Massachusetts Guaranty with Pledged Collateral

Description

How to fill out Guaranty With Pledged Collateral?

Are you presently in a circumstance where you need documents for either professional or personal purposes almost every day.

There are numerous legal document templates accessible online, but locating trustworthy versions can be challenging.

US Legal Forms offers thousands of form templates, like the Massachusetts Guaranty with Pledged Collateral, that are designed to comply with state and federal regulations.

Once you obtain the correct form, click Buy now.

Select the pricing plan you desire, fill out the necessary information to create your account, and pay for the order using your PayPal or credit card.

- If you are already acquainted with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Massachusetts Guaranty with Pledged Collateral template.

- If you do not possess an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct state/region.

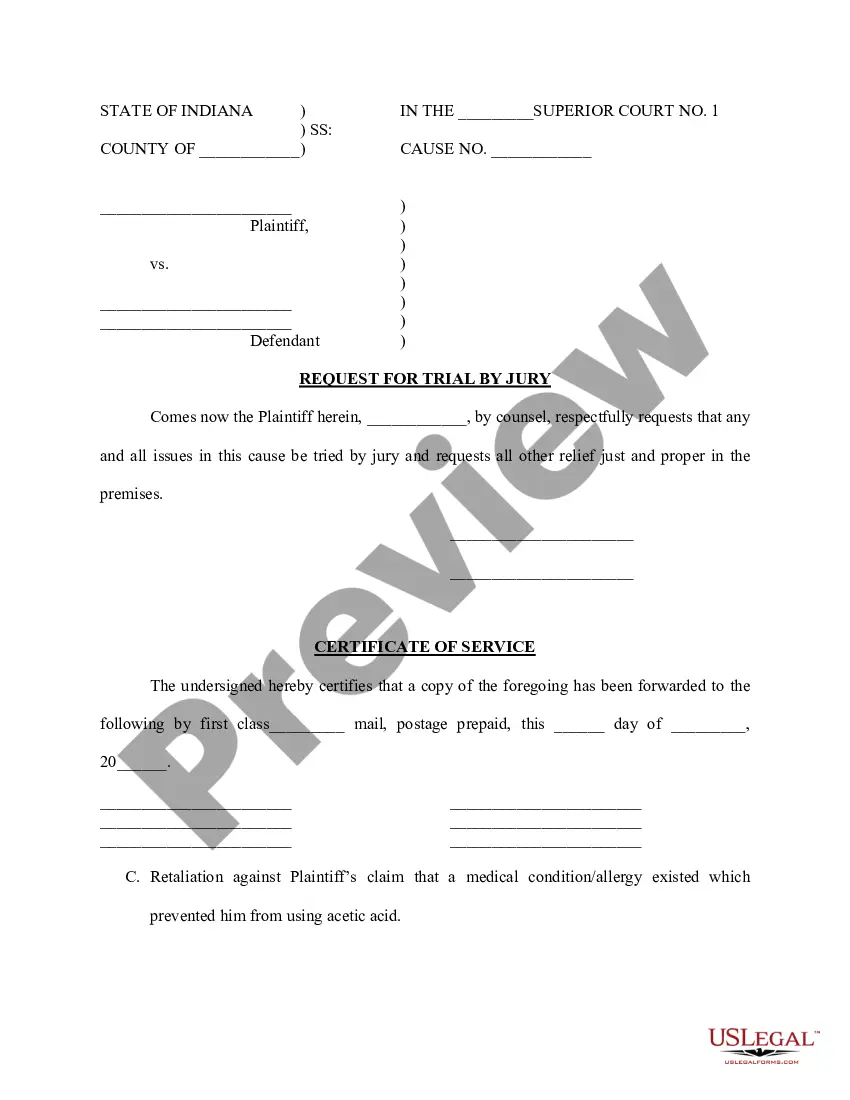

- Utilize the Preview button to examine the form.

- Review the summary to confirm that you have selected the right form.

- If the form is not what you are looking for, use the Search field to find the form that meets your requirements.

Form popularity

FAQ

Related Definitions Pledge Guaranty means that Guaranty of the Debt, dated as of the date hereof, by Pledgor in Lender's favor, as it may be amended, restated, replaced, supplemented or otherwise modified from time to time, and which is secured by the Pledge Agreement.

Pledged loans allow you to borrow against your savings or certificates of deposit (CD) without a credit check. So, even if you have little or no credit or your score needs improvement, you're more likely to be approved. And, making all your payments on time can boost your credit score.

Pledgors means the Company, the Guarantors and any other Person (if any) that provides collateral security for any Secured Debt Obligations.

Guarantor Pledgors means the initial Guarantor Pledgors and any other Guarantor that pledges Collateral to secure the obligations of the Company under the Notes and this Indenture and of such Guarantor under its Guarantee; provided that Guarantor Pledgor does not include any person whose pledge under the Security

To pledge assets as collateral (or Pledging) is the act of offering assets as collateral to secure loans. Assets pledged can be in the form of security holdings and act as assurance for recovering the borrowed amount should a borrower fail to pay up.

Pledge is an agreement made between pledger and pledgee. Most significantly, the property must be handed over as a financial guarantee for paying the debt. Those properties which are capable of being pledged are called 'Chattel' (movable property), such as gold, watch, car, etc.

Pledge is an agreement made between pledger and pledgee. Most significantly, the property must be handed over as a financial guarantee for paying the debt. Those properties which are capable of being pledged are called 'Chattel' (movable property), such as gold, watch, car, etc.

A pledge agreement is just another name for a security agreement which creates a security interest in equity interests and promissory notes. The term "pledge" predates the UCC, when a pledge involved the creation of a security interest by physical possession of the property.

A pledged asset is a valuable possession that is transferred to a lender to secure a debt or loan. A pledged asset is collateral held by a lender in return for lending funds. Pledged assets can reduce the down payment that is typically required for a loan as well as reduces the interest rate charged.

In the commercial lending context, a guaranty is an agreement made by a third party -- often the principal or principals of the commercial borrower -- to satisfy the payment obligations of the borrower upon an event of default (i.e., payment delinquency by the primary obligor/borrower).5 The guaranty is ordinarily