Maryland Sample Letter to Client regarding Dissolution Finalized

Description

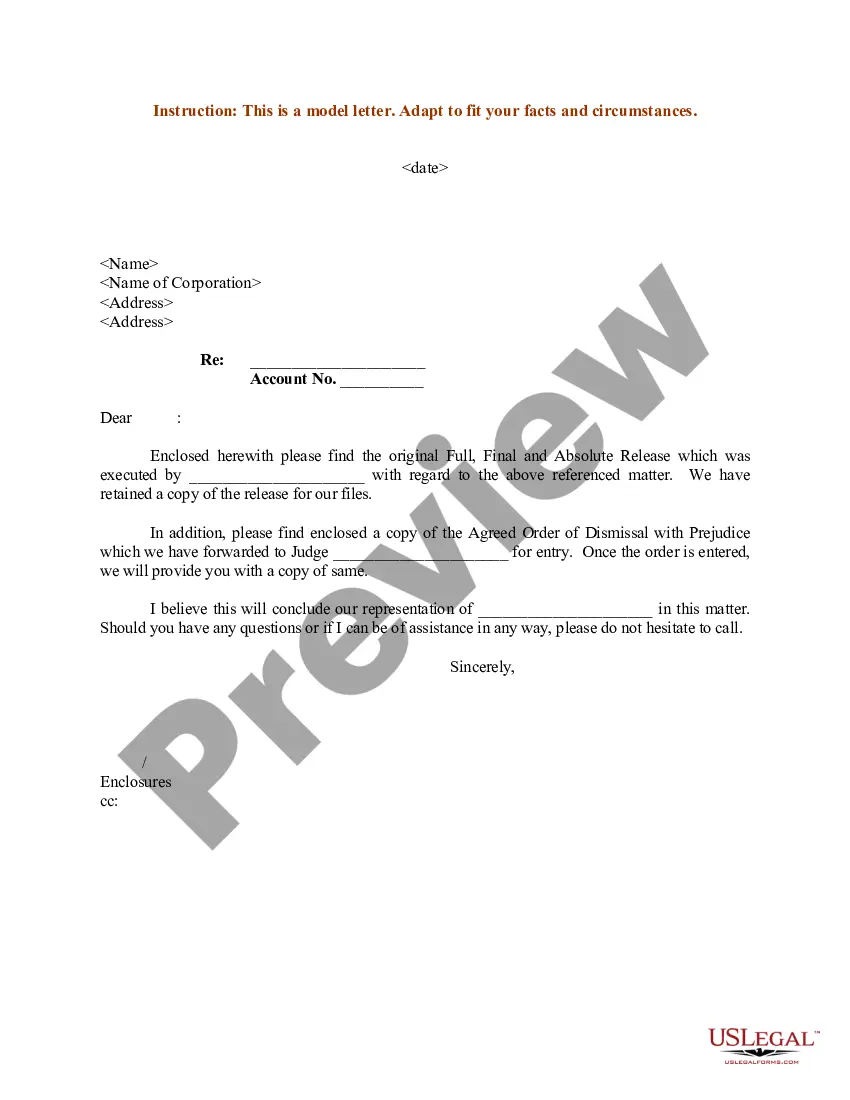

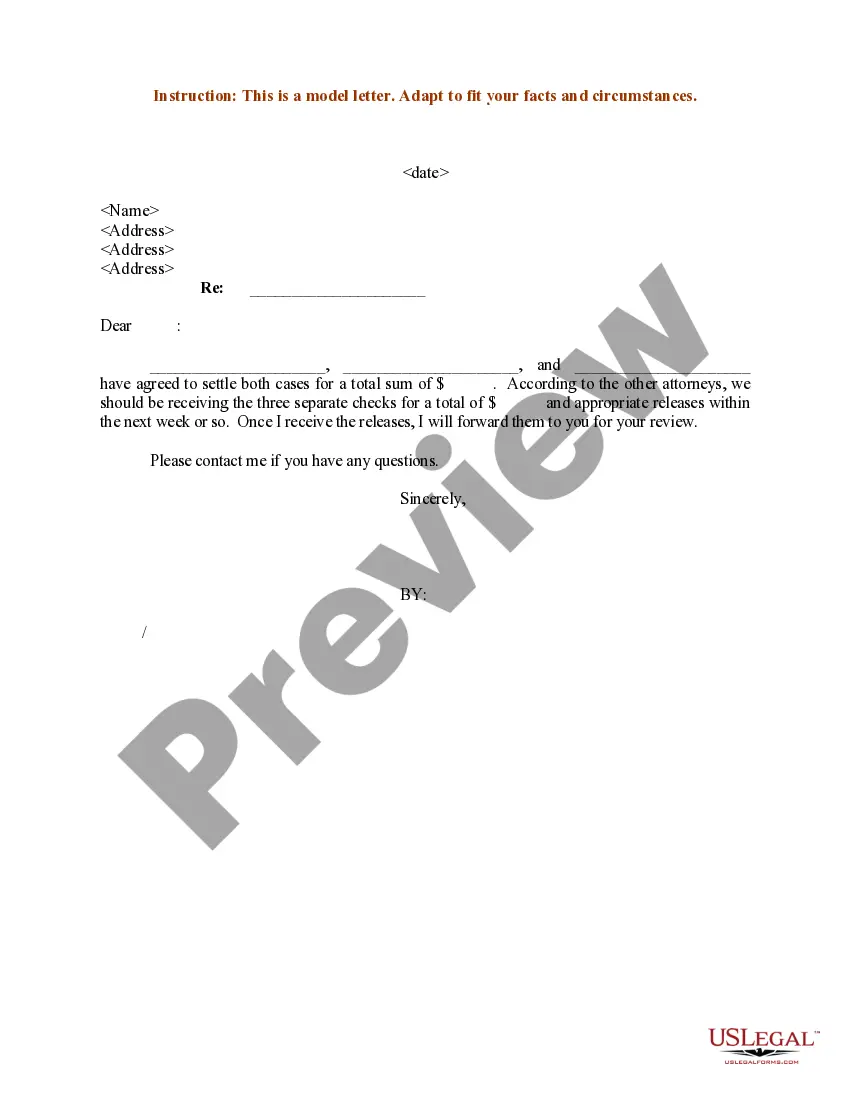

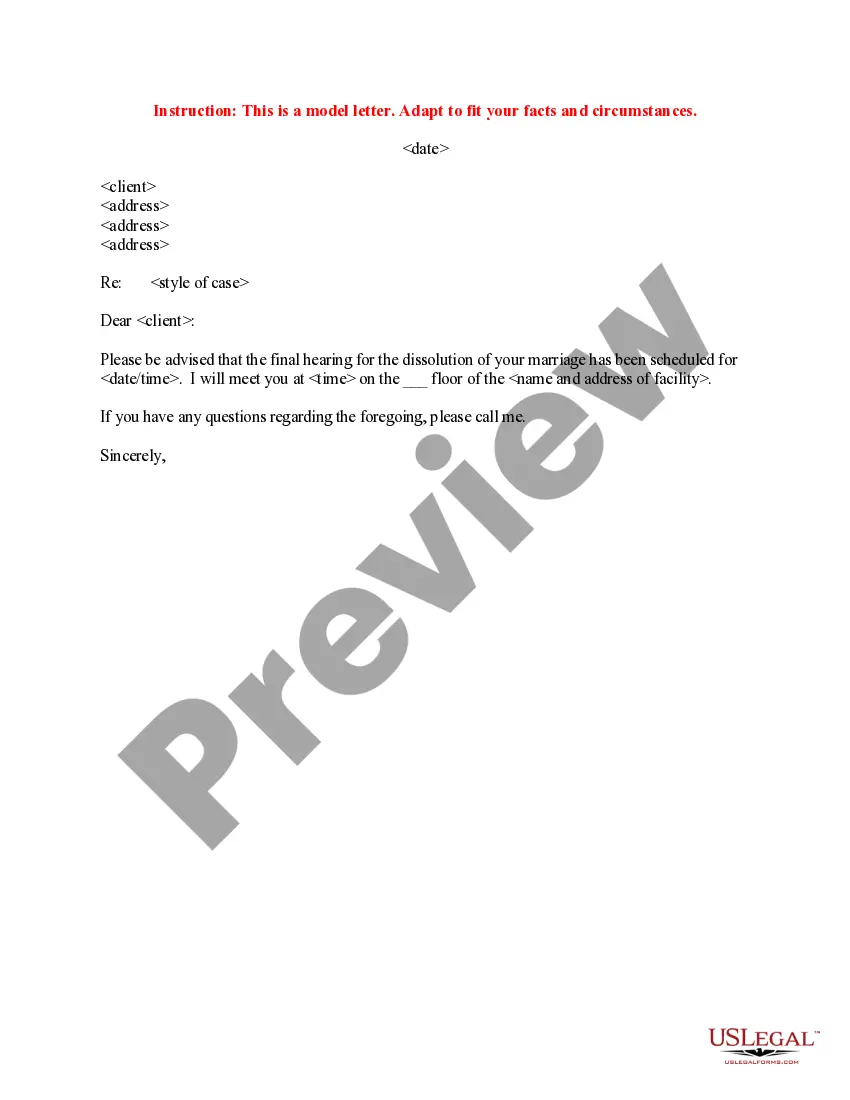

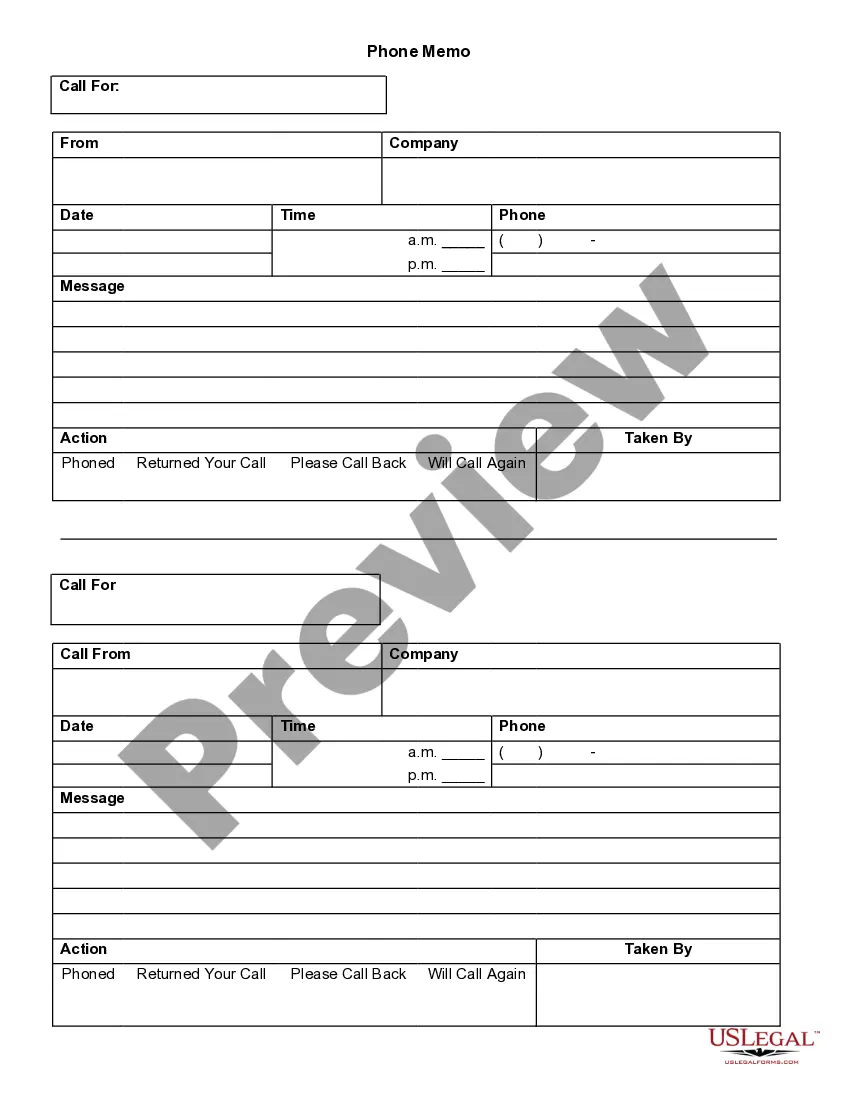

How to fill out Sample Letter To Client Regarding Dissolution Finalized?

Are you within a position the place you need documents for either company or individual functions just about every day? There are a lot of legal file themes accessible on the Internet, but finding ones you can rely is not simple. US Legal Forms offers a large number of type themes, much like the Maryland Sample Letter to Client regarding Dissolution Finalized, that happen to be created to fulfill federal and state requirements.

Should you be currently familiar with US Legal Forms website and also have your account, just log in. Afterward, you may down load the Maryland Sample Letter to Client regarding Dissolution Finalized web template.

Should you not provide an accounts and want to begin using US Legal Forms, abide by these steps:

- Get the type you require and ensure it is for your correct town/county.

- Make use of the Review key to review the form.

- Look at the explanation to actually have selected the right type.

- In the event the type is not what you`re searching for, utilize the Look for area to obtain the type that fits your needs and requirements.

- If you discover the correct type, click Purchase now.

- Opt for the pricing plan you need, fill in the specified information and facts to generate your money, and pay money for an order with your PayPal or Visa or Mastercard.

- Decide on a convenient document format and down load your duplicate.

Find all the file themes you may have purchased in the My Forms menu. You can obtain a more duplicate of Maryland Sample Letter to Client regarding Dissolution Finalized at any time, if necessary. Just go through the essential type to down load or print out the file web template.

Use US Legal Forms, by far the most considerable selection of legal kinds, in order to save efforts and stay away from faults. The services offers professionally made legal file themes that can be used for an array of functions. Make your account on US Legal Forms and start creating your lifestyle a little easier.

Form popularity

FAQ

The letter should include the date of termination, the reason for termination (if applicable), any remaining obligations that either party may have, and an acknowledgement of contributions made by the employee during their time with the company.

When drafting the client termination letter, keep the following in mind: It's not necessary, or suggested, to include a reason for the termination. The letter should simply and directly inform the client that you will no longer provide services to them.

A disengagement letter serves to make clear that a client has ceased to be a current client for conflict of interest analysis. We recommend lawyers include language about file destruction in all engagement letters and again in the disengagement letters.

Be Clear: Be direct and get straight to the point. Clearly state that you are terminating the attorney and briefly state the reasons why. Additionally, the termination letter should state that the attorney should immediately stop working on any pending matters.

?Sincerely? is one often used by lawyers. When writing to someone without referring to them by name (e.g. ?Dear Sir or Madam?), the convention in the US is to sign off with ?Yours truly? (or something similar) and the convention in the UK is to sign off with ?Yours faithfully? (or something similar).

Termination of Representation Letter - Permissive Withdrawal (Form ER05) [Date] [Name and Address of Client] Dear [Client's Name]: This letter will confirm our understanding that effective [DATE] this firm will no longer represent you in connection with [LEGAL MATTER].

The first paragraph of the letter should clearly indicate that the client relationship is being terminated, note the effective date of termination and provide the status of services agreed upon in previously issued engagement letters.

The decision to decline a representation is best to communicate that declination in writing. "Non-engagement letters" should clearly inform the prospective client that the law firm will not represent the prospective client in that matter and that he or she should not rely on the lawyer for any advice or legal action.