Maryland Joint Filing Agreement

Description

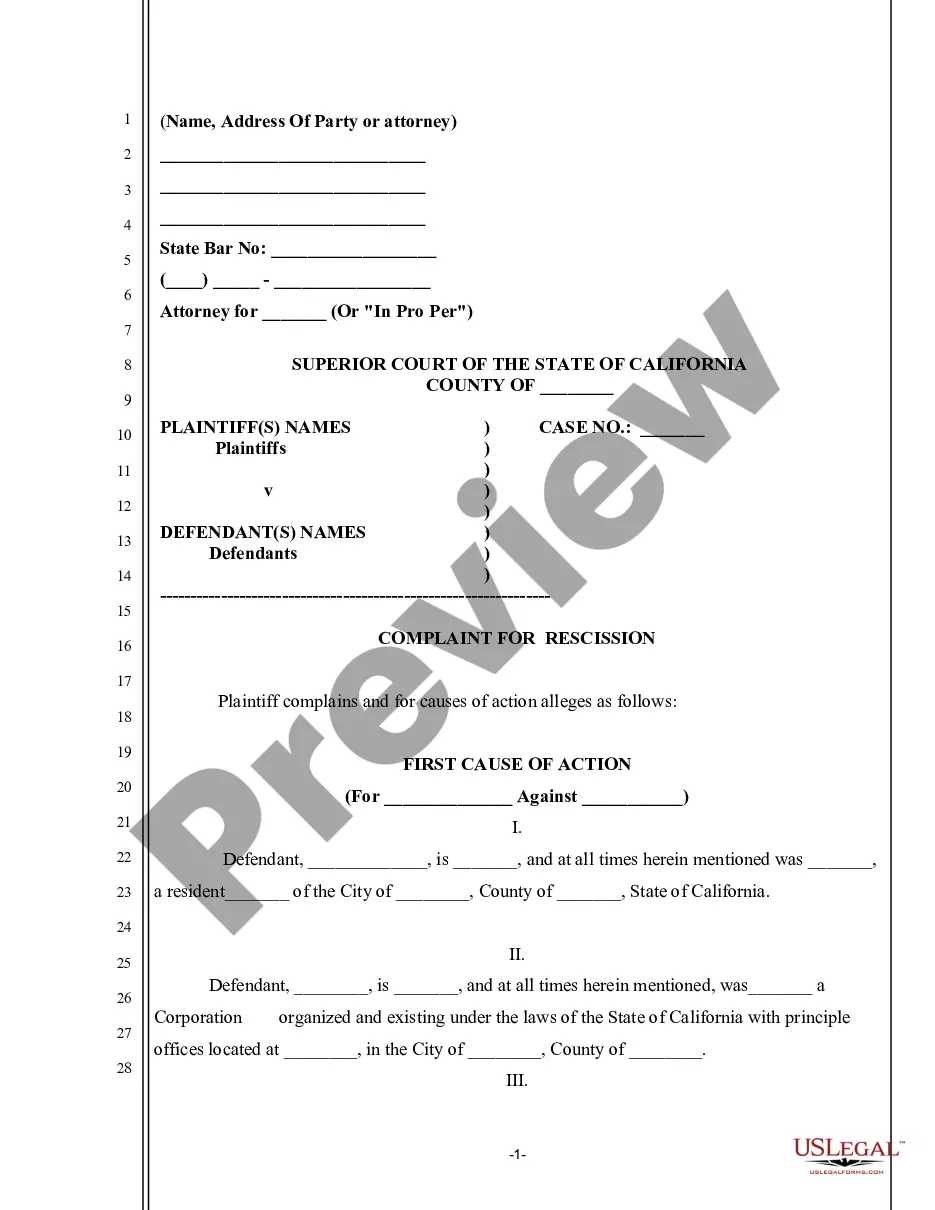

How to fill out Joint Filing Agreement?

Discovering the right lawful record format can be quite a struggle. Naturally, there are a lot of templates available on the Internet, but how do you obtain the lawful develop you require? Utilize the US Legal Forms site. The services gives 1000s of templates, such as the Maryland Joint Filing Agreement, which can be used for organization and personal requirements. All the varieties are checked out by professionals and fulfill federal and state needs.

If you are already registered, log in to your accounts and click the Download option to obtain the Maryland Joint Filing Agreement. Use your accounts to appear throughout the lawful varieties you possess acquired previously. Visit the My Forms tab of your accounts and have an additional version from the record you require.

If you are a whole new end user of US Legal Forms, listed here are easy recommendations that you can follow:

- Initial, make certain you have chosen the correct develop for your personal city/county. You can look through the shape using the Review option and browse the shape explanation to make sure it is the right one for you.

- In the event the develop does not fulfill your expectations, take advantage of the Seach area to find the correct develop.

- When you are certain the shape is acceptable, click the Get now option to obtain the develop.

- Opt for the rates plan you would like and type in the needed info. Build your accounts and purchase an order making use of your PayPal accounts or charge card.

- Choose the data file file format and acquire the lawful record format to your product.

- Total, edit and printing and signal the received Maryland Joint Filing Agreement.

US Legal Forms is the greatest library of lawful varieties where you will find numerous record templates. Utilize the service to acquire expertly-made papers that follow state needs.

Form popularity

FAQ

You'll also need to: Gather tax documents for both you and your spouse. This includes W2s, 1099s, medical and childcare expenses, mortgage interest statements, and investment income statements. Decide whether you'll claim the standard deduction or itemize.

This is a state-only deduction that reduces your taxable income. Married couples filing a joint return, when both have taxable income, may subtract up to $1,200 or the income of the spouse with the lower income, whichever is less.

2 form from each employer. Other earning and interest statements (1099 and 1099INT forms) Receipts for charitable donations; mortgage interest; state and local taxes; medical and business expenses; and other taxdeductible expenses if you are itemizing your return.

Married people can choose to file their federal income taxes jointly or separately each year. For most couples, filing jointly makes the most sense, but each couple should review their own situation. If a couple is married as of December 31, the law says they're married for the whole year for tax purposes.

To prove this, just keep records of household bills, mortgage payments, property taxes, food and other necessary expenses you pay for. Second, you will need to show that your dependent lived with you for the entire year. School or medical records are a great way to do this.

Married Filing Jointly. If you are married, you and your spouse can choose to file a joint return. If you file jointly, you both must include all your income, deductions, and credits on that return. You can file a joint return even if one of you had no income or deductions.

What's the penalty for filing as head of household while married? There's no tax penalty for filing as head of household while you're married. But you could be subject to a failure-to-pay penalty of any amount that results from using the other filing status.

Taxpayers may use the married filing jointly status if they are married and both agree to file a joint return. Both husband and wife must sign the income tax return. Special rules apply when a spouse cannot sign the tax return because of death, illness, or absence.