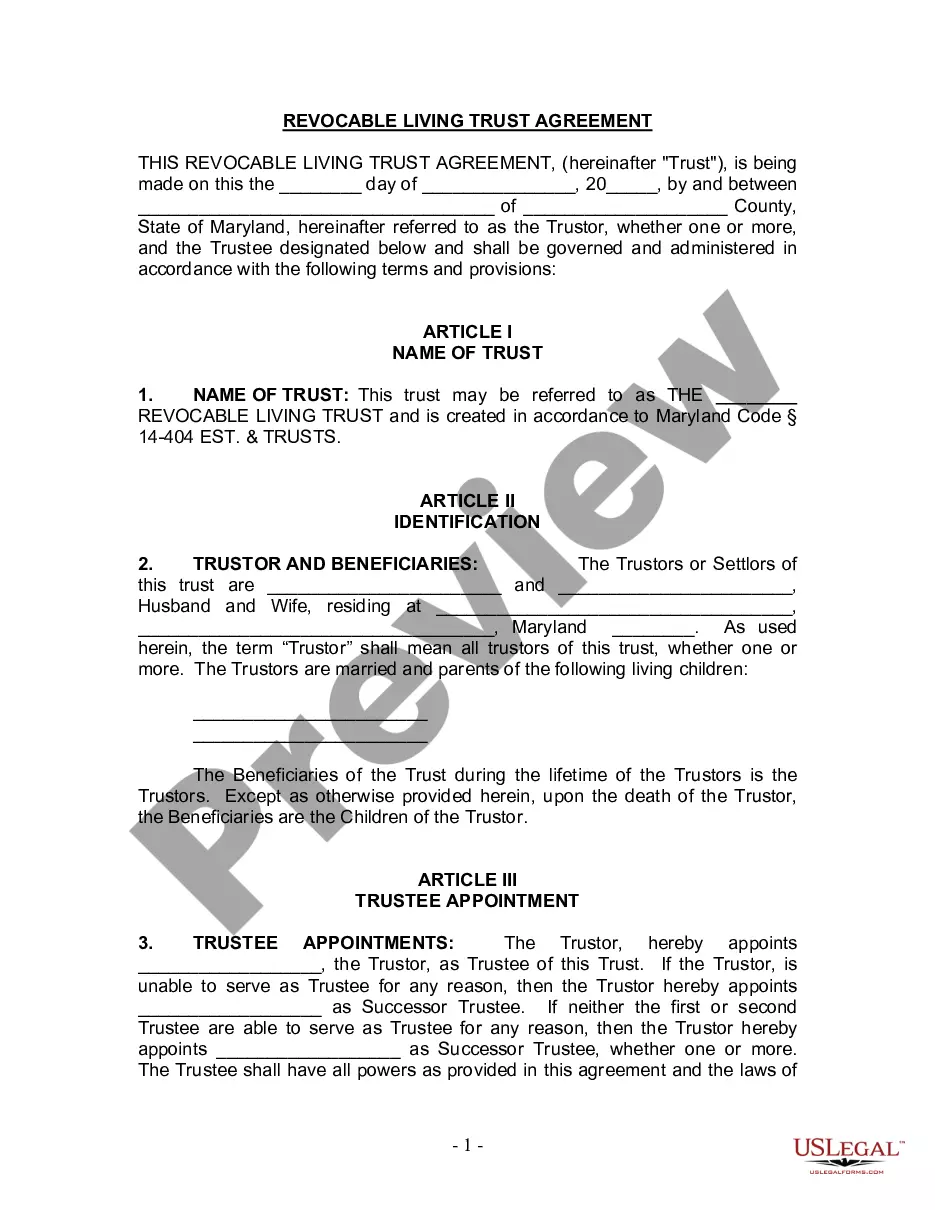

Maryland Living Trust for Husband and Wife with Minor and or Adult Children

Description

How to fill out Maryland Living Trust For Husband And Wife With Minor And Or Adult Children?

Welcome to the most significant legal documents library, US Legal Forms. Here you can get any sample including Maryland Living Trust for Husband and Wife with Minor and or Adult Children templates and save them (as many of them as you wish/need to have). Prepare official documents in just a several hours, instead of days or weeks, without having to spend an arm and a leg with an lawyer. Get the state-specific form in a few clicks and feel confident with the knowledge that it was drafted by our qualified attorneys.

If you’re already a subscribed customer, just log in to your account and then click Download near the Maryland Living Trust for Husband and Wife with Minor and or Adult Children you need. Due to the fact US Legal Forms is online solution, you’ll generally have access to your downloaded files, no matter what device you’re using. Locate them within the My Forms tab.

If you don't come with an account yet, just what are you awaiting? Check out our guidelines below to get started:

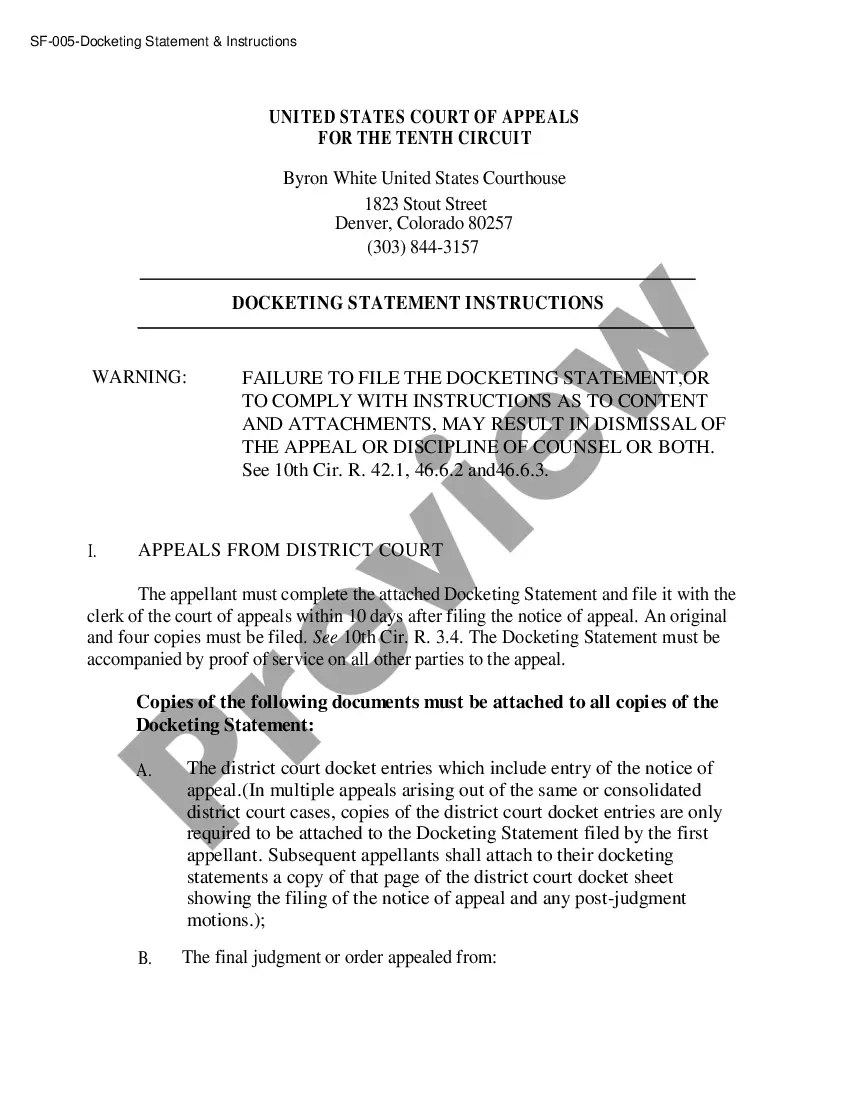

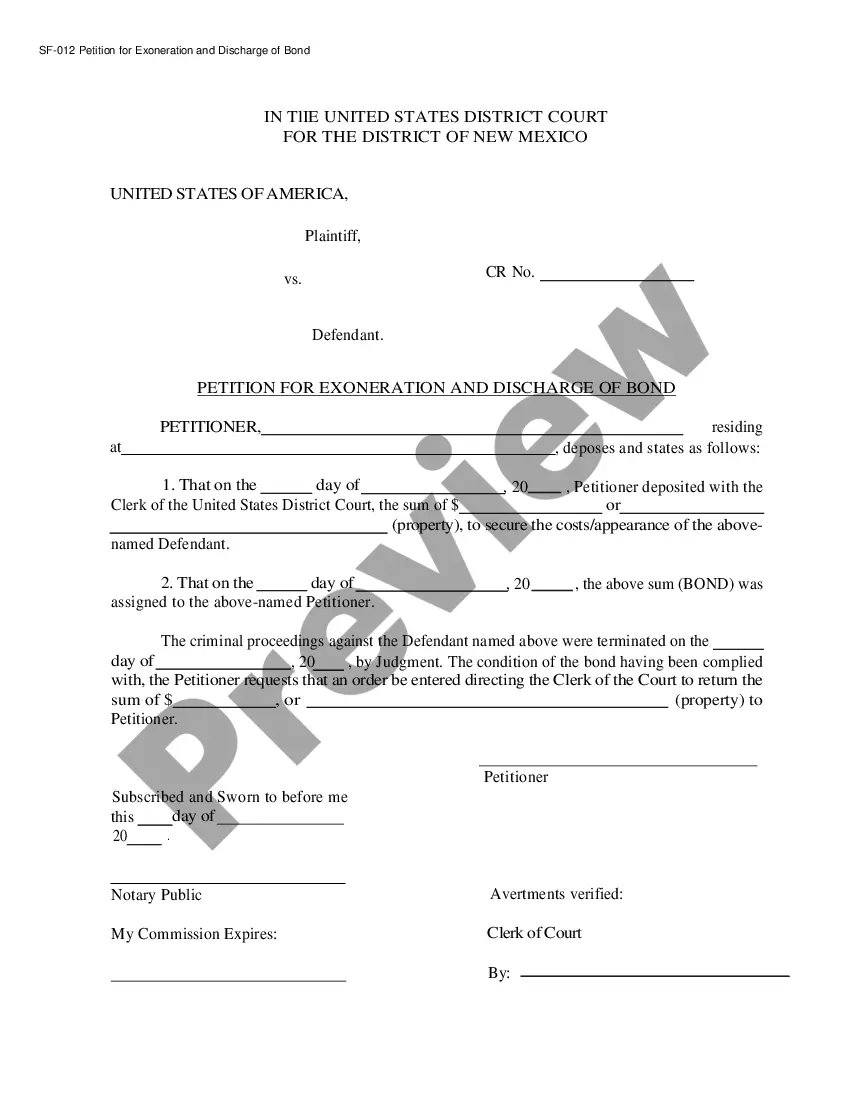

- If this is a state-specific sample, check its validity in the state where you live.

- See the description (if accessible) to learn if it’s the proper template.

- See a lot more content with the Preview function.

- If the document matches all of your requirements, click Buy Now.

- To create an account, select a pricing plan.

- Use a card or PayPal account to join.

- Save the template in the format you need (Word or PDF).

- Print the document and fill it with your/your business’s details.

As soon as you’ve filled out the Maryland Living Trust for Husband and Wife with Minor and or Adult Children, send it to your lawyer for confirmation. It’s an additional step but a necessary one for being certain you’re entirely covered. Sign up for US Legal Forms now and get a mass amount of reusable samples.

Form popularity

FAQ

Using a revocable living trust instead of a will means assets owned by your trust will bypass probate and flow to your heirs as you've outlined in the trust documents. A trust lets investors have control over their assets long after they pass away.

Paperwork. Setting up a living trust isn't difficult or expensive, but it requires some paperwork. Record Keeping. After a revocable living trust is created, little day-to-day record keeping is required. Transfer Taxes. Difficulty Refinancing Trust Property. No Cutoff of Creditors' Claims.

A living trust holds your assets during your lifetime and allows them to be distributed to the people you choose upon your death. To more easily understand how a living trust works, think of a trust as an empty box. You can put your assets into this box, including financial accounts and real estate.

When it comes to protecting your loved ones, having both a will and a trust is essential. The difference between a will and a trust is when they kick into action. A will lays out your wishes for after you die. A living revocable trust becomes effective immediately.