A corporation is an artificial person that is created by governmental action. The corporation exists in the eyes of the law as a person, separate and distinct from the persons who own the corporation (i.e., the stockholders). This means that the property of the corporation is not owned by the stockholders, but by the corporation. Debts of the corporation are debts of this artificial person, and not of the persons running the corporation or owning shares of stock in it. The shareholders cannot normally be sued as to corporate liabilities. However, in this guaranty, the stockholders of a corporation are personally guaranteeing the debt of the corporation in which they own shares.

Maryland Continuing Guaranty of Business Indebtedness By Corporate Stockholders

Description

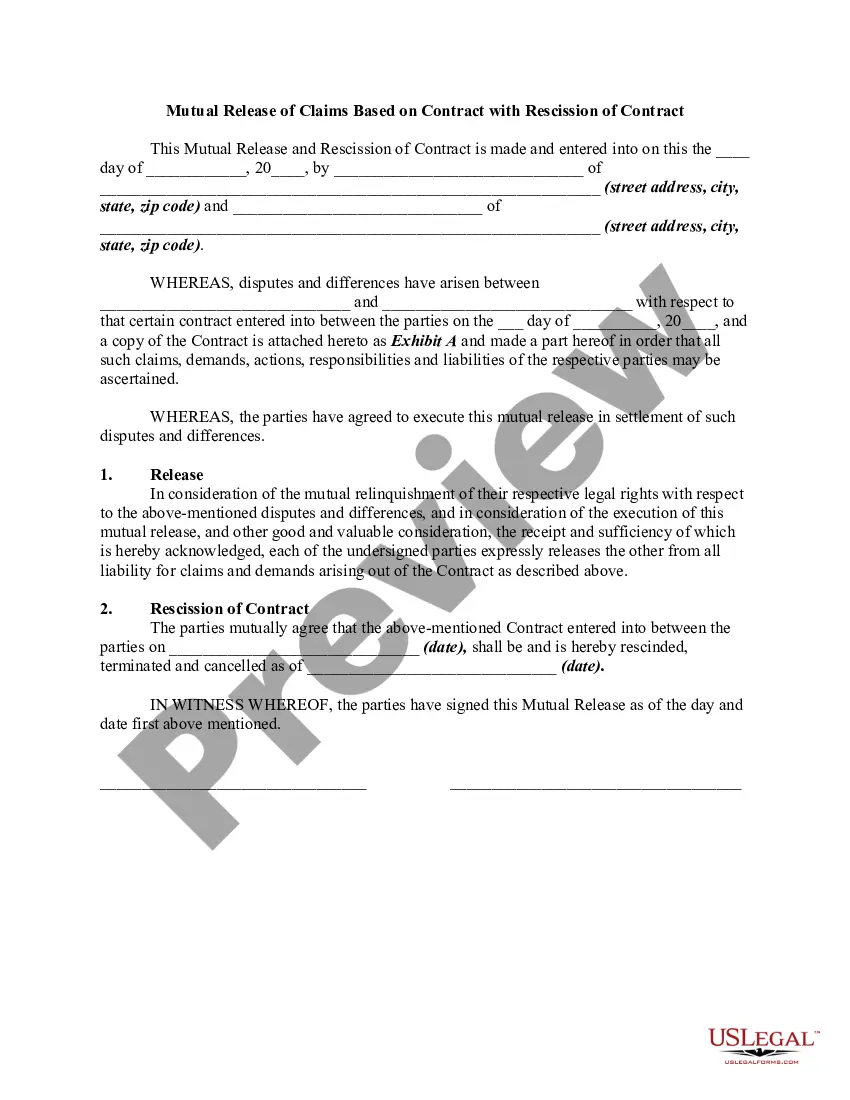

How to fill out Continuing Guaranty Of Business Indebtedness By Corporate Stockholders?

If you wish to finish, obtain, or print sanctioned document templates, utilize US Legal Forms, the largest selection of legal forms that are available online.

Take advantage of the website's straightforward and user-friendly search feature to locate the documents you need.

A selection of templates for business and personal purposes is organized by categories and jurisdictions, or keywords.

Step 4. Once you have located the required form, click on the Get now button. Select your preferred payment plan and enter your details to sign up for an account.

Step 5. Complete the transaction. You can use your credit card or PayPal to carry out the payment. Step 6. Choose the format of the legal form and save it to your device. Step 7. Fill out, edit, and print or sign the Maryland Continuing Guaranty of Business Indebtedness By Corporate Stockholders.

- Leverage US Legal Forms to acquire the Maryland Continuing Guaranty of Business Indebtedness By Corporate Stockholders with minimal effort.

- If you are currently a US Legal Forms user, Log In to your account and then click the Download button to access the Maryland Continuing Guaranty of Business Indebtedness By Corporate Stockholders.

- You can also find forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, refer to the following steps.

- Step 1. Ensure you have chosen the form relevant to the appropriate jurisdiction.

- Step 2. Use the Preview option to review the form's content.

- Step 3. If you are not content with the form, utilize the Search field at the top of the screen to find alternative versions of the legal form template.

Form popularity

FAQ

Section 2 106 outlines the provisions regarding corporate guarantees under Maryland law, specifically relevant to stockholders and business indebtedness. This section is important for understanding the rights and obligations of guarantors in Maryland. It plays a vital role in the framework of the Maryland Continuing Guaranty of Business Indebtedness By Corporate Stockholders, making it essential for stockholders to be familiar with its details.

A guarantor in a company is typically a person or a business that agrees to fulfill the financial obligations of the company if it fails to do so. In the case of the Maryland Continuing Guaranty of Business Indebtedness By Corporate Stockholders, this role is often filled by major stakeholders or stockholders. This ensures that lenders have assurance that debts will be covered, enhancing the company's creditworthiness.

A personal guarantor is an individual who uses their personal assets to secure a debt, while a corporate guarantor is a business entity that assumes this responsibility. In the Maryland Continuing Guaranty of Business Indebtedness By Corporate Stockholders, a corporate guarantor often limits personal liability, making it a safer option for stockholders. Understanding this distinction helps stockholders make informed decisions about their guarantees.

In the context of a Maryland Continuing Guaranty of Business Indebtedness By Corporate Stockholders, a guarantor is an individual or entity that agrees to take responsibility for the debt of another. This often includes corporate stockholders who may provide assurances that the company's obligations will be met. It's crucial that the guarantor has a solid understanding of the risks involved, as they can be held accountable for any defaults.

Yes, a personal guarantee functions as a form of security for lenders. It assures them that even if the business fails, they can seek repayment from the individual who signed the guarantee. With a Maryland Continuing Guaranty of Business Indebtedness By Corporate Stockholders, this security can be crucial in obtaining necessary funding, and accessing the right legal forms can facilitate this process efficiently through platforms like US Legal Forms.

The primary purpose of a personal guarantee is to provide lenders with an added layer of security. By signing, individuals offer assurance that they will be accountable for the debts of the company. This becomes particularly relevant in a Maryland Continuing Guaranty of Business Indebtedness By Corporate Stockholders, where lenders may require this guarantee to approve financing for start-ups or loans.

An example of a corporate guarantee involves a parent company guaranteeing the obligations of its subsidiary. This means if the subsidiary defaults, the parent company takes over the responsibility for the debt. In the realm of a Maryland Continuing Guaranty of Business Indebtedness By Corporate Stockholders, stockholders can also be implicated in similar guarantees, emphasizing the importance of understanding your role.

The primary risk of a personal guarantee is financial liability; if the business fails to meet its debt obligations, the individual’s personal assets may be at stake. This becomes crucial in the context of a Maryland Continuing Guaranty of Business Indebtedness By Corporate Stockholders, where stockholders could be personally liable for company debts. Understanding these risks is vital before signing a personal guarantee.

Yes, a personal guarantee is typically drafted as a separate document. This document outlines the individual's promise to take responsibility for the business's debts, ensuring the lender has a safeguard. When considering a Maryland Continuing Guaranty of Business Indebtedness By Corporate Stockholders, it is important to differentiate this from other contracts, as it specifically holds stockholders accountable.

A corporate guarantor is a company that guarantees the obligations of another business or individual. This scenario frequently arises when larger companies or stakeholders assure creditors that a borrower will fulfill their debts. Knowledge of the Maryland Continuing Guaranty of Business Indebtedness By Corporate Stockholders can help businesses find appropriate corporate guarantors to enhance credibility and secure financing.