Maryland Agreement to Purchase Note and Mortgage

Description

How to fill out Agreement To Purchase Note And Mortgage?

US Legal Forms - one of many biggest libraries of authorized types in the States - provides a variety of authorized papers web templates you are able to down load or produce. Using the website, you may get thousands of types for organization and person functions, sorted by categories, says, or keywords and phrases.You will discover the most recent models of types much like the Maryland Agreement to Purchase Note and Mortgage within minutes.

If you already have a registration, log in and down load Maryland Agreement to Purchase Note and Mortgage through the US Legal Forms catalogue. The Obtain button can look on every single form you view. You get access to all earlier downloaded types from the My Forms tab of your respective profile.

If you would like use US Legal Forms initially, listed here are simple directions to help you started out:

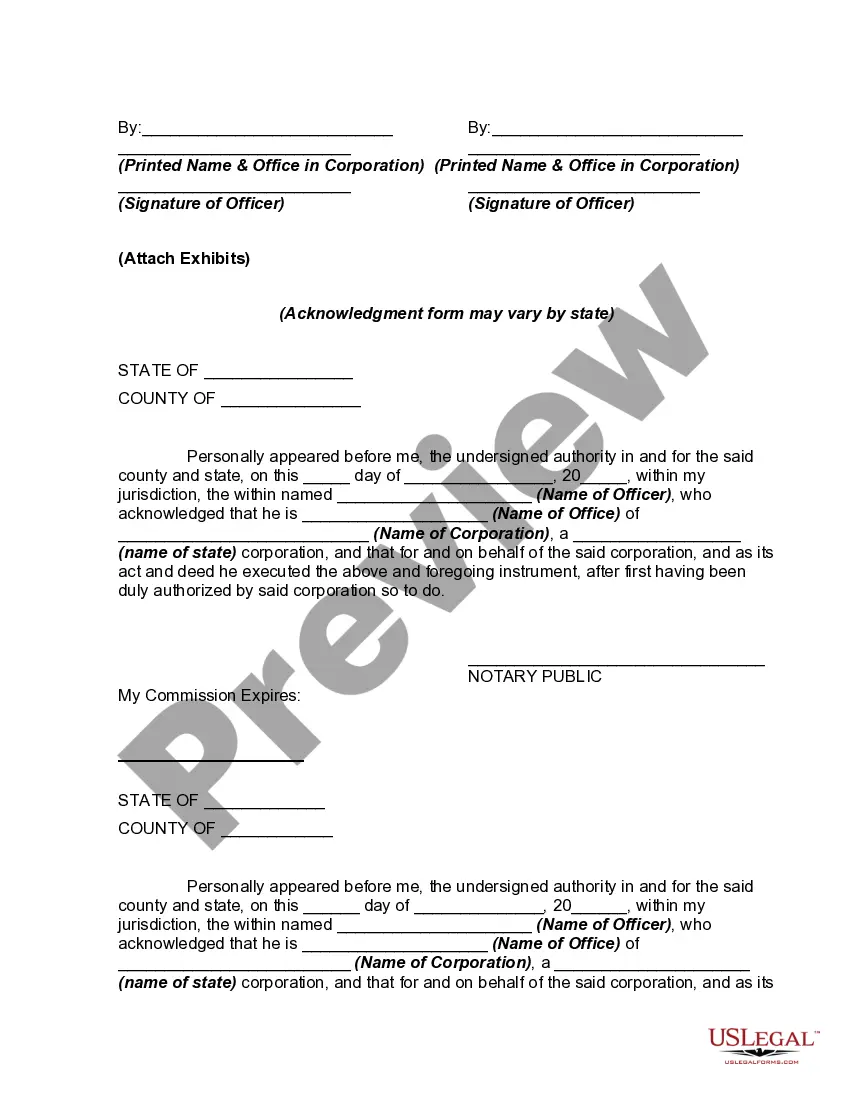

- Ensure you have selected the right form for the area/region. Select the Preview button to examine the form`s information. Look at the form information to actually have selected the appropriate form.

- In case the form does not match your requirements, make use of the Research area near the top of the monitor to get the one that does.

- If you are content with the shape, affirm your choice by clicking on the Buy now button. Then, pick the rates prepare you want and give your references to register for the profile.

- Process the transaction. Use your credit card or PayPal profile to finish the transaction.

- Pick the formatting and down load the shape on the product.

- Make alterations. Complete, modify and produce and sign the downloaded Maryland Agreement to Purchase Note and Mortgage.

Each and every format you included in your bank account does not have an expiration date and is the one you have eternally. So, if you wish to down load or produce yet another copy, just proceed to the My Forms portion and click on in the form you will need.

Gain access to the Maryland Agreement to Purchase Note and Mortgage with US Legal Forms, the most extensive catalogue of authorized papers web templates. Use thousands of expert and status-distinct web templates that fulfill your small business or person needs and requirements.

Form popularity

FAQ

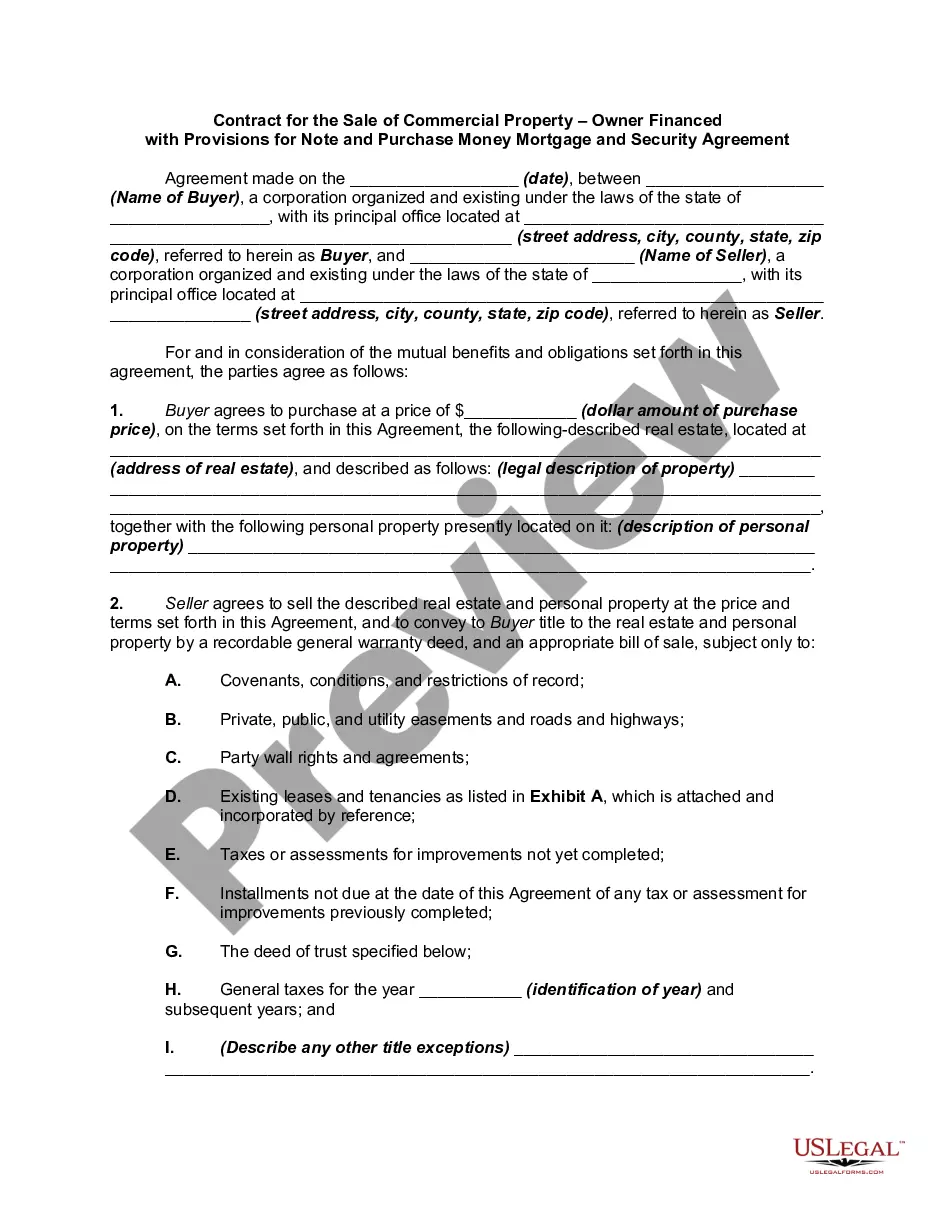

Secured: A secured promissory note is common in traditional mortgages. It means the borrower backs their loan with collateral. For a mortgage, the collateral is the property. If the borrower fails to pay back their loan, the lender has a legal claim over the asset and, in extreme cases, may foreclose on the property.

A borrower usually must sign a promissory note along with the mortgage. The promissory note gives legal protections to the lender if the borrower defaults on the debt and provides clarification to the borrower so that they understand their repayment obligations.

When you are applying for a loan to purchase a home, the lender may require you to sign a promissory note and a mortgage or a deed of trust. In the event that your loan is sold to another party, these documents will be transferred to the new owner with an assignment and an endorsement.

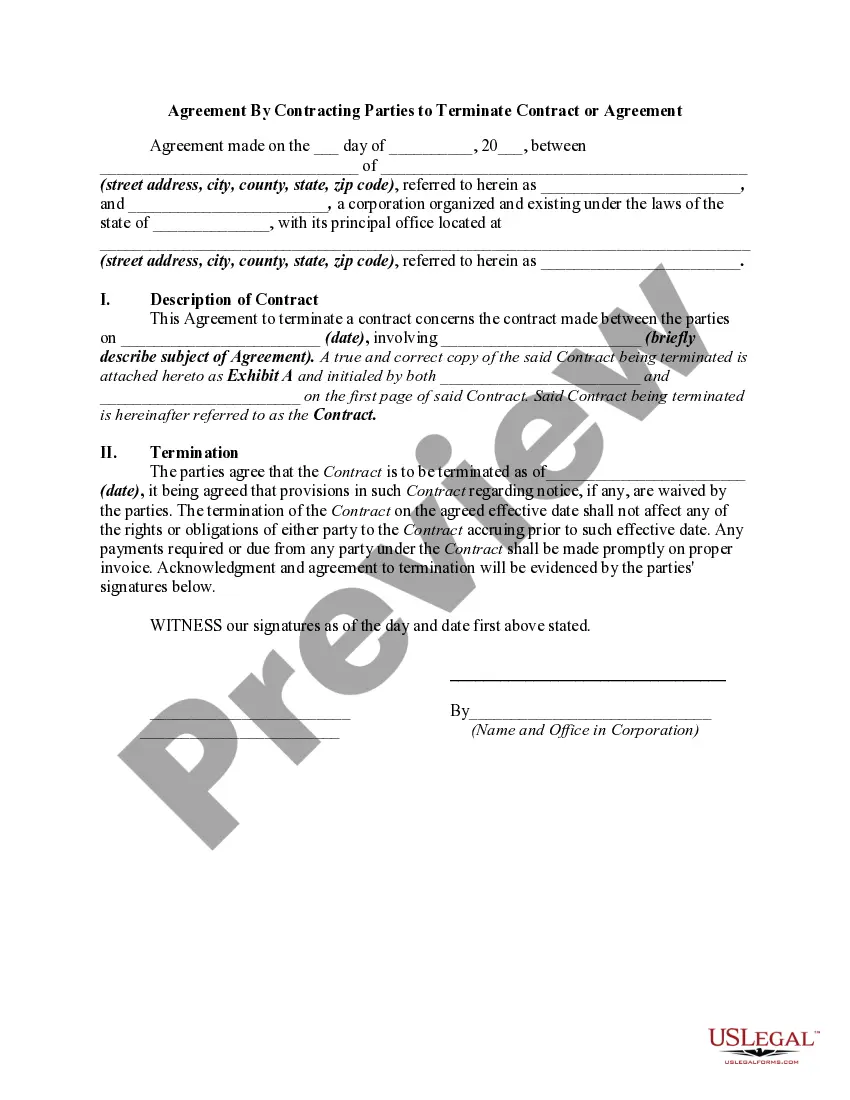

A promissory note could become invalid if: It isn't signed by both parties. The note violates laws. One party tries to change the terms of the agreement without notifying the other party.

Some of the most significant differences between promissory notes and loan agreements include: Collateral: Most loan agreements center around loans with collateral, while promissory notes are only secured by the borrower's word. Repayment Terms: Promissory notes might require lump-sum repayment.

To be legally enforceable, a promissory note must meet multiple legal conditions. Moreover, it must contain both an offer of agreement and an acceptance of agreement. All contracts state the type of services or goods rendered and indicate how much they cost.

Secured: A secured promissory note is common in traditional mortgages. It means the borrower backs their loan with collateral. For a mortgage, the collateral is the property. If the borrower fails to pay back their loan, the lender has a legal claim over the asset and, in extreme cases, may foreclose on the property.

Promissory Note Vs. Mortgage. A promissory note is a document between the lender and the borrower in which the borrower promises to pay back the lender, it is a separate contract from the mortgage. The mortgage is a legal document that ties or "secures" a piece of real estate to an obligation to repay money.