Massachusetts Sample Letter for Explanation of Insurance Rate Increase

Description

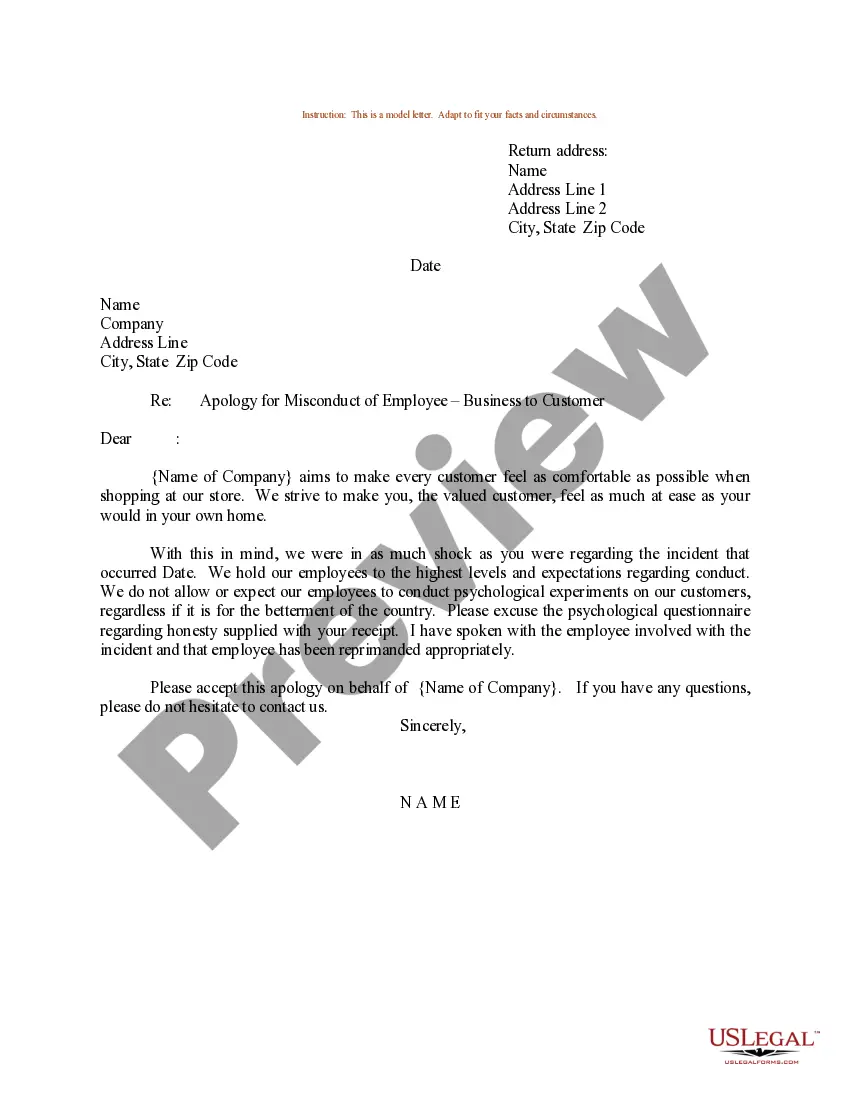

How to fill out Sample Letter For Explanation Of Insurance Rate Increase?

If you wish to compile, obtain, or print sanctioned document formats, utilize US Legal Forms, the best assortment of official forms available online.

Leverage the site’s straightforward and user-friendly search function to find the documents you require.

A range of templates for both business and personal purposes are categorized by categories and jurisdictions, or keywords.

Step 3. If you are not satisfied with the form, use the Search area located at the top of the screen to find different versions of the legal form template.

Step 4. Once you have found the form you need, click the Get now button. Select the pricing plan you prefer and input your information to register for an account.

- Utilize US Legal Forms to quickly find the Massachusetts Sample Letter for Explanation of Insurance Rate Increase.

- If you are already a US Legal Forms subscriber, Log In to your account and click the Download button to obtain the Massachusetts Sample Letter for Explanation of Insurance Rate Increase.

- You can also access forms you previously saved in the My documents section of your account.

- If you are accessing US Legal Forms for the first time, follow the instructions below.

- Step 1. Confirm that you have selected the form for the correct city/state.

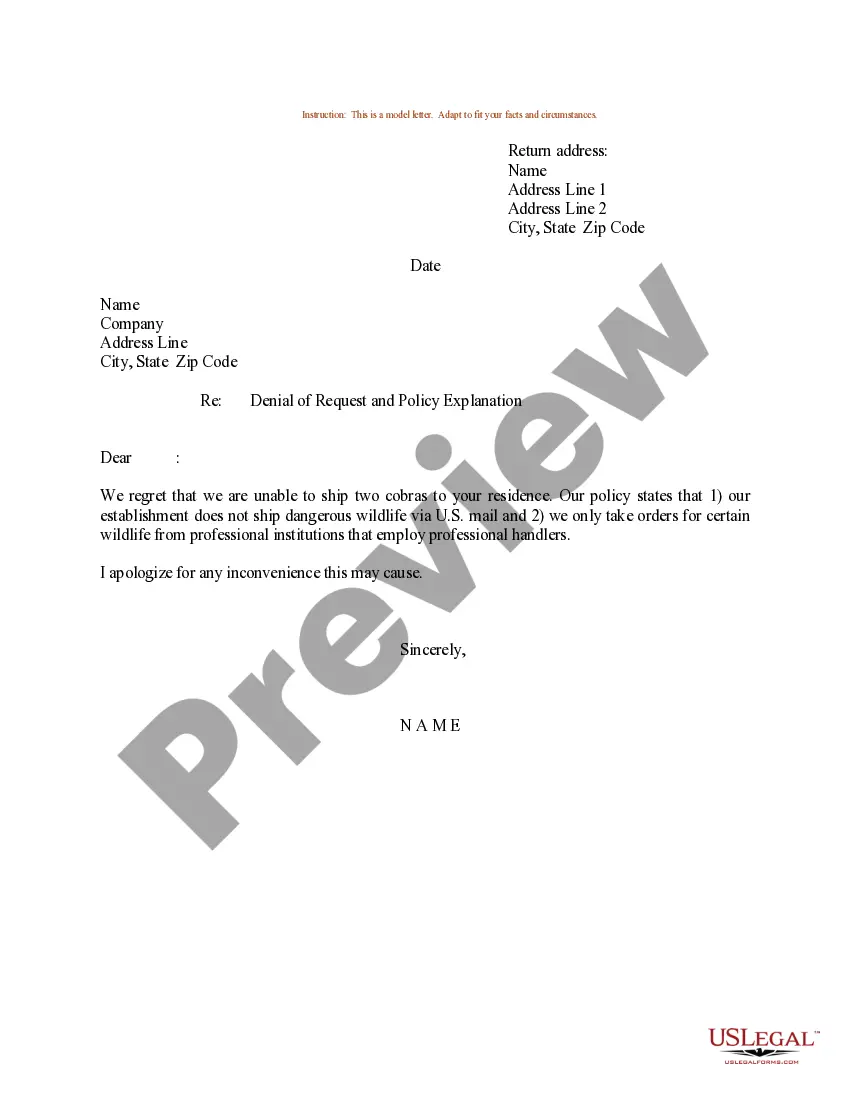

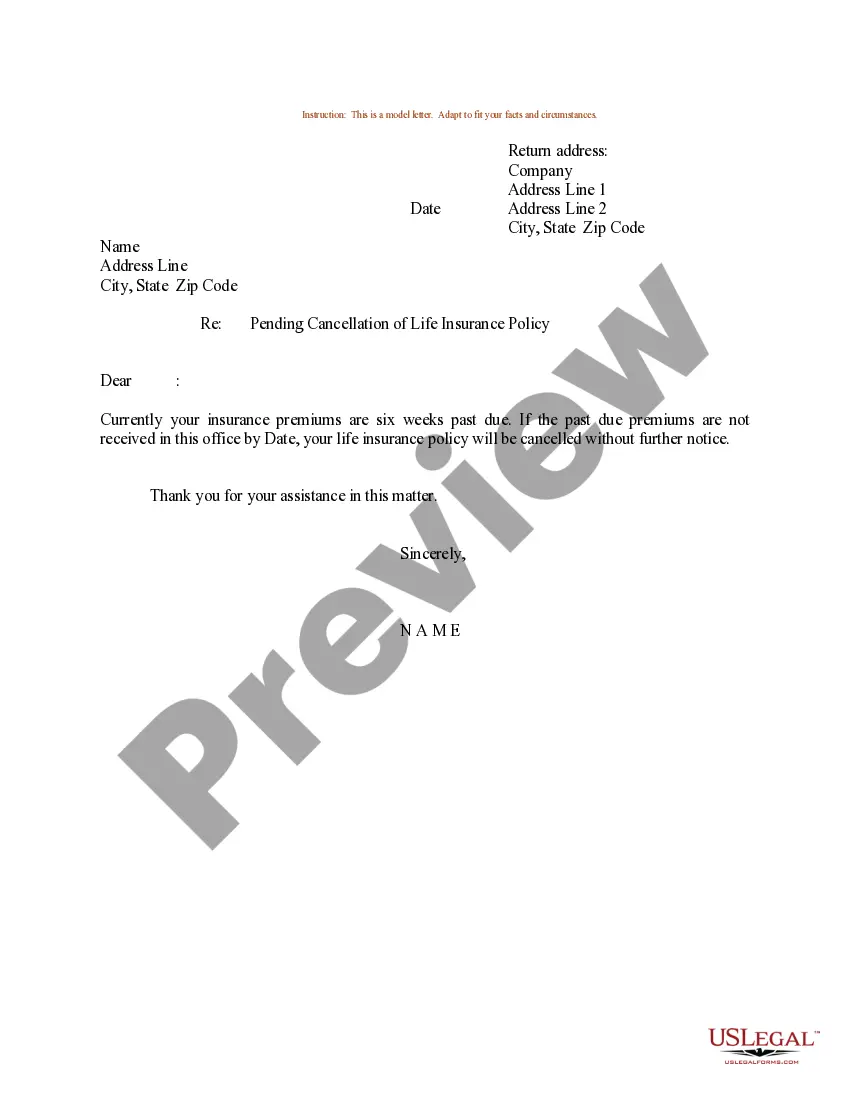

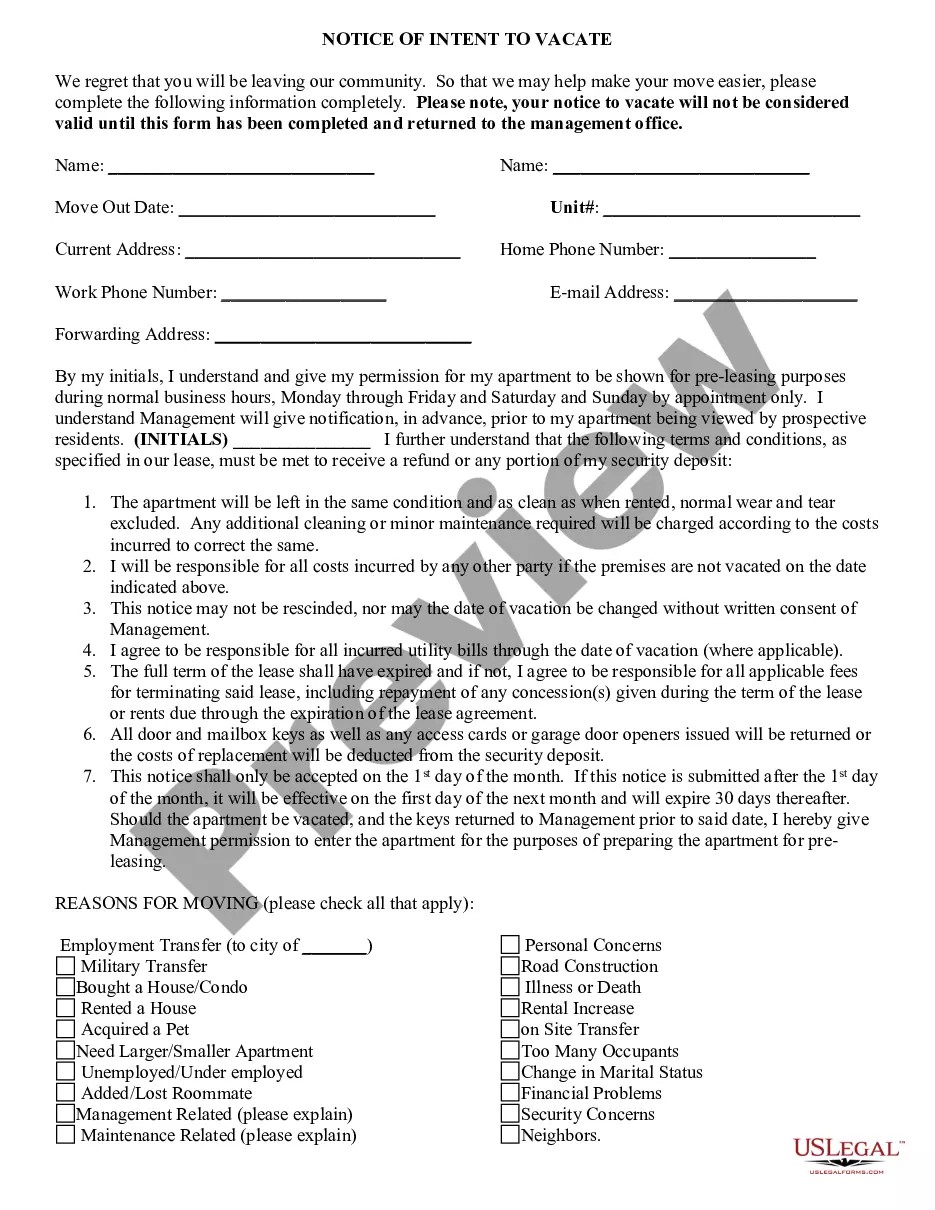

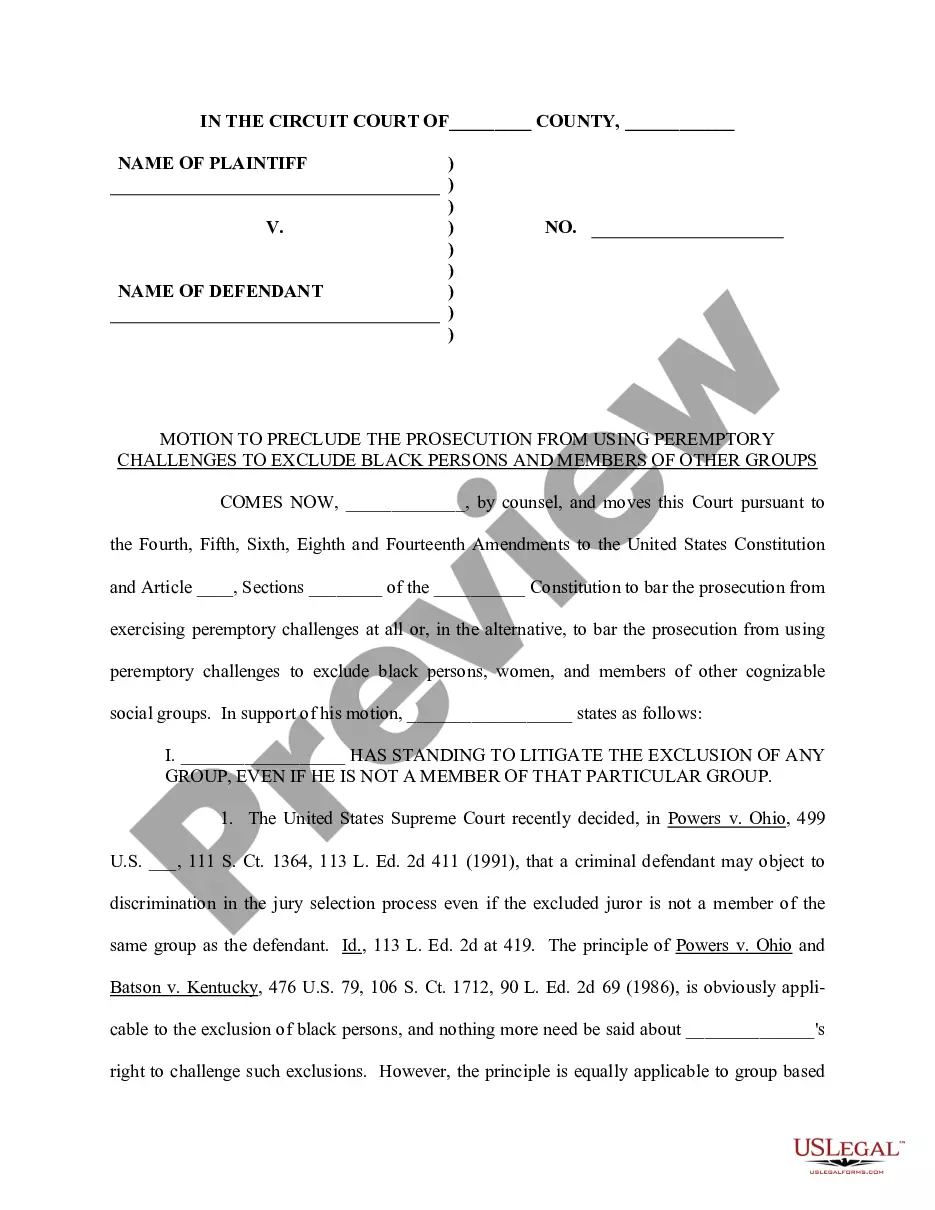

- Step 2. Use the Review option to examine the content of the form. Be sure to read the details.

Form popularity

FAQ

Typically, DOI on insurance refers to the Date of Issue, which tells you when your policy began. Understanding the DOI can help you make sense of your insurance timeline, especially if you plan to discuss rates or seek clarifications. Utilizing a Massachusetts Sample Letter for Explanation of Insurance Rate Increase can aid in articulating your questions effectively.

In insurance, DOI can also refer to the Department of Insurance, which regulates the insurance industry in each state. The DOI works to ensure that companies comply with state laws and protect consumers. For more detailed inquiries related to insurance rate increases, consider using a Massachusetts Sample Letter for Explanation of Insurance Rate Increase to highlight your situation.

To file a complaint against an insurance company in Massachusetts, you can start by contacting the Massachusetts Division of Insurance. They provide resources and guides to help you through the complaint process. Additionally, if you need to explain the reasons behind your complaint, a Massachusetts Sample Letter for Explanation of Insurance Rate Increase could be a valuable tool.

Car insurance rates in Massachusetts are increasing due to several factors, including rising repair costs and more accidents reported. Insurance companies consider these trends when determining rates. If you are facing a rate increase, using a Massachusetts Sample Letter for Explanation of Insurance Rate Increase may help you communicate your concerns effectively.

Co-DOI refers to additional coverage dates that may apply to your insurance policy. It can indicate when certain benefits began alongside the primary Date of Issue. Understanding co-DOI can be crucial when addressing discrepancies, especially when crafting a Massachusetts Sample Letter for Explanation of Insurance Rate Increase.

DOI stands for Date of Issue. This date indicates when your Blue Cross Blue Shield insurance policy was officially activated. Knowing your DOI is important, especially when you consider the Massachusetts Sample Letter for Explanation of Insurance Rate Increase, as it helps you reference your policy during any inquiries.

When discussing an auto insurance rate increase, it is crucial to highlight the factors leading to the change. Explain how claims, driving records, and market trends can impact rates. Offering a clear, empathetic rationale helps the customer grasp the situation better. Using a Massachusetts Sample Letter for Explanation of Insurance Rate Increase can guide you in crafting a thoughtful response to address your customers' concerns.

To explain an insurance premium increase, you should focus on transparency and clarity. Mention how market conditions, individual claims history, and changes in risk evaluation might have influenced the decision. Being open about these factors can help customers understand the reasoning behind the increase. Consider drafting a Massachusetts Sample Letter for Explanation of Insurance Rate Increase for a structured approach.

DOI stands for Department of Insurance, which regulates the insurance industry within each state. This agency ensures that insurance companies comply with the appropriate laws and regulations to protect consumers. If you wish to appeal a rate increase, the DOI can provide valuable resources, including templates like the Massachusetts Sample Letter for Explanation of Insurance Rate Increase.

To write a letter requesting a rate increase, begin by providing your policy details and the specific rate change you're seeking. Clearly articulate your reasons for the increase, such as changes in coverage needs or financial situation. For reference, consider using a Massachusetts Sample Letter for Explanation of Insurance Rate Increase to guide your writing. This template can help ensure that your letter is structured properly and conveys your message clearly.