Massachusetts Assignment Creditor's Claim Against Estate

Description

How to fill out Assignment Creditor's Claim Against Estate?

Have you found yourself in a scenario where you require documents for both organizational or personal reasons nearly all the time.

There are numerous legal document templates available online, but finding reliable versions is not easy.

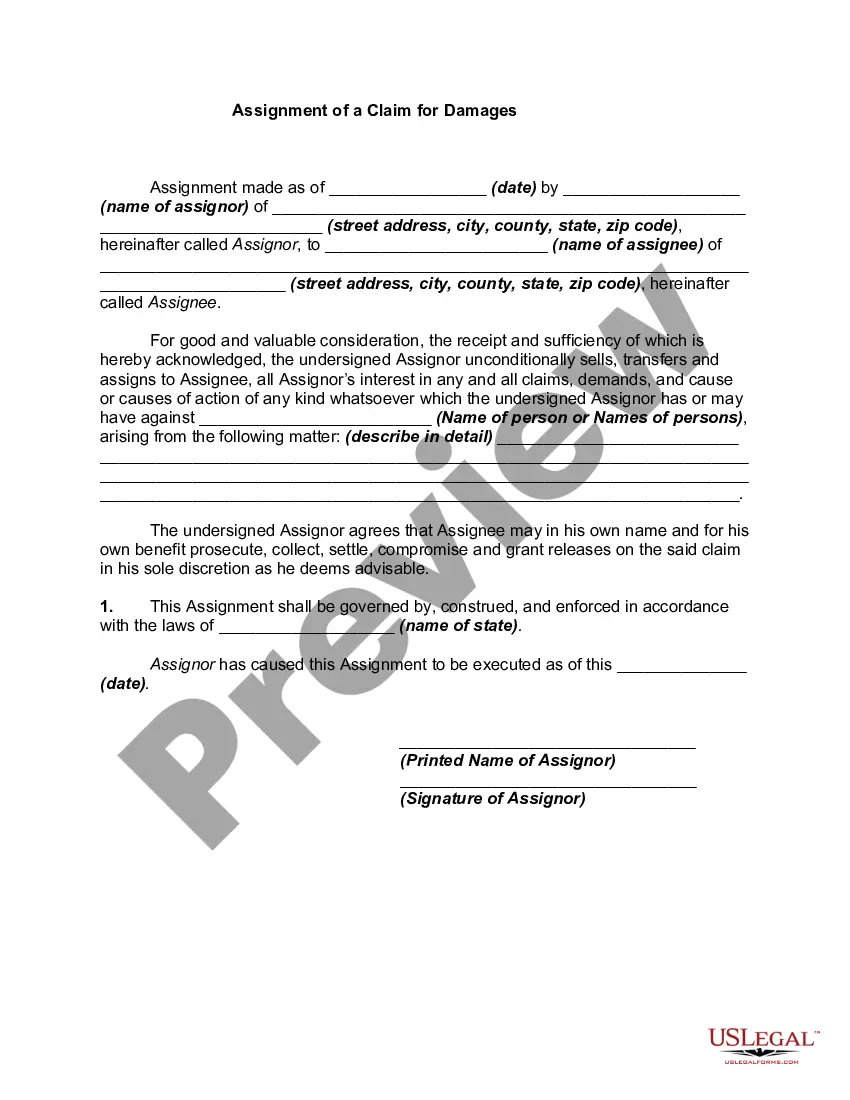

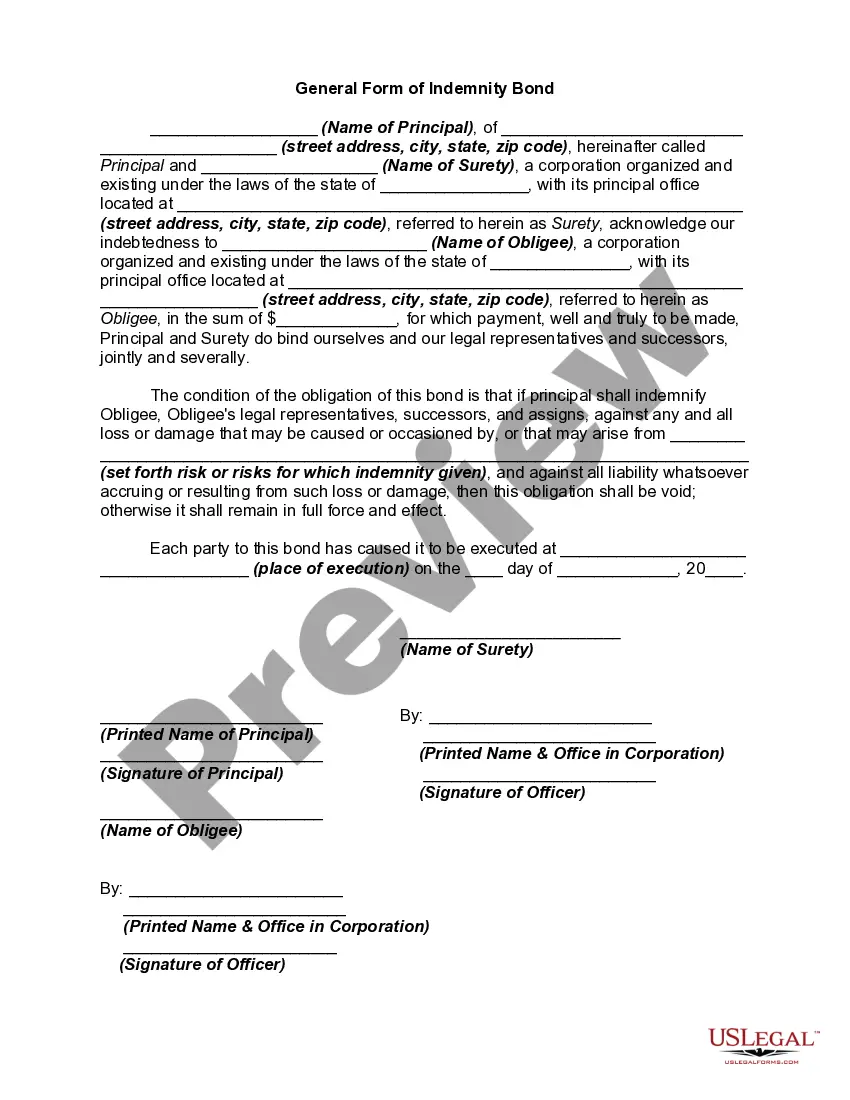

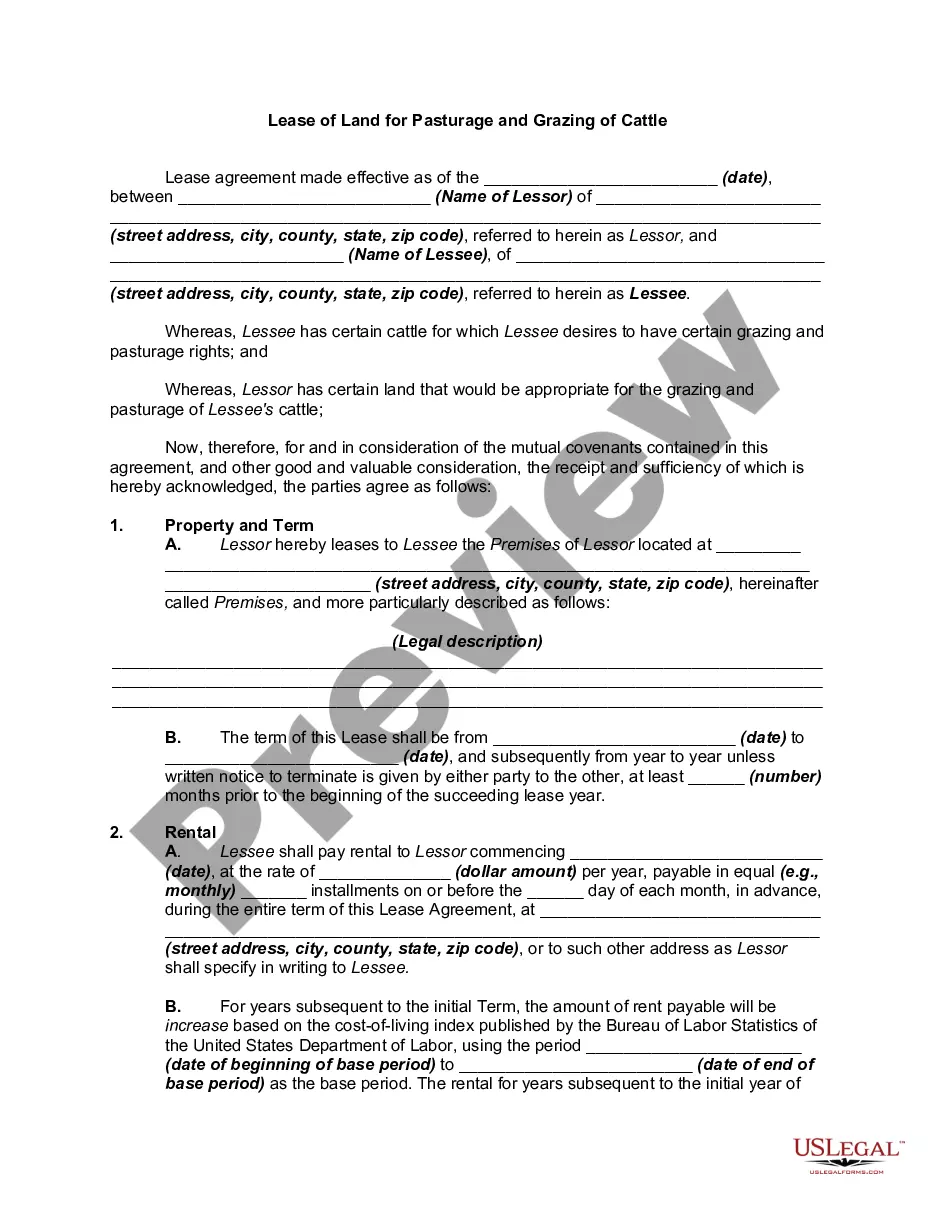

US Legal Forms offers thousands of form templates, including the Massachusetts Assignment Creditor's Claim Against Estate, which can be tailored to meet state and federal requirements.

Choose the pricing plan you want, complete the required information to create your account, and pay for the transaction using your PayPal or credit card.

Select a convenient document format and download your copy.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- Then, you can download the Massachusetts Assignment Creditor's Claim Against Estate template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Acquire the form you need and ensure it is for the correct city/county.

- Utilize the Review feature to verify the form.

- Check the information to confirm that you have selected the appropriate form.

- If the form isn’t what you’re seeking, use the Search field to find the form that meets your needs and requirements.

- Once you locate the correct form, click Get now.

Form popularity

FAQ

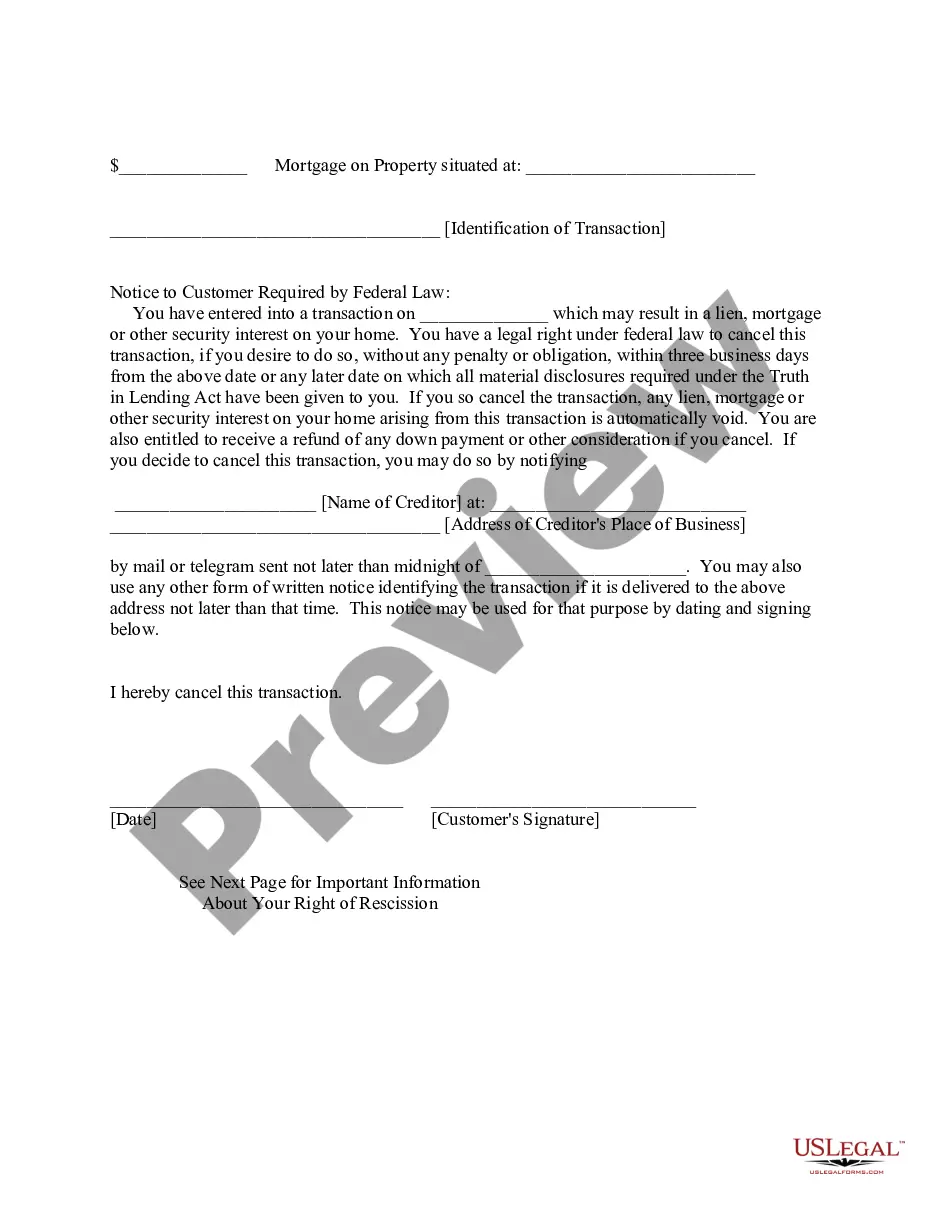

In Massachusetts, creditors have up to 12 months to make claims against the estate to get payment for the debt. The executor reviews these claims and pays the legitimate ones from the estate's assets.

If you received a cash inheritance, the court may order the bank account levied, which would allow the creditor to take the funds in the bank account to settle the debt. If the inheritance is real estate, the creditor may place a lien on the property.

What debt is forgiven when you die? Most debts have to be paid through your estate in the event of death. However, federal student loan debts and some private student loan debts may be forgiven if the primary borrower dies.

In any event, where it is accepted that payment is due, the executor can seek to pay you (the creditor) from the deceased's estate. There is normally a six-month period from the deceased's death for creditors to advise the executor of any sums due to them from the estate.

Remember, credit does not die and continues after the death of the debtor, meaning that creditors have a right to claim from the deceased's estate. Remember, the executor is obliged to pay all the estate's debts before distributing anything to their heirs or legatees of the deceased.

Every personal representative must, unless the notice has been given by a special administrator as provided in Section 215 of this title, within two (2) months after the issuance of his letters, file notice to the creditors of the decedent stating that claims against said deceased will be forever barred unless

Under Massachusetts law, general (unsecured) creditors have one (1) year from the date of death to file a claim against an estate.

How long do you have to make a claim? The Act has a strict time limit for making a claim of six months from the date of the Grant of Probate or Letters of Administration. In very exceptional circumstances this may be extended to allow a late claim, but as a rule you must stick to the six month deadline.

Filing a claim against an estate is a fairly simple process: In the claim, you'll state under oath that the debt is owed and provide details on the amount of the debt and any payments the decedent made. If you have written documentation, you can attach it to your claim.

Timeframe For Filing Claims That four-month timeframe runs from the time that notice is first published to creditors. However, with respect to the IRS, it has a 10-year collection period that runs from the date it assesses tax. I.R.C.