Full text and statutory guidelines for the Insurers Rehabilitation and Liquidation Model Act.

Maryland Insurers Rehabilitation and Liquidation Model Act

Description

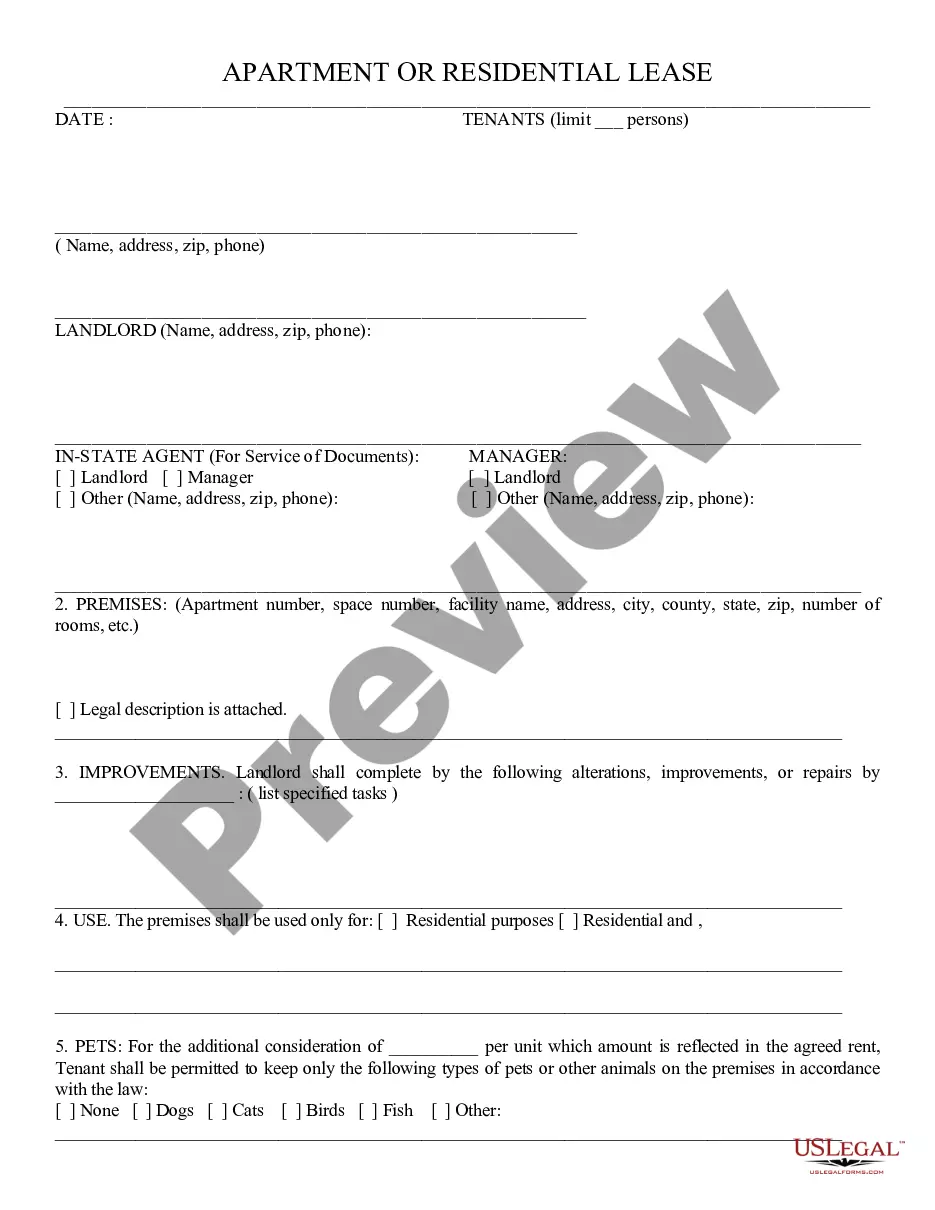

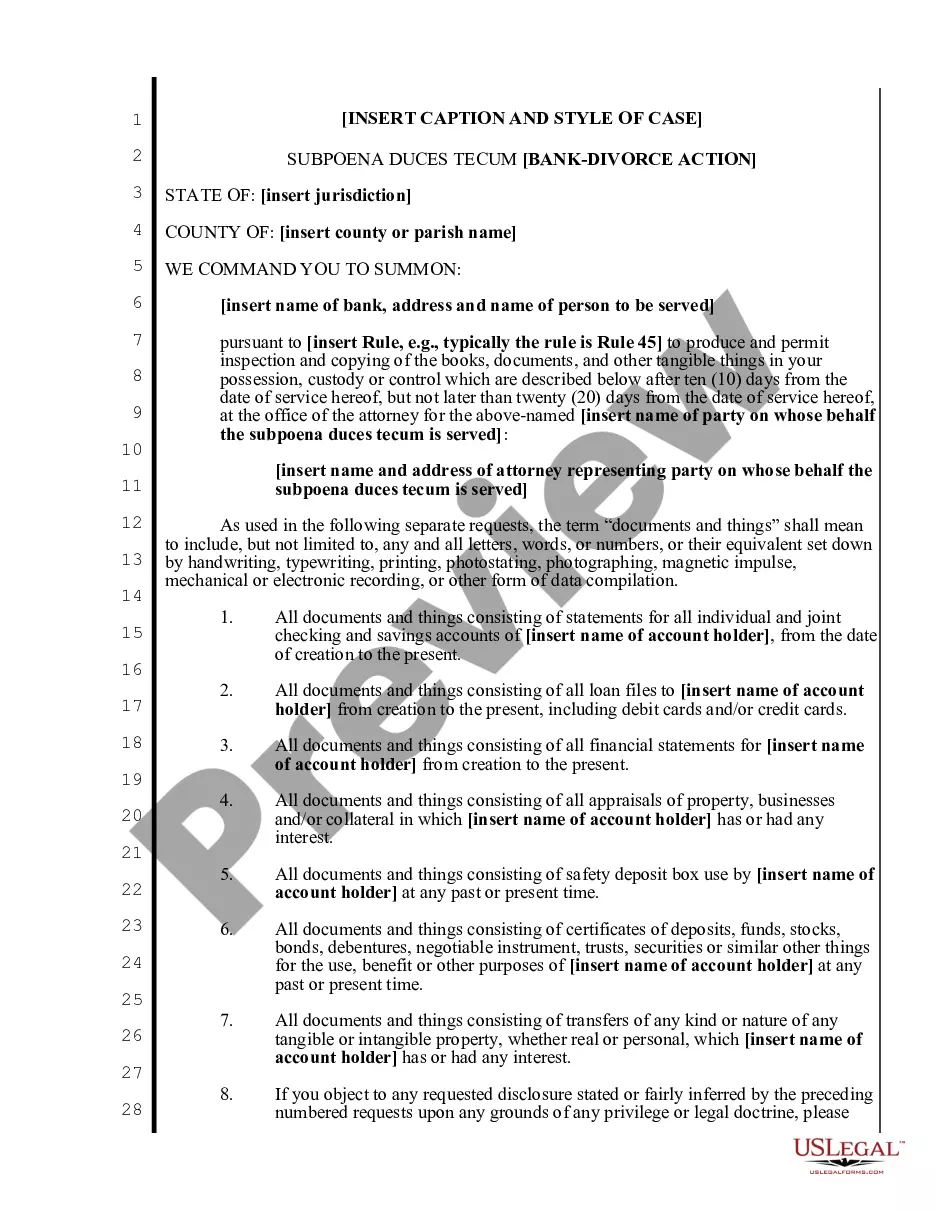

How to fill out Insurers Rehabilitation And Liquidation Model Act?

Are you currently inside a situation that you require paperwork for possibly organization or personal purposes almost every time? There are a variety of legal document themes available online, but finding ones you can rely isn`t effortless. US Legal Forms offers a huge number of kind themes, just like the Maryland Insurers Rehabilitation and Liquidation Model Act, that are written to fulfill federal and state needs.

Should you be already informed about US Legal Forms internet site and get an account, basically log in. Afterward, you can obtain the Maryland Insurers Rehabilitation and Liquidation Model Act format.

If you do not provide an account and wish to begin using US Legal Forms, abide by these steps:

- Find the kind you will need and make sure it is for your right city/county.

- Take advantage of the Review button to analyze the shape.

- Look at the information to actually have selected the correct kind.

- In case the kind isn`t what you`re looking for, make use of the Research field to discover the kind that fits your needs and needs.

- Once you find the right kind, click on Get now.

- Opt for the rates plan you want, submit the necessary information and facts to make your bank account, and pay for the order with your PayPal or Visa or Mastercard.

- Decide on a convenient paper formatting and obtain your duplicate.

Find all the document themes you may have bought in the My Forms menus. You can aquire a more duplicate of Maryland Insurers Rehabilitation and Liquidation Model Act anytime, if needed. Just click on the necessary kind to obtain or print out the document format.

Use US Legal Forms, one of the most extensive collection of legal forms, in order to save efforts and stay away from mistakes. The services offers expertly produced legal document themes that can be used for an array of purposes. Make an account on US Legal Forms and begin generating your lifestyle a little easier.

Form popularity

FAQ

The regulatory action level occurs if surplus falls below 150 percent of the RBC amount. The authorized control level occurs if surplus falls below 100 percent of the RBC amount.

Liquidation is the process of converting a company's assets into cash, and using those funds to repay, as much as possible, the company's debts. Liquidation results in the company being shut down.

(3) ?Authorized Control Level RBC? means the number determined under the risk-based capital formula in ance with the RBC Instructions; (4) ?Mandatory Control Level RBC? means the product of . 70 and the Authorized Control Level RBC.

"Liquidation" is the process whereby the Commissioner, upon a Superior Court's order, terminates an insurance company's insurance business by canceling all insurance policies and by not issuing any new or renewal policies.

When a company becomes insolvent, meaning that it can no longer meet its financial obligations, it undergoes liquidation. Liquidation is the process of closing a business and distributing its assets to claimants. The sale of assets is used to pay creditors and shareholders in the order of priority.

When an insurer is given an order of liquidation, who will protect the insureds' unpaid claims? The Insurance Security Fund was created to provide insureds with protection against an insurer's liquidation.

Once the liquidation is ordered, the guaranty association provides coverage to the company's policyholders who are state residents (up to the levels specified by state laws?see below; any benefit amounts above the guaranty asociation benefit levels become claims against the company's remaining assets).