Massachusetts Irrevocable Trust for Lifetime Benefit of Trustor with Power of Invasion in Trustor

Description

How to fill out Irrevocable Trust For Lifetime Benefit Of Trustor With Power Of Invasion In Trustor?

Are you in a situation where you require documents for either business or particular purposes almost every day.

There are many legal document templates accessible on the internet, but finding ones you can rely on is challenging.

US Legal Forms offers a vast collection of form templates, such as the Massachusetts Irrevocable Trust for Lifetime Benefit of Trustor with Power of Invasion in Trustor, which are designed to comply with federal and state regulations.

Choose a convenient file format and download your copy.

View all the document templates you have purchased in the My documents menu. You can obtain another copy of the Massachusetts Irrevocable Trust for Lifetime Benefit of Trustor with Power of Invasion in Trustor at any time, if needed. Simply click on the desired form to download or print the document template. Use US Legal Forms, the most extensive selection of legal forms, to save time and reduce errors. The service offers professionally crafted legal document templates that can be used for various purposes. Create your account on US Legal Forms and start simplifying your life.

- If you are currently familiar with the US Legal Forms website and have an account, simply sign in.

- Then, you can download the Massachusetts Irrevocable Trust for Lifetime Benefit of Trustor with Power of Invasion in Trustor template.

- If you do not have an account and wish to use US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct state/region.

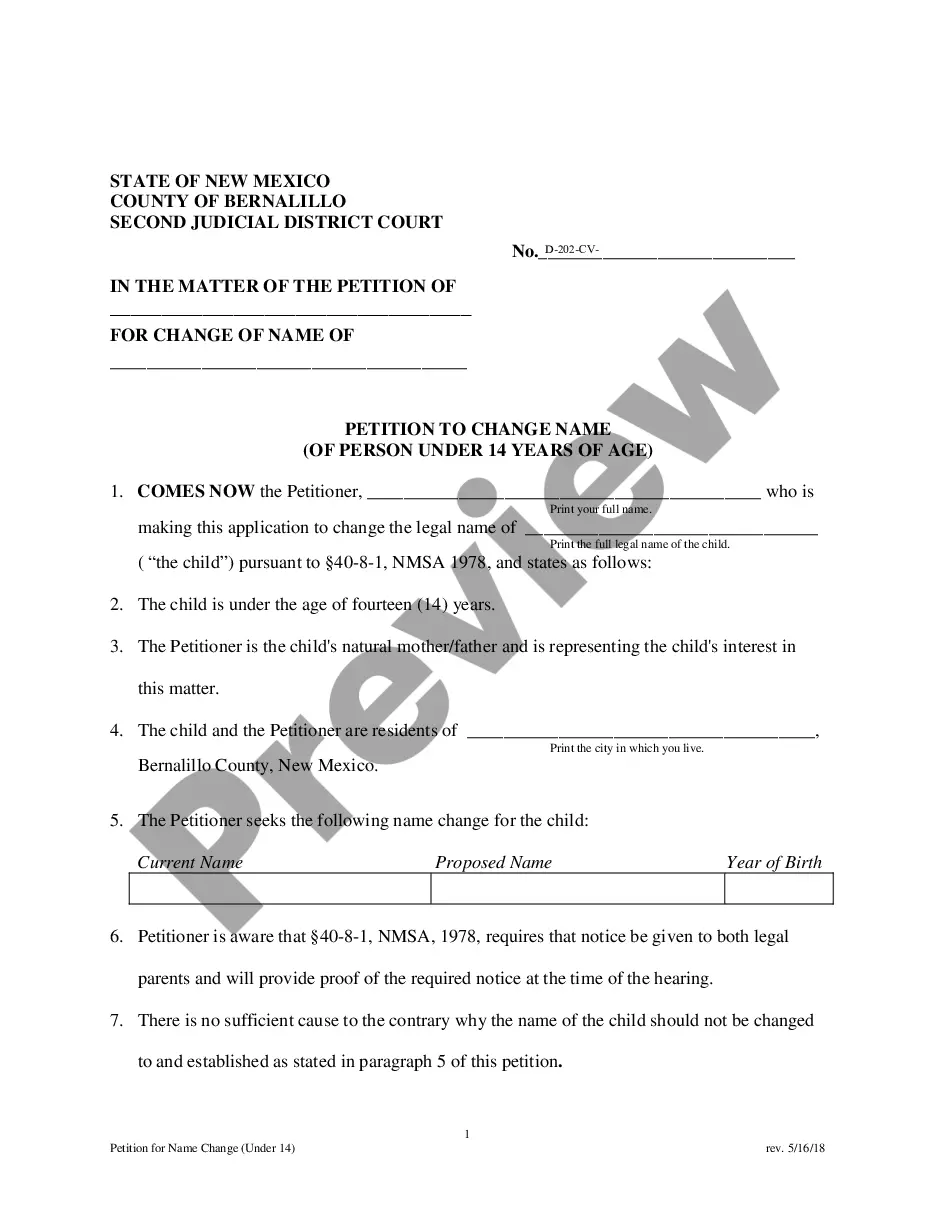

- Use the Review button to check the form.

- Verify the information to ensure you have selected the right form.

- If the form is not what you are looking for, use the Search field to locate the form that suits your needs and requirements.

- When you find the appropriate form, click Purchase now.

- Select the pricing plan you prefer, fill in the required details to complete your payment, and process the transaction using your PayPal or credit card.

Form popularity

FAQ

Getting out of an irrevocable trust often entails legal actions, which might include seeking a court's approval to alter its terms. In certain cases, if all beneficiaries agree, the trustee can petition the court for modifications. Understanding your options is key with a Massachusetts Irrevocable Trust for Lifetime Benefit of Trustor with Power of Invasion in Trustor, to ensure the trust serves your intended purpose.

Consistent with current Massachusetts practice, a non-charitable irrevocable trust may be terminated or modified with consent of all the beneficiaries and with court approval, so long as the modification or termination is not inconsistent with a material purpose of the trust.

The only three times you might want to consider creating an irrevocable trust is when you want to (1) minimize estate taxes, (2) become eligible for government programs, or (3) protect your assets from your creditors.

An Irrevocable Trust is an estate planning tool designed to protect assets that may appreciate over time. When an individual establishes an Irrevocable Trust with identified beneficiaries, it cannot be changed by him or her without their consent, as all assets technically belong to them.

Irrevocable trusts are an important tool in many people's estate plan. They can be used to lock-in your estate tax exemption before it drops, keep appreciation on assets from inflating your taxable estate, protect assets from creditors, and even make you eligible for benefit programs like Medicaid.

The trustee of an irrevocable trust can only withdraw money to use for the benefit of the trust according to terms set by the grantor, like disbursing income to beneficiaries or paying maintenance costs, and never for personal use.

The downside to irrevocable trusts is that you can't change them. And you can't act as your own trustee either. Once the trust is set up and the assets are transferred, you no longer have control over them.

An irrevocable trust cannot be modified or terminated without permission of the beneficiary. "Once the grantor transfers the assets into the irrevocable trust, he or she removes all rights of ownership to the trust and assets," Orman explained.

Removing a Trustee But if the trustor is no longer alive or has an irrevocable trust, anyone wishing to remove a trustee will have to go to court. Any party with a reasonable interest in the trustsuch as co-trustee or a beneficiarymust file a petition with the probate court requesting that it remove the trustee.

Irrevocable trusts can be used to protect assets, reduce estate taxes, get government benefits and access government benefits.