establishing specific terms of the contract. Lastly, include payment details, deadlines, and any other essential provisions to ensure clarity and mutual agreement.

Writing a contract as an independent contractor involves clear communication of expectations, services, and financial arrangements. Start by defining the work scope, then outline payment methods and timelines. You may find that using a specialized Maryland Auctioneer Services Contract - Self-Employed Independent Contractor template from USLegalForms simplifies this process and ensures you cover all necessary legal aspects.

In Maryland, independent contractors are not typically required to carry workers' compensation insurance unless they have employees. However, it is prudent for self-employed individuals, especially in auctioneer services, to consider this coverage for personal safety. Understanding the needs for workers' comp can be essential when drafting your Maryland Auctioneer Services Contract - Self-Employed Independent Contractor.

Yes, you can create your own legally binding contract, but it must meet specific legal requirements. The contract should include relevant details, such as the names of the parties, services provided, and payment terms. Utilizing resources like USLegalForms can assist you in drafting a reliable Maryland Auctioneer Services Contract - Self-Employed Independent Contractor that adheres to state guidelines.

Creating an independent contractor contract involves outlining the scope of work, payment terms, and timeline for services. You should include terms that address confidentiality and ownership of work. Using a template for a Maryland Auctioneer Services Contract - Self-Employed Independent Contractor can streamline this process and ensure legal compliance, which is essential for both parties.

The independent contractor rule distinguishes between employees and self-employed individuals. In Maryland, auctioneer services supplied by self-employed independent contractors require a proper agreement to clarify the working relationship. Understanding this rule helps avoid misclassification and ensures compliance with state laws regarding Maryland Auctioneer Services Contract - Self-Employed Independent Contractor.

A real estate salesperson, classified as an independent contractor, typically receives compensation through commissions based on sales. This payment structure aligns with the Maryland Auctioneer Services Contract - Self-Employed Independent Contractor, allowing salespeople to earn income through their individual efforts. They retain the freedom to negotiate their commission rates with clients, fostering a performance-driven environment. This model empowers real estate professionals to excel while managing their business relationships.

The new federal rule for independent contractors clarifies how workers are classified, focusing on their level of independence and control over their work. Under this rule, a Maryland Auctioneer Services Contract - Self-Employed Independent Contractor reflects a true contractor relationship, ensuring that individuals are recognized for their entrepreneurial efforts. It aims to prevent misclassification, providing protections for those who operate independently. Understanding this rule is crucial for auctioneers and other self-employed individuals to navigate their business effectively.