Massachusetts Proposal to approve adoption of stock purchase assistance plan

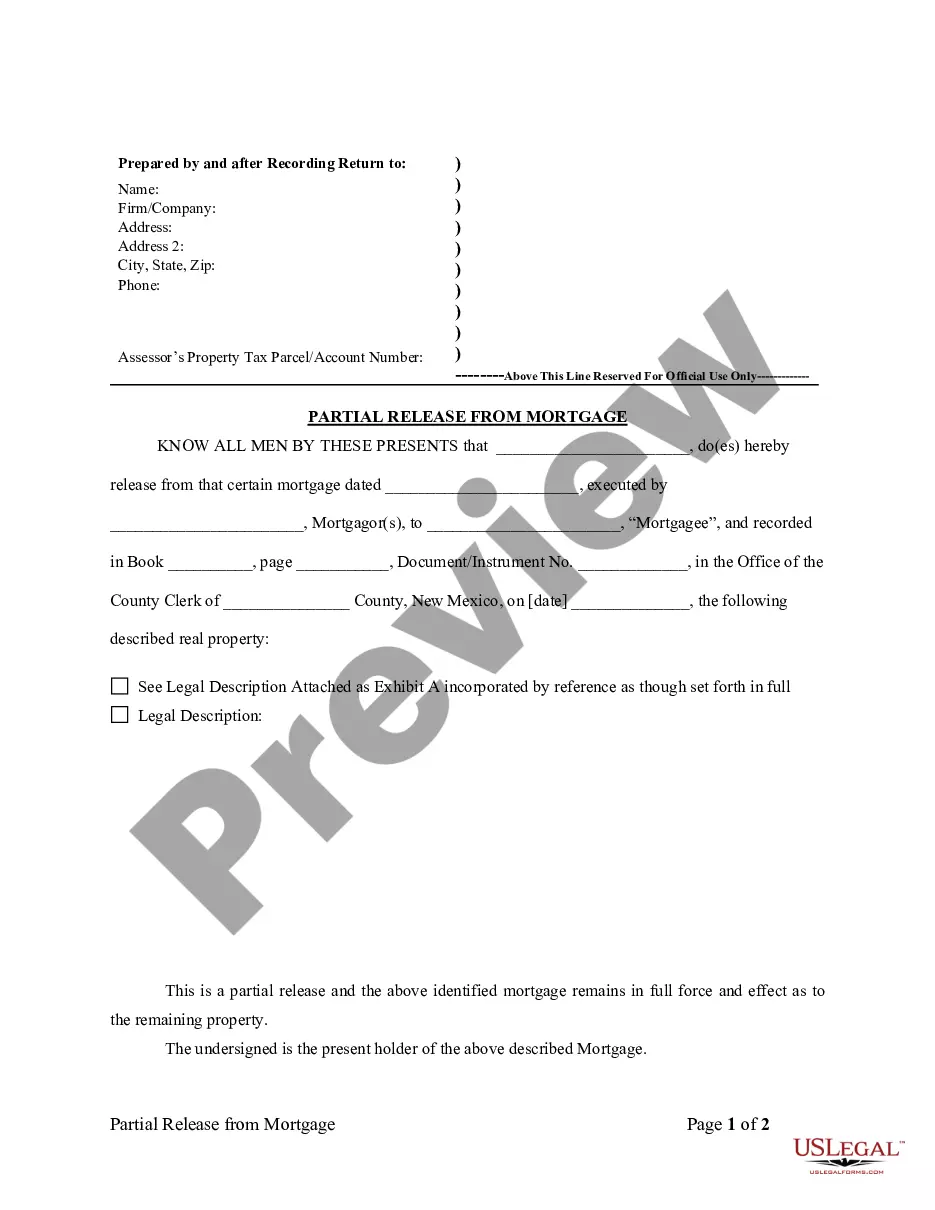

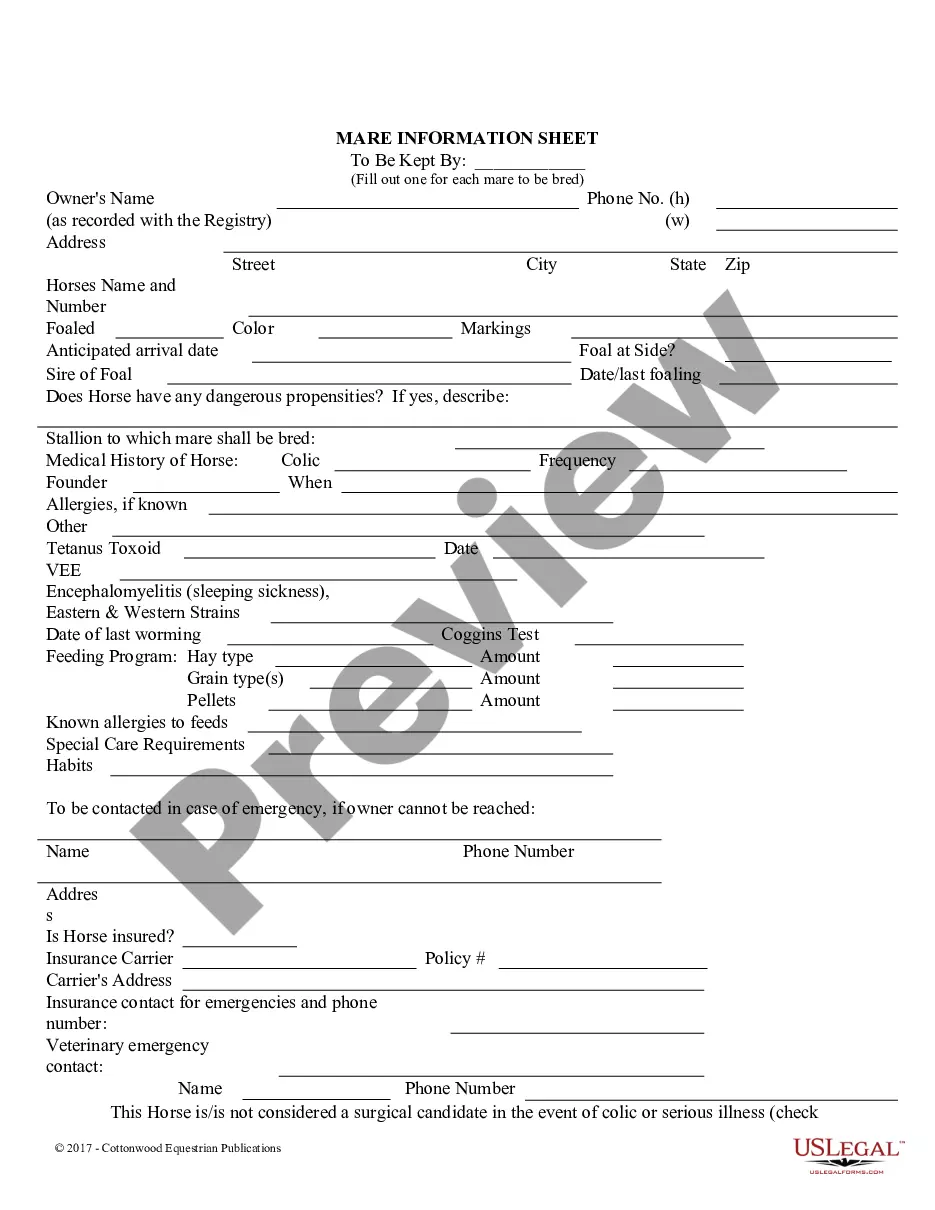

Description

How to fill out Proposal To Approve Adoption Of Stock Purchase Assistance Plan?

Finding the right authorized document web template can be quite a have difficulties. Naturally, there are a variety of web templates accessible on the Internet, but how can you obtain the authorized kind you require? Utilize the US Legal Forms site. The services delivers thousands of web templates, including the Massachusetts Proposal to approve adoption of stock purchase assistance plan, which you can use for company and private requires. Every one of the forms are inspected by specialists and meet state and federal demands.

Should you be currently listed, log in in your profile and click on the Acquire key to obtain the Massachusetts Proposal to approve adoption of stock purchase assistance plan. Make use of your profile to look through the authorized forms you possess acquired earlier. Proceed to the My Forms tab of your own profile and have another version of the document you require.

Should you be a fresh consumer of US Legal Forms, listed here are basic directions that you can stick to:

- First, ensure you have selected the appropriate kind to your metropolis/area. It is possible to examine the shape while using Review key and study the shape description to make certain this is basically the right one for you.

- When the kind does not meet your expectations, utilize the Seach discipline to obtain the right kind.

- When you are positive that the shape is proper, click the Get now key to obtain the kind.

- Choose the costs plan you want and enter in the required info. Make your profile and purchase an order using your PayPal profile or bank card.

- Choose the submit file format and download the authorized document web template in your device.

- Full, edit and printing and indicator the obtained Massachusetts Proposal to approve adoption of stock purchase assistance plan.

US Legal Forms is definitely the biggest library of authorized forms where you will find different document web templates. Utilize the company to download expertly-produced papers that stick to express demands.