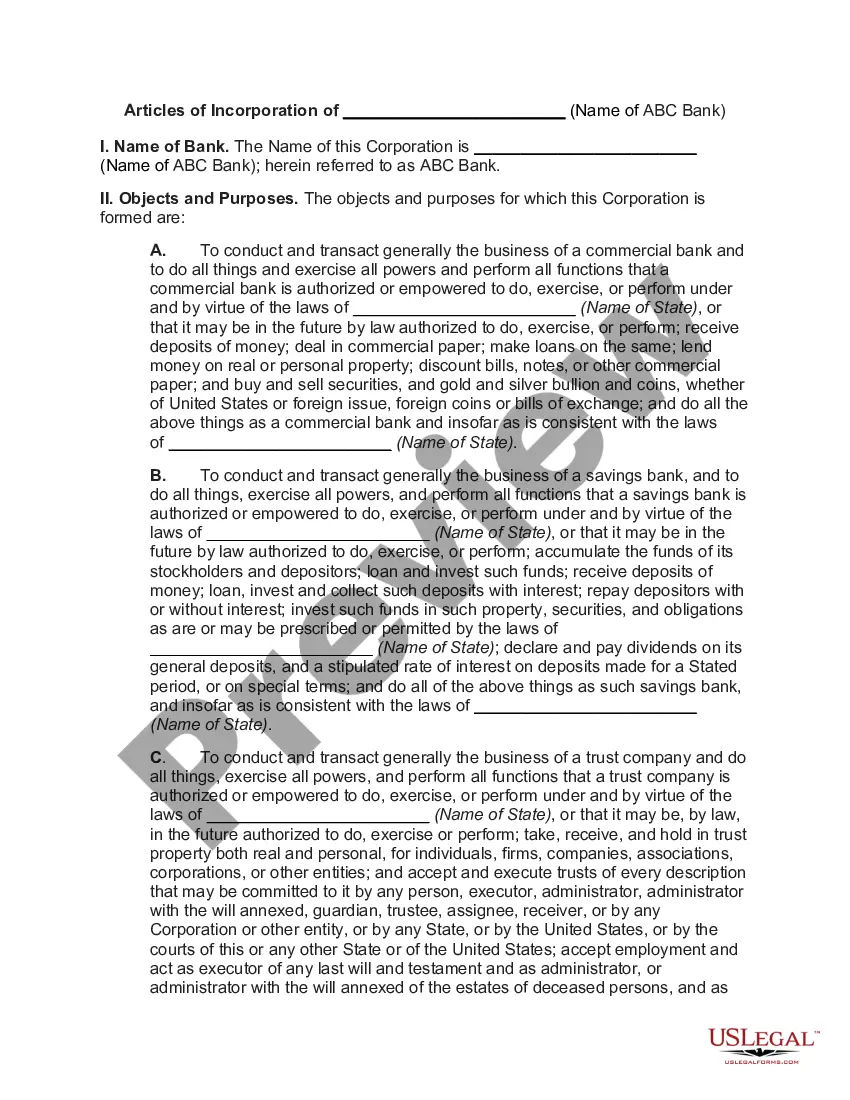

Maryland Articles of Incorporation, Not for Profit Organization, with Tax Provisions

Description

The proper form and necessary content of articles or certificates of incorporation for a nonprofit corporation depend largely on the requirements of the state nonprofit corporation act in the state of incorporation. Typically nonprofit corporations have no capital stock and therefore have members, not stockholders. Because federal tax-exempt status will be sought for most nonprofit corporations, the articles or certificate of incorporation must be carefully drafted to include specific language designed to ensure qualification for tax-exempt status.

How to fill out Articles Of Incorporation, Not For Profit Organization, With Tax Provisions?

US Legal Forms - one of many biggest libraries of legitimate types in the United States - gives a wide array of legitimate papers templates it is possible to download or printing. While using web site, you will get a huge number of types for enterprise and individual uses, categorized by classes, claims, or search phrases.You can get the latest variations of types such as the Maryland Articles of Incorporation, Not for Profit Organization, with Tax Provisions within minutes.

If you already possess a membership, log in and download Maryland Articles of Incorporation, Not for Profit Organization, with Tax Provisions from the US Legal Forms local library. The Obtain switch will appear on every single form you view. You gain access to all previously saved types within the My Forms tab of your own bank account.

If you want to use US Legal Forms the first time, listed below are simple directions to help you get started:

- Ensure you have chosen the best form for your personal area/area. Select the Preview switch to analyze the form`s information. See the form outline to actually have selected the right form.

- In case the form does not match your requirements, make use of the Research area at the top of the screen to get the the one that does.

- When you are satisfied with the form, confirm your decision by simply clicking the Purchase now switch. Then, choose the costs prepare you like and provide your accreditations to sign up on an bank account.

- Method the deal. Use your charge card or PayPal bank account to perform the deal.

- Choose the formatting and download the form on the gadget.

- Make adjustments. Fill out, modify and printing and sign the saved Maryland Articles of Incorporation, Not for Profit Organization, with Tax Provisions.

Every single web template you included in your money lacks an expiration date and is the one you have forever. So, if you want to download or printing an additional duplicate, just check out the My Forms segment and then click around the form you want.

Get access to the Maryland Articles of Incorporation, Not for Profit Organization, with Tax Provisions with US Legal Forms, by far the most extensive local library of legitimate papers templates. Use a huge number of professional and state-certain templates that meet your business or individual needs and requirements.

Form popularity

FAQ

Are Nonprofits Taxed? Nonprofit organizations are exempt from federal income taxes under subsection 501(c) of the Internal Revenue Service (IRS) tax code. A nonprofit organization is an entity that engages in activities for both public and private interest without pursuing the goal of commercial or monetary profit.

You can check an organization's eligibility to receive tax-deductible charitable contributions (Pub 78 Data). You can also search for information about an organization's tax-exempt status and filings: Form 990 Series Returns. Form 990-N (e-Postcard)

Nonprofit organizations are exempt from federal income taxes under subsection 501(c) of the Internal Revenue Service (IRS) tax code. A nonprofit organization is an entity that engages in activities for both public and private interest without pursuing the goal of commercial or monetary profit.

Corporations, and any community chest, fund, or foundation, organized and operated exclusively for religious, charitable, scientific, testing for public safety, literary, or educational purposes, or to foster national or international amateur sports competition (but only if no part of its activities involve the ...

The exempt purposes set forth in section 501(c)(3) are charitable, religious, educational, scientific, literary, testing for public safety, fostering national or international amateur sports competition, and preventing cruelty to children or animals.

The exempt purposes set forth in section 501(c)(3) are charitable, religious, educational, scientific, literary, testing for public safety, fostering national or international amateur sports competition, and preventing cruelty to children or animals.

A 501(c) organization and a 501(c)3 organization are similar in designation, however they differ slightly in their tax benefits. Both types of organization are exempt from federal income tax, however a 501(c)3 may allow its donors to write off donations whereas a 501(c) does not.

A nonprofit organization that is exempt from income tax under Section 501(c)(3) or Section 501(c)(19) of the Internal Revenue Code, and holds a valid Maryland sales and use tax exemption certificate, is still be liable for other state and local taxes in Maryland, such as local hotel taxes.