Massachusetts Assignment of Promissory Note & Liens

Description

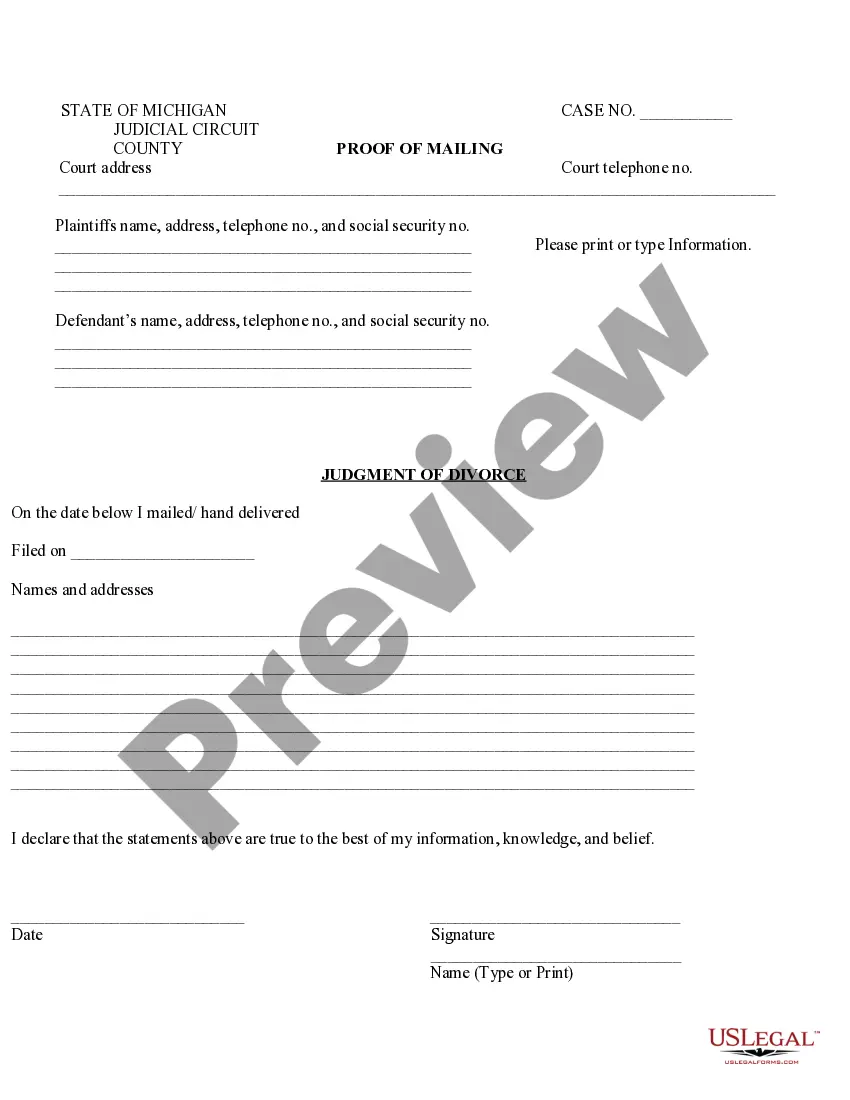

How to fill out Assignment Of Promissory Note & Liens?

Choosing the right authorized record design might be a battle. Needless to say, there are a variety of layouts available online, but how will you find the authorized type you require? Utilize the US Legal Forms web site. The service delivers a large number of layouts, like the Massachusetts Assignment of Promissory Note & Liens, that you can use for enterprise and private demands. Each of the types are checked by experts and meet federal and state needs.

If you are previously registered, log in to your profile and then click the Download key to find the Massachusetts Assignment of Promissory Note & Liens. Make use of your profile to appear throughout the authorized types you have bought formerly. Visit the My Forms tab of your own profile and acquire one more version of your record you require.

If you are a new consumer of US Legal Forms, listed below are simple instructions that you can adhere to:

- First, make sure you have selected the correct type to your town/state. You are able to check out the shape while using Preview key and read the shape explanation to make certain this is basically the best for you.

- When the type will not meet your expectations, utilize the Seach discipline to find the right type.

- When you are certain the shape is proper, click the Purchase now key to find the type.

- Choose the prices plan you desire and enter in the necessary information and facts. Create your profile and buy your order making use of your PayPal profile or credit card.

- Opt for the data file structure and acquire the authorized record design to your system.

- Complete, edit and produce and indication the received Massachusetts Assignment of Promissory Note & Liens.

US Legal Forms is definitely the greatest library of authorized types in which you can see various record layouts. Utilize the company to acquire expertly-produced papers that adhere to condition needs.

Form popularity

FAQ

Promissory notes are generally governed by state law. The most common restrictions cover interest rates and secured loans. Be sure to specify in the agreement which state's law controls the note if the parties are from multiple states.

In order for the note to be negotiable, the Code requires that it must be in writing, be signed by the maker, be an unconditional promise to pay, state a specific sum of money, be payable on demand or at a definite time and be payable to the payee or bearer.

When you are applying for a loan to purchase a home, the lender may require you to sign a promissory note and a mortgage or a deed of trust. In the event that your loan is sold to another party, these documents will be transferred to the new owner with an assignment and an endorsement.

Promissory notes are legally binding contracts that can hold up in court if the terms of borrowing and repayment are signed and follow applicable laws.

Promissory notes may also be referred to as an IOU, a loan agreement, or just a note. It's a legal lending document that says the borrower promises to repay to the lender a certain amount of money in a certain time frame. This kind of document is legally enforceable and creates a legal obligation to repay the loan.

It must include all the mandatory elements such as the legal names of the payee and maker's name, amount being loaned / to be repaid, full terms of the agreement and the full amount of liability, beside other elements. The note must clearly mention only the promise of making the repayment and no other conditions.

A promissory note must include the date of the loan, the loan amount, the names of both the lender and borrower, the interest rate on the loan, and the timeline for repayment. Once the document is signed by both parties, it becomes a legally binding contract.

1) The maker: This is basically the person who makes or executes a promissory note and pays the amount therein. 2) The payee: The person to whom a note is payable is the payee. 3) The holder: A holder is basically the person who holds the notes. He may be either the payee or some other person.