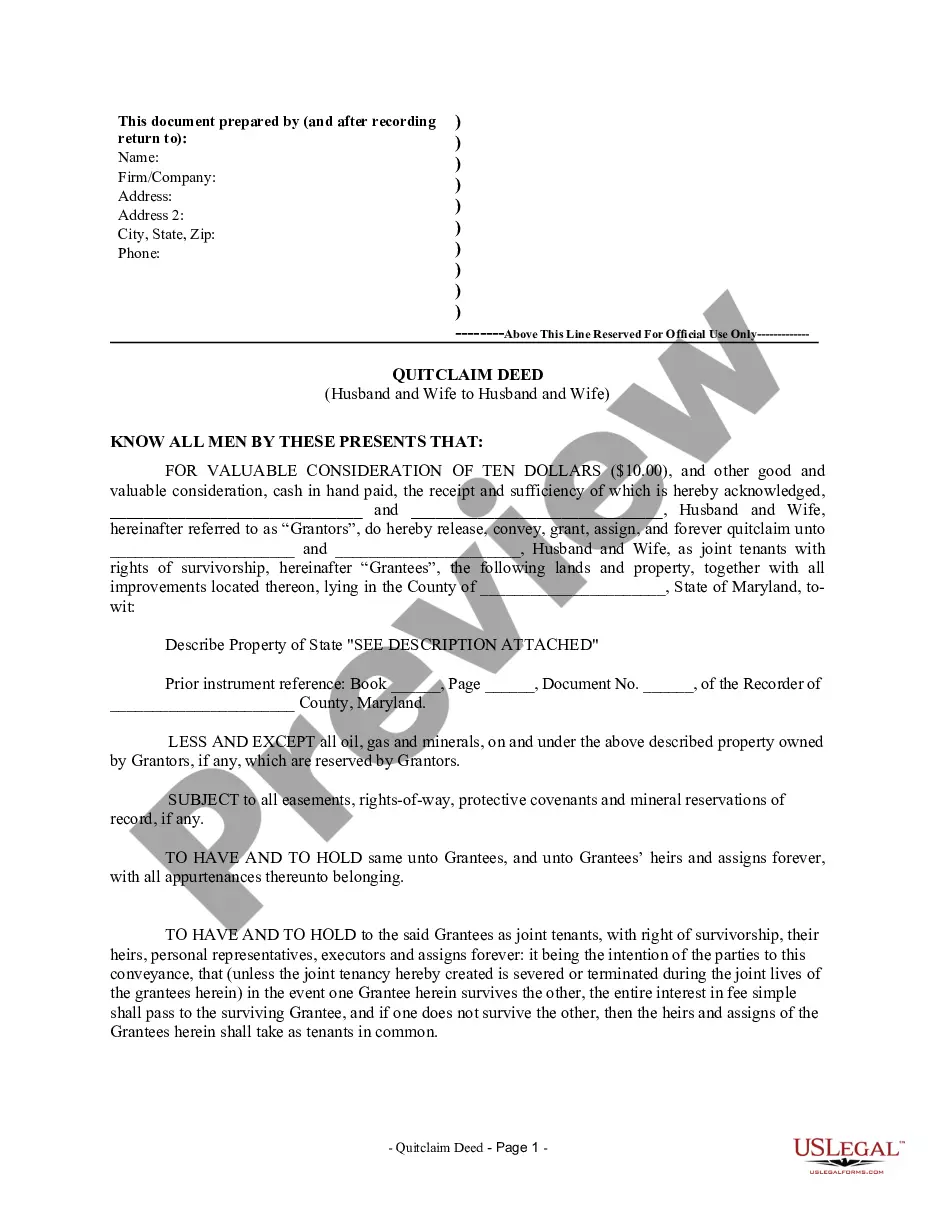

Maryland Quitclaim Deed from Husband and Wife to Husband and Wife

Description

How to fill out Maryland Quitclaim Deed From Husband And Wife To Husband And Wife?

You are welcome to the biggest legal files library, US Legal Forms. Here you can get any example including Maryland Quitclaim Deed from Husband and Wife to Husband and Wife templates and save them (as many of them as you want/need to have). Prepare official papers in just a few hours, rather than days or weeks, without spending an arm and a leg on an lawyer. Get your state-specific example in a couple of clicks and feel confident with the knowledge that it was drafted by our state-certified lawyers.

If you’re already a subscribed consumer, just log in to your account and then click Download near the Maryland Quitclaim Deed from Husband and Wife to Husband and Wife you require. Because US Legal Forms is web-based, you’ll always get access to your saved templates, regardless of the device you’re using. See them inside the My Forms tab.

If you don't come with an account yet, just what are you waiting for? Check our instructions listed below to start:

- If this is a state-specific sample, check out its applicability in your state.

- View the description (if offered) to understand if it’s the right template.

- See more content with the Preview function.

- If the sample matches all of your requirements, just click Buy Now.

- To make an account, pick a pricing plan.

- Use a credit card or PayPal account to sign up.

- Save the document in the format you need (Word or PDF).

- Print out the file and complete it with your/your business’s information.

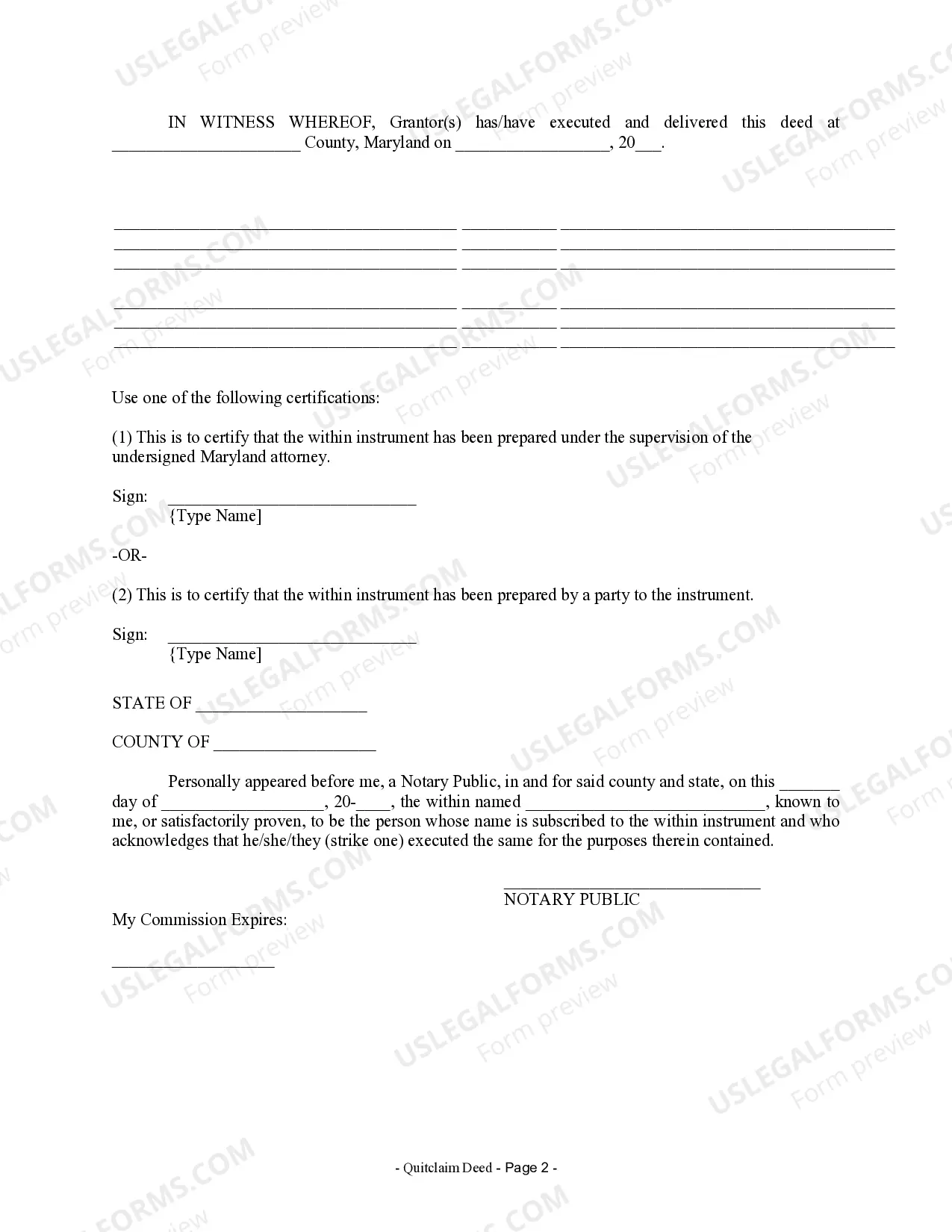

After you’ve filled out the Maryland Quitclaim Deed from Husband and Wife to Husband and Wife, give it to your legal professional for verification. It’s an additional step but an essential one for making confident you’re totally covered. Sign up for US Legal Forms now and get access to a mass amount of reusable examples.

Form popularity

FAQ

But you might be wondering if an owner can transfer a deed to another person without a real estate lawyer. The answer is yes. Parties to a transaction are always free to prepare their own deeds.A quitclaim deed, for example, is far simpler than a warranty deed.

When done properly, a deed is recorded anywhere from two weeks to three months after closing. However, there are many instances where deeds are not properly recorded. Title agents commit errors, lose deeds, and even go out of business. Even county offices sometimes fail to record deeds that were properly submitted.

Today's question is is it possible to deed real estate to someone without them knowing it? Strictly speaking, the answer is no. Because it does not meet the acceptance element of a valid deed transfer. Us lawyers must learn to speak in elements because it governs everything that we do.

It is possible to be named on the title deed of a home without being on the mortgage. However, doing so assumes risks of ownership because the title is not free and clear of liens and possible other encumbrances.If a mortgage exists, it's best to work with the lender to make sure everyone on the title is protected.

If you are adding your spouse or other party to the deed, put your name in the "Transferred From" line and place both your name and the other person's name in the "Transferred To" section. Failure to put your name in the "Transferred To" section will make the new person the sole owner of the house.

Yes you can. This is called a transfer of equity but you will need the permission of your lender. If you are not married or in a civil partnership you may wish to consider creating a deed of trust and a living together agreement which we can explain to you.

Documents: To submit the quitclaim deed to the Clerk of the Circuit Court, you must have a Land Intake Sheet with the deed. Filing: Quitclaim deeds in Maryland are filed with the Clerk of the Circuit Court in the county where the property is located. Each county has its own filing fee.

For a flat fee of $240 - $250 in most cases (plus governmental recording fees) the firm can in most circumstances have an attorney prepared deed ready for signature in 2-4 business days. In most cases a true " Quit Claim Deed" is rarely the best choice.

The drawback, quite simply, is that quitclaim deeds offer the grantee/recipient no protection or guarantees whatsoever about the property or their ownership of it. Maybe the grantor did not own the property at all, or maybe they only had partial ownership.