Massachusetts Gift Deed of Nonparticipating Royalty Interest with No Warranty

Description

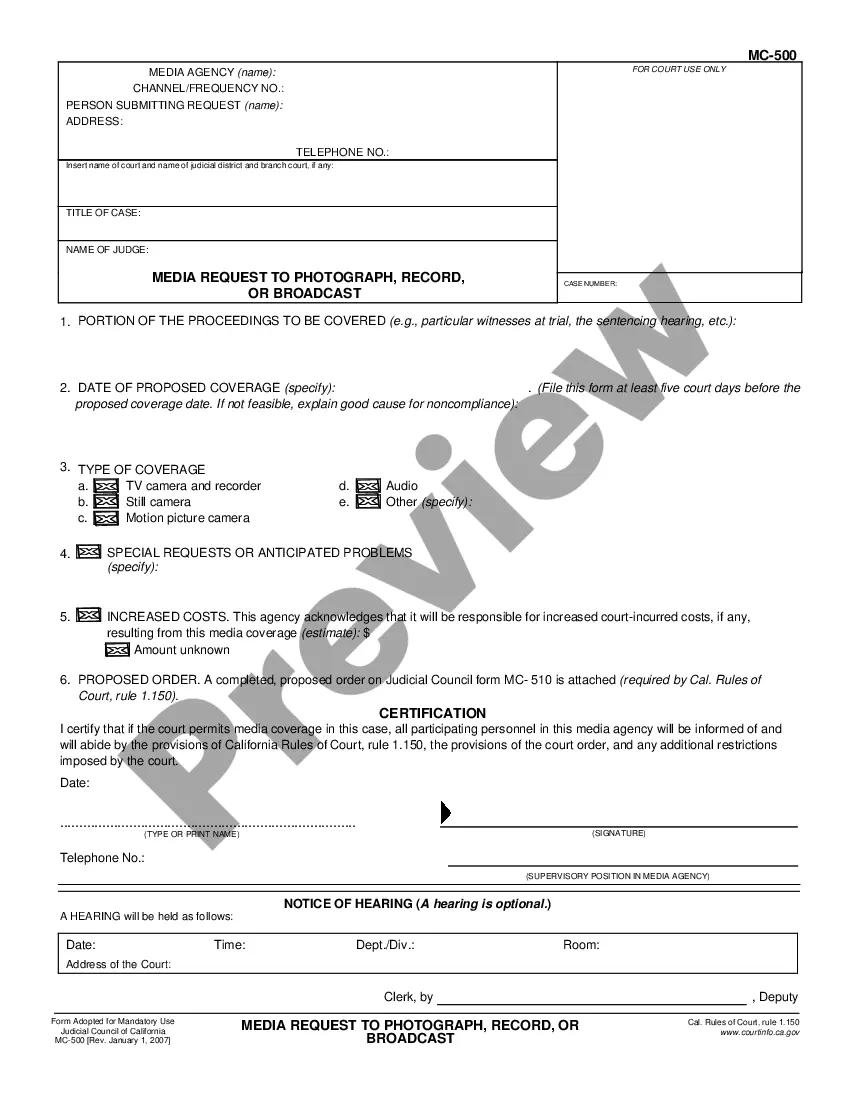

How to fill out Gift Deed Of Nonparticipating Royalty Interest With No Warranty?

US Legal Forms - one of the most significant libraries of legal varieties in the USA - provides a wide array of legal papers web templates you may download or printing. Using the website, you will get 1000s of varieties for organization and specific reasons, sorted by classes, says, or keywords and phrases.You can get the newest types of varieties just like the Massachusetts Gift Deed of Nonparticipating Royalty Interest with No Warranty in seconds.

If you already possess a subscription, log in and download Massachusetts Gift Deed of Nonparticipating Royalty Interest with No Warranty from the US Legal Forms local library. The Down load key can look on each and every type you view. You have accessibility to all earlier downloaded varieties from the My Forms tab of the account.

If you want to use US Legal Forms for the first time, listed below are simple guidelines to get you started out:

- Ensure you have picked the best type for the area/region. Go through the Preview key to examine the form`s content. Browse the type description to actually have chosen the appropriate type.

- In case the type doesn`t match your needs, use the Search area on top of the display screen to discover the one who does.

- When you are pleased with the form, verify your choice by visiting the Acquire now key. Then, pick the pricing prepare you want and offer your qualifications to sign up for an account.

- Approach the purchase. Utilize your Visa or Mastercard or PayPal account to complete the purchase.

- Pick the formatting and download the form on your device.

- Make modifications. Fill out, modify and printing and signal the downloaded Massachusetts Gift Deed of Nonparticipating Royalty Interest with No Warranty.

Each and every template you included in your money does not have an expiry day which is your own property permanently. So, if you wish to download or printing an additional copy, just go to the My Forms area and then click in the type you require.

Get access to the Massachusetts Gift Deed of Nonparticipating Royalty Interest with No Warranty with US Legal Forms, by far the most considerable local library of legal papers web templates. Use 1000s of skilled and condition-distinct web templates that meet your company or specific demands and needs.

Form popularity

FAQ

A percentage of ownership in an oil and gas lease granting its owner the right to explore, drill and produce oil and gas from a tract of property. Working interest owners are obligated to pay a corresponding percentage of the cost of leasing, drilling, producing and operating a well or unit.

Net Revenue Interest is the portion of an oil and gas leaseholder's interest in production that they are entitled to receive as part of their lease. The amount is calculated after deducting all royalty payments, production costs, and other fees.

An assignment of oil and gas lease is a contractual agreement between a landowner and an oil or gas company in which the company gains the right to explore for, develop, and produce oil and gas from the property.

The definition of assignment in real estate is the sale, transfer, or conveyance of a whole property ownership/rights or part of it to another party. The term in the oil and gas industry is used for sale, transfer, or conveyance of working interest, lease, royalty, overriding royalty interest, or net profit interest.

Oil and gas interests are interests in real property and thereby have the same attributes as other real property such as a home or a ranch. Although the ownership of oil and gas interests can take many forms, courts commonly analogize the ownership of oil and gas interests to a bundle of sticks.

A percentage of ownership in an oil and gas lease granting its owner the right to explore, drill and produce oil and gas from a tract of property. Working interest owners are obligated to pay a corresponding percentage of the cost of leasing, drilling, producing and operating a well or unit.

8/8ths / 8/8ths Basis: a term used to describe either the full Working Interest or full Net Revenue Interest with respect to a given Tract. Pursuant to an Oil and Gas Lease, the Lessor retains the Lessor Royalty.