Massachusetts Ratification of Oil, Gas and Mineral Lease by Mineral Owner, Paid-Up Lease

Description

How to fill out Ratification Of Oil, Gas And Mineral Lease By Mineral Owner, Paid-Up Lease?

Have you been in the position the place you require documents for either company or person uses virtually every working day? There are a variety of legitimate document templates available online, but locating versions you can depend on isn`t straightforward. US Legal Forms delivers a huge number of type templates, like the Massachusetts Ratification of Oil, Gas and Mineral Lease by Mineral Owner, Paid-Up Lease, that are composed to fulfill state and federal specifications.

In case you are currently acquainted with US Legal Forms website and possess an account, just log in. Following that, you can obtain the Massachusetts Ratification of Oil, Gas and Mineral Lease by Mineral Owner, Paid-Up Lease design.

Should you not provide an account and would like to begin using US Legal Forms, abide by these steps:

- Discover the type you will need and make sure it is for your appropriate metropolis/state.

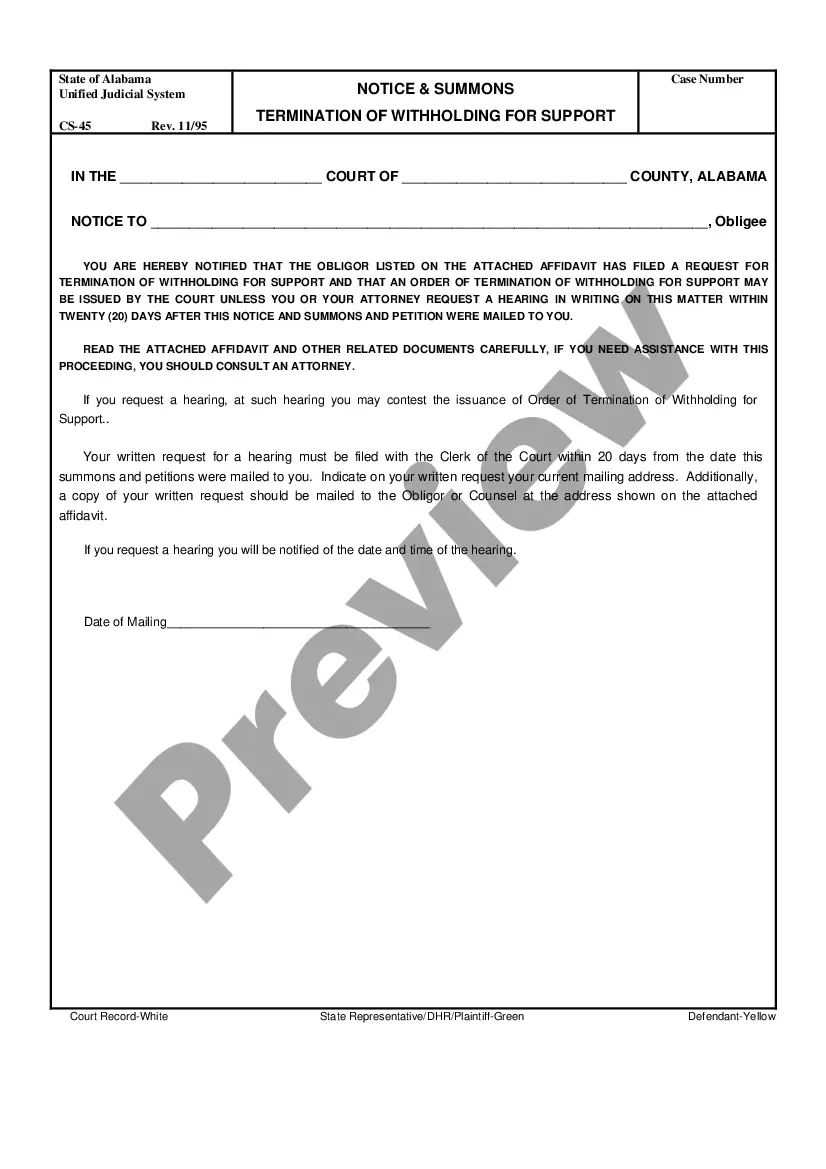

- Make use of the Review switch to review the form.

- See the information to actually have chosen the appropriate type.

- In case the type isn`t what you`re trying to find, use the Look for field to get the type that meets your needs and specifications.

- When you get the appropriate type, click Purchase now.

- Choose the costs prepare you would like, fill out the necessary information and facts to create your account, and pay for an order utilizing your PayPal or Visa or Mastercard.

- Decide on a practical file format and obtain your version.

Get each of the document templates you possess purchased in the My Forms menus. You can get a additional version of Massachusetts Ratification of Oil, Gas and Mineral Lease by Mineral Owner, Paid-Up Lease whenever, if necessary. Just click on the required type to obtain or print the document design.

Use US Legal Forms, the most considerable collection of legitimate forms, in order to save some time and steer clear of errors. The service delivers appropriately created legitimate document templates which you can use for a variety of uses. Make an account on US Legal Forms and start producing your life a little easier.

Form popularity

FAQ

Historically, mineral owners (?lessors?) and landmen/oil companies (?lessees?) spend most of their time focusing and negotiating the bonus payment, primary term and royalty provisions of an oil and gas lease. These provisions are important, but they represent only a small number of the important elements of the lease.

Royalty Payment Clauses A royalty is agreed upon as a percentage of the lease, minus what was reasonably used in the lessee's production costs. This is stipulated in a Royalty Clause. The royalty is paid by the lessee to the owner of the mineral rights, the lessor in the lease.

To ?ratify? a lease means that the landowner and oil & gas producer, as current lessor and lessee of the land, agree (or re-agree) to the terms of the existing lease.

A mineral lease is a contractual agreement between the owner of a mineral estate (known as the lessor), and another party such as an oil and gas company (the lessee). The lease gives an oil or gas company the right to explore for and develop the oil and gas deposits in the area described in the lease.

A full release of a single Texas oil and gas lease. This Standard Document releases all the lessee's interest in and to the lease. It also has helpful drafting notes explaining when releases are necessary and how to record them.

Landowners who sign non-development leases receive revenue with no liability and no disruption to their property. Frequently Asked Questions: If I sign a non-development lease, will there be any drilling or related activity on my property? No. All drilling activities will take place on another property.

A mineral lease is a contract between a mineral owner (the lessor) and a company or working interest owner (the lessee) in which the lessor grants the lessee the right to explore, drill, and produce oil, gas, and other minerals for a specified period of time.

O&G: oil & gas leases, or contracts, between the owner of minerals, typically called a ?lessor,? and a corporation, typically known as the ?lessee,? where the lessor gives the lessee the right to explore, drill, produce, and sometimes even store oil, gas and other minerals for a specified primary term, and as long ...