If you need to total, down load, or produce legitimate record web templates, use US Legal Forms, the greatest collection of legitimate forms, that can be found online. Take advantage of the site`s basic and convenient search to obtain the files you need. A variety of web templates for enterprise and individual purposes are categorized by categories and says, or keywords. Use US Legal Forms to obtain the Massachusetts Motion to Avoid Creditor's Lien within a couple of click throughs.

If you are presently a US Legal Forms buyer, log in for your bank account and click the Down load key to get the Massachusetts Motion to Avoid Creditor's Lien. You may also entry forms you earlier delivered electronically within the My Forms tab of the bank account.

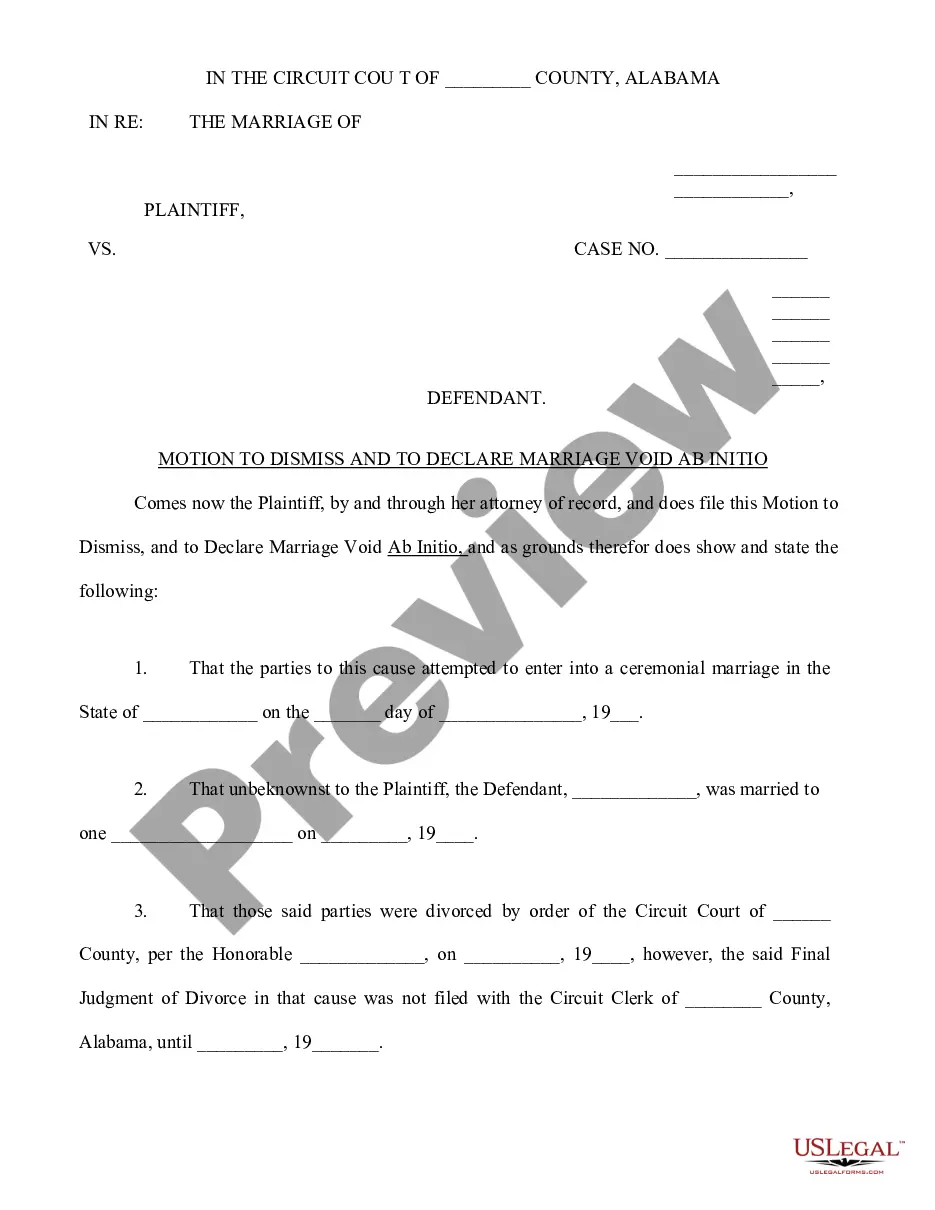

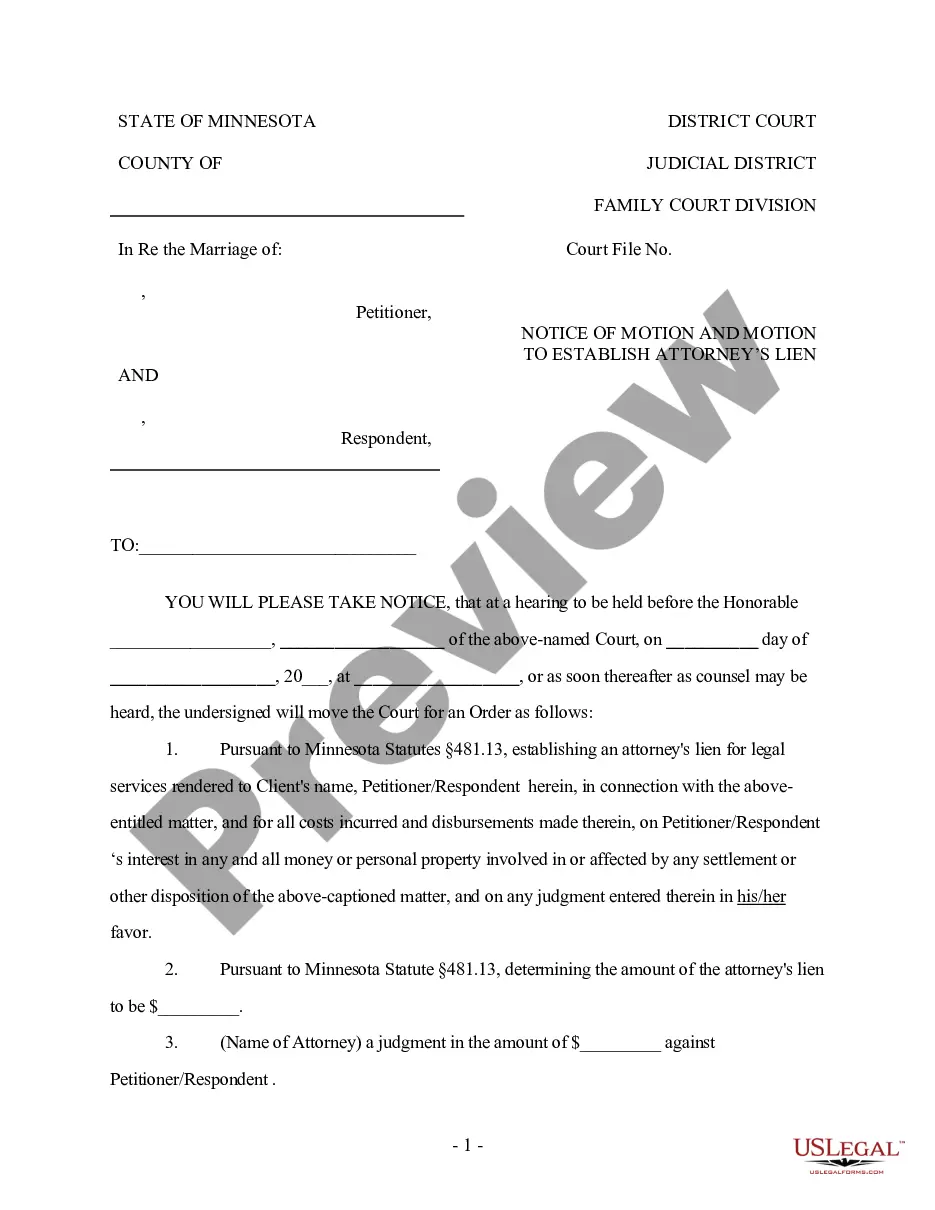

If you use US Legal Forms for the first time, refer to the instructions under:

- Step 1. Be sure you have chosen the form for your proper area/region.

- Step 2. Make use of the Preview choice to look over the form`s content material. Never neglect to learn the outline.

- Step 3. If you are unsatisfied with the form, utilize the Search industry at the top of the monitor to find other types of the legitimate form format.

- Step 4. Upon having identified the form you need, go through the Get now key. Select the pricing plan you favor and put your qualifications to sign up to have an bank account.

- Step 5. Process the transaction. You can use your credit card or PayPal bank account to perform the transaction.

- Step 6. Choose the file format of the legitimate form and down load it in your gadget.

- Step 7. Total, modify and produce or indicator the Massachusetts Motion to Avoid Creditor's Lien.

Every single legitimate record format you get is the one you have for a long time. You may have acces to each and every form you delivered electronically inside your acccount. Select the My Forms portion and select a form to produce or down load once again.

Be competitive and down load, and produce the Massachusetts Motion to Avoid Creditor's Lien with US Legal Forms. There are thousands of specialist and express-specific forms you can utilize to your enterprise or individual needs.