A Line of Credit refers to the maximum borrowing power that a lender extends to a borrower. The borrower may draw required amounts from the fixed amount. Usually, it is a credit source extended to any credit-worthy business by a bank or any financial institution. A line of credit includes cash credit, overdraft, demand loan, export packing credit, term loan, discounting or purchase of commercial bills, etc. The borrower may use the line of credit to overcome liquidity problems. Requisite amounts may be withdrawn from the account as and when required. The borrower pays interest only for the amount withdrawn.

Massachusetts Line of Credit Promissory Note

Description

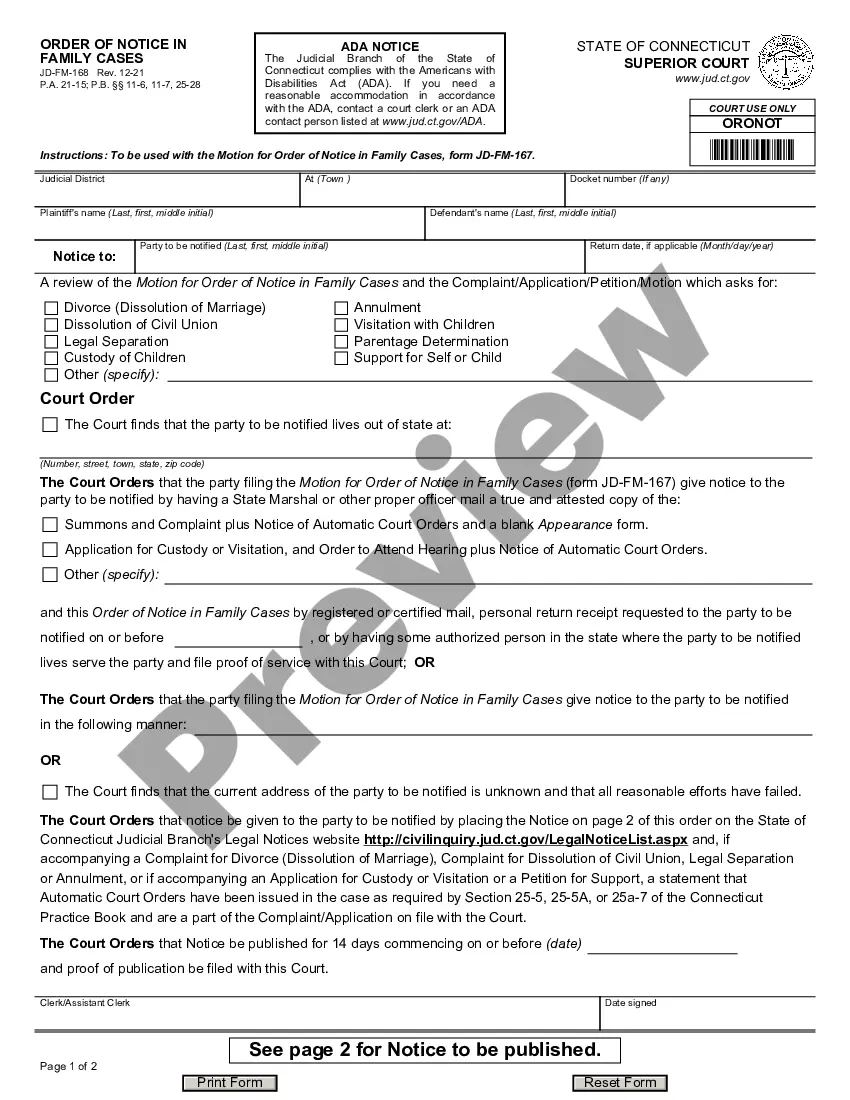

How to fill out Line Of Credit Promissory Note?

You can spend several hours online looking for the valid documents format that suits the federal and state requirements you desire.

US Legal Forms offers thousands of valid forms that can be assessed by professionals.

You can easily download or print the Massachusetts Line of Credit Promissory Note from the service.

If provided, use the Review button to examine the document format as well.

- If you possess a US Legal Forms account, you can Log In and click the Download button.

- After that, you are able to complete, modify, print, or sign the Massachusetts Line of Credit Promissory Note.

- Each valid document template you purchase is yours to keep forever.

- To obtain another copy of any purchased document, go to the My documents tab and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the straightforward instructions below.

- First, ensure that you have selected the correct document format for your state/region of choice.

- Review the form details to confirm you have chosen the right document.

Form popularity

FAQ

To fill out a promissory demand note, including a Massachusetts Line of Credit Promissory Note, follow a straightforward process. Begin by labeling the document as a promissory demand note. Clearly outline the borrower and lender names, the total amount due, and any relevant interest terms. Remember to sign and date the note, ensuring it complies with all legal standards for enforcement.

Filling out a promissory note, such as a Massachusetts Line of Credit Promissory Note, requires specific steps. Start by clearly writing the title and stating that it is a promissory note. Include the names of both the borrower and lender, the amount borrowed, the interest rate, and the repayment schedule. Finally, do not forget to sign and date the document to make it legally binding.

Banks may accept promissory notes, particularly when used as collateral for securing loans. However, institutions typically evaluate the creditworthiness of the borrower and the terms of the note before making a decision. Utilizing a Massachusetts Line of Credit Promissory Note can provide a standardized format that banks appreciate, ensuring a smoother approval process.

A promissory note is generally enforceable, given it meets specific legal requirements. It must include essential details, such as the amount owed and the repayment timeline. The Massachusetts Line of Credit Promissory Note effectively outlines these conditions, enhancing its enforceability in a court of law. If disputes arise, clarity in the document can be instrumental.

While a promissory note and a line of credit serve similar purposes, they are not the same. A promissory note is a written promise to repay a debt, whereas a line of credit offers ongoing access to borrowed funds. Nevertheless, the Massachusetts Line of Credit Promissory Note can combine the benefits of both, providing a structured way to manage borrowing.

A promissory note can function as a line of credit, depending on its structure and terms. Essentially, it can provide an agreed-upon amount of credit that a borrower can draw upon when needed. By leveraging the Massachusetts Line of Credit Promissory Note, borrowers can access needed funds while outlining repayment conditions with the lender.

Yes, a promissory note can be legally binding without a notarization in Massachusetts. The key factor for its validity lies in the clarity of the terms and the signatures of the involved parties. This means that even without notarization, a well-drafted Massachusetts Line of Credit Promissory Note can uphold its legal standing, making it an important tool for borrowing.

In Massachusetts, it is not a strict requirement for promissory notes to be notarized to be legally enforceable. However, having the note notarized can provide additional assurance and credibility to the agreement. You might find that some lenders prefer notarized documents as they enhance trust and authenticity in a Massachusetts Line of Credit Promissory Note.

Yes, a line of credit often involves a promissory note, which outlines the terms under which you can borrow funds. The promissory note acts as a legal acknowledgment of the debt and details the repayment obligations. Understanding this relationship is crucial when managing your finances, particularly with a Massachusetts Line of Credit Promissory Note.

For a promissory note to be valid in Massachusetts, it must include several key elements. First, it should clearly state the amount borrowed and the repayment terms, including interest rates. Both parties should sign the note, indicating their agreement to the terms laid out. This structure is essential for a Massachusetts Line of Credit Promissory Note to hold legal weight.