Maryland Statement of Current Monthly Income and Disposable Income Calculation for Use in Chapter 13 - Post 2005

Description

How to fill out Statement Of Current Monthly Income And Disposable Income Calculation For Use In Chapter 13 - Post 2005?

If you want to full, acquire, or printing legitimate record templates, use US Legal Forms, the biggest collection of legitimate forms, that can be found online. Make use of the site`s basic and convenient search to get the paperwork you will need. Different templates for company and individual uses are categorized by categories and suggests, or keywords and phrases. Use US Legal Forms to get the Maryland Statement of Current Monthly Income and Disposable Income Calculation for Use in Chapter 13 - Post 2005 in a number of mouse clicks.

When you are previously a US Legal Forms buyer, log in in your profile and click the Acquire key to have the Maryland Statement of Current Monthly Income and Disposable Income Calculation for Use in Chapter 13 - Post 2005. Also you can entry forms you earlier delivered electronically inside the My Forms tab of the profile.

Should you use US Legal Forms the very first time, refer to the instructions below:

- Step 1. Be sure you have chosen the form for the correct metropolis/nation.

- Step 2. Utilize the Review option to look over the form`s information. Never overlook to see the outline.

- Step 3. When you are unhappy with the form, take advantage of the Search area towards the top of the monitor to discover other types in the legitimate form format.

- Step 4. Once you have found the form you will need, select the Acquire now key. Pick the rates strategy you choose and put your qualifications to sign up for the profile.

- Step 5. Approach the transaction. You may use your Мisa or Ьastercard or PayPal profile to accomplish the transaction.

- Step 6. Pick the format in the legitimate form and acquire it on your product.

- Step 7. Complete, change and printing or sign the Maryland Statement of Current Monthly Income and Disposable Income Calculation for Use in Chapter 13 - Post 2005.

Each and every legitimate record format you acquire is your own property permanently. You possess acces to every form you delivered electronically in your acccount. Select the My Forms segment and select a form to printing or acquire yet again.

Be competitive and acquire, and printing the Maryland Statement of Current Monthly Income and Disposable Income Calculation for Use in Chapter 13 - Post 2005 with US Legal Forms. There are many professional and condition-specific forms you may use for your personal company or individual needs.

Form popularity

FAQ

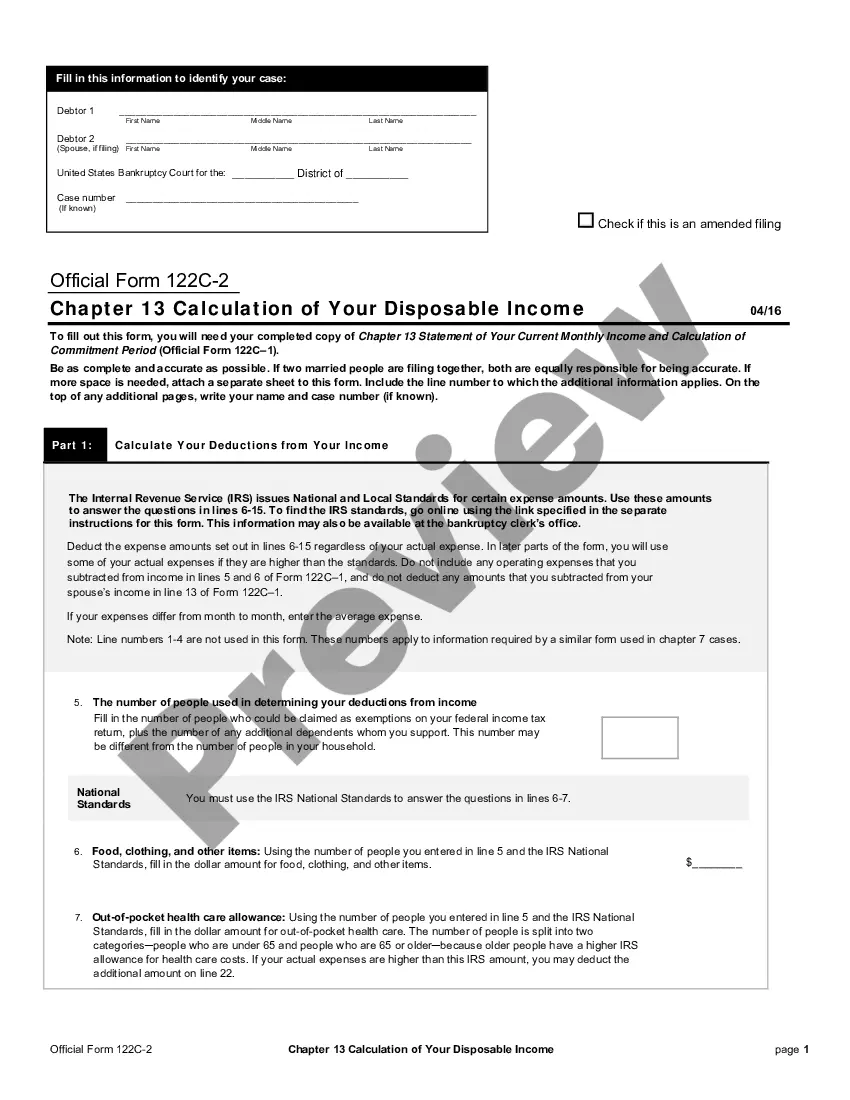

Take your monthly income and deduct living expenses, priority debt payments, and secured payments. The remaining amount is your disposable income.

To calculate your monthly payment amount in a Chapter 13 bankruptcy, calculate your income for the six months before your bankruptcy filing. Deduct allowable expenses to determine your disposable income. Pay your priority debtors and any secured debts that you want to keep after the bankruptcy.

These can include expenses all households must take on monthly, including: Rent or home mortgage payments. Utilities like electricity, natural gas, cable TV, internet service and phone service. Municipal services like water, sewer and trash pickup.

In chapter 13, "disposable income" is income (other than child support payments received by the debtor) less amounts reasonably necessary for the maintenance or support of the debtor or dependents and less charitable contributions up to 15% of the debtor's gross income.

Your plan payment will be based on your budget. The bankruptcy court will usually approve your Chapter 13 plan even if you're paying little or nothing to your nonpriority unsecured creditors, regardless of how much disposable income you have.

A Chapter 13 petition for bankruptcy will likely necessitate a $500 to $600 monthly payment, especially for debtors paying at least one automobile through the payment plan. However, since the bankruptcy court will consider a large number of factors, this estimate could vary greatly.

To calculate your monthly payment amount in a Chapter 13 bankruptcy, calculate your income for the six months before your bankruptcy filing. Deduct allowable expenses to determine your disposable income. Pay your priority debtors and any secured debts that you want to keep after the bankruptcy.

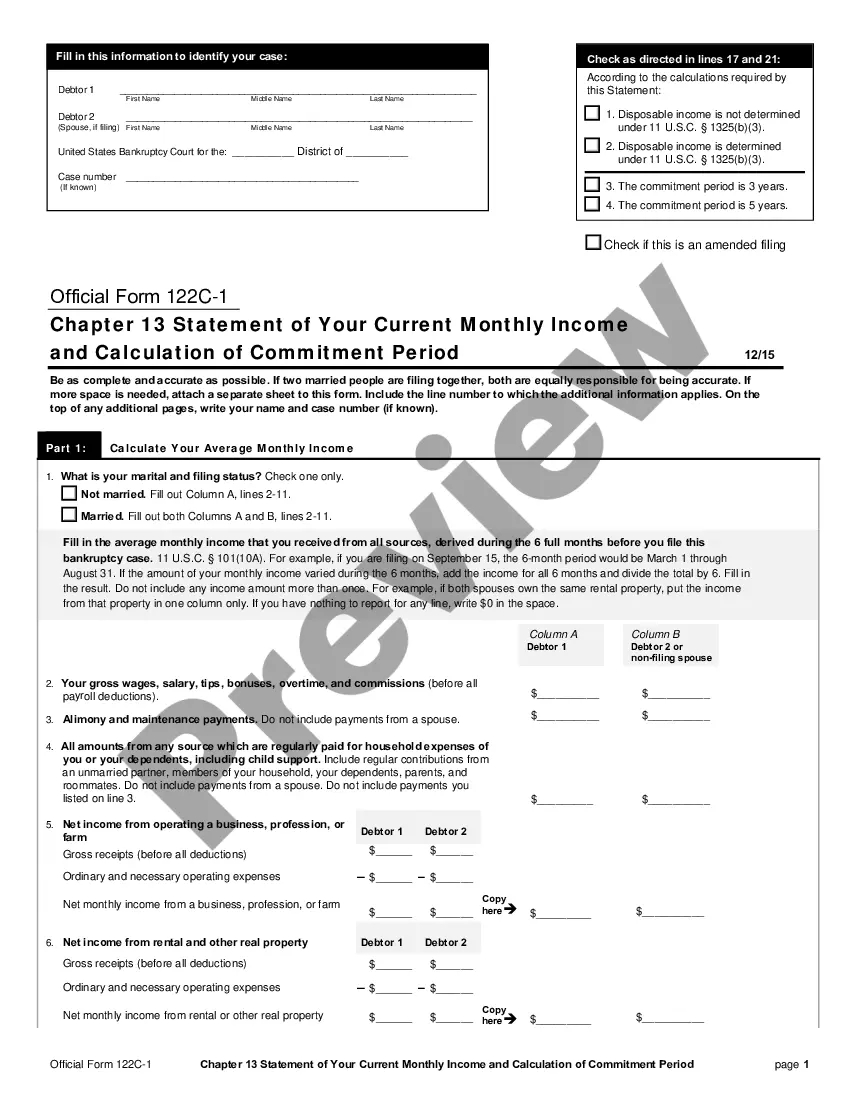

For a Chapter 13, the ?Chapter 13 Statement of Your Current Monthly Income and Calculation of Commitment Period? (Form 122C-1) tells the court your average monthly income. Your income is compared to the median income for your state, which will assist in calculating your disposable income.