Massachusetts Amendment to Merger

Description

How to fill out Amendment To Merger?

Are you presently in a placement where you will need paperwork for both business or personal reasons just about every day? There are a variety of authorized document layouts available online, but locating versions you can rely on is not simple. US Legal Forms provides 1000s of develop layouts, much like the Massachusetts Amendment to Merger, which are composed to fulfill state and federal requirements.

In case you are presently informed about US Legal Forms internet site and possess a free account, basically log in. After that, you may acquire the Massachusetts Amendment to Merger web template.

Unless you offer an profile and want to begin to use US Legal Forms, adopt these measures:

- Obtain the develop you want and ensure it is for the proper city/region.

- Take advantage of the Review option to review the shape.

- Read the explanation to ensure that you have chosen the proper develop.

- When the develop is not what you`re seeking, make use of the Search field to discover the develop that meets your requirements and requirements.

- When you discover the proper develop, click Buy now.

- Choose the rates plan you need, complete the desired information and facts to produce your account, and pay for an order making use of your PayPal or credit card.

- Choose a practical file file format and acquire your version.

Discover all of the document layouts you may have bought in the My Forms food selection. You may get a additional version of Massachusetts Amendment to Merger any time, if needed. Just click the needed develop to acquire or printing the document web template.

Use US Legal Forms, one of the most comprehensive assortment of authorized types, to save lots of time as well as steer clear of blunders. The assistance provides appropriately created authorized document layouts which you can use for a selection of reasons. Generate a free account on US Legal Forms and start making your daily life a little easier.

Form popularity

FAQ

You can file an amendment to update the state's records. You can also change the address when you file your company's annual report. To make sure your corporation receives all legal documents, you have to keep the state updated about the operating address and registered office.

Most Massachusetts Annual Reports can be filed online or with paper forms. To file online, log in to the Corporations Division's online filing portal. To file a paper form, you'll need to download and print one from the file by mail or walk-in section of the Corporation Division's website.

Corporations must complete a Form 966, Corporate Dissolution or Liquidation, and file it with the final corporate return. Partnerships must file the final Form 1065 and Schedule K-1s. Sole proprietors stop filing the Schedule C with the individual income tax return.

Corporations Division Filing Fees Domestic Profit and Professional CorporationsArticles of CorrectionNo FeeArticles of Dissolution$100.00Annual Report$125.00; $150 if not filed timely ($100 if filed electronically)Articles of Consolidation / Merger / Conversion / Share Exchange$250.00 min.138 more rows

To obtain such a certificate, voluntarily dissolving corporations must complete the following steps: Give Notice of its Authorization of Dissolution to the Commissioner; Pay all taxes that have been assessed or deemed assessed against it; and, Provide for any unassessed corporate excise liabilities.

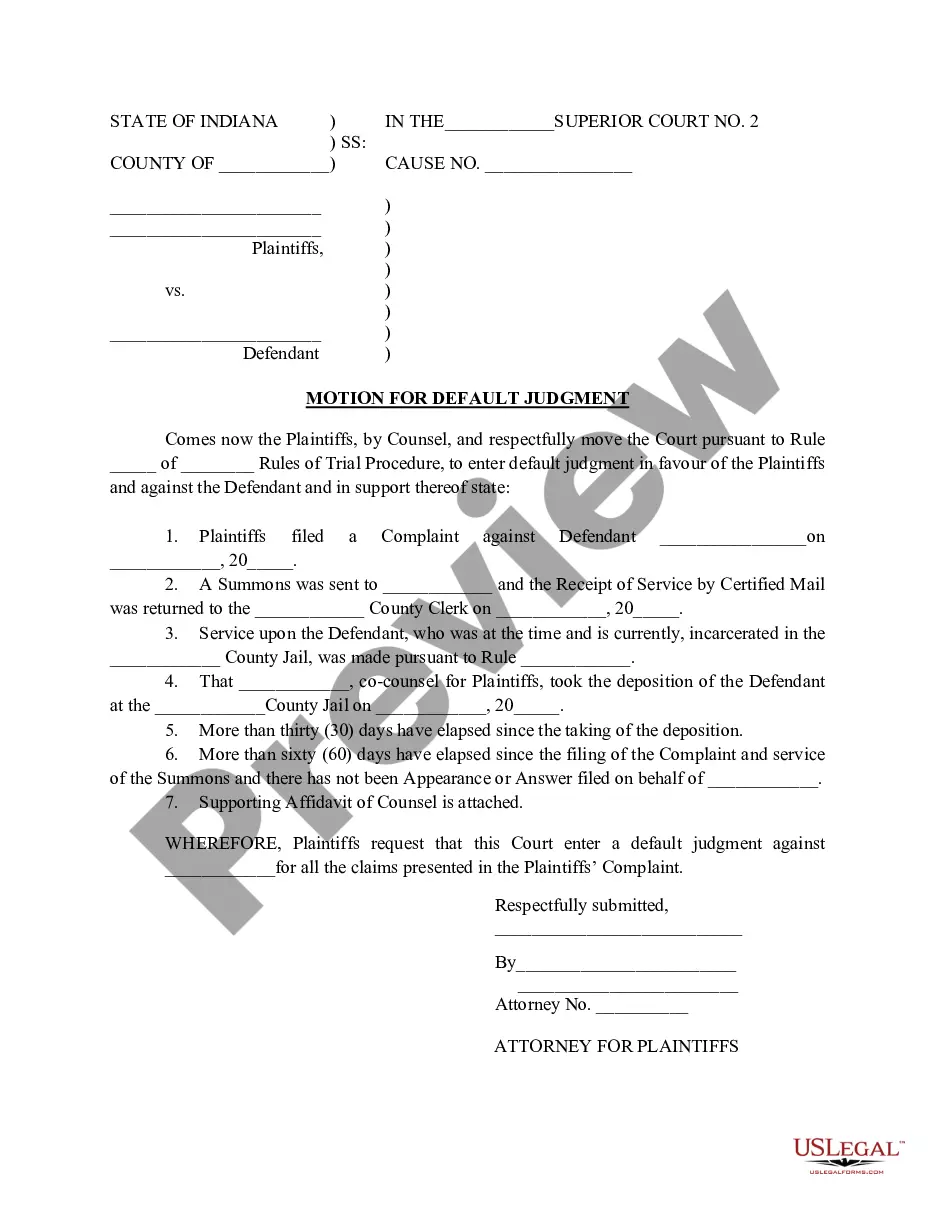

If you need to make changes to your Massachusetts articles of organization, file Articles of Amendment with the Massachusetts Secretary of the Commonwealth, Corporations Division (SOC). Amendment forms are available in your online account or on the SOC website. However, use of Massachusetts SOC forms is not mandatory.

To dissolve a corporation, California's default rules call for written consent by shareholders holding at least 50% of the voting power?the same minimum requirement if there was a vote at a meeting. However, the corporation's articles can require a higher voting percentage.

The first is voluntary dissolution, which is an elective decision to dissolve the entity. A second is involuntary dissolution, which occurs upon the happening of statute-specific events such as a failure to pay taxes. Last, a corporation may be dissolved judicially, either by shareholder or creditor lawsuit.