Massachusetts Qualified Written RESPA Request to Dispute or Validate Debt

Description

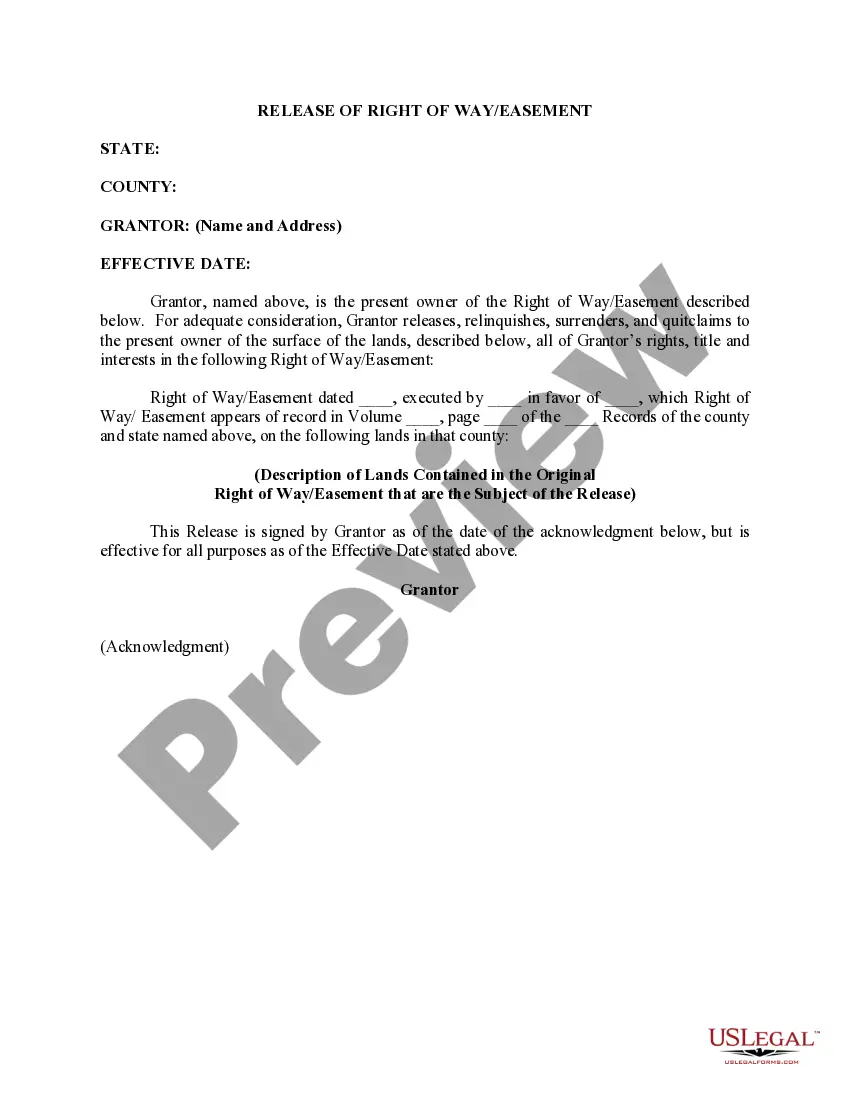

How to fill out Qualified Written RESPA Request To Dispute Or Validate Debt?

If you require to download, obtain, or print valid document templates, utilize US Legal Forms, the leading collection of authentic forms, which are accessible online.

Employ the site's straightforward and user-friendly search feature to find the documents you need.

Numerous templates for business and personal purposes are categorized by types and states, or keywords.

Step 4. Once you have found the form you need, click the Purchase now button. Choose the payment plan you prefer and enter your credentials to create an account.

Step 5. Complete the transaction. You may use your credit card or PayPal account to process the payment.

- Use US Legal Forms to locate the Massachusetts Qualified Written RESPA Request to Dispute or Validate Debt in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to obtain the Massachusetts Qualified Written RESPA Request to Dispute or Validate Debt.

- You may also access forms you have previously acquired in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions given below.

- Step 1. Ensure you have selected the form relevant to your state/region.

- Step 2. Use the Preview option to review the form's content. Don't forget to read the description.

- Step 3. If you are unsatisfied with the form, utilize the Search field at the top of the screen to find other variations of the legal form format.

Form popularity

FAQ

To write a dispute letter to a mortgage company, start by gathering all relevant details about your mortgage account. Include your account number, a clear statement of your dispute, and any supporting documentation. Then, express your concerns clearly and request a resolution, referencing the Massachusetts Qualified Written RESPA Request to Dispute or Validate Debt to ensure your rights are upheld.

A debt collector must provide a written validation notice within five days of first contacting you about the debt. This notice should detail the amount owed, the name of the creditor, and inform you of your rights to dispute the debt. Utilizing a Massachusetts Qualified Written RESPA Request to Dispute or Validate Debt can enhance your understanding of these rights and ensure you receive the necessary documentation. If you have further questions, platforms like US Legal Forms can guide you through the process effectively.

A certified letter to validate debt serves as a formal request for a debt collector to confirm the legitimacy of a debt. This letter typically includes crucial information about the debtor's rights under the Fair Debt Collection Practices Act. By using a Massachusetts Qualified Written RESPA Request to Dispute or Validate Debt, you can ensure your request is documented and acknowledged by the collector. This process helps facilitate communication and can clarify any disputes regarding the debt in question.

Yes, you can dispute a valid debt; however, it is essential to have valid reasons for your dispute. You may contest the legitimacy of the amount owed or the validity of the debtor. To effectively communicate your disputes, create a Massachusetts Qualified Written RESPA Request to Dispute or Validate Debt. Use platforms like uslegalforms to draft a well-structured letter.

A debt validation letter qualifies when it contains specific information about the debt, including the amount owed and the name of the original creditor. Additionally, it must indicate that it acts as a formal request under the Massachusetts Qualified Written RESPA Request to Dispute or Validate Debt. This request ensures that you receive verification of the debt's legitimacy.

To file a debt validation claim, first gather all relevant documents related to the debt. Next, draft a letter that requests validation and reference it as your Massachusetts Qualified Written RESPA Request to Dispute or Validate Debt. Send this letter to the debt collector and keep copies for your files. If necessary, follow up to ensure your request is addressed.

Responding to a debt validation letter requires careful attention to the details. Acknowledge the receipt of their letter and state whether you dispute the debt or believe it is valid. If you dispute it, mention that your response serves as a Massachusetts Qualified Written RESPA Request to Dispute or Validate Debt. Keeping a copy of your response for your records is also advisable.

When writing a letter to dispute the validity of a debt, focus on clarity and detail. Begin by indicating that you are disputing the debt and include a request for proof. Highlight that this letter acts as a Massachusetts Qualified Written RESPA Request to Dispute or Validate Debt. Ensure you send it via a method that offers proof of receipt, such as certified mail.

The best sample for a debt validation letter includes specific components like your identifying information, the debt collector's information, and a request for verification of the debt. Use clear language to state that this letter serves as your Massachusetts Qualified Written RESPA Request to Dispute or Validate Debt. You can find templates on platforms like uslegalforms, which can help ensure all necessary elements are included.

To write a letter disputing a debt, start by clearly stating your request for validation. Include your personal information, the debt collector's details, and the account number. Specify that you are submitting this as a Massachusetts Qualified Written RESPA Request to Dispute or Validate Debt. Conclude with your signature and date to authenticate the letter.