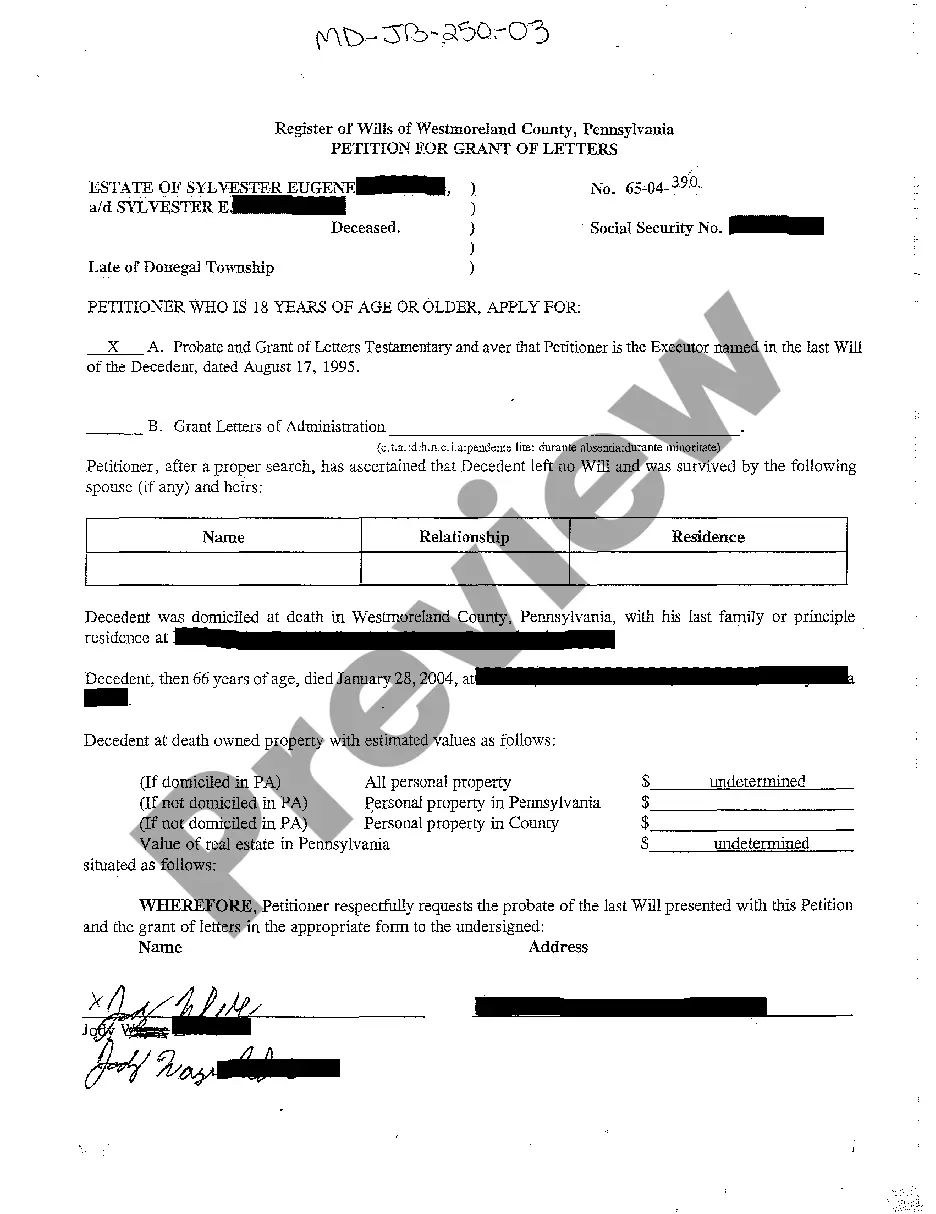

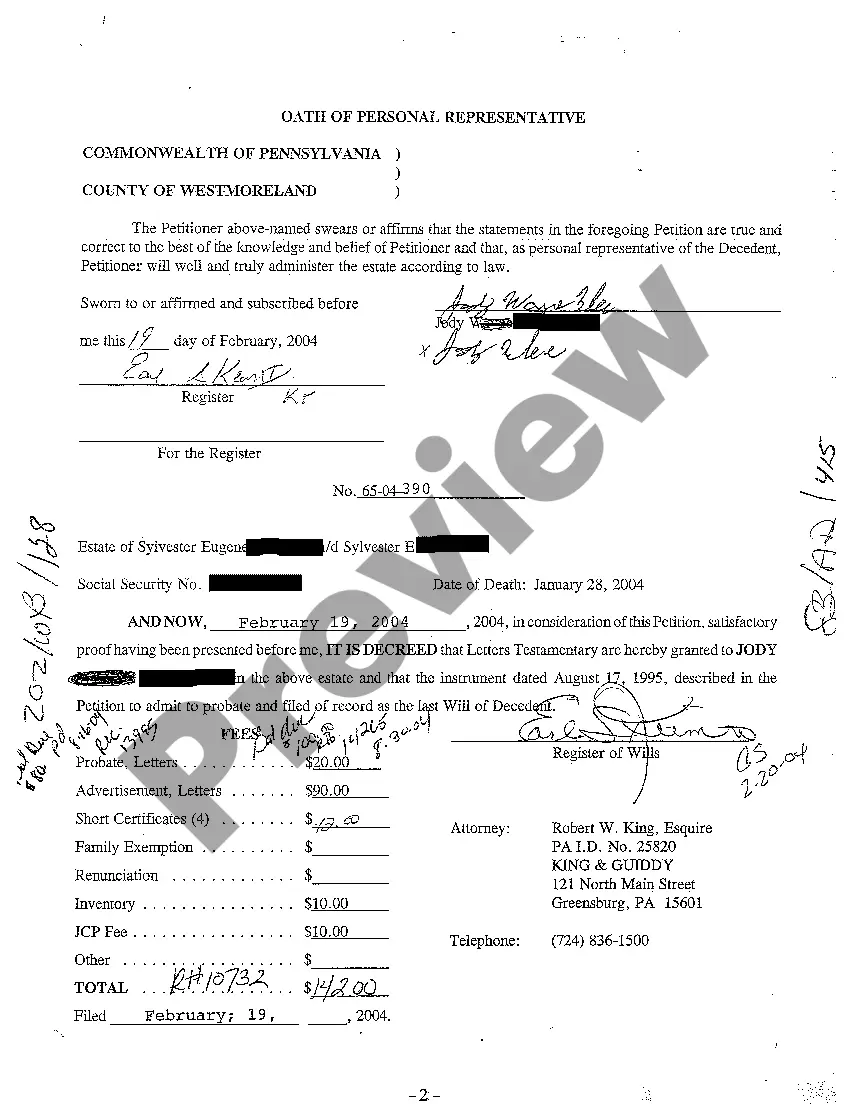

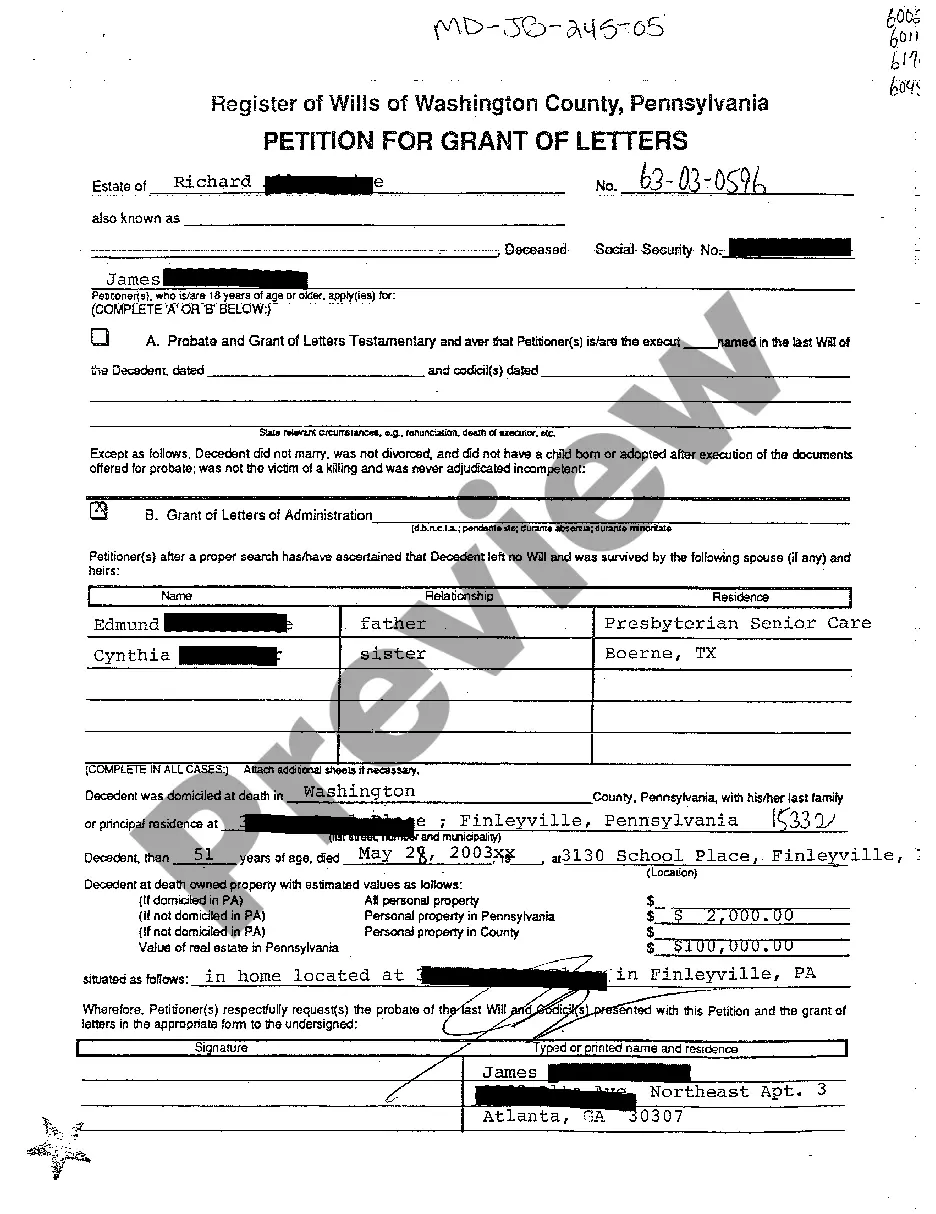

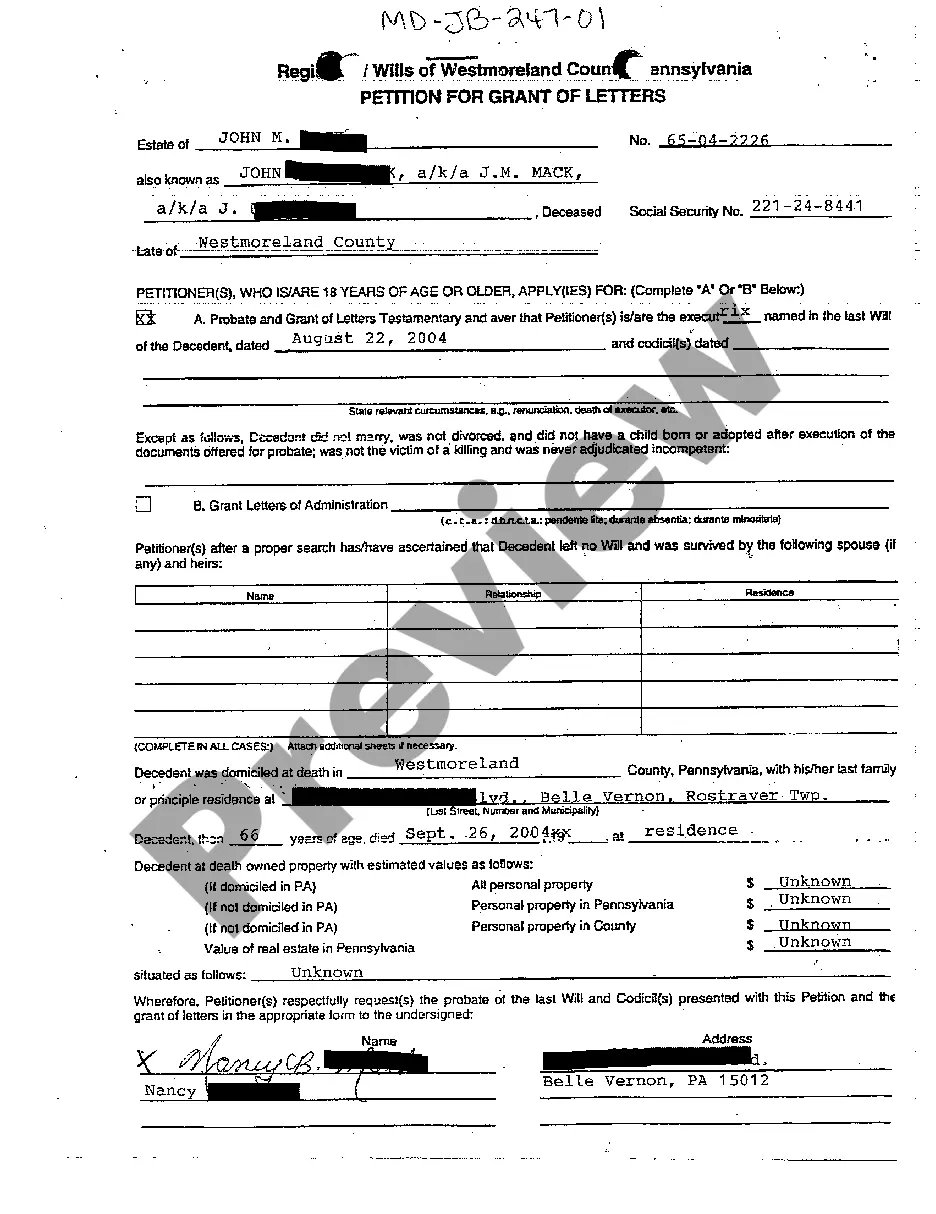

Maryland Petition for Grant of Letters Testamentary by Named Executor in Will

Description

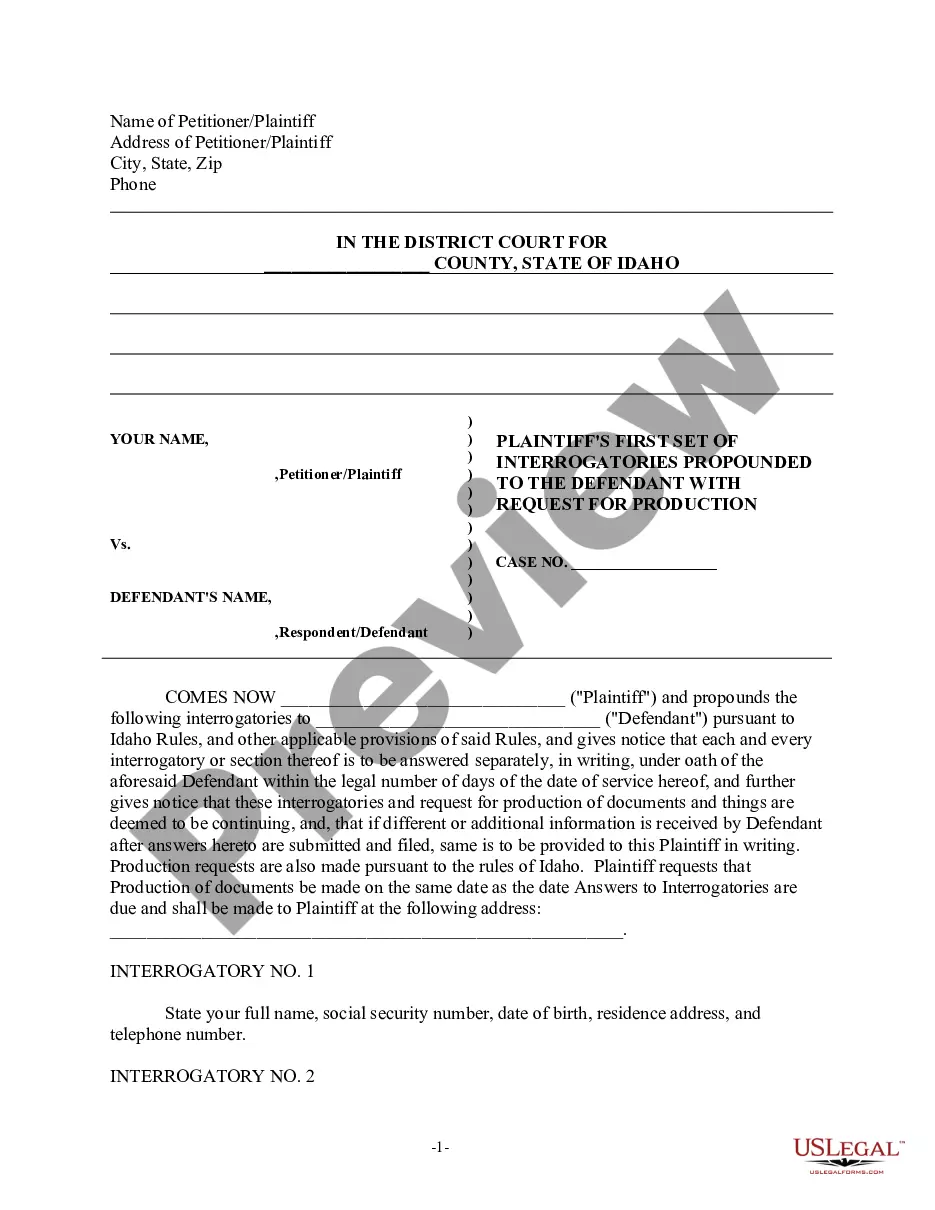

How to fill out Maryland Petition For Grant Of Letters Testamentary By Named Executor In Will?

You are invited to the most extensive legal documents collection, US Legal Forms. Here you can locate any template including Maryland Petition for Grant of Letters Testamentary by Named Executor in Will samples and download them (as many as you require). Prepare official documents within a few hours, rather than days or weeks, without spending a fortune on a lawyer or attorney. Obtain the state-specific form in just a few clicks and feel assured knowing that it was created by our experienced legal experts.

If you are already a subscribed member, just sign in to your account and select Download next to the Maryland Petition for Grant of Letters Testamentary by Named Executor in Will you need. Since US Legal Forms is an online service, you will typically have access to your downloaded forms, regardless of the device you’re using. Find them in the My documents section.

If you don't possess an account yet, what are you waiting for? Review our instructions listed below to get started.

After you’ve completed the Maryland Petition for Grant of Letters Testamentary by Named Executor in Will, forward it to your lawyer for validation. It’s an additional step but a crucial one for ensuring you're entirely secure. Join US Legal Forms today and gain access to numerous reusable templates.

- If this is a state-specific template, check its relevance in your state.

- View the description (if available) to determine if it’s the correct template.

- Explore additional content with the Preview feature.

- If the template meets all your needs, just click Buy Now.

- To create an account, select a pricing option.

- Use a credit card or PayPal account to register.

- Download the template in your desired format (Word or PDF).

- Print the document and fill it out with your/your business’s details.

Form popularity

FAQ

The critical difference between Probate and Letter of Administration is that Probate is granted to an executor nominated under the will. Letter of Administration is granted to the beneficiaries after they apply to a Court of law having competent jurisdiction.

Accounts or assets with named beneficiaries may be transferred without going through the probate process. Assets with joint ownership with right of survivorship pass to the second owner when the first owner dies.

To apply for a Letter of Administration you need to have details of everything the deceased person owned and how much this is worth, as well as their outstanding debts. You will need this information to complete the Inheritance Tax returns and calculate any Inheritance Tax that needs to be paid to HM Revenue & Customs.

To obtain your letter of testamentary, you will need to file the will and death certificate in the probate court, along with forms asking for the letter of testamentary. You'll need to provide your information, as well as some basic information about the value of the estate and the date of death.

Normally, one or more of the executors named in the will applies for the grant of probate. Otherwise (if the person died without a will or the will did not appoint executors) a beneficiary or relative can be the administrator and can apply for letters of administration.

If you are named in someone's will as an executor, you may have to apply for probate. This is a legal document which gives you the authority to share out the estate of the person who has died according to the instructions in the will. You do not always need probate to be able to deal with the estate.

Accounts With a Payable-on-Death Beneficiary The money is not part of the deceased person's probate estate, so you, as executor, don't have any authority over it. The beneficiary named by the deceased person can simply claim the money by going to the bank with a death certificate and identification.

Children (or grandchildren if children have died) Parents. Siblings (or nieces and nephews over 18 if siblings have died) Half-siblings (or nieces and nephews over 18 if half-siblings have died) Grandparents. Aunts or uncles.

What is probate?If no executors are named, or none of the executors is prepared to act, a beneficiary of the will can apply to the probate registry for a 'grant of letters of administration (with will annexed)'. If there is no will, a relative can apply for a 'grant of letters of administration'.