Maryland Charitable Pledge Agreement - Gift to University to Establish Scholarship Fund

Description

How to fill out Charitable Pledge Agreement - Gift To University To Establish Scholarship Fund?

Are you in a situation where you require documents for either business or personal purposes almost every day.

There are numerous legal document templates available online, but finding reliable versions can be challenging.

US Legal Forms provides thousands of form templates, such as the Maryland Charitable Pledge Agreement - Gift to University to Establish Scholarship Fund, designed to meet both federal and state requirements.

Once you find the appropriate form, click Buy now.

Choose the pricing plan you want, fill in the required information to create your account, and pay for your order using PayPal or credit card.

- If you are already acquainted with the US Legal Forms website and have an account, simply Log In.

- After logging in, you can download the Maryland Charitable Pledge Agreement - Gift to University to Establish Scholarship Fund template.

- If you do not have an account and wish to use US Legal Forms, follow these steps.

- Locate the form you need and ensure it is for the correct city/county.

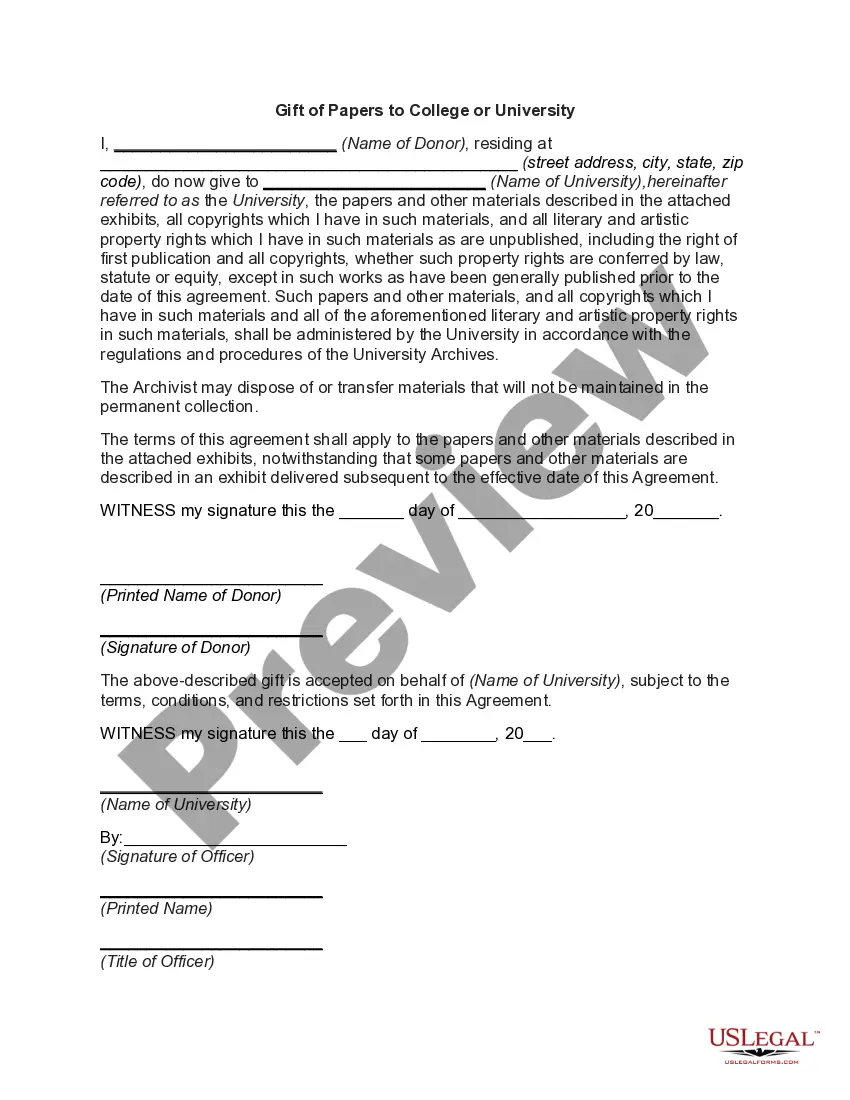

- Utilize the Review option to view the document.

- Check the description to ensure you have selected the correct form.

- If the form is not what you are looking for, use the Search field to find the form that suits your needs.

Form popularity

FAQ

To write a donation pledge, start by clearly stating your intention, the amount you wish to donate, and how you plan to fulfill the pledge. For a Maryland Charitable Pledge Agreement for a Gift to a University to Establish a Scholarship Fund, include specific details about the scholarship's purpose and timeline for contributions. Be sure to personalize the agreement to reflect your beliefs and goals. Utilizing a platform like uslegalforms can offer templates and guidance to streamline this process.

The purpose of a pledge agreement is to formalize a commitment to donate funds for a specific cause, such as educational initiatives. A Maryland Charitable Pledge Agreement for a Gift to a University to Establish a Scholarship Fund serves to affirm your intention to support talented students. This agreement can establish a timeline for payments and clarify how the funds will be used. Ultimately, it reinforces your dedication to making an educational difference.

Pledge agreements can function as legally binding documents, depending on their terms and conditions, as well as the intentions of both parties involved. When you create a Maryland Charitable Pledge Agreement for a Gift to a University to Establish a Scholarship Fund, it’s essential to ensure the document outlines all necessary details clearly. Having a written agreement can protect both you and the university, allowing for a smooth transaction. Consulting legal advice can provide additional clarity and assurance.

The primary difference between a pledge and a donation lies in commitment versus fulfillment. A pledge indicates an intention to donate a specified amount in the future, often documented through a Maryland Charitable Pledge Agreement - Gift to University to Establish Scholarship Fund. In contrast, a donation represents an actual transfer of funds or assets. Understanding this difference can aid you in your charitable planning and decision-making.

A gift pledge is a commitment by a donor to contribute a specific financial amount to a charitable organization, usually over time. This is commonly structured through a Maryland Charitable Pledge Agreement - Gift to University to Establish Scholarship Fund, which formalizes the donor's intention. Such pledges allow organizations to budget and plan for future programs, particularly in establishing scholarship funds that empower students.

When something is given as a pledge, it signifies that the contribution has been promised but not yet delivered in full. In the context of a Maryland Charitable Pledge Agreement - Gift to University to Establish Scholarship Fund, this means that you commit to donating a certain amount over a specified period. This approach allows universities to anticipate future funding and manage their resources accordingly, making it easier to establish scholarship funds.

In giving, a pledge represents a promise to contribute a specific amount to a cause or organization. This commitment is often formalized through a Maryland Charitable Pledge Agreement - Gift to University to Establish Scholarship Fund. By making a pledge, you are expressing your intent to support the university financially, ensuring that your contributions can be planned for and utilized effectively.

Donating to college funds usually involves visiting the college's website to find information about giving options. You can often decide how your donation will be used, including for scholarships. A Maryland Charitable Pledge Agreement - Gift to University to Establish Scholarship Fund can provide a clear pathway to support students and ensure your generosity has a lasting effect.

A charitable pledge agreement is a formal commitment to donate a specified amount to an organization over time. This agreement allows donors to plan their contributions while ensuring the funds will benefit the intended cause, such as scholarships. Utilizing a Maryland Charitable Pledge Agreement - Gift to University to Establish Scholarship Fund can help create a significant impact on students’ lives.

Yes, donations to accredited universities are often tax-deductible, which can provide financial benefits for donors. When you contribute through a Maryland Charitable Pledge Agreement - Gift to University to Establish Scholarship Fund, you not only support education but also potentially reduce your taxable income. It’s wise to consult with a tax professional to understand the specifics of your situation.