Massachusetts Term Royalty Deed for Term of Existing Lease

Description

How to fill out Term Royalty Deed For Term Of Existing Lease?

You are able to devote several hours on the Internet looking for the legitimate file format that suits the federal and state demands you require. US Legal Forms provides 1000s of legitimate varieties that happen to be evaluated by pros. You can actually obtain or print out the Massachusetts Term Royalty Deed for Term of Existing Lease from the support.

If you already have a US Legal Forms account, you may log in and click the Down load button. Next, you may total, change, print out, or sign the Massachusetts Term Royalty Deed for Term of Existing Lease. Every single legitimate file format you acquire is the one you have for a long time. To get another copy of the purchased type, visit the My Forms tab and click the corresponding button.

If you are using the US Legal Forms site for the first time, adhere to the straightforward instructions under:

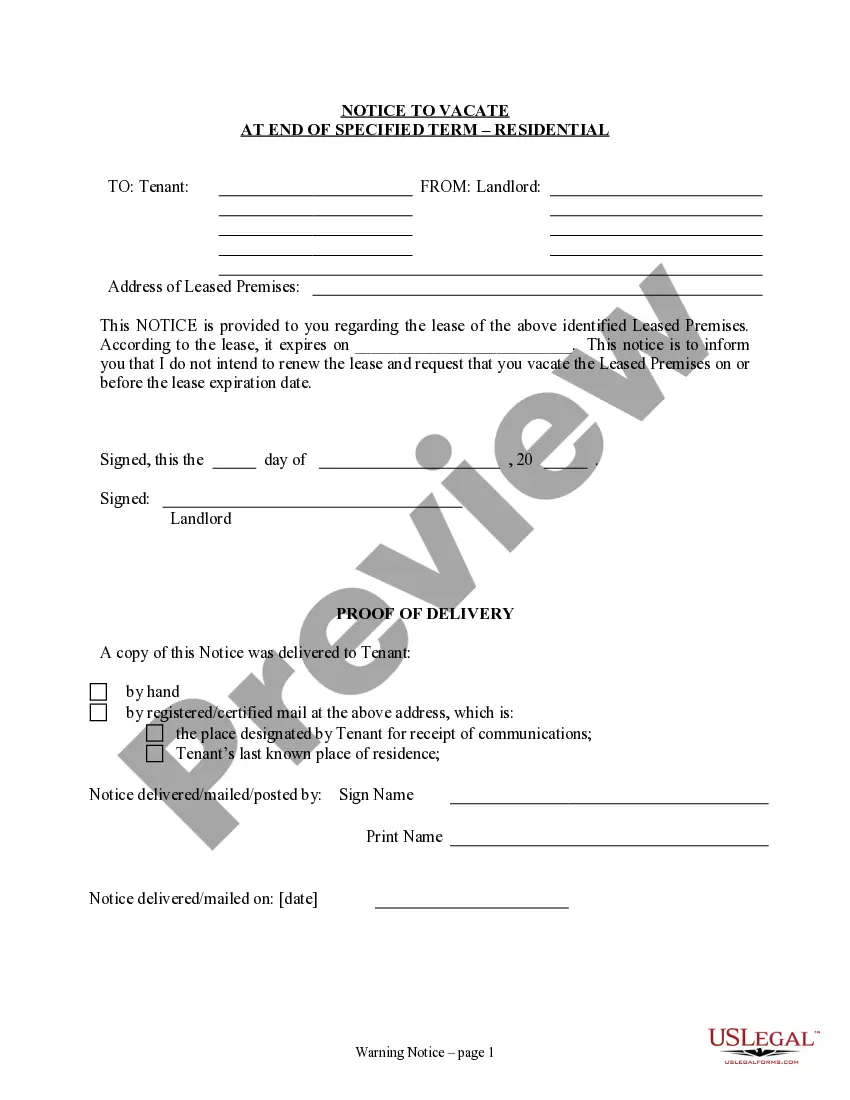

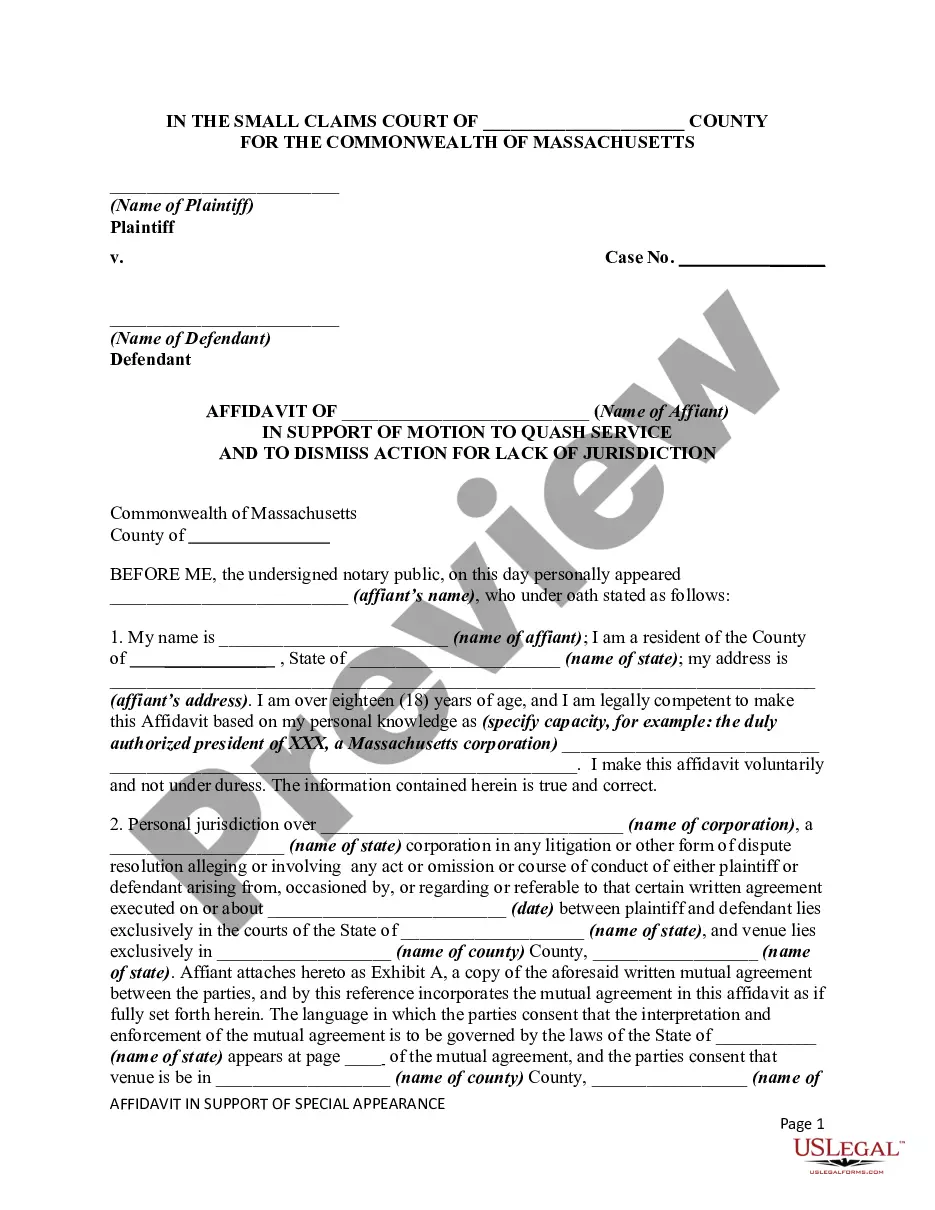

- Initial, ensure that you have chosen the right file format for your state/city of your liking. Browse the type description to make sure you have chosen the right type. If available, take advantage of the Review button to look through the file format too.

- If you want to find another variation in the type, take advantage of the Research area to obtain the format that meets your needs and demands.

- Once you have found the format you desire, click on Purchase now to continue.

- Select the costs plan you desire, key in your accreditations, and register for a free account on US Legal Forms.

- Complete the deal. You can utilize your bank card or PayPal account to cover the legitimate type.

- Select the file format in the file and obtain it to your system.

- Make alterations to your file if possible. You are able to total, change and sign and print out Massachusetts Term Royalty Deed for Term of Existing Lease.

Down load and print out 1000s of file web templates making use of the US Legal Forms web site, that provides the most important collection of legitimate varieties. Use specialist and condition-particular web templates to handle your organization or individual requires.

Form popularity

FAQ

When the mineral interest owner becomes inactive or simply abandons the parcel of land and stops exploring or exploiting oil and gas and other resources ? as well as the oil and gas wells ? present beneath the land for an extended period, the rights may become abandoned. As a result, the mineral rights expire.

Royalty Clause There are two types of royalties, a net and a gross royalty. Normally, the oil and gas lease contains a net royalty. If the lease provides for a net royalty, this means that post-production deductions will be taken from the royalty.

Cost Free Royalty Provision shall refer to a provision in the royalty clause of a lease pursuant to which the lessor does not bear certain post production costs traditionally shared by the lessor, i.e., providing that the lessor's royalty interest shall not bear any charge for the cost of compressing, treating, ...

A royalty interest is a property interest that entitles the owner to receive a share of the production revenue. An individual or company that owns a royalty interest does not have to pay for any of the operational costs required to produce the resource, but they still own a portion of the revenue produced.

What is the difference between working interest and royalty interest? Working interests are oil and gas investments that give owners the right to exploit the resources on a property. Royalty interests are the rights belonging to the landowner who leased out the property to the working interest owner.

A royalty deed gives its holder the right to receive a percentage of the profits from the sale of the minerals, if and when they are actually produced. This kind of legal document does not convey all of the mineral rights to the holder, only the right to receive royalties.

Mineral rights deeds are not the same as royalty deeds. Royalty deeds do not allow for surface access, or for the initiation of the extraction and sale of minerals. A royalty owner will only benefit economically if the mineral owner decides to produce and sell the minerals.

Overriding Royalty Interest: A given interest severed out of the record title interest or lessee's share of the oil, and not charged with any of the cost or expense of developing or operation. The interest provides no control over the operations of the lease, only revenue from lease production.