Massachusetts Contract with Independent Contractor to Work as a Consultant

Description

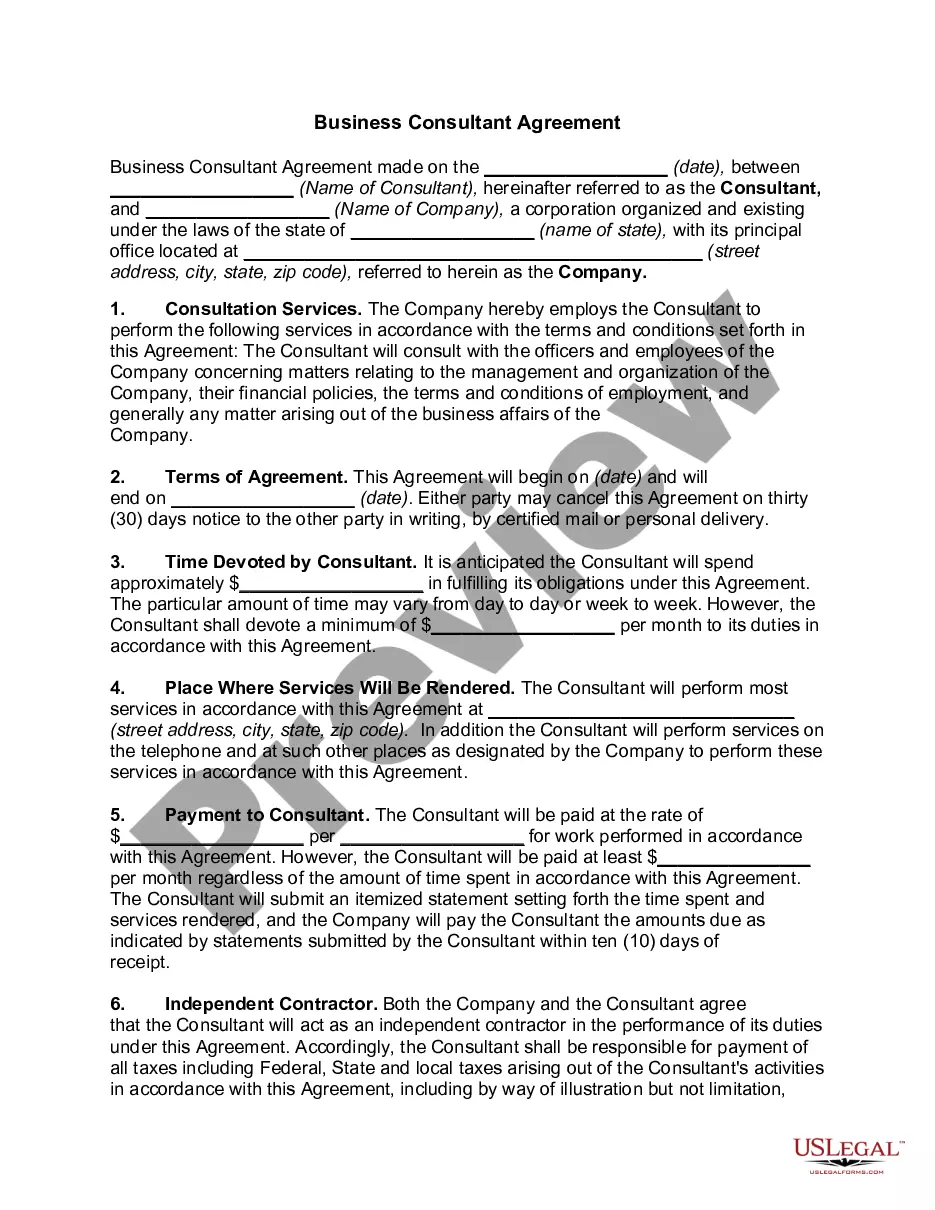

How to fill out Contract With Independent Contractor To Work As A Consultant?

Are you currently in a situation where you require documents for either business or personal reasons almost every day.

There are numerous legitimate document templates available online, but locating reliable ones can be challenging.

US Legal Forms provides thousands of form templates, such as the Massachusetts Contract with Independent Contractor to Provide Consulting Services, designed to meet state and federal standards.

You can obtain an additional copy of the Massachusetts Contract with Independent Contractor to Provide Consulting Services at any time, if needed. Click on the desired form to download or print the document template.

Utilize US Legal Forms, the most extensive collection of legitimate templates, to save time and avoid mistakes. The service offers professionally crafted legal document templates for various purposes. Create your account on US Legal Forms and start making your life a little easier.

- If you are already familiar with the US Legal Forms website and possess an account, just Log In.

- After that, you may download the Massachusetts Contract with Independent Contractor to Provide Consulting Services template.

- If you do not have an account and wish to use US Legal Forms, follow these steps.

- Select the form you need and ensure it is for the correct city/region.

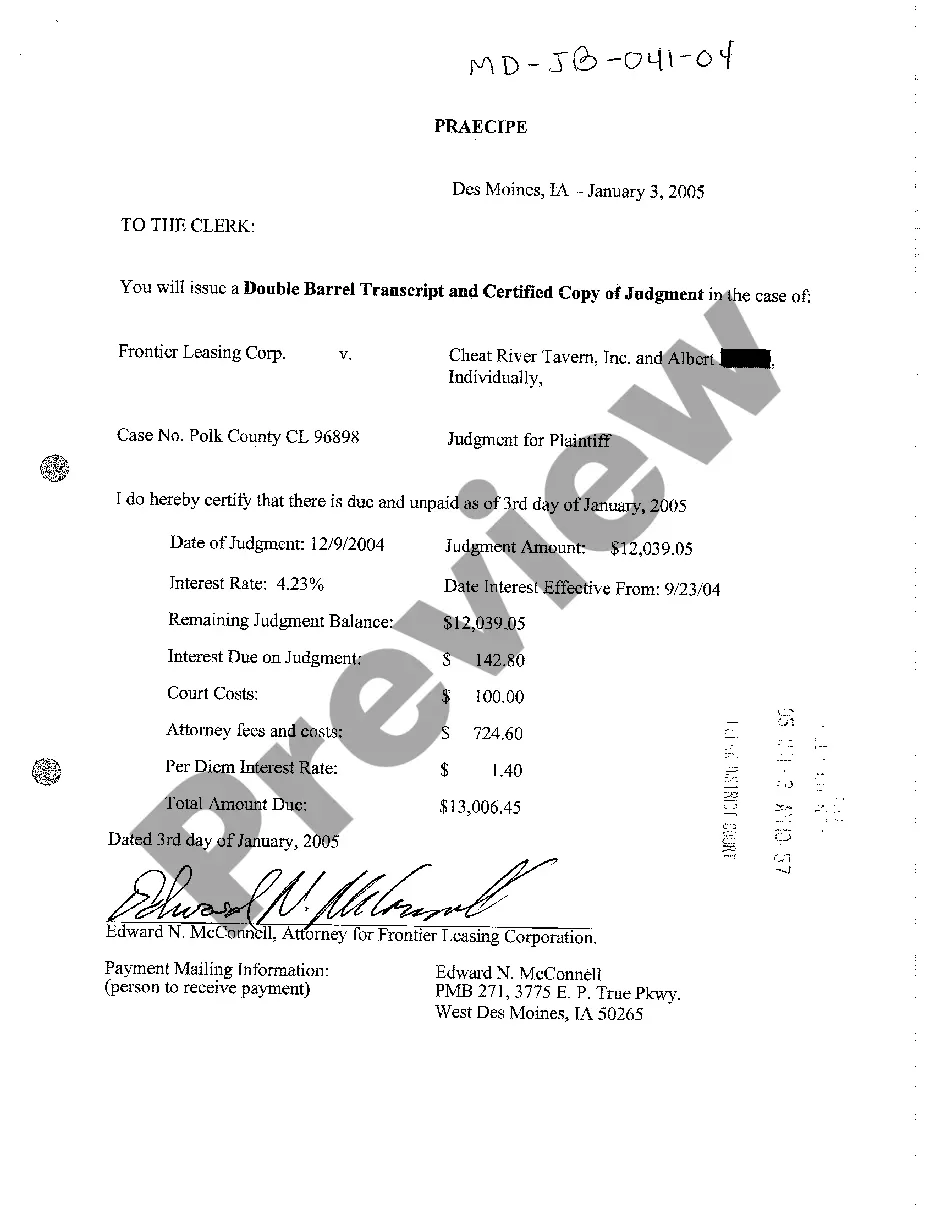

- Use the Review button to check the form.

- Read the description to confirm you have chosen the correct form.

- If the form is not what you are looking for, use the Search box to find the form that meets your needs and specifications.

- Once you find the right form, click on Purchase now.

- Choose the pricing plan you prefer, complete the necessary information to create your account, and pay for the transaction using your PayPal or credit card.

- Select a convenient file format and download your copy.

- Access all the document templates you have purchased in the My documents section.

Form popularity

FAQ

Pay self-employment taxAs an independent consultant you are considered self-employed, so if you earn more than $400 for the year, the IRS expects you to pay your own tax. The self-employment tax rate is 15.3% of your net earnings.

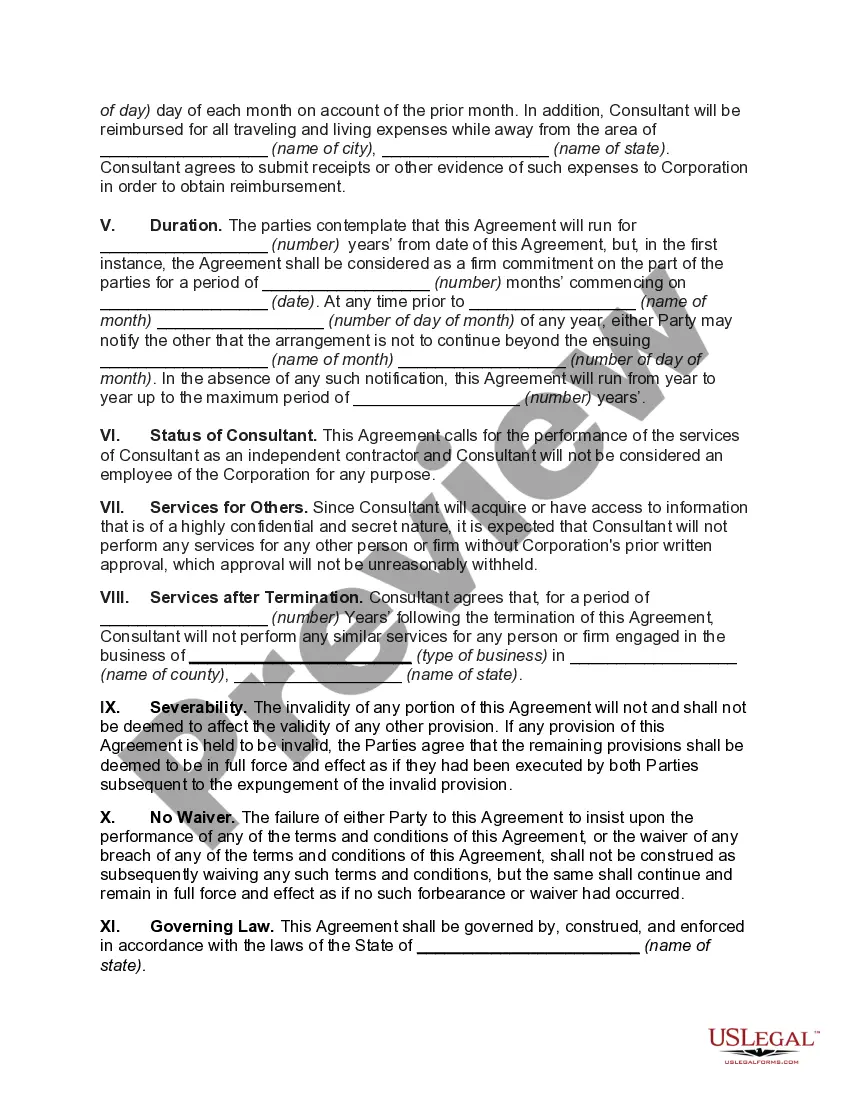

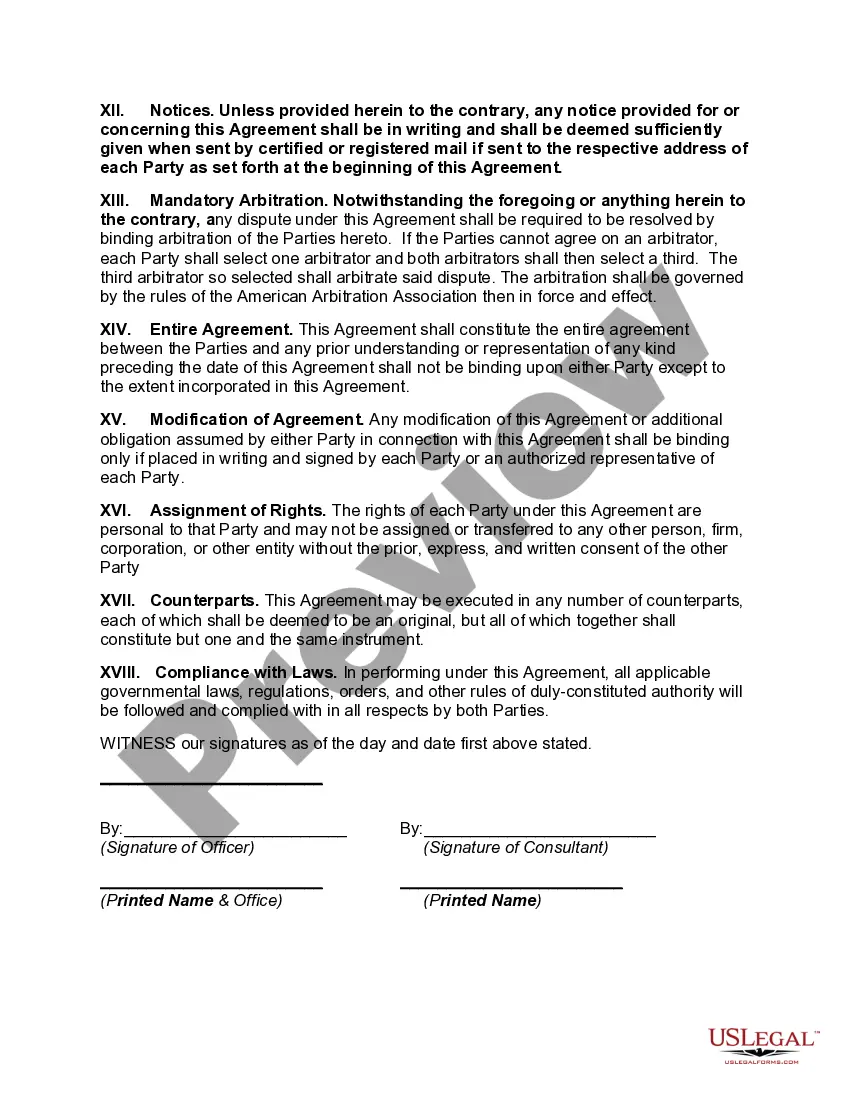

The contractor isn't an employee of the company but works independently. The contractor provides services to the client under an Independent Contractor Agreement.

An independent contractor agreement is a contract between a freelancer and a company or client outlining the specifics of their work together. This legal contract usually includes information regarding the scope of the work, payment, and deadlines.

An independent contractor agreement is a legally binding document signed by a 1099 employee and the company that hires them. It outlines the scope of work and the terms under which that work will be completed, which goes a long way to making sure both parties are on the same page about the project from the start.

The contract should state who pays which expenses. The contractor is usually responsible for all expenses including mileage, vehicle maintenance, and other business travel costs; work supplies and tools; licenses, fees, and permits; phone and internet expenses; and payments to employees or subcontractors.

What is the difference between a Consultant and a Contractor? The short answer is that the Consultants role is evaluate a client's needs and provide expert advice and opinion on what needs to be done while the Contractors role is generally to evaluate the client's needs and actually perform the work.

What is the difference between a Consultant and a Contractor? The short answer is that the Consultants role is evaluate a client's needs and provide expert advice and opinion on what needs to be done while the Contractors role is generally to evaluate the client's needs and actually perform the work.

Freelancers and consultants are known as "independent contractors" in legal terms. An independent contractor (IC) is a person who contracts to perform services for others without having the legal status of an employee.

Freelancers and consultants are known as "independent contractors" in legal terms. An independent contractor (IC) is a person who contracts to perform services for others without having the legal status of an employee.

In general, the difference is that the consultant's role is to evaluate a client's needs and provide expert advice and opinions on what needs to be done, while the contractors role is generally to evaluate the client's needs and actually perform the work.