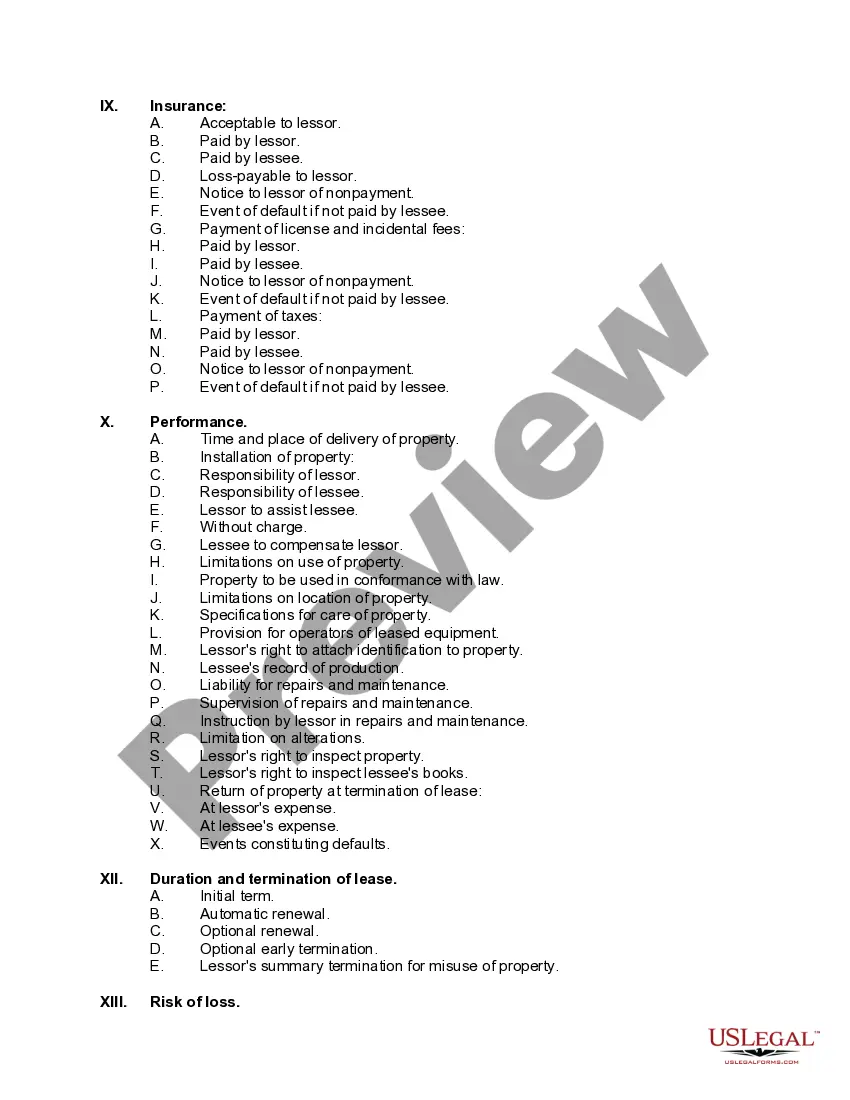

Maryland Equipment Lease Checklist

Description

How to fill out Equipment Lease Checklist?

US Legal Forms - one of the largest collections of legal templates in the United States - provides a vast selection of legal document formats you can download or print.

By utilizing the website, you can discover thousands of forms for corporate and personal use, categorized by types, states, or keywords. You can access the most recent versions of forms such as the Maryland Equipment Lease Checklist within moments.

If you already possess an account, sign in and download the Maryland Equipment Lease Checklist from the US Legal Forms library. The Download button will appear on each document you view. You can find all previously downloaded forms in the My documents section of your account.

Process the payment. Utilize your credit card or PayPal account to complete the transaction.

Choose the format and download the form to your device. Make modifications. Fill out, edit, print, and sign the downloaded Maryland Equipment Lease Checklist. Every template you added to your account has no expiration date and is yours permanently. Therefore, if you wish to download or print another copy, just navigate to the My documents section and click on the form you desire. Gain access to the Maryland Equipment Lease Checklist with US Legal Forms, the largest collection of legal document formats. Utilize a vast array of professional and state-specific templates that cater to your business or personal needs.

- To utilize US Legal Forms for the first time, here are simple steps to assist you in getting started.

- Ensure you have selected the correct form for your area/region.

- Click the Preview button to review the details of the form.

- Check the form summary to confirm that you have chosen the correct document.

- If the form does not satisfy your requirements, use the Search field at the top of the screen to find the one that does.

- If you are satisfied with the form, confirm your choice by clicking the Get now button.

- Then, select the pricing plan you prefer and provide your information to register for an account.

Form popularity

FAQ

Yes, equipment leases can be tax deductible, giving businesses potential savings. When you utilize our Maryland Equipment Lease Checklist, you can understand which expenses qualify. Generally, lease payments and certain costs related to the equipment can be deducted. This tax advantage can enhance your overall financial strategy.

An equipment lease is generally viewed as a liability because it represents a long-term obligation to make payments over time. However, the equipment can be considered an asset for operational purposes while the lease is active. This dual perspective is crucial for financial planning. Using a Maryland Equipment Lease Checklist can help you understand this dynamic better and assess your financial position more accurately.

To record leased equipment, you must first determine whether the lease is classified as an operating or capital lease. This classification affects how you record the lease on your financial statements. Following the Maryland Equipment Lease Checklist can guide you through the process, ensuring you meet accounting standards. For assistance and templates related to recording leased equipment, consider exploring the solutions available through USLegalForms.

A master lease agreement for equipment is a comprehensive document that outlines the terms and conditions of leasing multiple pieces of equipment over a specified period. It serves as a framework for future leases, allowing you to include additional equipment without creating a new agreement each time. Understanding this concept is essential when using a Maryland Equipment Lease Checklist to ensure all leased items are accurately covered. Utilizing a service like USLegalForms can help you draft and manage your master lease agreements effectively.

For most equipment leases, the minimum credit score usually falls in the 600 to 650 range. Understanding that different lessors have varying criteria is essential. To find more tailored options, check the Maryland Equipment Lease Checklist, which outlines requirements from different providers.

Setting up an equipment lease involves several straightforward steps. You start by choosing the equipment you need and identifying potential lessors. Next, review the terms and conditions, ensuring you follow the Maryland Equipment Lease Checklist for documentation and approvals to avoid unforeseen issues.

The minimum credit score for equipment financing typically hovers around 600 to 650, depending on the lender. Scores below this may limit your options or lead to higher rates and more stringent terms. To streamline your financing process, consult the Maryland Equipment Lease Checklist for detailed insights on credit requirements tailored to your needs.

Getting approved for a lease with a 600 credit score is possible, but it often comes with conditions. Many leasing companies might require additional documentation or offer higher interest rates. Always check the Maryland Equipment Lease Checklist for suppliers open to working with lower scores, as options may vary across providers.

When you look into leasing equipment, your credit score plays a pivotal role in the approval process. Generally, a score of at least 650 is preferred to secure favorable terms. However, some leasing companies may consider scores below this threshold but with potentially higher rates. It is wise to refer to the Maryland Equipment Lease Checklist for specific requirements from various lenders.