Are you currently in the position the place you need to have papers for possibly company or person uses just about every time? There are a lot of legitimate record themes available on the Internet, but locating ones you can rely isn`t straightforward. US Legal Forms delivers a huge number of type themes, such as the Massachusetts Objection to Allowed Claim in Accounting, that are composed to meet federal and state requirements.

In case you are previously informed about US Legal Forms web site and possess your account, simply log in. Afterward, it is possible to obtain the Massachusetts Objection to Allowed Claim in Accounting web template.

Should you not come with an bank account and would like to start using US Legal Forms, follow these steps:

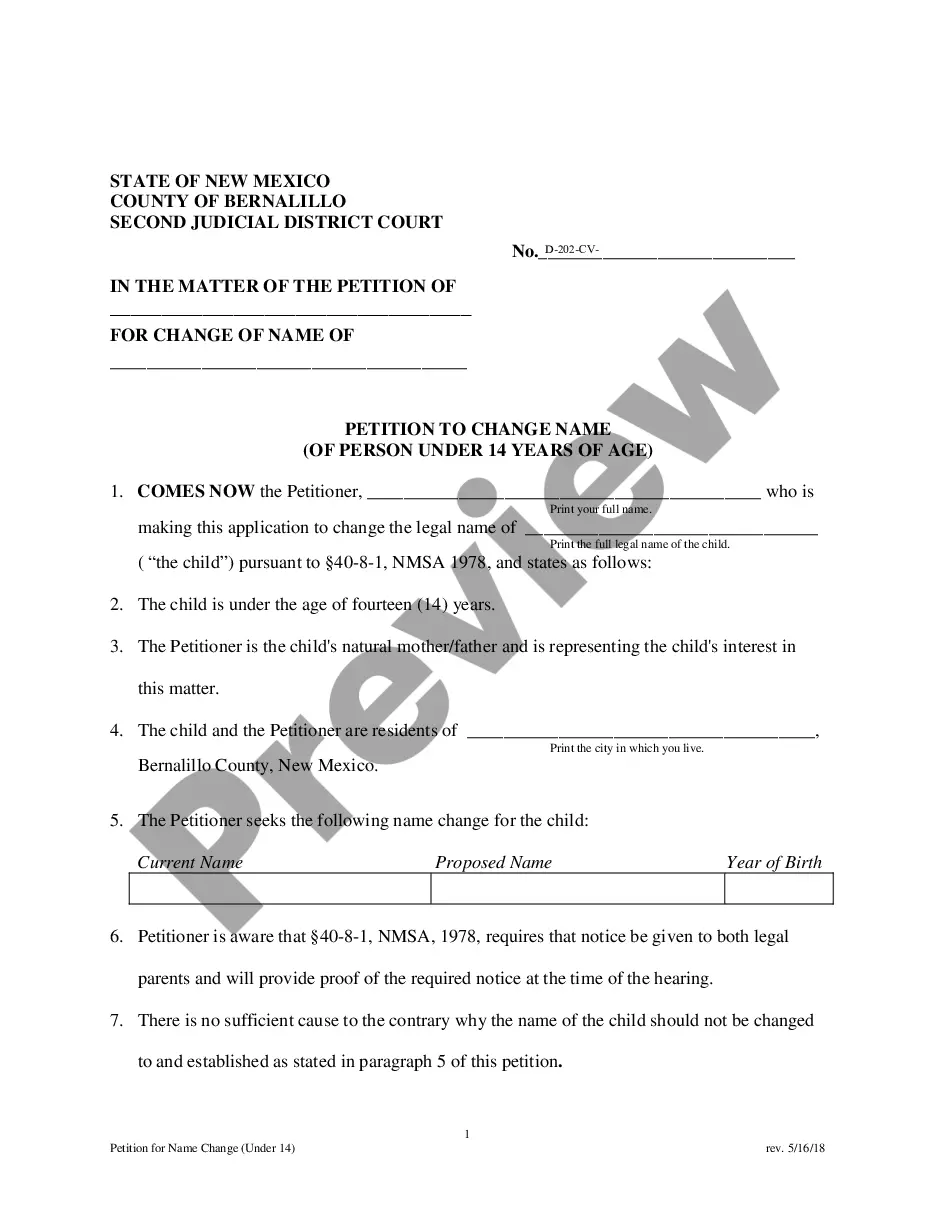

- Find the type you need and make sure it is for the right city/area.

- Make use of the Review key to analyze the form.

- Browse the description to ensure that you have selected the proper type.

- In the event the type isn`t what you`re searching for, make use of the Research area to get the type that fits your needs and requirements.

- Once you get the right type, just click Buy now.

- Pick the rates plan you would like, complete the necessary information to generate your bank account, and pay for the order making use of your PayPal or Visa or Mastercard.

- Select a practical data file formatting and obtain your version.

Find each of the record themes you possess purchased in the My Forms menu. You can aquire a more version of Massachusetts Objection to Allowed Claim in Accounting at any time, if required. Just go through the essential type to obtain or print out the record web template.

Use US Legal Forms, the most comprehensive selection of legitimate kinds, to save lots of some time and prevent mistakes. The services delivers expertly made legitimate record themes which you can use for a selection of uses. Produce your account on US Legal Forms and commence making your way of life easier.