Massachusetts Accident Policy

Description

How to fill out Accident Policy?

You are capable of dedicating hours on the web looking for the valid document templates that meet the federal and state requirements you seek.

US Legal Forms offers a multitude of valid templates that are reviewed by specialists.

You can actually obtain or print the Massachusetts Accident Policy from our service.

To find another version of the form, utilize the Search field to discover the template that fits your needs and specifications.

- If you possess a US Legal Forms account, you can Log In and click the Download button.

- After that, you can complete, modify, print, or sign the Massachusetts Accident Policy.

- Every valid document template you acquire is yours permanently.

- To get another copy of any purchased form, go to the My documents section and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for your area/town of choice. Review the form details to ensure you have selected the correct one.

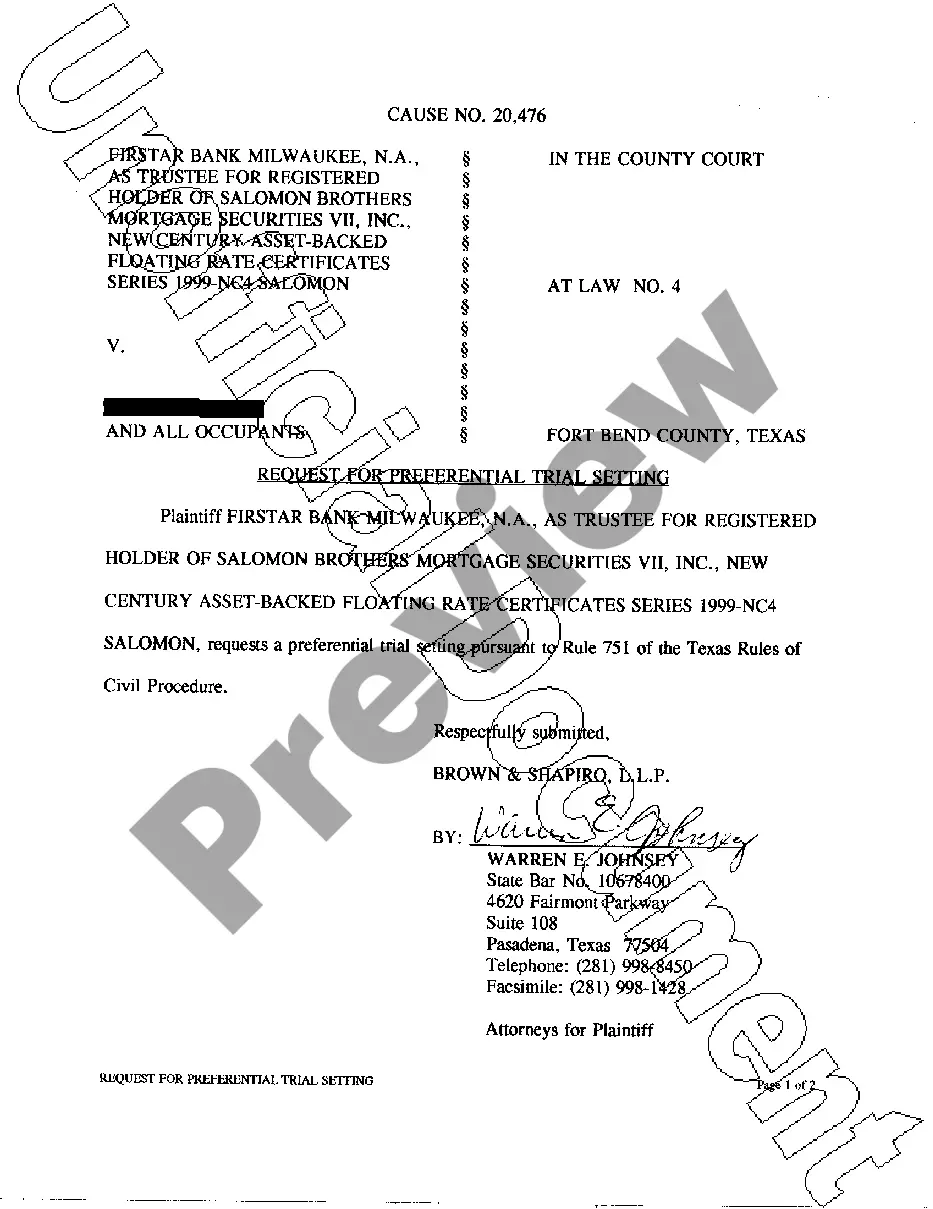

- If available, use the Preview button to view the document template as well.

Form popularity

FAQ

The claims handlers at both insurers will try to build up a picture of the accident with evidence to support their policyholder's version of events. Where the drivers' stories are disputed, the quality of that evidence can help to resolve differences and determine liability.

In Massachusetts, for instance, at-fault accidents may affect future premiums for no more than five years. Esurance says on its website that it asks drivers if they've had moving violations in the past three years and if they've had DUIs in the past 10 years.

Regardless of fault, Massachusetts requires that your own insurance company pay for your injuries, up to your personal policy limit. Nevertheless, state law allows individuals the legal right to sue the at-fault party for non-monetary damages (like pain and suffering) if those damages surpass the threshold of $2,000.

The standards of fault Insurance companies are required to use the Massachusetts standards of fault to determine if the operator is more than 50 percent at fault in an accident. The determination of fault is made by the insurance company that makes the claim payment.

In most states, car accidents remain on a driver's record from 3 to 5 years. In Massachusetts, a liability insurer cannot look back more than 6-years for accidents or traffic violations in determining your rates.

Some Massachusetts automobile insurance companies offer an accident forgiveness feature as part of their automobile insurance policies.

Massachusetts is a no-fault state which means no matter who causes the accident, PIP will pay these expenses for you or anyone you let drive your car, anyone living in your household, passengers in your vehicle and pedestrians.

What Is Accident Forgiveness? Accident forgiveness is a way to save on auto insurance. Not every at-fault accident will be forgiven by an insurance company. Most often this applies only to your first at-fault accident and then only if your driving record is clean.

Massachusetts is a No-Fault State Massachusetts is a "no-fault state" with regards to car accidents. This means that your own Massachusetts car accident insurance company pays up to $8,000 of your medical bills, regardless of who was at fault. These benefits are called First-Party Benefits.

Accident forgiveness is a feature you can add to your auto coverage with some insurers so that it forgives the driver if the accident turns out to be your fault. This means an accident you're at fault for won't negatively affect youthink a rate hikeas a result.