Maryland Liquidation of Partnership with Sale of Assets and Assumption of Liabilities

Description

How to fill out Liquidation Of Partnership With Sale Of Assets And Assumption Of Liabilities?

If you wish to obtain, download, or print legal document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Employ the site's simple and user-friendly search functionality to find the documents you need.

A variety of templates for business and personal purposes are organized by categories and states, or keywords.

Step 4. Once you have found the form you desire, click the Buy now button. Choose your payment plan and enter your details to register for an account.

Step 5. Complete the transaction. You may use your Misa or MasterCard or PayPal account to finalize the purchase.

- Utilize US Legal Forms to acquire the Maryland Liquidation of Partnership with Sale of Assets and Assumption of Liabilities in a few clicks.

- If you are a current US Legal Forms user, Log Into your account and then click the Obtain button to locate the Maryland Liquidation of Partnership with Sale of Assets and Assumption of Liabilities.

- You can also access forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions outlined below.

- Step 1. Ensure you have selected the form for your specific area/state.

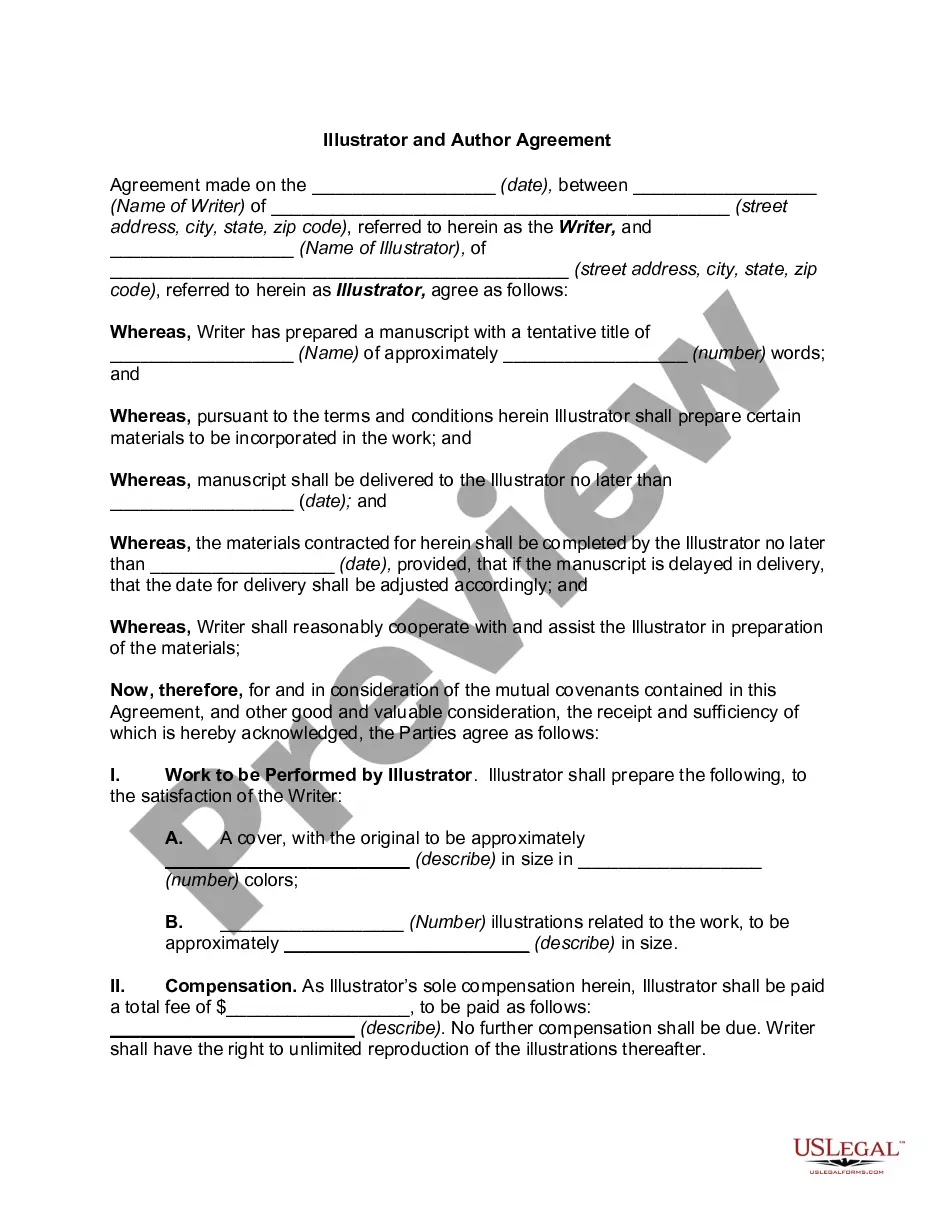

- Step 2. Use the Preview feature to review the form's content. Remember to read through the description.

- Step 3. If you are not satisfied with the form, utilize the Search field at the top of the page to discover other versions of the legal form template.

Form popularity

FAQ

Yes, when a partnership is dissolved, the assets must be liquidated as part of the overall process. This involves assessing the value of business assets, selling them, and using the proceeds to settle any outstanding debts and obligations. By adhering to the Maryland Liquidation of Partnership with Sale of Assets and Assumption of Liabilities guidelines, partners can effectively manage this process, ensuring they fulfill all financial responsibilities and distribute remaining resources fairly.

This means the ownership interest a partner has in a partnership is treated as a separate asset that can be purchased and sold. The general rule is the selling partner treats the gain or loss on the sale of the partnership interest as the sale of a capital asset (see IRC 741).

In an asset purchase, the buyer agrees to purchase specific assets and liabilities. This means that they only take on the risks of those specific assets. This could include equipment, fixtures, furniture, licenses, trade secrets, trade names, accounts payable and receivable, and more.

Acquisitive D reorganization. The transfer of "substantially all" of the target corporation's assets to an acquiring corporation, provided that the target corporation or its stockholders (or a combination of the two) has "control" (generally 80% ownership) of the acquiring corporation immediately after the transfer.

Generally, in an asset purchase, the purchasing company is not liable for the seller's debts, obligations and liabilities. But there are exceptions, such as when the buyer agrees to assume the debts, obligation or liabilities in exchange for a lower sales price, for example.

In an asset sale, sellers are subject to potentially higher taxes than in a stock sale. While intangible assets, such as goodwill, are taxed at capital gains rates, other hard assets may be taxed at higher ordinary income tax rates. Currently, federal capital gains rates are around 20%, while state rates vary.

Q18 What is the difference between an acquisitive Type C reorganization and an acquisitive Type D reorganization? Type D reorg requires T to have >50% control of A after the reorg. Type C has no such requirements.

In an asset purchase or acquisition, the buyer only buys the specific assets and liabilities listed in the purchase agreement. So, it's possible for there to be a liability transfer from the seller to the buyer. Undocumented and contingent liabilities, however, are not included.

A Type D reorganization involves a transfer of assets between corporations. Immediately after the transfer, the transferor corporation or its shareholders must be in control of the corporation to which the assets are transferred (Sec. 368(a)(1)(D)).

The purchaser will take on all of the target company's debts and liabilities, whether they are known at the time of the sale or not. That is, even if a purchaser is not aware of a company's debts and the time of the sale, they will still be held responsible for them after the acquisition.