Maryland Convertible Note Subscription Agreement

Description

How to fill out Convertible Note Subscription Agreement?

You may spend hrs on the web looking for the lawful papers format that fits the federal and state demands you want. US Legal Forms gives 1000s of lawful varieties that happen to be analyzed by specialists. It is possible to down load or printing the Maryland Convertible Note Subscription Agreement from our support.

If you have a US Legal Forms account, you can log in and click on the Down load key. Following that, you can full, edit, printing, or indication the Maryland Convertible Note Subscription Agreement. Every lawful papers format you buy is yours permanently. To have an additional version associated with a obtained kind, check out the My Forms tab and click on the corresponding key.

If you are using the US Legal Forms site initially, follow the simple instructions under:

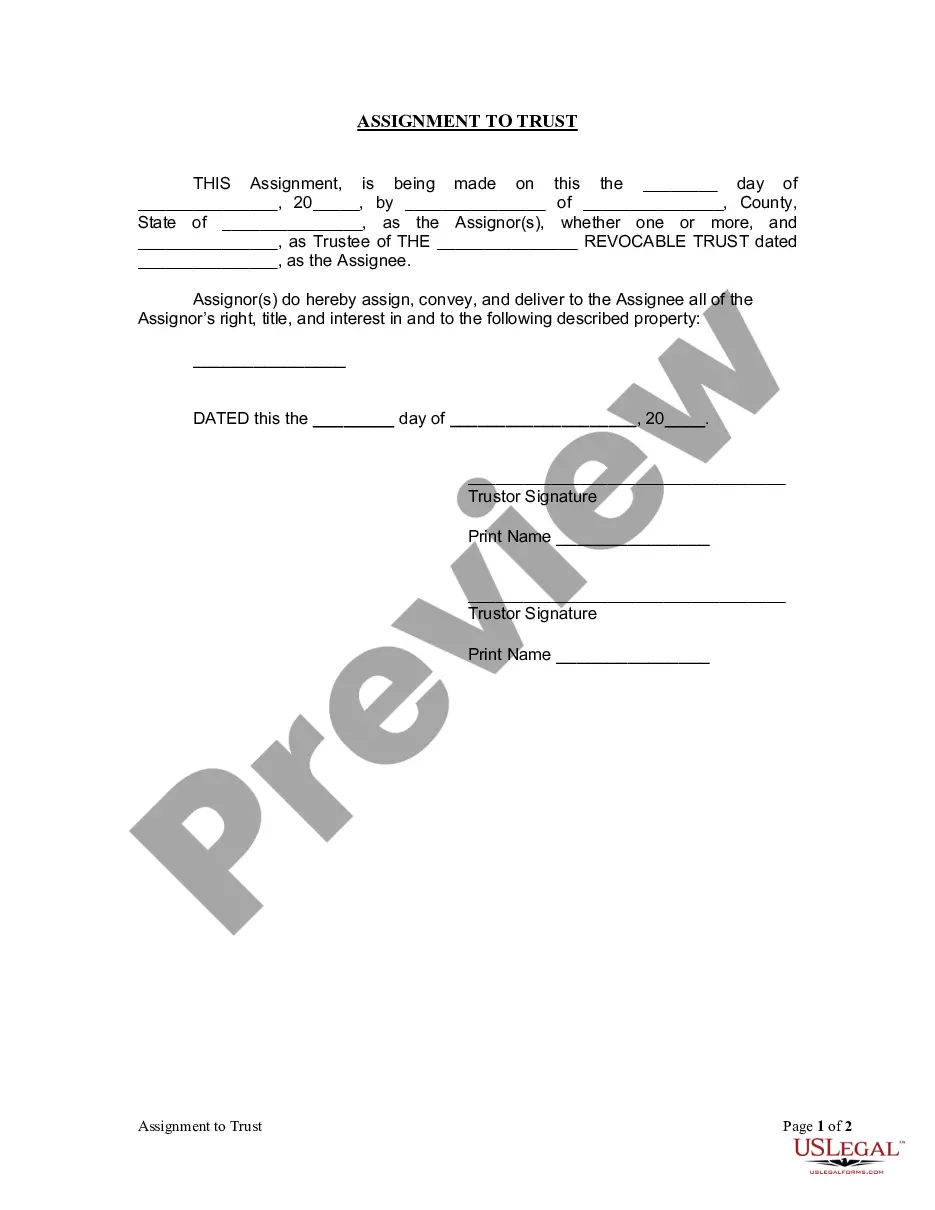

- Initial, make sure that you have chosen the best papers format for your region/area that you pick. Read the kind information to ensure you have picked out the correct kind. If offered, make use of the Review key to search through the papers format at the same time.

- If you would like locate an additional variation of your kind, make use of the Lookup field to obtain the format that meets your needs and demands.

- Once you have identified the format you want, just click Get now to carry on.

- Pick the costs plan you want, enter your references, and sign up for a merchant account on US Legal Forms.

- Comprehensive the purchase. You can utilize your charge card or PayPal account to purchase the lawful kind.

- Pick the file format of your papers and down load it for your product.

- Make modifications for your papers if needed. You may full, edit and indication and printing Maryland Convertible Note Subscription Agreement.

Down load and printing 1000s of papers web templates making use of the US Legal Forms Internet site, which offers the largest collection of lawful varieties. Use skilled and state-distinct web templates to handle your small business or individual needs.

Form popularity

FAQ

Are SAFE Notes Debt? No, SAFEs should not be accounted for as debt but instead as equity. Experienced venture capitalists expect to see SAFE notes in the equity section of a company's balance sheet - therefore, they should be classified as equity, not debt.

Common provisions of a convertible debt financing include: The interest rate. Usually somewhere between 4% and 8%. The maturity date. Usually 12?24 months. A mandatory conversion paragraph. ... An optional conversion paragraph. ... A change of control provision. ... A conversion discount. ... A valuation cap. ... An amendment provision. Terms of Convertible Debt ? Angel Investing: Start to Finish - Holloway holloway.com ? angel-investing ? sections holloway.com ? angel-investing ? sections

So the cash coming in from your convertible note will generally equate to the liability that you add to the balance sheet. And, if your accounting is doing a good job, the accrued interest is a non-cash expense that flows through your income statement and impacts your accumulated net income in the equity section. How should convertible note financing be handled on the balance sheet? kruzeconsulting.com ? convertible-note-balance-s... kruzeconsulting.com ? convertible-note-balance-s...

As noted above, convertible notes can be classified as all debt, all equity, or a mixture of both. To determine the appropriate classification, we need to consider the relevant definitions in IAS 32 Financial Instruments: Presentation.

A convertible note is a short-term debt instrument that automatically turns into equity when a predetermined milestone or conversion event occurs. Essentially, a convertible note functions like a business loan that converts into equity instead of being repaid..

Convertible Notes are loans ? so they are recorded on the Balance Sheet of a company as a liability when they are made. Depending on the debt's maturity date, they can either be shown as a current liability (loans maturing within 12 months) or as a Long-term liability (loans maturing over 12 months).

Convertible loan notes (?CLN?) and advance subscription agreements (?ASA?) are ways of companies getting a cash injection which may later convert into shares, rather than being paid back in cash. ASAs tend to be shorter agreements than CLNs and therefore involve less negotiation. What are Convertible Loan Notes and Advance Subscription Agreements? vestd.com ? help ? what-are-convertible-loa... vestd.com ? help ? what-are-convertible-loa...

Promissory Note. The Promissory Note (or Convertible Promissory Note) is the actual debt instrument in the deal. ... Note Purchase Agreement. ... Subscription Agreement. ... Note Holders Agreements and Voting Agreements. ... Subordination Agreement. ... Warrant to Purchase Stock. A Guide to Angel Investing Documents: Convertible Debt Deals seraf-investor.com ? compass ? article ? guide-an... seraf-investor.com ? compass ? article ? guide-an...